BW Energy - Diversification done right

Exposition to Santos and Orange basins plus a safe play in Gabon

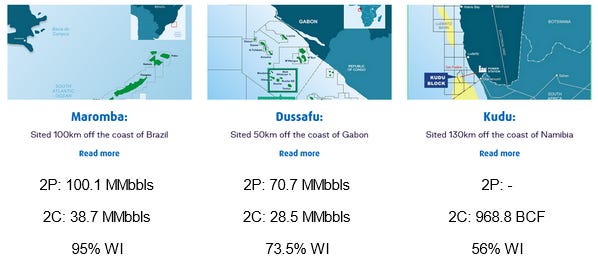

To be honest, I have known the name of BW Energy ($BWE.OL) for a long time but I had paid little attention to it. BWE was a spin off from BW Offshore, which owns and operates 40 FPSO and FSO, and this drove me to think that it would be a minor o&g player without a lot of value left in it. I was wrong. While I was preparing a write-up on another company, I took a further look at what BWE is doing, because I didn’t know much about it. When I checked its operations, I found this:

I was very surprised, does everyone know what BWE is doing? Maybe it was just me due to my misconception of the company. Dussafu is a great oil field that has an expansion plan in progress, and Kudu was the first discovery offshore Namibia in the Orange basin, those two I knew about. Although I didn’t know anything about Maromba and the ongoing acquisition of Golfinho (more details below), which are located in the Santos Basin, a monster in front of the Brazilian coastline, where many huge discoveries have been made since 1999.

Dussafu is a producing oilfield with several resources. First production came from Tortue (currently at 8,501 bopd gross in Q1 2023). The Hibiscus / Ruche Phase 1 drilling campaign is currently in progress with 6 wells targeting 2 formations; the first well achieved first oil and it is producing close to 6,000 bopd. The total cost of the Hibiscus / Ruche expansion is estimated at $450 million, most of which has already been deployed. The goal of the company is to reach 30,000 bopd from Dussafu in early 2024. BWE has obtained a RBL of $300 million ($200 million drawn by the end of Q1 2023) using Dussafu’s reserves.

The Kudu gas field was discovered 5 decades ago, and its geological challenges have delayed its development, which BWE is firmly advancing. The Field Development Plan has been already approved by the Namibian regulator. The current project includes gas sales and a gas-to-power development (a protocol with NamPower was recently signed) to supply electricity to Namibia. Due to the recent successful exploration wells in the area by TotalEnergies and Shell, the whole Orange basin is a hotspot for oil and gas exploration. The company has acquired additional seismic data to improve the definition of the boundaries of the field and enhance the design of the wells. In my opinion, they are trying to confirm whether there could be any oil prospects besides the gas reserves, as there are adjacent oil prospects that will be drilled soon (like Galps’ PEL 83). Furthermore, this seismic could also target potential prospects below Kudu’s reservoir, which was discovered at shallower depths (~4,500 meters) than recent oil discoveries like Venus-1 (~6,300 meters). Hence, the company may try to confirm whether there are other oil reservoirs below the target gas-bearing reservoir, but this is just speculation.

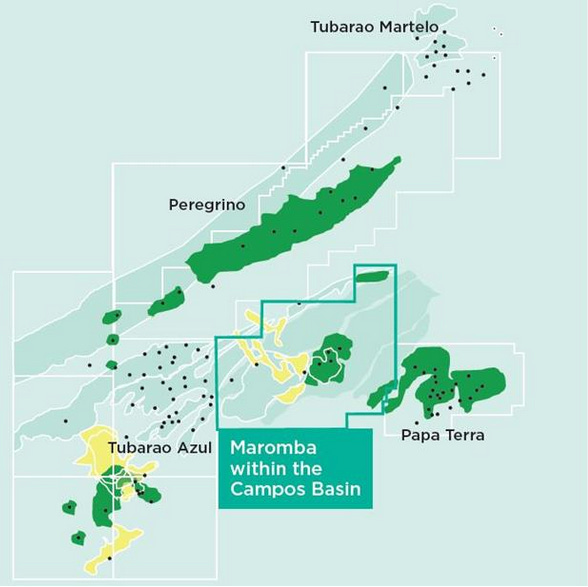

In the case of the Maromba oil field in Brazil, the project is in a definition phase: the FDP was already approved, contracts are being signed with suppliers and the financing is being discussed. This field holds heavy crude oil at API gravity of 16° but with low relative viscosity and sulphur content. The field is located close to Papa Terra, a field that Petrobras sold to 3R Offshore, a JV between 3R Petroleum and DBO (now part of Maha Energy). The Final Investment Decision is expected this year, and first oil is planned in H2 2026. It has been delayed since the first original date of 2025 due to discussion on the refurbishment of the FPSO that will be used.

As an example of how productive the area is, Equinor’s adjacent Peregrino field started production in 2011 with initial reserves estimated at 300-600 MMbbls. Peregrino has already produced more than 210 million barrels in the 2011-2020 period. The field was shut-in in 2020 to complete an upgrade of the field and resumed production in July 2022. The upgrades to the FPSO and installation of a new platform will add 250-300 MMbbls by extending the production towards the southern area of the field. If the second phase is successful, the life of the field would be extended beyond the original EoL date of 2040.

The development of Maromba will follow the same process that BWE is applying to Dussafu, with incremental developments to reduce the time to first oil and upfront investment. Here it is important to stress that BWE is the operator in all three fields, benefitting from its past as FPSO charterer before it was spun off in Q1 2020.

Finally, BWE is expecting to complete the acquisition of the 100% WI in the Golfinho and Camarupim clusters and a 75% WI in the exploration block BM-ES-23, all offshore Brazil, with a consideration of $15 million at closing and $60 million in contingencies. This transaction will add ~9Mbopd with 19 MMbbls of 2P reserves and 19 MMbbls of 2C resources and the potential to develop a gas project in the future. Besides the fields, the acquisition includes the FPSO operating the fields. Thanks to its past in FPSO chartering and operatorship at Gabon, BWE is able to receive the offshore deep-water operation license from ANP. Hence, this requirement reduces the list of potential bidders in future Petrobras’ divestment of offshore assets. The Golfinho/Camarupim transaction was halted when Lula’s government enacted the suspension of Petrobras’ divestment program, but it was resumed a few weeks later.

Another relevant aspect is the management, which has demonstrated that it can generate value for the shareholders. The BW Group is a diversified holding with business in shipping (BW LNG, BW Epic Kosan, Navigator Gas, BW LPG, Hafnia, BW Dry Cargo), water (BW Water), energy (BW Solar, BW Ideol, Corvus Energy, BW Energy Storage Systems), o&g (BW Energy, BW Offshore) and communications (BW Digital).

In summary, I think almost nobody is paying attention to BWE. The expansion of Dussafu and the completion of the Golfinho acquisition may conservatively reach a production of ~36,000 bopd in Q1 2024. In the medium term, the company offers the upside of Kudu and Maromba that could begin production in 2025-2026. The company has low ARO liabilities at the moment, Golfinho/Camarupim is the only mature asset, and even it has the potential to extend its life following the example of Peregrino.

The Mcap is $688 million and it had $34 million of debt by the end of Q1 2023. I assume that the RBL will be extended beyond the existing $300 million once the Hibiscus/Ruche drilling program is completed. The investment needed for the 2023-2026 capex program may put the company in debt in the coming years. With the expansion of Dussafu, the company may generate monthly operating after-tax cash flow above $25 million at $75/bbl. After Kudu and Maromba enter into production at some point between 2025 and 2026, the combined production could reach ~60,000 boepd across Brazil, Namibia and Gabon, three friendly jurisdictions for o&g.

Maybe I am getting too excited, but I see that BWE is clearly undervalued compared to other E&P companies operating in Brazil or West Africa (just compare it to Vaalco with its no-growth plans as of today and its infamous management). I think it deserves more attention and the share price may not reflect everything they are doing, but, you know, markets are efficient.

If you liked this, please, check my other articles and share them, so the increased serotonin level thanks to your support will encourage me to keep writing =)

Disclaimer: this document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.