A troubled APAC oil & gas company (part I)

Despite Jadestone Energy's challenging 2022-2023, there's potential for redemption in 2024

Jadestone Energy (LON:JSE) is an independent oil and gas company that focuses on the exploration, development, and production of hydrocarbons in the Asia-Pacific region. The company's portfolio includes various assets, mostly mature assets like Montara, North West Shelf, Stag, Peninsular Malaysia (PenMal), and Sinphuhorm. The only development asset is Akatara, which is not totally a greenfield as it was before an oil field. Additionally, there is a licence in Vietnam that seems to be on hold.

Jadestone’s future looked great at the end of 2021, when it reached 20,000 boepd, but a combination of poor operational management and overoptimistic M&A brought the company to its knees in June 2023 and it had to resort to a financing to strengthen its financials.

We'll delve into the past and present of the company, the recent value destruction caused by subpar risk management and the potential turn-around of the company with a 2024 that looks positive, conditional to its assets operating without further disruption. This first post focuses on the assets that the company owns.

Origin

The company was founded with the name Mitra Energy Inc. In 2015, it completed the reverse takeover of Petra Petroleum Inc. (formerly known as Fortress Petroleum Inc.) and began trading on the TSX Venture Exchange. At that time, Mitra owned several exploration licences with 2C Contingent Resources 1,148 billion cubic feet (“Bscf”) of gas and 20 million barrels of associated liquids (totalling 212 million barrels of oil equivalent). Mitra had no reserves as it had no producing or developing assets at that time.

In June 2016, Paul Blakeley, former Executive Vice President Asia Pacific & Middle East of Talisman Energy APAC, was appointed as Executive Chairman. One of his first decisions was to change the name of the company to Jadestone Energy in December 2016. In June 2017, Mr Blakely assumed the role of CEO. In August 2018, JSE listed on London AIM with the Canada listing ending in 2021. Blakeley’s takeover of the control of the company was supported by two of its current major shareholders: Tyrus capital and Livermore Partners.

During Blakeley’s supervision of Talisman’s activity in Asia Pacific, Mitra and Talisman had been partners in several licences in Vietnam, including some successful discoveries. Hence, he knew the company and the area where Mitra was operating before joining it.

Management & strategy

Strategy

Blakeley introduced a radical change of strategy. Mitra used to be an explorer rather than a producer. The new management and directors focused on increasing production through M&A, rather than exploration, similar to Talisman Energy’s strategy. The thesis was clear, acquire mature assets with growth potential and maximize production while extending their life and optimizing costs. The strategy was made obvious in the Capital Markets Event 2020

And that’s what they did. One month after Blakeley was appointed Exec. Chairman, JSE announced Stag’s acquisition. Since then, all producing fields have come through M&A with the first development being completed as you read these lines, the Akatara (or Lemang) natural gas field.

Interestingly, the former CEO, Paul Ebdale, and VP Business Development, Andrew Butler, established SundaGas after their departure. SundaGas pursued a similar exploration-focused strategy. Subsequently, Baron Oil (LON:BOIL) acquired the company. However, its primary asset, a license in Timor-Leste, remains undeveloped as they search for a farm-in partner, while Andrew Butler stays as a director. It seems that Blakeley’s approach was the correct one and these major shareholders were right.

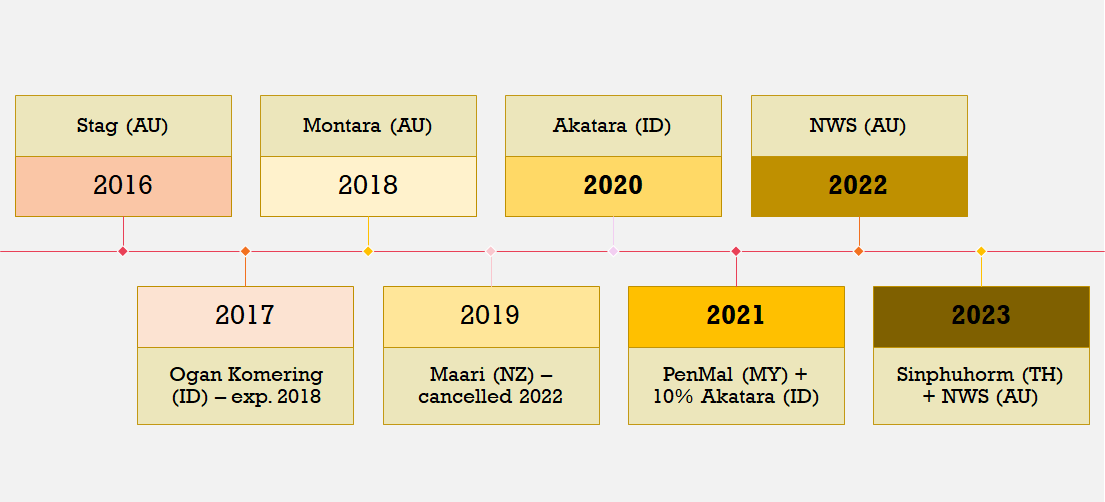

Since the year that Blakeley assumed the control over JSE, the company has closed at least 1 acquisition every year, including some that haven’t been successfully concluded:

The cancellation of Maari’s acquisition dealt a significant blow, given that the time passed since the effective date had accrued substantial economic value. However, JSE saw no future in the deal after several regulatory challenges were introduced by New Zealand’s parliament. Both JSE and the seller opted to move forward and cease the transaction.

The graph above shows a steady M&A pace, at least 1 acquisition per year, despite a couple of them being unsuccessful. I think it is reasonable to expect a similar pace of 1 or 2 transactions in the coming years. In the last webinar, both JSE’s CEO and CFO confirmed that they are eyeing another expansion in the North West Shelf (NWS) project, particularly Chevron's stake, which would leave Woodside Energy and JSE as 50:50 partners in those fields.

Blakeley may not have been lucky in his last 2 years in JSE, but he has demonstrated that he is the right person for the job. He has acknowledged the current situation is far from perfect and that many mistakes have been made. Since 2016, he has managed to transform JSE into one of the leaders in o&g production in the APAC region (outside NOCs), a company he inherited with 0 production and low prospects of reaching first oil or gas in the following years. JSE was also hit hard by the COVID pandemic, which impacted very negatively the development plans for the licences in Vietnam. During Blakeley’s leadership, JSE has gronw to 20,000 boepd right now. Oil represents most of the production and reserves, with Sinphuhorm and Akatara being the only asset that are 100% natural gas and condensates. Should the Vietnamese licence be developed and more M&A transactions completed, JSE can keep this upwards trajectory beyond the 30,000 boepd that were originally foreseen in 2020 before COVID came to our lives.

Paul Blakeley

He is the alpha and omega in JSE. Since he replaced the previous CEO, he makes all calls and is the public face of the company. He had a great tenure in Talisman Asia Pacific and Middle East, before the sale of the company to Repsol for $8 billion at a crazy valuation. Paul did great in the beginning of JSE and closed very beneficial acquisitions at a time where the interest in mature assets in APAC wasn’t as high as it has become today. He benefited from several major’s divestments and the lack of interest on the troubled Montara, a cursed asset.

In the last 2 years he hasn’t delivered at the same level, and the company has paid the price. JSE announced the 20,000 boepd mark by year-end in 2021, and almost 2 years have passed for the company to reach that level again. JSE’s management of the Montara situation has been suboptimal. More than 15 months after the oil leak, the field is still recovering its previous levels and the FPSO that operates the field is not fully operational. Also, the quality of the acquisitions hasn’t been the same. I do think they have overpaid for Sinphuhorm, the case of NWS is different because most of the amount paid (a staggering $184 million) will go to the cess/abandonment funds.

He has a standard protection in case of a change of control: payment in the amount of twenty-four (24) times his monthly salary; two (2) times the annual performance pay target and an amount equivalent to US$500,000 as compensation for the loss of foreign service allowances and all other benefits over the period of twenty-four (24) months. So, if a competitor wanted to acquire the company, he would receive more than $6 million. In the case of the CFO, Bert-Jaap Dijkstra, he would receive c. $2.5 million. Mr. Dijkstra began his tenure at JSE in August 2022, so his financial modeling and risk management abilities don’t seem to excel.

Blakeley’s 2022 salary was $1.8 million, he owns 4.5 million shares and more than 6 million options and vesting shares. He acquired 40,000 shares in May 2023, just 27 days before the announcement of the required financing, so he could have been clueless, but it is something difficult to believe.

He is deeply connected to the company, making it improbable for a scenario in the near future where he isn't leading the company. Yet, 10% of the votes in the last Annual General Meeting (AGM) were against his re-election. If anything, he might be striving for redemption following the 'A Series of Unfortunate Events' in the past two years. The timing of the issues at Montara coinciding with the company's initial development was unfortunate. Improved corrosion prevention and monitoring of the FPSO (something that the Australian regulator had previously notified) could have averted it, although I'm not aiming to come across as Captain Hindsight.

Main shareholders

There have been small changes among the major shareholders in the last few years. Tyrus Capital and Livermore Partners, Blakeley’s backers when he joined the company, have maintained their trust on JSE. The former 2 largest shareholders of Mitra Energy, the Ontario Teachers' Pension Plan Board and West Face Capital, left the company when it announced its intention of listing the shares in the London AIM. After the last placing, the main shareholders are:

There is no certainty that the current major shareholders are aligned with the minor shareholders, but they seem interested in obtaining a return through income (increasing dividends through buybacks). Accordingly, JSE began paying a maiden dividend in 2020 and continued to pay so in 2021 and 2022. Last dividend was paid in October 2022. In total, the company has paid 4.2p, which represents 12% of today’s share price. The directors also proposed in the 2022 AGM a buyback program, which was approved. It started in August 2022 (Montara had to be shutdown in June for the first time) and was abruptly finished in February 2023. In my opinion, these shareholders would be keen to resume dividends first when the financial situation improves, as most British investors do.

The time spent between the Montara’s shutdown in September and the cancellation of the buyback program, leads to infer that directors and leadership weren’t prudently following the proper risk management policies. Somebody must have stress-tested the financial situation to maintain the payment of a dividend in parallel to buybacks while conserving a pipeline of potential acquisitions with Montara out of order. This is just a guess, but the high oil prices during 2022 could have affected the decision-making process and led the company to estimate future scenarios where oil prices stayed above $100/bbl. A tourist mistake …

Although both Tyrus Capital and Livermore Partners hold seats on the Board of Directors, their commitment to resolve the evident risk management issues remains uncertain. Tyrus Capital provided financial assistance to JSE but secured a hefty benefit from the shareholders company through the conditions of the Standby Working Capital Facility part of the financing package required last June. The acquisition of 500,000 shares by directors and Blakeley less than a month before the announcement of the financing raises some concerns. This situation suggests either a lack of proper information provided to the BoD by the management or a failure on their part to fulfill their fiduciary obligation in assessing the company's financial health.

At the time of the announcement of the 2023 AGM, the BoD included among the resolutions the authorisation to the company to generally and unconditionally make market purchases. Surprisingly, this was done a few days after the last placing in June, and it was withdrawn the same day of the AGM. Someone ought to have realised of the mistake they were making.

Never attribute to malice that which is adequately explained by stupidity.

Hanlon’s razor.

Assets

JSE owns assets in 5 different countries, with Australia and Malaysia being the most relevant ones. The company produces natural gas in Thailand, with a minor production in Malaysia, and it is completing the development of the Akatara gas field. There is a licence in Vietnam, but the company hasn’t completed the sales contracts and FEED for the FID.

The company has 74.5 MMboe of 2P reserves and 16.9 MMboe of 2C contingent resources, distributed as follows:

Australia and Malaysia are oil reserves while Indonesia and Thailand are natural gas reserves. The numbers in Malaysia don’t include the results from the infill drilling campaign carried out in 2023, its good results promise an increase in reserves and extension of the life of one of the fields. I didn’t include the numbers from Vietnam as there has not been any confirmation that there is any progress on developing the asset, yet. The company inherited from Mitra a licence in the Philippines that was dropped due to lack of progress.

Australia

Most of Jadestone’s production comes today from Australia, where the company produces oil from 3 different assets: Montara, North West Shelf (NWS) and Stag. All these assets are mature and nearing their end of life. The company acquired them with important ARO liabilities, except NWS, where it had to pay the abandonment costs in advance.

It is important to take a look at the situation in Australia regarding the ARO liabilities. After Northern Oil and Gas Australia declared bankruptcy, the Australian government was compelled to shoulder the financial burden of decommissioning the Northern Endeavour, an offshore oil production facility previously owned by the now-defunct company. The total cost is estimated close to A$1 billion (c. $685 million). The government decided that the offshore industry shall pay for this expense, due to the fact that Woodside Petroleum had sold the aging assets and didn’t assume any responsibility for it. As a result, the government passed the “Laminaria-Corallina Decommissioning Levy“ which, among many aspects, it secured the financing of any future decommissioning expenses:

a tax of 48 cents per barrel, starting retrospectively on 1 July 2021 and running indefinitely (yet it was said to be temporary). This tax is paid by all Australian offshore petroleum producers.

hardened requirements for the transfer of the titles on any offshore asset, including a liability on the seller to cover any future expense in the case of buyer’s insolvency.

That regulation explains why JSE has had to pay upfront most of the ARO liabilities for its recent acquisitions in Australia, it helps in softening the regulator’s view on the associated risks while also lifts the financial burden of the seller.

One important aspect of the o&g sector in Australia is the activity of the unions, which are particularly vocal and resolute to defend the offshore workers’ rights. The relationship between JSE and the unions has had ups and downs. JSE has successfully negotiated with the unions and has been praised at some times: “Jadestone has done what Shell have been incapable of doing – negotiating an EBA with the Offshore Alliance which locks in agreed salaries, employment conditions and job security”.

However, this same union has complained of JSE’s HSE and the latest development came this month when the union sent a complaint to the Australian regulator, NOPSEMA, due to a fire that started during tests at the Stag platform. When the news broke, the regulator had already assessed the incident and has yet to decide if any action is necessary. Hence, the Australian unions have been in conflict with most companies in the industry, including giants like Chevron and Woodside. They even forced the closure of some LNG export terminals with their strikes. Thus, JSE has to deal with a series of assets that are in the final stages of their life and a demanding union that is willing to clash with the company to enhance the conditions of their members.

Australia is a mature jurisdiction but it is currently transitioning to be a net exporter of LNG rather than dirty oil barrels. However, oil production still has many years of life ahead and there will be many opportunities in the future.

Montara

Montara (100% WI) has traditionally been Jadestone Energy's flagship asset and is located in the Timor Sea, off the coast of Northern Australia. Montara’s licence is indefinite and it doesn’t carry an expiration date. The Montara oil field consists of three elements: the Montara platform, the Montara Venture Floating Production, Storage, and Offloading (FPSO) vessel, and the Skua subsea tie-back. The FPSO vessel, in particular, is a crucial piece of infrastructure that enables the production and storage of oil.

The Montara field has been producing oil since 2013 and was acquired by JSE from PTTEP in 2018 for ca. $100 million. The field primarily produces light, sweet crude oil, which is highly sought after in global markets. The associated natural gas is reinjected in the Swift, Swallow and Skua wells, but the company has reported some limitations with the compression capacity on the Montara FPSO to cope with the raising gas-to-oil ratio. The company hasn’t updated on this issue in the recent PRs; a permanent solution to this bottleneck was initially expected for 2024 (as published in 2022), but it has been delayed to 2025 in recent updates. The gas compression system had experienced problems in early 2022, before the shut-down, and again during the ramp-up after the re-start, hence, the company should find a solution to these problems as soon as possible.

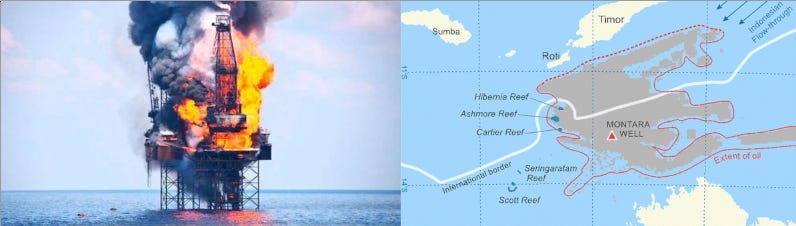

JSE could acquire the asset at a low price due to its troubled past. The platform suffered a major accident in 2009 that caused a major oil spill (largest in Australia) and completely burnt down the platform and the West Atlas rig. During re-entering the H1 well, the oil and gas flowed uncontrollably due to an insufficient cementing job done before suspending the well and the improper use of pressure caps with only one out of the two caps being installed. PTTEP has to pay hundreds of millions in fines and reparations as the incident affected numerous fishing resources and ecosystems.

JSE has invested in keeping the production level by a series of infill drilling campaigns that have allowed it to keep production (when the FPSO is in working conditions) above 7,000 bopd. Last drilled well was Montara H6, which came on stream in 2021.

Already in 2021, the Australian regulator issued JSE with several directions to improve its corrosion management system at its Montara oilfield. The decision came after an inspection that ran between October 2020 and February 2021. The revision was a follow up from the actions taken to address the deficiencies identified in prior inspections between 2017 and 2019.

It is difficult to summarize what happened at Montara in the 2022-2023 period. Everything started when an oil leak was detected in June 2022 during a transfer of oil to a crude tanker. This triggered a series of events that created a serious loss of confidence on JSE’s ability to properly manage Montara’s operation:

June 2022: The initial inspection found a 30mm hole in the hull of the vessel, right below one of the oil tanks.

July 2022: After repairing this leak, Montara resumes production.

August 2022: more issues are detected in a ballast tank, which leds JSE to stop production to accommodate enough personnel and equipment to conduct further inspections and repairs. 10 days before this update, JSE decides it is prudent to begin a Share Buyback Programme, 2 days after announcing the acquisition of a stake in the NWS project for $106 million excluding any adjustments since the effective date, with $84.5 million less closing adjustments to be paid in the span of 5 months.

September 2022: the Australian regulator steps in and issues a general direction to address all problems with the tanks of the Montara Venture FPSO. JSE lowers the guidance, as it cannot resume production until the satisfactory completion of the general direction. Share buybacks continue.

November 2022: the company announces that the defects on both tanks have been fixed, and accuses the conversion of the tanker into a FPSO as the cause. Other ‘minor defects’ are mentioned but not detailed. JSE and NOPSEMA appoint DNV to conduct an assessment of the condition of the vessel to guarantee the operational readiness before resuming production. Share buybacks continue.

January 2023: DNV’s report is complete, Montara can reopen and everybody is happy … well, it didn’t happen like that … The report wasn’t made public, but after it, the tank revision program grew substantially and extended to other tanks, leaving them out of operation until a revision. 1 day after this update, JSE announces the acquisition of the Thailand gas asset for $32.5 million, while share buybacks continue.

February 2023: NOPSEMA’s review concludes and the General Direction is closed. On the 2nd, Blakeley comments in an update that Montara’s restart is planned for the end of February. He also mentions that they are “remaining very disciplined about the opportunities we pursue“. On the 27th, the reopening is postponed. The share buyback program is halted without a notification. According to the last update, it had acquired 20.2 million shares at a total cost of $17.9 million (76p per share).

March 2023: on the 16th, the restart is again postponed due to “a small number of inconsistencies in standard fittings were identified and are currently being rectified to ensure safe operation“. On the 23rd, the restart is announced, beginning production from 1 well, while the other Montara and Skua wells are brought onstream. Montara’s production was completely off for 8 months.

July 2023: a gas alarm was triggered within ballast water tank 4S, indicating possible communication with one of the adjacent tanks within the FPSO. Montara is shut down again.

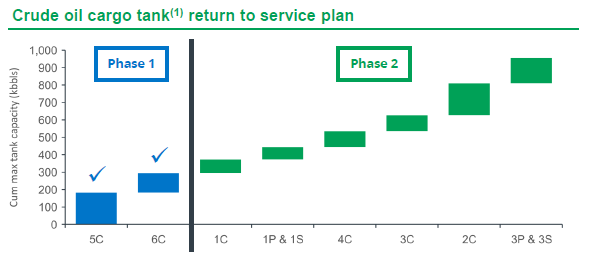

August 2023: on the 10th, JSE reports that the inspection reveals a defect between tank 4S and oil cargo tank 5C. JSE reports the risk of breaching one of the covenants of the $200m RBL: “The RBL includes the requirement for borrowing base assets, such as Montara, not to have production interrupted for a continuous period of 60 days or more.“ Hence, the situation turns even more negative due to the mention of the 60 days without production. On the 23rd, JSE confirms it doesn’t expect Montara to be offline for the required 60 days to breach the covenant. On the 31st, JSE announces that production would resume the following day, with a minimal production of 1,000 bopd from 1 well. The company reports that the need for a storage tanker will continue as several tanks remain closed.

September 2023: production resumes on the 1st with the 1,000 bopd previously announced and grows to 8,000 bopd by the 7th, but JSE confirms that production should quickly return to 6,000 bopd. On the 19th, the company reports that average production since restart has been of 6,250 bopd. Then guidance for the last 3 quarters is lowered to 13,500-15,000 boepd (from 13,500-17,000 boepd).

October-December 2023: JSE reports varying production rates, accounting for some required halts for maintenance and offtaking. The company also announces a planned shut-down for 1 week for compressor maintenance.

It is important to stress that despite some comments on social networks, nor the wells or the platform have been affected by the issues, everything has been caused by the FPSO, which is a vital element to ensure production. As it can be seen in the graphic below, the reported production since Montara’s reopening in April has been slowly growing with a peak of 7,500 bopd reported in early December:

Montara has been a solid contributor to JSE’s oil production with a rate of 7,500 bopd or higher before the problems began in 2022. It maxed in 2019 with more than 10,000 bopd. Below we show the production since JSE acquired the asset:

Today, Montara FPSO is operational but some tanks are still offline, which require the use of a tanker to be used as storage. This impacts the opex as there are more costs in surveying and fixing the tanks and paying the day rate of the tanker (c.$30,000/day). This is a planning provided by the company before the last shut-down caused by a gas alarm:

Since the restart in March, the company has been reporting the progress regarding the production at Montara, but there were some incidents after the restart in March, associated to extreme weather and the troubled gas compression system:

However, in a recent article, Blakeley didn’t discard dry-docking or replacing the Montara FPSO to find a definitive solution. His expectation is that the field continues to produce for another 10 years, as they have identified existing discoveries, both gas and oil, as well as two infill wells into some of the satellite fields. Hence, nothing is being discarded, as a replacement of the FPSO could be necessary at some point. This statement by Blakeley indicates that the search for an option could have begun, even if it is not necessary at the moment and the problems are fixable.

Regarding decommissioning, JSE entered into a deed poll with the Australian Government in 2019 with regard to the requirements of maintaining sufficient financial capacity to ensure Montara’s ARO can be met when due. The deed states that the Group is required to provide a financial security in favour of the Australian Government when the aggregate remaining net after tax cash flow of the Group is 1.25 times or below the Group’s estimated future decommissioning costs. As the deed states “remaining”, the disruptions during 2022 and 2023 shouldn’t enact the provision of the deed. In 2021, JSE proposed the abandoning of the Montara‐1, Montara‐2, Montara‐3 and Skua‐1 wells, but this plan was withdrawn in 2022. These wells are among the oldest and they had been already plugged. The company had deemed that “no further property inspections or maintenance, offshore operations, or environmental monitoring” were needed. The withdrawal was surprising, unless they suspected that this plan wasn’t going to be approved by the regulator as more work on these wells was necessary than initially planned, so the addition of more wells to this decommissioning plan could be more economical and they could wait until then.

Stag

The Stag oil field (100% WI) is another important asset in JSE's portfolio. Located in the Carnarvon Basin, off the northwest coast of Australia, the Stag field has been operating since 1998. Stag’s oil is a heavy sweet crude (18-19◦ API, 0.14% mass sulphur) type, which is perfect to be used as VLSFO, receiving a premium over lighter types like the Brent or Tapis. The average premium in 2022 was $22.78/bbl. Stag’s licence expires in 2039.

At the time of the acquisition, many of JSE’s staff in Australia had previously worked for both Quadrant Energy and Apache, both former owners of the Stag asset, which provided them with a deep technical knowledge of the field. The initial production was 3,400 bopd and JSE planned to extend the asset’s life through workover and infill drilling during the next years. The first estimation in 2017 was that Stag’s life could be extended to 2024 without further investment.

The Stag field consists of a wellhead platform (aka as Stag platform) and a Catenary Anchor Leg Mooring (CALM) buoy used for the tankers to complete the oil liftings. Until 2020, Stag operated through the Dampier Spirit FSO, which was retired to work through periodic liftings instead by adapting the Stag platform.

The first infill drilling campaign was carried out in 2019, with the first infill well (Stag 49H) on the asset in over six years, which had an initial production of 1,400 bopd with an average of 838 bbls/d during the first 7 months of production. The 2022 infill drilling campaign included the Stag-50H and 51H wells, which were brought onstream at an aggregate initial rate of approximately 2,000 bopd. Future plans targeted a workover campaign that would increase the production to 4,000 bopd. But the production from Stag hasn’t been close to that number since it was acquired, as the natural decline compensates any well drilling or workover, as the graph below shows:

Despite the decline of production, JSE doesn’t plan to halt production from Stag. Last July, it began the process to obtain new Environment Plans for both operation and drilling activities. The drilling EP includes both the plugging and abandonment of existing wells and drilling new wells. There is a five-year term drilling plan being prepared now.

Stag is the only asset that isn’t covered by a cess fund or an agreement with the regulator/government in regards to providing some financial guarantee for the ARO. This way, JSE will have to use its own liquidity to cover all expenses at the time of decommissioning.

North West Shelf (well, part of it)

The company announced the entry into this asset in Q3 2022, with the acquisition of 16.66% from BP. This asset is located in a demanded area with many different oil and gas fields. JSE has acquired a participation in Cossack, Wanaea, Lambert and Hermes (“CWLH”) oil fields, which produce low-sulphur and low-density oil through the Okha FPSO. Interestingly, all natural gas produced is not sold, but given for free to Woodside to avoid flaring it (at least that is my understanding from the information published). This gas is used for supplying the North West Shelf LNG Terminal (NWS) of the Karratha Gas Plant, operated by Woodside. So, JSE’s stake of the whole NWS project is a small fraction of all production, as it can be seen in Woodside’s production data for the whole area:

In Q4 2023, JSE announced the acquisition of another 16.66% from Japan Australia LNG (MIMI) Pty Ltd, which will raise the total stake to 33.33% on completion. On a side note, JSE has signed a new $200 million Reserve-based Lending (RBL) in May 2023, which restricts JSE’s freedom to expend the cash. Anyhow, the RBL banks have revised and approved this second acquisition. The structure of the two acquisition has been the following:

A consideration of $20 million (which resulted in the receipt of $5.75 million due to the effective date of 1 January 2020), a contingent payment of $4 million and $82 million into the CWLH abandonment fund. The total amount paid represents $3.6/bbl ($16/bbl including the ARO) on a 2P basis.

A consideration of $9 million (which is expected to result in the receipt of $3-6 million due to the effective date of 1 July 2022), no earn-outs this time and up to $102 million into the CWLH abandonment fund. This time the adjustment will go straight into the abandonment fund, so JSE will pay the $9 million on completion but the ARO invoice will be lowered. The total amount paid represents $1.7/bbl ($21/bbl including the ARO) on a 2P basis.

An important rationale for acquiring these stakes is that the accumulated expenditures and losses will offset any payment of the Petroleum Resource Rent Tax. The main difference in the price paid for the reserves comes from the lower 2P reserves acquired in the second deal, as the total amount paid, $106m vs. $111m, isn’t that different. On a positive note regarding the ARO, the amounts recurrently paid to the abandonment fund are based on an estimation of the final cost, if partners lowered the actual cost, they would be entitled to a reimbursement. Hence, if the cost is revised downwards, which could happen as the decommissioning industry is flourishing in Australia and APAC, JSE could benefit from lower contributions through opex (c.$25/bbl) to this fund.

Due to the small stake of 16.66% and the modest production, both Jadestone and Mimi could only complete 1 annual lifting (ca. 650,000 bbls), which adds exposure to the volatility of the oil prices. Next lifting for Mimi’s stake is planned in January 2024, and JSE will receive it in full. JSE had already accounted for this effect, and its current hedges reflect a higher amount of oil sold in Q4 due to this effect. A positive effect of doubling the stake is that now JSE could complete 2, or even 3 smaller, liftings per year, lowering the volatility.

JSE estimates that there is a significant amount of oil in place despite production from the first field, Cossack, began in 1995. The total recovery factor of the 4 fields is c.55%:

As we mentioned before, Blakeley confirmed in the last webinar that they are considering increasing the stake in the CWLH fields. The other partners in the licence are Woodside Energy (50% and operator) and Chevron (16.66%). He stated that they see more value in the fields, but it requires additional investment that current partners aren’t willing to spend. Although, if every ⅙ stake is going to cost c.$100 million, including the ARO liabilities, the total amount of more than $600 million seems quite high for an asset currenly producing at or below 10,000 bopd. However, this asset seems to be a good fit for Blakeley’s asset life optimisation expertise.

In the case of Chevron’s stake, there isn’t an objective reason that would impede JSE from acquiring it, which will create a 50:50 partnership with Woodside. It is unlikely that Woodside would sell its stake as it is the operator of all the assets and infrastructure in the NWS project, so it would be extremely inefficient to change the operator of just the CWLH fields to another company.

One can see in the table above that there are other assets in the NWS project with low production, so, JSE could use its position in CWLH to progressively acquire stakes in other assets. JSE would continue accumulating stakes in other assets. Assuming operatorship of any of those assets would be an important step forward that must require the support of NOPSEMA, the Australian regulator. Besides, this body may not be satisfied with JSE’s recent performance at Montara and could not allow a transfer of ownership.

The NWS project has given Blakeley an opportunity to continue its M&A strategy with lower risks than in other areas in APAC. The price paid is high but JSE could obtain important returns in the future.

Malaysia

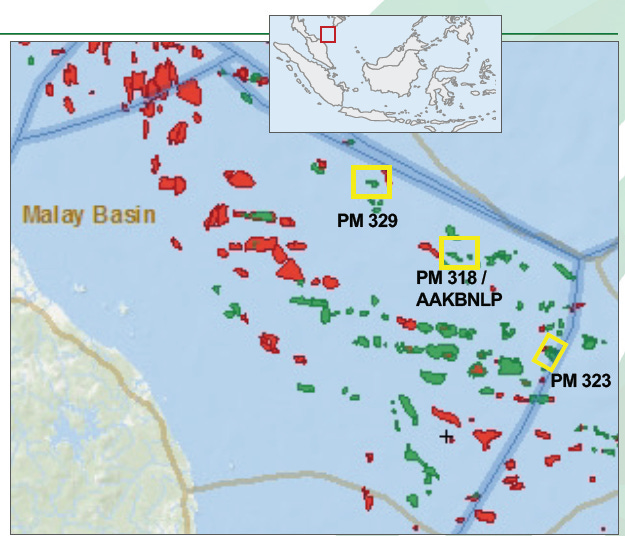

JSE participates in 4 different licences, 2 operated (PM323 and PM329) and 2 non-operated (PM318 and AAKBNLP). The participations in these licences were acquired in 2021 for just $9 million, which resulted in the receipt of $9.2 million at closing. The company had to satisfy two contingent payments of $3 million each. All licences were acquired from SapuraOMV in 2021. The non-operated licences ceased production in early 2022 due to technical deficiencies.

JSE has reported production from Malaysia as a whole, without providing unitized data. Hence, the production in 2021 and early 2022 includes production from all 4 licences. The licences have declined substantially, but JSE has completed in H2 2023 an infill drilling campaign in PM329 that will materially increase production in H2 2023 and beyond:

Operated PenMal: PM323 & PM329

This asset is composed of two different licences (PM323 - 60% WI and PM329 - 70% WI), but JSE reports them as if they were one. They are not even adjacent to each other. The PM323 licence expires in 2028 and the PM329 expires in 2031.

Production consists of oil and natural gas in a 80:20 ratio, approximately. Only the associated natural gas from PM329 is currently sold. The oil from both licences is light sweet crude that is blended to Tapis grade (43º API, 0.04% mass sulphur). The average premium realized in 2022 was US$6.38/bbl. The oil is sent to an onshore terminal through pipelines from the Chermingat, East Belumut, West Belumut and East Piatu platforms. Then, the oil is periodically sold through liftings.

At the time of its acquisition, JSE estimated 12.5 MMboe in 2P reserves (including the non-op assets) and a production of 6,000 boepd. The deal included all amounts that SapuraOMV had deposited in the cess fund for the decommissioning of the infrastructure, and will be used against any future abex. JSE assumed the decommissioning of the wells.

The fiscal terms for these assets are reasonable and consist of a 10% royalty, up to 70% of cost recovery and a 38% petroleum income tax (depreciation, opex and royalties are deductible). As a result, the effective take can depend on the production level (which affects the unused cost recovery that is shared with the government using a sliding scale) and depreciation, but a 55% effective entitlement is reasonable.

During H1 2023, the company reported some operation issues at the Chermingat platform that is required to produce one of the fields of the PM323 licence. These issues should have been fixed at the moment but there hasn’t been a confirmation.

JSE planned a 4-well infill drilling campaign in 2023 for PM323 that has been a great success with all wells showing an initial gross production of 3,000-3,500 bopd. The campaign had foreseen a combined increase in gross production of 3,500 bopd. However, it is anticipated that the production will rapidly decline as the water cut increases. Thus, the net production from PenMal has grown to 7,000 boepd (11,200 boe/d gross) from 3,878 boepd in H1. The fourth well is expected to increase the gross production above 14,000 boepd, resulting in a net production for JSE of 8,800 boepd. The capex for this infill drilling campaign is expected to be fully recovered by Q2 2024, in just 6-8 months.

One of the measures to reduce the natural decline is to halt the sales of natural gas and re-inject it into the reservoir to optimize production through gas lift. This will require modifications to the topside equipment and well workovers and hasn’t been confirmed yet.

Non-operated PenMal: PM318 & AAKBLNP

At the time of the acquisition of PenMal from SapuraOMV, a set of non-operated producing assets were included in the package: PM318 and AAKBNLP licences. Initially, the licences were shared 50:50 with Petronas Carigali, who also operated them. The AAKBNP licence expires in May 2024 with the PM318 lasting until 2034.

These fields haven't been in production since H1 2022 due to deficiencies in the maintenance of the infrastructure by Petronas Carigali, including a blockage in an intra-field pipeline. As a result, the Bunga Kertas FPSO saw its classification suspended due to the insufficient supervision and absence of the required surveys to ensure its integrity. The operator began some repair works, but they were halted after a diver suffered a deadly incident.

JSE decided this year to take over these licences and retain the 100% WI and operatorship. Now it plans to extract all the remaining value left. JSE’s Malaysian team has been analysing what assets could see an extension of their operational life and which ones should be abandoned for good. Before restarting production, JSE has to decide to apply for an extension of the licences (AAKBNP licence expires in 2024) including a Business Value Proposition (“BVP”) for both licences as holder of the 100% WI. The BVP was submitted to Petronas in June. JSE expects to commence soon negotiation with Petronas on the fiscal terms of the new PSC, reflecting the new situation of the fields after the withdrawal of Petronas Carigali and the operational issues. The new PSC could include the addition of other partner(s).

The company has already begun the decommissioning of some of the infrastructure that is not required anymore. JSE has guided an abex for the non-op assets of c.$15.0 million during 2023. The expenses for the decommissioning of the infrastructure are mostly covered from the cess fund while the well abandonment costs have to be paid by JSE (it is unclear whether it will claim Petronas Carigali its share of this cost).

The take-over of these licences makes sense, as JSE will be able to use 100% of the cess fund despite Petronas Carigali’s exit. Now JSE is investing on fixing the Bunga Kertas FPSO to recover its classification, which is an indication that it expects to receive positive results from its BVP application. During H1 2023, it already spent $3.9 million in rectification costs and $2.8 million in stand-by opex, but no updates have been provided. I think they made the right decision here, as the risk is low (most ARO covered) and there could be some upside in these mature fields.

Nevertheless, it is unclear whether these assets would return to production at some point and, if it does, when it would be. If the Bunga Kertas FPSO renewed the classification in 2024, the production could resume in a matter of weeks, at least from the PM318 licence.

Thailand

Sinphuhorm

This is the last completed acquisition. It includes 2 licences, one in production (Sinphuhorm, 9.5% WI) and one in exploration (Dong Mun, 27.2% WI). The acquisition was through direct and indirect stakes in APICO, an US private company with assets in Thailand. Sinphuhorm won’t contribute to the P&L, because it is classified as a financial investment. Thus, JSE won’t recognise revenue or expenses from Sinphuhorm, instead it will receive dividends (none paid in H1) and recognise future changes of the value of the asset in the balance sheet. JSE reports Sinphuhorm’s production as part of the company-wide production.

The gas from the Sinphuhorm field is served to the 710 Megawatt Nam Phong Power Plant. Condensates are sold separately through a sales agreement with PTT. The price of the gas is not fixed and it is linked to high sulphur fuel oil. There isn’t much information about the price-fixing mechanism or the exact oil reference.

JSE paid a final sum of $27.8 million on completion due to the effective date of 1 January 2022 with the ARO liabilities estimated at $2 million. Sinphuhorm has conducted in 2023 an upgrade process to boost its compression equipment. There is additional capex for drilling new wells in 2023 and 2024, but JSE hasn’t been transparent about the planning and the timing of the process.

The company projected 1,600 boe/d from Sinphuhorm, but the production level has been a bit below this projection with an average of 1,531 boepd in H1 and an average of 1,500 boepd from July to November. Thailand’s regulator publishes the production figures and this has been the production (natural gas + condensates) in the last 2 years:

As it can be seen, the production has been declining since 2022, with a major drop in October this year, but if the production data in October and March were normalized (it could be due maintenance at the fields or the power plant), the production would have been almost flat at 1,600 boepd.

The timing of this acquisition was odd, right after paying the ARO liabilities for the NWS acquisition while Montara was still shut-off and an ongoing buyback program. It added stress to the balance sheet that resulted in the need to raise capital in June. Does this production justify the price paid (c. $15,885/boepd)? I don’t think it does, particularly considering the timing, as the realized price per barrel is much lower than for oil barrels. However, the true value in the licence could be in the exploration field, where JSE has a higher stake. So far, Sinphuhorm hasn’t received much attention in the last CCs and updates, as it is not a key asset at the moment.

Indonesia

Lemang/Akatara

JSE acquired a 90% WI in this licence from Mandala Energy Lemang Pte Ltd, which it later increased to 100% by acquiring the remaining 10% from PT Hexindo Gemilang Jaya. Nevertheless, the Indonesian government has a back-in right of up to 10% WI under the terms of the PSC.

The licence is an abandoned oil field that began oil production in November 2016, but it ceased operations in 2019 due to lower than expected oil production caused by early water breakthrough and compartmentalized reservoirs in the Lower Talang Akar formation. Hence, the Upper Talang Akar (UTA) formation was left undeveloped and it is estimated to present better quality that will allow the exploitation of its natural gas. The core analysis completed from 3 wells seems to indicate significantly better quality of the UTA reservoirs (avg. porosity 23.4% vs. 15.8% & avg. permeability of 2,575 mD vs. 39.5 mD).

The UTA formation is a continuous sandstone created from a previous shoreface to foreshore marine environment. The UTA formation has several reservoirs with a total net thickness above contact of approximately 28 m and average total porosity is approximately 14%. Total GIIP estimates include 85.8 Bcf as low case, 153.3 Bcf as high case and 117.7 Bcf of mean case. The unrisked/risked 2C resources were estimated by ERCE in 63.7/57.4 Bcf of natural gas, 2.4/2.2 MMbbl of condensate and 6.5/5.9 MMboe of LPG. Most reserves (65%) come from the B-B3 Main reservoir in the UTA formation. The map below shows the distribution of the existing well across the B-B3 Main reservoir and confirms that the wells are arranged at some of the best locations.

The CPR prepared by ERCE didn’t have access to the original data and had to use the available tables and processed data. This uncertatinty was incorporated to the results provided, so there could be a revision down or upwards once JSE collects more data from the wells.

The fiscal terms of the Lemang PSC include:

First Tranche Petroleum of 20% of gross production.

Share of production: 52% SKK Migas - 48% Jadestone

Unrecovered cost pool of $124.9 million by the end of 2019 that has to be updated by the time that JSE reaches first gas.

Corporate income tax of 44%.

No domestic market obligation (DMO) for natural gas in Indonesia.

JSE has signed an offtake agreement with PT Pelayanan Listrik Nasional Batam, including a volume of 20,000 MMBtu/d and a price of US$5.6/MMBtu. Thus, Akatara will generate $112,000/d of sales of natural gas under the existing contract, which can be increased by the additional 5,700 MMBtu/d in the expected gas plateau rate and condensate and LPG sales. Condensate and LPG production are expected in 27.7 bbl/MMscf and 6.6 mt/MMscf, respectively. As a result, total potential sales of $274,000/d could be achieved during the plateau production rate, using $45/bbl of condensate and $600/mt of LPG. However, condensate production is expected to decline quickly after first gas, and it is more realistic that sales during the plateau (2025-2027) could reach $190,000/d from selling the 3 products. This is not net to JSE, as the fiscal terms will be updated once JSE gets to first gas and the recoverable cost pool is defined, but an after-tax income of c. $70,000/d might be a conservative approach.

The company publishes a monthly video on the progress. The evolution has been radical, from a muddy open field to an almost complete natural gas and LPG processing plant. Produced gas is sent to this processing plant, where condensate is recovered from the separator and also from the LPG plant. Most critical elements can be identified in the last videos. The field has already completed the sales pipeline for the offtakers and the wells will be re-entered in Q1 2024.

In July 2023, the company completed a service test of the Akatara-1 well, which was reactivated with a flow rate of up to 8.5 MMscfd gas with further untested flow potential. The company had procured the key elements for the workover of the wells.

A rig has been mobilised to Akatara and is expected to begin the workover of 2 existing wells during the next few weeks towards first gas. JSE announced that pre-commisionning activities had started and confirmed that first gas is planned for early Q2 2024.

Vietnam

Jadestone owns 2 different licences in the country: Block 46/07 (100% WI) containing the Nam Du field & Block 51 (100% WI) including the U Minh field. Some personnel, including Blakeley, had previous experience with similar assets in Vietnam during their previous tenure at Talisman Energy and JSE also benefits from the proximity of the PenMal asset. The 2 blocks are not distant from JSE’s PM329 in Malaysia and share some geological similarities:

JSE’s predecessor, Mitra Energy, drilled the 46/07-ND-1X well that discovered oil and gas in block 46/07. Mitra was a partner of Talisman Energy in some of the offshore blocks in Vietnam close to these 2 licences. Hence, JSE’s team had some first-hand information when they acquired the company.

The current field development plan includes 2 platforms, a FPSO and a gas export line. JSE submitted this plan to the Vietnamese regulator and even selected some suppliers for some critical components, including the leased FPSO, but the contracts weren’t signed.

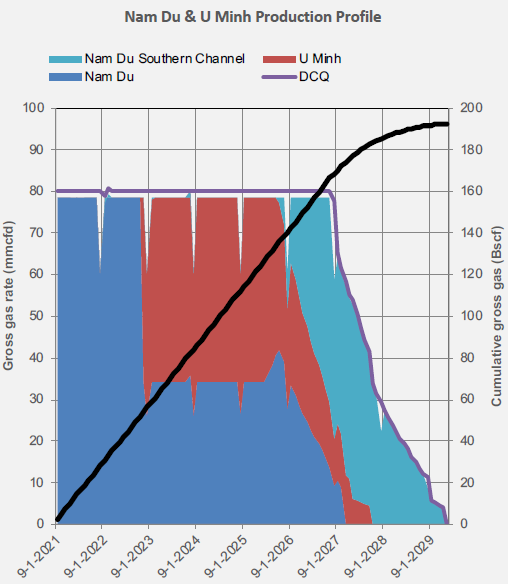

The company had foreseen first gas for 2021, but the progress since 2019 has stalled with less and less mentions to the Vietnam assets in the company’s reports and updates. The interest seemed to have declined since 2020 after the delays in closing the gas sales contract (a heads of arrangement was signed with Petrovietnam in 2019) that is required to complete the FEED and FID. The initial production forecast had a plateau of 80MMscfd (c.14,000 boepd) with a wellhead gas price range of $7-9/MMbtu:

The development of these licences mainly depends on signing a gas sales agreement, which has been the key obstacle. Then, JSE can proceed to start signing contracts with suppliers and reach FID. The company has engaged in discussions with public officials regarding these licences during 2023, but relevant progress remains inconclusive. Additionally, Blakeley has indicated that JSE will not concurrently pursue two developments. As a result, the commencement of these licenses' development is not expected before Q3 2024 at the earliest, coinciding with Akatara's initial gas production. The signing of the gas sales agreement would serve as a strong confirmation of JSE's commitment to the development of these licences, making it the primary catalyst.

Conclusion

In this first post, I have covered the assets of the company and commented on the troubles and potential for each of them. JSE’s strategy is clear, focused on mature assets and extending their life. With Akatara, and potentially with the Vietnamese licences, JSE has slightly adapted this strategy and is also pursuing development of assets.

Despite 2022 and 2023 haven’t been great years for JSE, Blakeley remains as one of the most experienced CEOs in the APAC region. His abilities to close accretive deals have been complemented with the development of a greenfield like Akatara, where he had to go from signing the sales agreement to building a gas processing plant in the middle of the jungle. The core strategy remains the same: use existing cash flows to finance more acquisitions. The $200 million RBL signed this year is vital for Blakeley’s plans, every new asset can be included in this RBL, which expands the borrowing capacity, then Blakeley can use the additional funds to pay for the asset. Lenders have approved the recently announced second transaction in NWS and it shows that they have Blakeley’s back.

Once the problems at Montara are left behind and the company reaches first gas at Akatara, a new chapter will begin (I understand this is a big IF). Many previous shareholders would have lost all faith in JSE. It cannot be dismissed that Blakeley and his team had a terrible 2022-2023 period in the operational side, but they continued implementing their M&A strategy adding Sinphuhorm and NWS to JSE’s portfolio. As market’s expectations are low, it is not difficult to imagine that JSE could surpass them. If that’s the case, current shareholders will be rewarded with a hefty return.

I hope you found this post interesting, and it made you eager to read the continuation, which will delve into the production and financial details of the company, including some scenarios and a comparison with other peers. The second post will confirm whether there is a potential return for JSE’s shareholders. I think there is. See you in a few days!

Disclaimer: this document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes. The author of this article own shares in the company and could sell or buy shares in the future. Please, make your own due diligence and analysis.

Could you link to the Thai gov't website to look up production statistics by field? Ideally by month, so relatively real-time?

Also, is there a site that shows royalties paid by field/license to the government? For example, I found this very old (20+ years) breaking out value sold and royalties paid by field, but I can't find the updated version? Any ideas?https://www.dmf.go.th/bid19/annaul/Sale_Value_Royalty_Natural_Gas.html

Great post. I followed jadestone for a while and am long Valeura (wrote the SA post). What's interesting from an anthropological perspective with jadestone is that no online discussion ever mentions FCF , steady state fcf, ... After tax metrics of FCF. The only stuff that is mentioned is EBITDA, BOEs etc. Is it super complex to calculate given Malaysia taxation etc or is management avoiding these metrics for some reason of business quality?

Do you have an estimate ?

Thanks again!