Expecting a company shake-up

Significant value hindered by the wrong setup

i3 Energy is a British company listed in both the UK (LSE:i3E) and Canada (TSE:ITE). The company has producing assets in Canada and an undeveloped offshore license in the UK. Its production consists of gas, condensates, NGLs and oil in Alberta across 4 different plays: Central AB, Wapiti, Montney and Clearwater. We believe there is value in the assets but the current setup is not supportive for any value discovery, converting it in an ignored stock still producing 21,000+ boepd.

The origin

i3 Energy (i3e) was originally listed only in the British AIM in 2017, when its only focus was in the exploration, appraisal and development of the P.2358 license in the Outer Moray Firth area, which included the Serenity and Liberator field discoveries. The license was acquired in 2016 from Dana Petroleum.

The company’s most relevant advancement occurred between 2020 and 2021, when i3e began a buying spree:

June 2020: the company successfully approached Toscana Energy, a Canadian company, acquiring all the shares in June 2020. The company did a brilliant move, first, it bought the rights and interests in Toscana's CAD$24.8 million senior debt facility and CAD$3.2 million junior debt facility for a total consideration of C$3.0 million and C$0.4 million, respectively. Then, it paid C$0.45 for the equity, managing to acquire Toscana’s 2P reserves of 3.98 MMboe (46% natgas, 54% liquids) for a total consideration of C$3.85 million. The multiple paid was very low, even using different metrics: 0.7x Toscana's 2019 Field Netback of CAD$5.5 million (c.US$4 million), CAD$3,618/boepd (c.US$2,661/boepd), or CAD$0.83/boe (c.US$0.61/boe). Aside from all the production and reserves, Toscana also brought in its accumulated tax pools of C$128 million (US$94 million). As part of this deal, i3e listed in the Toronto Exchange, rearranging the ticker from TEI to ITE.

July 2020: i3e acquired Gain Energy for a total consideration of C$80 million (~US$58.8m), which included 26.4 MMboe PDP and 69.4 MMboe 2P reserves. Those assets had produced 11,020 boepd during 2019. The multiple paid was again very low with approx. 1.7x 2019 field EBITDA, US$5,526/boepd, and US$0.85/boe of 2P reserves.

March 2021: i3e acquired a 15-year lease on 7 sections (17.9 km2) of land in the emerging Cadotte area, with no associated drilling obligation, for under US$0.3 million.

April 2021: i3e entered into a farm-in to participate in a drilling programme at the Clearwater play within the Marten Hills, Cadotte and West Dawson areas, which included 9 wells in total. Should all nine wells be drilled, i3e will earn 11.5 net sections of land (circa 29.4 km2) across the three areas. i3e will pay 75% of the costs to drill the first two wells to earn its 50% working interest. Subsequent wells will be funded by i3e and the Partner on a 50:50 basis.

May 2021: acquired from Anegada Oil Corporation an additional 49.5% position plus operatorship in the Company's South Simonette (Montney) oil property, increasing i3e's interest to 99% through exercise the Right of First Refusal ("ROFR") for an amount of US$4.2 million (C$5m) plus planned capital investment of US$0.58 million.

June 2021: executed a binding sales and purchase agreement to acquire 230 boe/d of Wapiti production with total acquisition and capital cost of US$0.41 million.

July 2021: i3e announced an acquisition of assets from Cenovus Energy in i3e's Central Alberta core area of approximately 8,400 boepd (51% oil and NGLs) for a consideration of CA$65 million (US$53.7 million).

The 2020 transactions were funded by a placement of £30 million in August from the issuance of 581,147,255 shares at 5 pence plus the sale of the Saskatchewan portfolio recently acquired from Gain to Harvard Resources Inc. for C$45 million (~US$33m). The 2021 acquisitions were funded from own resources plus a placement of £40 million from the issuance of 363,700,000 Placing Shares at 11 pence, a 3% discount to the 15-day average closing price.

Management and board

The company is led by Majid Shafiq as CEO with John Festival as Chairman. Mr. Shafiq comes from the financial world and i3e has been his first rodeo leading an E&P company. The role of Mr. Festival is particularly interesting as he participated in the sales of BlackPearl Resources Inc. to International Petroleum in December 2018 and BlackRock Ventures Inc. to Shell Canada for US$715 million and C$2.4 billion, respectively. Maybe a sale of i3e could be the key to unlock all its potential value.

The BoD is 50:50 UK and Canadian profiles, which ensures a balance when making decisions, but it isn’t aligned with the relevance of both geographies for the future of the business. Other positions like Chief Developments Officer, Manager New Ventures, International Corporate Manager or COO are UK-based profiles with expertises more related to the North Sea than North America. On the other hand, they have also retained some talent from their acquisition, such as the President at i3 Energy Canada and Board member who was Toscana Energy’s CEO before the deal, or hired specialists in Canada, such as the CFO, who has a very long career in Canadian companies. The VP Corporate and Exploration profiles in the Canadian company seem very adequate but they still aren’t the top executives

In our opinion, the composition of management and board resemble more a British than a Canadian company, and that is not what the operations show. Should the company continue to generate most of the revenue from the Canadian assets, maybe a change of configuration shall be made.

As a proof that the team is still aspiring to increase production both organic and inorganically. The company issued options over 3,000,000 ordinary shares @ 20p to the CFO that will vest according to the following milestones:

One-third upon achieving production of 26,000 boepd;

One-third upon the addition of 5,000 boepd via acquisitions; and

One-third upon the addition of 25 MMbbl of 2P reserves.

The executive team and board have focused on providing a return for shareholders through dividends, instead of allocate capital for increasing the CAPEX program with more drilling in the best location and development of the unbooked locations. It is on their hands to review this policy and decide if it has provided the expected returns, as it doesn’t seem positive that a company confirms a monthly dividend and the next quarter and halves it, making it quarterly again.

Assets and reserves

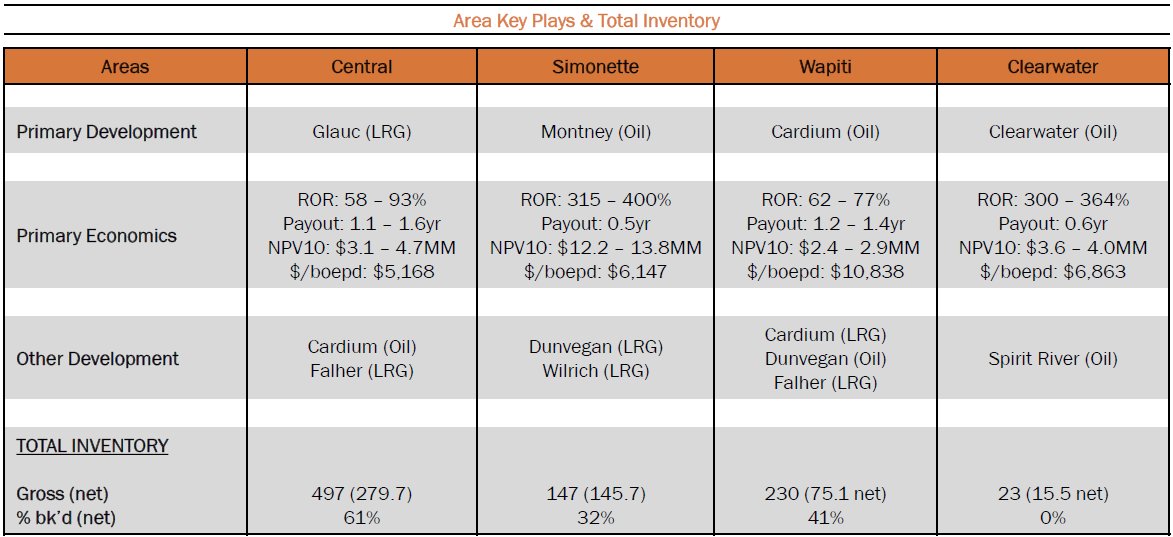

The main assets can be divided between the UK and Canada, as both locations are opposites. The UK consists of an offshore license to be developed, and Canada includes 537 net locations across 4 different plays in liquid-rich areas. The reserves included in the 2022 Reserves Report elaborated by GLJ Ltd. for i3e’s Canadian assets (Central AB, Wapiti, Monteny and Clearwater) are:

The P+P reserves in the 2022 Reserves Report can be split as follows, showing the minimal contribution from Clearwater:

As aspect that we consider relevant is the fact that the company added proved reserves above the production during 2022:

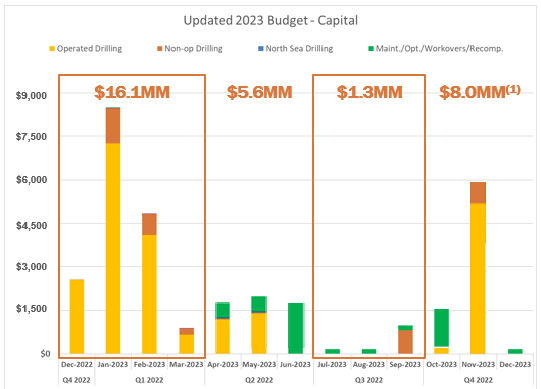

The company has ambitious plans for the Canadian assets, the British license seems to be a bit on the air right now and little information has been published about it. The 2023 CAPEX guidance barely assigns any relevant amounts to Serenity. The CAPEX program was slashed with the Q1 update (-52%), when the WTI was at its lows of the year to date. With the WTI at $80+, we could see an uptick of the total amount to be spent in the year, but this is speculation.

The UK: Serenity field

After unsuccessfully drilling the Liberator prospect, i3e’s sole UK asset is the Serenity field in the P.2358 license in the North Sea, which lies very close to the Tain field, owned by Repsol Sinopec & Rockrose. In August 2022, i3e farmed-out a 25% WI to Europa Oil & Gas (Europa), when it was preparing the appraisal well of the license.

The conditions of Europa’s farm-in were beneficial for i3e, as Europa funded 46.25% of the appraisal well up to a gross capped well cost of £15 million, with any well costs exceeding £15 million funded by the companies in proportion to their respective working interests.

The discovery well was drilled in 2019 and was a great success. It confirmed the presence of an oil-bearing reservoir with a sequence of Captain and Coracle sands with oil confirmed in the interval from 4,740 ft (1,445 m) to 5,252 ft (1,601 m) TVDSS (TVD minus the elevation above mean sea level). The two horizons include 339 ft (103 m) MD, 165 ft (50 m) TVD of sand in total, with oil in the uppermost Captain sand and in the Coracle sands at the base of the interval. The reservoir quality was high, with porosities averaging 24.5% and oil samples, recovered by wireline, having an API of 31.5°. This confirmed that the Blake, Tain and Serenity fields share similar characteristics and belong to the same hydrocarbon system.

However, the appraisal well was drilled to the east to test the extension of the field, and it was disappointing. The well didn’t show commercial potential as the sands were water bearing and not in direct communication with the oil bearing sand. Nonetheless, this result delimited the extension of the field.

The results of the appraisal were disappointing, but it helped in understanding the whole discovery. Using the information from both wells, i3e decided to consider a 1-well development connected to the Tain field, which will reduce both capex and opex, making it commercial even at lower reserves. Similarly, the abandonment costs are minimal compared to the removal of a platform.

Neither i3e or Europa have provided a timeline for the development of the Serenity field. However, both companies have confirmed in public their intentions to continue advancing the concept towards the submission of a Field Development Plan. As the political situation in the UK is becoming more polarized in regards to its national o&g production, the earliest this FDP is submitted and approved, the better for the future of this field. A single subsea well will also pose a low “threat” for the environmental group, as the impact of a FPSO or platform is avoided. It is not totally clear if this field will be developed, but we understand that both partners will be in a hurry to get the consent ahead of a potential change or power in Downing Street.

We would like to see a major advancement regarding the development of Serenity already in H2 2023, such as completion and submission to the NSTA of the FDP in Q3 or Q4 2023, before receiving the go-ahead by the NSTA in early 2024. As the development is simple, FEED and FID could be completed by mid-2024 with first oil achieved in early 2025. This timeline we propose could be feasible, but the pace of progress is yet to be confirmed.

Canada

i3e owns acreage in Central AB, Wapiti, Montney and Clearwater, with 940 gross and 537 net locations, combined. The company hasn’t booked all locations, which leaves them out of the attributed reserves. Particularly relevant is Clearwater, which barely contributes to the reserves in the last reserves report. However, as i3e has completed the commitments for its farm-in agreement, more delineation and exploration is expected in Q4 2023, which could increase the relevance of Clrearwater in the next reserves report.

According to the 2022 reserves report, the total PDP and P+P reserves are 49MMboe and 181MMboe, respectively. These reserves only include 255 net locations of the total 537 net locations in the inventory. As it is shown above, Central and Wapiti make for the most number of locations already booked, Montney and Clearwater remain mostly undeveloped with any meaningful reserves at the moment:

As it can be seen above, oil and NGLs represent 18.7% and 34.1% of the P&P reserves, respectively. However, the two most developed plays are the more gas-prone areas, with Montney and Clearwater contributing much less than Central and Wapiti. As drilling progresses in those two areas, more liquids could be added to the reserves, subject to finding commercial volumes, of course.

Relevant events in Canada

To show how difficult it is to monitor the company’s progress (something that MUST be address by the company ASAP), we have included below the different events that occurred in Canada and were reported in the quarterly updates. The reporting of this information is inconsistent and perplexing. At times, data from one quarter appears in the update of the preceding quarter, without subsequent mention in the update for the appropriate quarter.

Wapiti:

Q1 2023: completed the drilling of 4 gross (2.0 net) horizontal wells: 3 gross (1.8 net) operated 1.5-mile Cardium wells and 1 gross (0.2 net) operated 2-mile Dunvegan well. No production data provided due to high gathering system pressures and unanticipated apportionment issues associated with the Pembina Peace Pipeline liquids line.

Q4 2022: no activity was reported.

Q3 2022: previously drilled and operated four gross (2.94 net) wells were tied-in, with realized IP30 of greater than 490 boepd per well, despite ongoing third-party backpressure curtailment.

Q2 2022: drilled and operated 4 gross (2.94 net) horizontal oil wells in its initial phase of Cardium development within this core area.

Q1 2022: participated in 4 gross (0.2 net) non-operated horizontal oil wells, including 3 gross (0.1 net) Cardium wells and 1 gross (0.1 net) Dunvegan well, no production rates were reported but pay-out was projected in 5 months.

Q4 2021 (same than for Central AB): brought on stream four gross (1.5 net) highly economic non-operated horizontal wells within its Central Alberta and Wapiti core areas, including one Ellerslie liquids-liquid well, one Belly River oil well and two Dunvegan oil wells, which in aggregate contributed net IP30 rates of approximately 600.

Central AB:

Q1 2023: drilled 1 gross (1.0 net) horizontal Cardium oil well and a 2.3 km pipeline to reroute production away from third-party infrastructure. No production data provided due to Alberta wildfires disruptions.

Q4 2022: Drilling, completion and clean-up of the two-well (1.3 net) Belly River. No production data was provided.

Q3 2022: results from the previous (3.0 net) Glauconite show pay-outs of approximately 8 months with peak 30-day individual well rates averaging in excess of 600 boepd. Spudded the first two (2 net) 1.5-mile extended-reach horizontal Falher wells. Commenced a two-well (1.3 net) Belly River drilling programme in Leedale.

Q2 2022: drilled and completed another 3 gross (3.0 net) extended-reach horizontal liquids-rich Glauconite wells from a new 3-well pad. Clean-up was completed.

Q1 2022: brought on production 2 gross (2.0 net) Glauconitic wells. Test flow reached a combined rate of 8,900 mcf/d, and IP30 showed 778 boe/d (3,315 mcf/d, 40 bbl/d condensate and 185 bbl/d of NGLs) per well. These results accelerated the drilling of 3 gross (3.0 net) Glauconitic wells at Open Creek from a common surface pad. All 5 wells encountered excellent quality Glauconitic reservoir rock throughout.

Q4 2021 (same than for Wapiti): brought on stream four gross (1.5 net) highly economic non-operated horizontal wells within its Central Alberta and Wapiti core areas, including one Ellerslie liquids-liquid well, one Belly River oil well and two Dunvegan oil wells, which in aggregate contributed net IP30 rates of approximately 600.

Montney:

Q1 2023: no activity was reported. No final figures for the 2 previous wells were provided.

Q4 2022: results of the previous 2 wells

South Simonette Lower Montney well was fully cleaned and had initial production rates of over 1000 boepd.

Middle Montney formation in North Simonette hadn’t completed fluid recovery and peak producing day exceeded 500 boepd.

Q3 2022: 2 gross (1.99 net) Middle Montney and Lower Montney extended-reach 2-mile horizontal wells at North and South Simonette, respectively, were drilled and tied-in to production. Results were expected in Q4.

Q2 2022: completed the previous Lower Montney well with 206 hydraulic fracturing stages, continued facility construction operations at the wellsite and began well tie-in operations.

Q1 2022: spudded initial 1 gross (0.99 net) Lower Montney extended-reach horizontal well at South Simonette.

Q4 2021: no activity was reported.

Clearwater:

Q1 2023: drilled 3 gross (2.5 net) multilateral horizontal Clearwater wells at Dawson and Marten Creek.

Dawson: IP30 of 81 bopd, and expected to reach 110 bopd with an eight-leg multilateral horizontal well configuration (10,000 m). A second well to be drilled and completed by year-end.

Marten Creek: 2 gross (2.0 net) exploratory three-leg multilateral horizontal wells (retrieving a vertical core from one well). Production testing couldn’t be completed in January-February due to warm water

Q4 2022: drilled, equipped and tied-in three gross (0.9 net) nine-leg with an average gross initial 30-day producing rate of 235 bbl/d. multilateral horizontal wells at Marten Hills.

Q3 2022: drilled an initial six-leg horizontal multilateral well (0.5 net) in the greater Harmon area. Completed clean-up flow operations from previous 2 wells achieving each 214 bbl/d for the first half of August.

Q2 2022: drilled 2 gross (0.6 net) eight-leg multilaterals in the Clearwater formation.

Q1 2022: completed 4 gross (2.0 net), eight-leg multilaterals (12,000m total) with IP7 of 214 bbl/d (4% water), completing the earning phase of Clearwater farm-in. Decided to drill 2 gross (0.6 net) additional wells to earn an additional 13 sections.

Q4 2021: no activity was reported.

Clearwater

We want to comment on the situation in this specific play, as it is a “special situation’. ie3 acquired the locations through successive acquisitions, bids at Alberta Crown Land Sales, joint ventures, partner consolidation and a farm-in. In 2022, i3e increased the acreage in Clearwater to 109 sections (+44 since Toscana acquisition), with an average working interest of 76%.

The image below shows one of the best displays of the different E&P companies present in Clearwater, kudos to Captain Clearwater for this work (please, follow the account to show him/her some love). The image shows that most wells are located in Nipisi and Marten Hills, where the premium locations can be found.

Disclaimer, all i3e’s locations are not shown in the map above, particularly the last additions in Cadotte and Walrus (in the northwest limit of the Clearwater play, where the reservoir is thinner). It is clear that i3e’s locations in Clearwater aren’t the best, most are to the north of Nipisi’s core locations. Below we show how the acreage in the play has increased (left Q1 2022, right Q1 2023), and how most existing wells aren’t close to i3e’s locations. This doesn’t necessarily mean these locations are not economical, but that rates and total production may not be as high as in other parts of the play. The price paid for the locations wasn’t very high, thus, the company still projects high IRR for the area. If the results confirm an oil play (not so far), the whole area will be very accretive for the company’s valuation.

Until today, wells drilled in Clearwater were contingent for the farm-in commitment assumed in 2021, so they were part of a work programme to increase the acreage across the play. Some wells included the preparation of pads and reception infrastructure, but the main goal was not in maximizing production, yet. The data collected from these wells was (and will be) incorporated to the development plans for the play. The company included more exploration wells in the initial 2023 CAPEX program, so more data will be collected.

Although results were not great compared to those obtained by other players in the area, there are still improvements to be made in the design of the wells and infrastructure (e.g. build and use of common surface pads). Also, the price paid for the acreage hasn’t been particularly high and the accumulated acreage will support making a more efficient development of the whole acreage with common reception, storage and transportation infrastructure.

Production

In the Q1 results the company already commented that production has been affected by planned facility turnarounds throughout May and into June, at operated and third-party area gas plants. Production over this period has been further impacted by the ongoing Alberta wildfires in the Company's Lodgepole, Wapiti and Simonette areas, averaging 20,729 boepd in the last 7 days of May. Then, it is expected that Q2 production could not grow over Q1 and, even, potentially come lower.

Since it acquired the Canadian assets in 2020, the production has increased, mostly in 2021 due to the last round of acquisition that i3e completed. In the last 2 years, the growth pace has been constant but slow:

In Q1 the production was the following, showing i3e’s high dependency from Central AB, followed by Wapiti and Montney:

Montney and Clearwater aren’t contributing to i3e’s production in a meaningful way. In the case of Clearwater, the last 2 drilled wells appearing in the records don’t show production, at least in the data available in Cartofact. However, Captain Clearwater published that there is some available information and only gas and water is being produced from those wells, no oil, which would not align with the expectations for any E&P company in Clearwater.

After completing the farm-in program, i3e’s plan still seems to be focused on delineation of the acreage, which is not a good sign as it would confirm they haven’t still found what they expect. At some point, there should be a change in the i3e approaches to Clearwater to optimize the value from the acreage there; this strategy shift shall include a comprehensive development program with more pads, wells and infrastructure.

The 2023 CAPEX program was recently lowered (more on this later) and this is not a good indication of a rapid production growth. Since then, oil prices have recovered, which could enable a reduction of the cuts applied to the investment program. It wouldn’t be the first time that i3e increases the CAPEX program during the year, following the evolution of the business, and this time shouldn’t be different.

Financials

The company receives revenue from the production of natural gas, NGLs and oil, but it also receives a 2% royalty interest - £4.9 (C$7.8) million in 2022 -, and income from the processing of third-party - £6.3 (C$10.1) million in 2022.

Together with the revised guidance, i3e included an estimation that every US dollar of increase of the WTI will result in US$1.3 million of extra net operating income. Thus, as the average for the year is getting closer to US$80, an additional US$10 million in cash shall be available, plus any upside from the natgas pricing and FX (slightly more positive for i3e right now).

In the case of the guidance for the CAPEX, the commitment for Q4 is not totally confirmed and it has yet to be approved by the BoD. The company has made a deep review of the program for the year, which has impacted the total production:

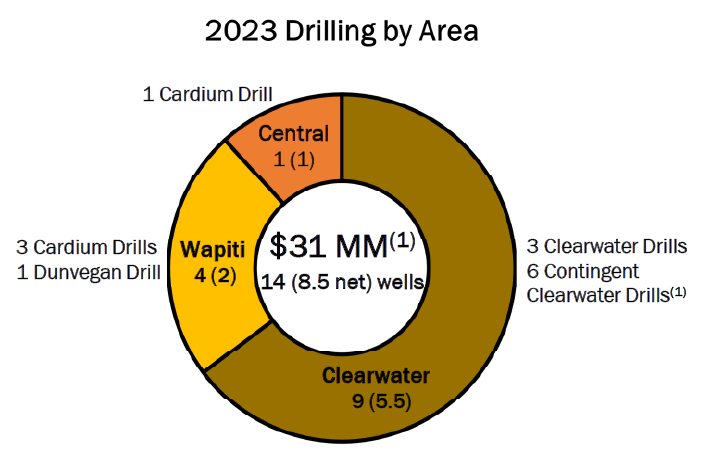

i3e has barely allocated any capex to the UK license, so the focus is on Canada. However, the expenditure in Q3 seems disappointing, as most capex was already spent in Q1 and Q2. Together with the impact of the Alberta wildfires, we think the Q2 production will disappoint and it could fall to c.21,000 boepd.

Surprisingly, there won’t be any drilling done in Montney during 2023. Despite the company isn’t producing much from Clearwater, the area will receive most capex, but part of it is contingent and is planned for Q4, hence, not 100% confirmed. The campaign in Clearwater includes exploration and delineation wells, which could confirm the value of the acreage and ideally lead to an increase of reserves. This work is important for the future of the company, should the campaign be confirmed and successfully executed, the value generation will be massive as Clearwater is mostly oil and with very good economics.

Hedging

In the last update included in Q1 2023, the hedged position looks like this:

These hedges already ensure US$45.6 million (C$60.7 million) of net operating income for 2023, covering 38.9%, 22.6%, 18.4% and 16.9% of the Company's projected Q1, Q2, Q3 and Q4 2023 production volumes. Natgas hedges weren’t added before the start of Q2, we don’t know yet if they added some during the quarter. More hedges were added in Q1 for Q3 and Q4 at not great prices, as the futures are currently trading above those levels. Current oil hedges are now below the current WTI price, but the total volume doesn’t represent a relevant concern as there still is a large exposition to the spot price.

We expect to see an update to the hedged position together with the Q2 results, and we hope (maybe we are näive) that i3e hasn’t covered oil below $70/bbl and instead has acquired swaps and options with the WTI above $80/bbl.

Capital

The company has 1,202 million outstanding shares with 34.3 million options (2.8% of outstanding), increasing the fully diluted number of shares to 1,236.2 million

By the end of Q1 2023, i3e had a net debt of C$53.2 million, including leases, payables and receivables. The net debt of £31.7 (C$53.2) million makes the Enterprise Value reach £193 (C$325) million, at the moment of writing this.

During Q2, the company settled its outstanding ~C$50 million Senior Secured Notes with a C$100 loan facility with Trafigura for the oil production of i3 Energy Canada, at an interest of 9.521% per annum only for the outstanding portion of the loan. The company used the C$75 million after the signature and there is an accordion of C$25 million that could be used for working capital purposes (which remain undrawn). The facility has a 36-month amortization schedule on a straight-line monthly basis to fully repay the debt. The company will pay US$16.1 (~C$21.5) million in 2023 in amortization, interest commitments and associated set-up costs.

In the last AGM, shareholders approved a cancellation of the Company's share premium, which will result in the creation of further distributable reserves. The cancellation is not yet complete, as it requires the High Court of England and Wales to confirm the Capital Reduction, which is expected to take place by the end of August. This cancellation will allow i3e to create available reserves that could be distributable as dividends or other forms of return to shareholders. These funds could be used for the CAPEX program, an extraordinary dividend (the least interesting option) or the start of buy-backs.

Major shareholders

At 30 June, 2023, the main shareholders are:

Polus Capital Management (UK): 19.50% + (7.98% in CFDs)

Premier Miton Investors (UK): 10.0%*

Slater Investments (UK): 9.21%

JP Morgan Securities (UK): 8.1%*

Hargreaves Lansdown Asset Mgt (UK): 5.77%

Interactive Investor (UK): 5.45%

AJ Bell Securities (UK): 3.86%

Janus Henderson Investors (UK): 3.39%

Graham A. Heath (former Director and CFO): 1.29%

Majid Shafiq (CEO): 0.81%

Ryan Heath (President i3e Canada): ~0.7%

Neill Carson (Director): ~0.7%

John Festival (President): ~0.35%

* shareholders who have increased the ownership since 30 June, 2023, showing final figure

These shareholders represent 69.6% of the outstanding shares (excluding Polus’ CFDs), and this list confirms that major institutional shareholders are British, which demonstrates once again that there is a lack of interest among Canadian investors. Among the shareholders who have increased the ownership, JP Morgan Securities is worth mentioning, as it has increased its shareholding by 2.6% in 5 weeks, from 5.5%, which is significant.

Dividends

i3e started paying a dividend in 2021, with £3.4 million (29% of FCF) in 2021 and £17.4 million (76% of FCF) in 2022. In the guidance for FY 2023, i3e estimated a monthly dividend of 0.171 p/share, totalling £24.5 million (C$40.6 million) for the whole year.

During the review of the 2023 guidance, i3e subsequently lowered the dividend to £15 million (C$25.3 million), lowering by 50% the equivalent monthly dividend to 0.0855 pence/share per month. to be paid for the first 9 months of the year and on a quarterly basis together with the revised guidance due to the drop of the WTI and AECO prices. The extension of the dividend in Q4 2023 has yet to be approved.

In our opinion, approving a dividend while the company is facing a lack of investment to maximise the value of its assets doesn’t make any sense. The company spent too much during 2021 and 2022 in dividends, and it had to reduce the optimistic projections for 2023. A growth company shouldn’t be focused on offering a high dividend yiled.

Conclusions

The dual-listing of the company isn’t contributing to show the value of the company due to the lack of interest on both sides of the Atlantic Ocean. Most British investors in o&g are very focused on the UK and North Sea and, in some way, Middle East and North and West Africa. There isn’t much enthusiasm about companies operating in Asia or America (both South and North). Their lack of interest in Canada leads them to ignore that the current potential of i3e lies in its Canadian assets.

Another flaw in the dual-listing is that they are listed in the Toronto Exchange in Canada but they remain in the AIM in the UK, why? If they want to be seen as a serious company, they must immediately uplist to the main exchange. In our opinion, the AIM is the worst exchange to be listed in, and many relevant and institutional investors don’t consider any company listed in the AIM. In order to make the company appealing to the best investors, i3e should leave the AIM and uplist into the main exchange in London ASAP.

In order to unlock all the potential, we think the company must take decisive actions that unlock the value in the assets. First and foremost, i3e should increase the pace of development of the oil-rich locations. It is hard to understand that Montney and Clearwater are the least developed plays. Their acreage may not be in the premium locations, but they are more oil-prone areas than Central or Wapiti. In the corporate front, we see different alternatives on how to unlock value that are possible for the company, we ordered them from most to least interesting:

Diversification into a third location: in our opinion this is the most unlikely scenario, yet the most interesting to us. Should the company acquire another asset outside the UK and Canada, it will still maintain the value of the existing assets whilst adding exposure to a third jurisdiction. More shareholders will see it as a diversified company and the British-Canadian dichotomy will be dismissed. i3e showed excellent M&A skills with the acquisitions of Gain and Toscana, paying very low multiples, why couldn’t they repeat this move?

Sale of the UK license: this would be the most obvious move, as it is the part of the company that provides the least value. This move should also be followed by the reallocation of the company’s headquarters and main listing to Canada, adding more Canadian faces to the exexutive team and/or the board. If most value lies in Canada, wouldn’t it make sense that it became a Canadian pure-player? Most Canadian investors don’t show interest in the company as they see it as a British company (same perception as British investors who don’t consider it a UK player). A very good description of the situation that I read online: buying CA assets and paying UK taxes for returning their value. The Canadian fiscality for dividends received abroad is not the best. This could be done after the submission - and approval by the NSTA - of the FDP for Serenity, when the license will carry the most value.

Sale of the CA assets: this would be the more straightforward scenario, as the company hasn’t increased production at the same pace than other players in the different areas where it operates. All the acreage in the 4 plays is valuable, but none seem to be premium or in the best areas. The most value will be realized if each acreage is sold separately, as the value from Montney and Clearwater could be higher that way thank together with Wapiti or Central. This move will allow the company to go back to its origins and use the consideration to complete Serenity and acquire stakes in other fields or licenses.

The leadership team took the opportunity in 2020-2021 and made really good acquisitions for the price paid, the multiples paid were incredible accretive, and they transformed the company from the typical AIM company with promising assets to a producer in Canada with importante reserves. Although they haven’t been intelligent capital allocators as they instated the dividend at an early stage. We think it is time for the company to move again and act differently to what it has done in the last 2 years. Since 2021, they haven’t created any significant value, they have completed the unsuccessful appraisal of Serenity and continue drilling in Canada at a slow pace. The use of funds for paying a dividend when it is necessary for drilling in the existing acreage could explain this.

The company is well capitalized and there is a chance that there could be additional financial resouces from the cancelation of the share premium or the increase of the commodity prices. These funds should NOT be used for increasing the dividend, the should be used instead for the CAPEX program or a buy-back program. Management and BoD should prioritise value discovering and paying dividends will not generate any long-term value un the company. There are several alternatives for increasing the return to shareholders without increasing the dividend, in the case none of the scenarios described above are implemented.

With more than 21,000 boepd of production, the potential to add new production from Montney and Clearwater and a RLI that can increase well above current 22 years, i3 Energy is an interesting company but its stock doesn’t benefit from its current setup. However, it is essential that the decision-makers change the way in which they approach the return for shareholders. The market is focusing on the negative aspects: a UK company with suboptimal management and main assets in Canada, which are not in the premium locations. Should the company refocus in any of the aforementioned ways, revise its capital allocation policies or close new accretive acquisitions, the stock could reflect plenty of value.

Disclaimer: at the moment of writing this article, we don’t hold shares of i3 Energy. However, we may buy and/or sell shares at any time. This document only represents the opinion of its authors; its content cannot be considered investment advice. It has been prepared only for informative purposes.