Evolving views of 2 companies

A comment about Valeura Energy and Vaalco Energy

I have owned for some time two companies that have achieved an outstanding return in 2024 so far: Vaalco Energy EGY 0.00%↑ and Valeura Energy $VLERF. This post is not a deep dive into these companies, but a reflection on how I see them and why I have acted very differently with them. I hope you find it interesting, and I invite you to share your thoughts in the comments.

These two small-cap companies have performed extraordinarily well in the past year, but most of the return came from the last result releases in March.

A bit of context

I have bought and managed the positions in two different ways as well. The first time I heard about Vaalco was in Q2 2022, when I bought on the rise and sold after the market's disappointment with the TransGlobe transaction (combined with worse drilling results and the rapid decline of the oil price). I didn’t own any shares for a long time; however, I started accumulating after the Q2 2023 results, which opened my eyes to the cheapness of the company and its good operational delivery. Shortly after, I saw an opportunity after the coup d’etat in Gabon and significantly increased my position. I think most of you who follow me on Twitter already know that I'm not a fan of George Maxwell, but he has delivered since the TransGlobe acquisition.

In the case of Valeura, I knew nothing about it until it announced the Mubadala deal, which looked too good to be true. It basically consisted of Valeura receiving three mature producing assets from Mubadala for peanuts. It complemented the previous acquisition of two non-producing assets from KrisEnergy, creating a very nice, diversified portfolio in Thailand. The conditions were so good that I was a bit skeptical of the completion of the deal. This made me arrive at Valeura a bit late. Instead of buying it in the CAD 0.75-1.5 range, I bought it between CAD 1.5 and 2. At least, I bought a nice amount of Valeura, which I have trimmed a couple of times. Some, like my colleague

, caught the opportunity immediately, much earlier than I did, and they now have a multibagger.Right now, both positions have surpassed by far the first bagger for me, and after the last updates, I have approached them with a very different strategy. I think that both will not continue the same upward trajectory during the remaining 2024.

Vaalco Energy

In the case of the US company, I sold some shares at $6.05 and saw it continuing to climb. Then, it reached $7.5, and I decided that I had to act. Despite the momentum of the share price, I doubted that it could get to the previous levels of the 2022 run. At that time, the oil price was in a very sharp upward trend, and the drilling results in Gabon were very good, one after the other. Today, many doubt that the oil price will stay much longer in the $85-$90 range, mostly due to fears of OPEC reducing the voluntary cuts if oil stays at $90 or even goes to $95 a barrel. So, I decided to reduce my position by two-thirds.

The reason that drove me to do that is that I don’t expect a good Q1. The ongoing drilling program in Q1 consists of more wells in Canada, and it usually takes some time for those long lateral wells to be drilled, completed, and cleaned. Also, the break-up in March-April adds some uncertainty regarding the access for completing the job. So, the actual impact will be seen in Q2-Q3 2024. Most of the remaining CAPEX is focused on maintenance, workovers, and long-lead elements for the 2025 infill drilling campaign in Gabon. I expect these numbers to be revised slightly upwards once the company closes the Svenska transaction (which I think it was great).

After the 2023 results were published, one aspect that worried me was the non-renewal of the buyback program. This program was not announced because Vaalco’s leadership thought it was a good decision; instead, it was forced to commit to it as a measure to appease the discontent of TransGlobe’s shareholders regarding the terms offered. Even I didn’t like the decision initially, later, I understood why Maxwell had decided this. The company is entering into a 2024-2026 period of record levels of CAPEX with significant uncertainty regarding the amount and timing of some of the investments. Henceforth, a conservative approach under these circumstances is convenient, and I think Maxwell and his team made the right call here.

2024 CAPEX

Vaalco is entering a period of high CAPEX. Despite the company postponing the plans for an infill campaign in Etame to 2025, the 2024 CAPEX is still at a significant level of $70-90 million. It may not look like much; however, it is still below last year’s expenditure of $97.2 million on a cash basis.

There are some caveats to that amount that have led me to believe that the actual CAPEX will be higher. First, there is a contingent 10 to 15-well drilling program for Egypt with a cost of $18 million for H2. The company hasn’t yet secured a rig for it, but I think it is very likely that it will be executed.

Additionally, the Svenska transaction comes with the drydocking of the FPSO for 2025, which will require some CAPEX during 2024 to prepare for that campaign. This could add some $5 to $10 million to the CAPEX program.

Following the report, the recent announcement of the finalization of the required agreements in Equatorial Guinea means the company has to begin the work to prepare the Field Development Plan (FDP) that must be approved by the authorities. This FDP will be key to achieving FID in the first half of 2025 and will require a series of engineering FEED studies performed by various contractors and consultants, as well as data acquisition and processing services. I would estimate realistic development costs of $15-20 million for becoming FID-ready. During the last call, some FEED studies were mentioned as part of the 2024 CAPEX guidance when the CFO, Ronald Bain, commented on the breakdown of CAPEX (“possibly FEED studies”), but there isn’t certainty.

These expenses are usually shared by all licensees, but it seems that this is not going to happen for Block P. Other partners include Atlas Petroleum International Limited and GEPetrol (the National Oil Company), both with a 20% interest. GEPetrol is carried to first oil, and Africa Intelligence published this week that Atlas will not contribute to the development costs of the Venus oil field. This information illustrates what one could expect in a West African country, and it doesn’t bring hope to IOCs returning to Equatorial Guinea. As a result of this 'decision,' Vaalco will bear 100% of all costs for the development, but then I wonder if that also includes the CAPEX. For many E&P companies, the investment to reach production is classified as DEVEX before FID and CAPEX after it. However, I haven’t managed to read the article (the paywall is strong) and I cannot confirm if Vaalco will carry both GEPetrol and Atlas to first oil. I think it will, so this adds a significant amount of investment for the next 2 years, with the preparation of the FDP and PDO and the subsequent construction of all elements, platforms, templates, wells, connections, etc.

I have contacted the company, and they haven’t disclosed any information that confirms the piece from Africa Intelligence, but the language used leads me to think it is true. The details of these agreements (which shall include the position of Atlas) will be disclosed with the Q1 2024 results call. My take is that Atlas will be carried until first oil, and then Vaalco will recover the costs from the first shipments of oil, but this is my theory. As some of the FEED studies could already be accounted for in the 2024 guidance but Vaalco now has to carry Atlas, I assume that an additional $5-$10 million is required this year.

Therefore, Vaalco is facing an actual CAPEX program for 2024 in the range of $90 to $130 million, which is on top of the price to be paid for Svenska ($30-$40 million net). This will bring the total outflow to the range of $120 to $170 million. Hence, the company is facing a serious level of investment in 2024. However, there is much more ahead for the company.

2025-2026 CAPEX

The company has already committed to completing the following investments:

Gabon infill drilling campaign, which could require a similar investment to that of 2022, resulting in $94 million net to Vaalco. Hence, Vaalco would have to spend approximately $100-$110 million in Gabon alone (accounting for inflation since 2022). CAPEX for 2026 would be much lower, but a nice amount of $20-$30 million could be spent on maintenance and workovers.

Ebouri field redevelopment, discovered in 2003 at approximately 18 kilometers northwest of Etame. The Gamba sandstone formation extends over Ebouri, and Vaalco already knows how to work with it. The company could apply the latest data collected from the Dentale sands that can be incorporated. The redevelopment will take place after the infill drilling at Etame and would add 8-12 MMbbls of reserves from 2 wells and 1 workover. These wells could be drilled in Q4 2025 or early 2026. A realistic cost of drilling the wells and connecting them to Etame would be $20-$30 million in total.

Egypt. One can conservatively assume a similar level of CAPEX as in the last years, with an average of $30 million for both 2025 and 2026.

Canada, despite not being a large contributor to the group’s production, Vaalco seems satisfied with the results obtained until now. In fact, it is the only asset where the guidance shows higher production for the full year than for Q1. I think the company will continue drilling wells, with an annual expense of around $30 million in the next 2 years.

Svenska’s FPSO drydock: The total cost for the required upgrades hasn’t been published by Vaalco yet; it will be done after the transaction closes, hopefully. But the costs of such an operation can be significant and reach $100-120 million to be shared by the partners. Hence, Vaalco will have to pay circa $30 million in 2025.

Block P’s FID and start of development, as Vaalco has already confirmed the intention to prepare a drilling campaign for both Etame and Block P. On top of this, it will have to fully carry the partners. However, it makes sense that the wells for Block P are the last ones to be drilled, delaying this cost to 2026. I think that the CAPEX for Block P could be split with $60-$70 million in 2025, $150-$180 million in 2026, and some investment left for 2027. The cost is not as high as other developments, as I expect Vaalco to reduce CAPEX and use as many production contracts (e.g., an FPSO) as possible. The Venus field is located in shallow waters, and the development will consist of a multi-well program that can be drilled with a jack-up rig and not a more expensive floater. Part of this CAPEX will be recovered shortly after first oil, but Vaalco will still have to pay for it before production begins.

In summary, Vaalco may be facing a CAPEX of approximately $210-$250 million in 2025 and $280-$300 million in 2026. These figures cannot be easily ignored, and I understood Maxwell’s decision not to extend the buyback program until the timing and amounts are confirmed. These are my own estimations, and I’m sure that they will diverge from the actual numbers, but they gave me some reason to think that the company shall be conservative with regards to its spending. The addition of Baobab’s production for almost three quarters in 2024 will help in accumulating enough cash for navigating through the rough waters.

Additional contingent CAPEX beyond 2024

Above I presented the costs that many of you already know, but there are more contingent costs that may add more pressure to Vaalco's financial position.

The company owns a 37.5% non-operating stake in Blocks G and H in Gabon, and Maxwell mentioned in the last call that he had seen an acceleration of the conversation with the partners, BW Energy and Panoro. The situation may advance to a decision by the end of Q2, which will impact the CAPEX for the next years. These blocks are at an exploration stage, and some studies and the drilling of exploration wells may be planned for the next two years. This could add even more pressure to a generous CAPEX program for 2025-2026, which will be confirmed in the Q2 results update and CC.

Additionally, there is another important CAPEX commitment coming with the Svenska acquisition. The field has been producing since 2005, and this CAPEX is required for expanding the life of the field by increasing the production. Baobab’s development has followed a phased approach. So far, four phases have been completed, and the 5th phase will be initiated after the maintenance of the FPSO. This phase 5 has been postponed since it was originally planned for 2022. Its goal is to increase the recovery factor with the production of an additional 50 mmbbls in the following years, which should be stable in the 20,000-30,000 bopd range for the next four to five years. Svenska’s website describes the details of this phase:

Attention has now turned to planning for Phase 5. This phase will most likely consist of 5-6 production wells and 1-2 water injectors, increasing the field recovery factor to 25 per cent. The operator, Canadian National Resources, CNR, has generated a charter for Phase 5 indicating first oil in Q2 2022. A Baobab-type reservoir should be able to achieve an Ultimate Recovery Factor in excess of 30 per cent demonstrating further development potential post Phase 5.

The wells of this phase could be drilled in 2025/2026 or 2026/2027, as CNQ stated in 2023 that it was targeting phase 5 development at Baobab in 2026/2027. The timing of this phase will greatly affect the CAPEX for Vaalco in the next few years.

Vaalco now has reached a market capitalisation of $730 million, with a WI production of 22,100 boepd in the mid-range and an OPEX+CAPEX expense of $30 per barrel. I think it is not expensive, but the company will consume the cash reserves and require some debt between 2025 and 2026 in a realistic scenario. I think it will do well, but I see the upside limited with the share price above $7 and greatly dependent on the oil price.

Valeura

The situation with Valeura is different. I haven’t sold any shares in a very long time, and I don’t expect to sell any despite it being a 52W high levels.

Valeura has had an amazing run since it announced the Mubadala deal going from C$0.65 to C$5.5, almost 8.5x times growth in less than 1.5 years. The fears about the low life of the assets have been dismissed by Sean’s decision to keep a continuous drilling program across the 4 assets: Manora, Nong Yao, Jasmine and Wassana. Despite some operational problems with the re-start of Wassana, the company has ended 2023 in a very strong position. It closed 2023 with a cash position of $151 million and Q1 2024 with $193.6 million (+$42.6 million in 1 quarter). The cash position includes restructed capital and doesn’t account for taxes payable, but the change QoQ shows the resilience of the company while it is continually drilling more wells.

To me, the most important aspect of Valeura’s thesis is this table:

Sean’s team has managed to increase reserves by 30% in a year, extending the life of the 3 producing fields (Manora, Nong Yao and Jasmine) by almost 2 years in average. This has confirmed the potential of the assets to generate value in the coming years with a reasonable level of investment that will allow for FCF generation.

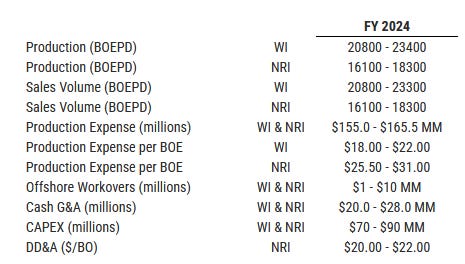

In parallel, the company is completing the Nong Yao C development, which should be online by the end of Q2 or early Q3. You can see below the guidance for the year, and I think it is very promising. In my opinion, it hides one aspect that is very interesting, can you see it?

Yes, it includes some exploration expense, and the company just released this week the following comment:

Valeura provided an operations update on March 26, 2024, along with its announcement of results for Q4 and the full year 2023. Since that time, the Company has been conducting an exploration drilling campaign, and will provide an update shortly.

This was intriguing because Valeura doesn't frequently provide comments on such results between quarterly updates. I looked up the data in the Thailandese Ministry of Energy and saw this:

Busarakham G11 Ltd. is the official operator of the Nong Yao oil field, which Valeura controls with a 90% interest. The inclusion of this comment in the last update could imply that the previously announced Nong Yao D prospect has delivered very good results, potentially extending the current potential of the ongoing Nong Yao C extension.

While the assets Valeura already owns demonstrate their ability to maintain existing production levels of 21,000-24,000 boepd for many years, it's disappointing that the company has not yet completed the reorganization to utilize Wassana's tax losses across all assets after two years.

However, many shareholders, investors, and commentators have demanded that Sean initiate a shareholders' return program through either dividends or buybacks. It's important to note that Thailand imposes a 10% tax on capital outflows, which would reduce the net amounts reaching shareholders. Sean has insisted that his team's objective is to pursue growth by acquiring more assets, particularly natural gas assets. While Chevron and PTTEP currently own the best natural gas assets in Thailand, there could be an opportunity for a proven operator like Valeura to acquire some of their assets. However, I believe Sean is also considering opportunities beyond Thailand, with a continued focus on the Asia-Pacific region.

Despite reaching a market capitalization of C$560 million ($407 million) with a WI production of 23,000 boepd and an OPEX+CAPEX expense of $43/bbl, the company still appears undervalued. Although the total expense is higher than that of Vaalco, I believe it can be reduced during the year, as it was in 2023.

In my opinion, Valeura has a growth path and the financial strength to invest in increasing production in Thailand while pursuing new opportunities. Even if the oil price returns to the $75-$80/bbl range, I believe Valeura will perform well in 2024. In an optimistic scenario where the oil price remains at $85-$90/bbl well into 2024, there still is potential for the share price to double.

Conclusion

I've outlined above why I've taken a conservative approach to Vaalco's position in my portfolio, but I still have faith in Valeura's continued delivery. I will continue to monitor the performance of both companies and may consider adjusting my positions based on how the situation evolves.

Both companies have promising futures, but the CAPEX requirements for Vaalco limit its short-term potential.

Please note that this is not a recommendation. I've simply shared my thoughts on these two companies that I own, which I thought might be interesting to others. Before making any investment decisions, please conduct your own analysis.

Feel free to subscribe to this substack, but please understand that there won't be a regular schedule for posts, as explained here. I welcome your feedback on these companies or any others you own or have analyzed. I hope posts like these will increase engagement with readers. You can also share your thoughts with me on Twitter or by email to anotheroilgastourist@gmail.com

Disclaimer: the author owns both companies and this post has been prepared only for informative purposes. This is not investment advice.

Pleased to see more content.

Great work again, thank you !

Valeura under CAD 2 was an incredible gift indeed !