In a country already crowned as the world's largest LNG exporter, the Beetaloo Basin's estimated 500 trillion cubic feet of gas resources could reshape Australia's energy future for decades to come. This potential became tangible in February 2024, when Tamboran Resources' Shenandoah South 1H well achieved a 90-day flow rate comparable to the most productive regions of America's prolific Marcellus Shale. After decades of false starts, billions in stranded investments, and a complete moratorium on fracking that was only lifted in 2018, Australia's own shale revolution may finally be underway.

The timing couldn't be more critical. With the Australian Competition and Consumer Commission forecasting gas shortfalls on the eastern seaboard beginning as early as 2027, the stakes couldn't be higher. Australia's LNG export earnings surged to $90 billion in 2022, making successful Beetaloo development critical not just for corporate balance sheets but for the nation's economic security. Like George Mitchell's persistent experimentation in Texas's Barnett Shale that eventually sparked the U.S. shale boom, Tamboran has methodically imported American technology and expertise to unlock this remote Northern Territory basin.

Yet commercial success is far from guaranteed. Tamboran and other Beetaloo operators face formidable challenges—from building infrastructure in one of Australia's most remote regions to operating within Australia's stringent environmental framework. As the global energy transition accelerates, the Beetaloo represents a high-stakes test case for whether significant new gas resources can be developed in an environmentally and economically sustainable manner.

Cracking the Beetaloo Code

The story of the Beetaloo, like many frontier basins, is one of persistence through repeated setbacks that ultimately created the foundation for today's promising developments. While hydrocarbon potential was first identified in the McArthur Basin as early as the 1920s, it wasn't until 1967 that geologists recorded the unusual low gravity anomaly that would later be recognized as the Beetaloo sub-basin.

The basin's first serious test came in 1984 when AMOCO drilled the Broadmere #1 well, which burned through 31 drill bits only to come up dry—a stark reminder of the technical challenges ahead. A year later, a glimmer of hope emerged when the Bureau of Mineral Resources identified live oil in the Velkerri shale formation. This discovery prompted Pacific Oil and Gas to drill 12 wells and conduct 2D seismic surveys, confirming source rock continuity. However, like many before them, they ultimately walked away without establishing commercial production.

The real turning point came at the turn of the century when four American geologists, working through Sweetpea Petroleum, saw something their predecessors had missed. Drawing on their experience with U.S. shale plays, they completed the first-ever hydraulic fracturing operation in Australian shale through the Shenandoah #1A well in 2011. These early tests identified the Middle Velkerri "B" shale as the primary target for future exploration—a discovery that would later prove crucial for the basin's development.

Industry excitement peaked in 2011-2012 when global energy giant Hess conducted an extensive seismic program, investing $80 million in the most comprehensive data acquisition effort to date. Yet in a familiar pattern, Hess walked away in 2013 despite encouraging results. The breakdown between Hess and Falcon Oil & Gas reveals the complexity behind their exit: Hess requested an extension to their June 28 deadline to conclude a farm-out with "one of the largest oil and gas companies in the world," but Falcon rejected this request, causing Hess to forfeit its potential 62.5% stake.

While Falcon's CEO claimed there was "no technical justification for Hess's decision not to move forward," the situation reflected how corporate priorities often supersede geological potential. Due to its remoteness, the basin demanded significant investment in pipelines and processing facilities. These high capital costs, along with stringent regulatory oversight and local opposition to fracking, prompted Hess to refocus its assets.

Origin Energy and Santos subsequently formed partnerships that drove the next phase of exploration, with Origin's partnership with Sasol leading to valuable drilling programs in 2015-2016. Just as momentum was building, the Northern Territory government imposed a moratorium on fracking in 2016 that lasted until 2018, requiring a comprehensive scientific inquiry and implementation of 135 separate recommendations before exploration could resume.

In 2022, Origin Energy, after investing heavily in the basin and achieving encouraging well results, decided to exit its Beetaloo position, selling its 77.5% stake for just A$60 million to Tamboran Resources and Bryan Sheffield—a fraction of what the company had invested. Origin's decision reflected a strategic pivot toward cleaner energy sources rather than a negative assessment of the basin's potential. By this point, more than $600 million had been spent on exploration with no commercial production to show for it.

In September 2022, Bryan Sheffield, the founder of Permian Basin producer Parsley Energy, made a decisive entry into the Beetaloo. Sheffield had built Parsley Energy from a small private operator into a $7.3 billion public company before its sale to Pioneer Natural Resources for $4.5 billion. His personal investment of over $100 million in Beetaloo ventures signaled serious conviction in the basin's potential.

Tamboran secured a strategic alliance with Helmerich & Payne, importing one of H&P's super-spec FlexRig rigs to the Northern Territory—the same rigs that helped drive efficiency gains in U.S. shale plays. The impact was immediate: the Amungee NW-3H well was drilled in just 17.9 days, a 20-day improvement over previous wells.

Tamboran partnered with Liberty Energy, securing the first modern frac spreads ever deployed in Australia. This wasn't simply about importing equipment; Liberty brought crews with extensive U.S. shale experience, capable of executing the high-intensity completions that drove productivity gains in plays like the Marcellus.

Perhaps most significantly, this new phase introduced an operational philosophy characterized by continuous improvement, rapid learning cycles, and relentless cost optimization. Mixed crews of American experts and Australian workers are bridging the skills gap, transferring crucial technical knowledge while ensuring operations meet local requirements.

Geological Promise and Early Proof: Beetaloo's Marcellus-Like Potential

The Beetaloo Basin's geological characteristics reveal why industry veterans see it as a world-class resource. Building on earlier discoveries, more extensive testing has confirmed exceptional qualities that make the basin comparable to premier U.S. shale plays.

Dating back 1.2 billion years, the Beetaloo's ancient algal deposits created what appears to be a relatively uniform shale formation across its 5-million-acre expanse. This potential uniformity reduces geologic risk and could simplify development planning, offering more predictable drilling outcomes than many established shale plays.

What makes the Beetaloo particularly promising is its combination of favorable characteristics. Preliminary data show high porosity (abundant tiny spaces that hold gas), significant overpressure (higher-than-normal pressure that drives stronger production), and large gas-in-place volumes.

Initial core samples suggest Mid-Velkerri B shale contains low-reactivity clays and minimal carbonate content. This composition, if proven consistent across the basin, creates advantages for hydraulic fracturing operations, potentially allowing for more predictable responses and maximum reservoir contact.

The Beetaloo's organic matter developed under unique conditions when Earth's atmosphere contained less than 2% oxygen, potentially reducing oxidation of organic material before burial. This may have led to higher retention of hydrocarbons within the rock matrix – similar to how food preserves better in low-oxygen packaging.

Furthermore, the geological consistency, if confirmed across the basin, could reduce drilling risk and variability between wells, potentially decreasing the number of underperforming wells that typically affect portfolio returns in shale plays.

Recent drilling results have provided early evidence of this potential. Tamboran's Shenandoah South 1H (SS-1H) well encountered nearly 300 feet of Mid-Velkerri B shale – reportedly the thickest section intersected in the basin to date. The well achieved a 90-day flow rate of 2.9 MMcf/d (million cubic feet per day) from a 1,644-foot stimulated lateral length. While extended production testing across multiple wells is needed to confirm these early results, initial performance suggests promising commercial potential.

The scale of Tamboran's position contextualizes the basin's significance. The company holds approximately 1.9 million net acres – a position comparable in size to leading U.S. independent gas producers' holdings in the Marcellus and Utica regions. This acreage contains multiple potential productive horizons, including four shale benches with the Velkerri B Shale as the primary focus.

Initial results from subsequent wells (SS-2H ST1 and SS-3H) have shown consistent rock properties with SS-1H, with gas shows throughout their horizontal sections and no observed faulting within the target zone. This increases confidence in the reservoir's continuity, though more extensive drilling is needed to confirm consistency across the broader basin.

The Beetaloo's geological advantages create opportunity, but realizing economic value requires addressing the basin's remoteness and infrastructure needs. Tamboran's three-phase development plan is designed to leverage these geological strengths while methodically overcoming practical hurdles that stalled previous attempts – potentially transforming this resource into a significant energy asset for Australia.

Vaca Muerta: Lessons from Argentina's Shale Evolution

In assessing the Beetaloo's global significance, the basin ranks among the few remaining world-class onshore gas opportunities. Argentina's vast Vaca Muerta shale formation offers perhaps the closest parallel—a case study that contains both warnings and lessons for Beetaloo's development.

Located in Argentina's Neuquén Basin, Vaca Muerta contains approximately 308 trillion cubic feet of gas and 16 billion barrels of oil/condensate, comparable to Beetaloo's estimated 500 trillion cubic feet.

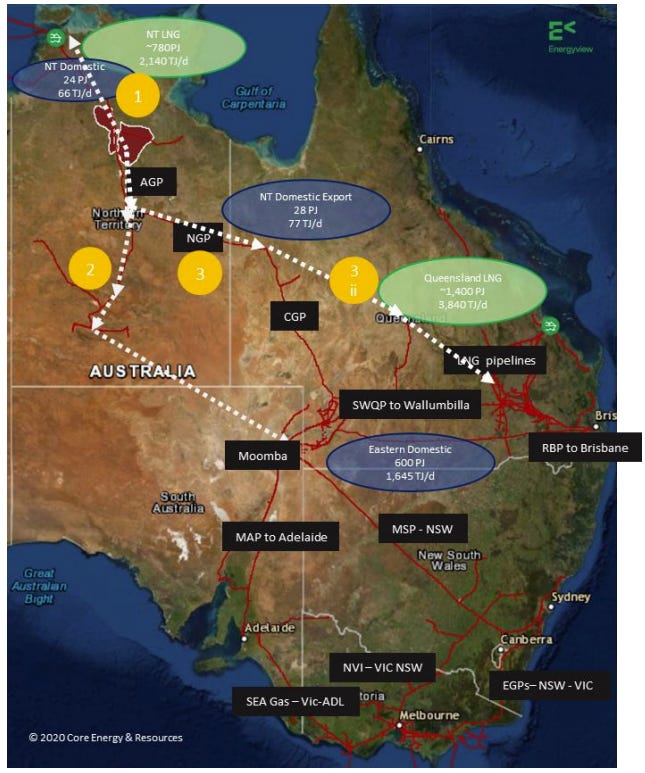

Despite enormous potential, Vaca Muerta's growth was initially constrained by insufficient infrastructure—a classic chicken-and-egg problem where producers hesitated without guaranteed takeaway capacity, while midstream companies wouldn't build without firm production commitments. These bottlenecks created a self-reinforcing cycle: limited pipeline capacity meant gas largely supplied only the domestic market, creating oversupply that suppressed prices; oil evacuation constraints forced production curtailments; and the absence of LNG export terminals prevented access to premium international markets.

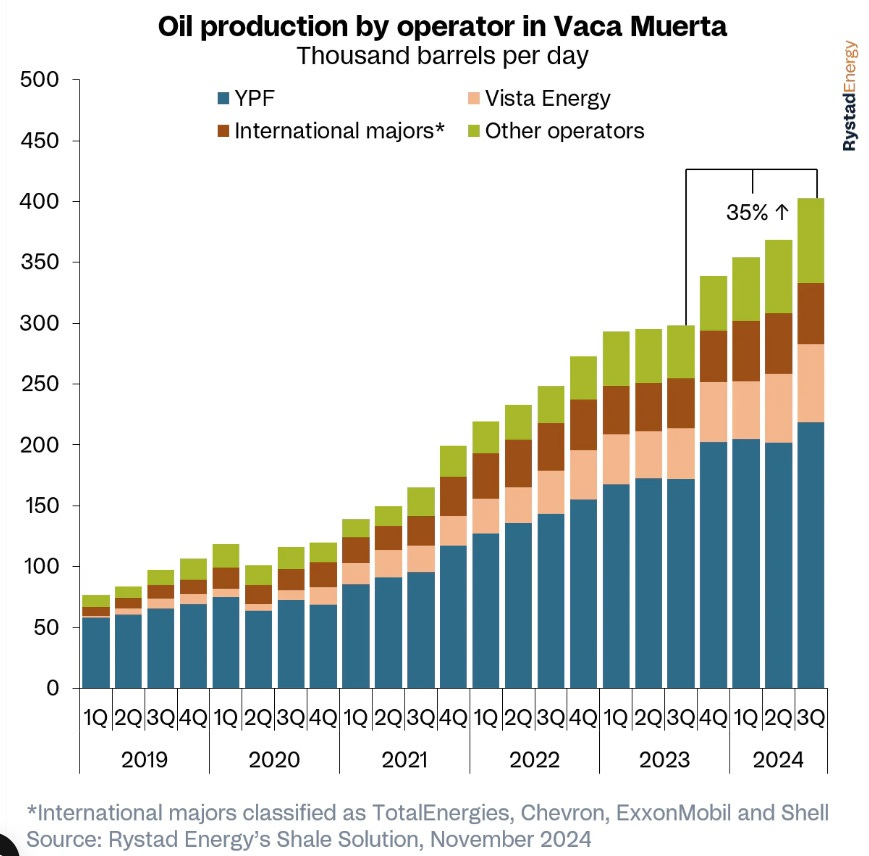

By 2024, after a decade of development, Vaca Muerta was producing 428,000 bbl/d of oil and 108 million m³/d of gas—impressive but still below potential. Only recently has infrastructure development accelerated with key projects: the Néstor Kirchner Gas Pipeline (11-14 million m³/day, expanding to 22-23 million m³/d), the reopened Trasandino oil pipeline (110,000 bbl/d), the Oldelval expansion (reaching 750,000 bbl/d by 2025), and the Vaca Muerta Sur pipeline (enabling 550,000 bbl/d of exports by 2027). These improvements have finally catalyzed growth, with Vaca Muerta now contributing 58% of Argentina's oil production and 74% of its gas.

Australia's approach to Beetaloo differs significantly from Argentina's experience:

Australia is attempting proactive coordination of production, processing, and market arrangements, whereas Argentina's infrastructure evolved reactively.

Beetaloo's plans include LNG export capacity from the outset, while Vaca Muerta is only now developing significant LNG projects.

Australia's governments have taken a more active role with the $220 million Beetaloo Strategic Basin Plan.

Operationally, Vaca Muerta offers valuable lessons. Operators reduced drilling times from 30-40+ days in 2013-2014 to under 3 weeks today, with YPF drilling a record 4,948-meter lateral well in just 27 days by 2024. Frac stages increased from 5-10 initially to 40-50+ today. Well costs dropped from $15-20 million to $10-12 million for standard laterals. Establishing domestic frac sand mines cut costs by $1-2 million per well—a strategy Beetaloo could emulate.

Argentina resumed gas exports to Chile in 2018, reaching 6-10 million m³/d in summer 2023. Oil exports climbed to approximately 130,000 bbl/d by 2023. Two significant LNG projects are advancing: a YPF/Shell joint venture (10 mtpa by 2029-2030) and a PAE/Golar FLNG project (2.5 mtpa by 2027).

Australia's approach attempts to avoid Argentina's sequencing mistakes through binding pipeline agreements before major production begins and planning multi-phase export routes from the outset. If successful, this infrastructure-first mindset could enable Beetaloo to achieve in years what took Vaca Muerta over a decade to accomplish.

The Three-Phase Development Story: Operational Excellence Enabling Commercial Scale

Building on the promising geological foundation and early well results, Tamboran Resources is translating technical improvements into a carefully sequenced commercial strategy. Each operational milestone directly supports the company's three-phase development plan, transforming the Beetaloo from geological potential to commercial reality.

What sets the Beetaloo development apart is its methodical, phased approach to commercialization. As Tamboran's CEO Joel Riddle puts it, 'We're on the first tee and we're just trying to put a five iron in the middle of the fairway. We're not trying to pull it back like John Daly and cut off the dog leg and be a hero.' This measured philosophy is reflected in both operational improvements and the three-phase strategy that systematically de-risks the play while building crucial infrastructure. The strategy also maintains flexibility to incorporate emerging opportunities, such as potential partnerships with data center operators seeking reliable power sources in regions with renewable energy potential.

Driving Operational Excellence

The commitment to excellence is demonstrated by dramatic improvements in drilling efficiency. The SS-3H well reached its total depth in just 25 days, averaging an impressive 843 feet per day—a 43% improvement over the SS-2H well. This rapid progress approaches world-class standards, as top U.S. operators in the Marcellus average about 1,300-1,400 feet per day. Earlier wells using smaller 4.5-inch casing achieved modest flow rates of only 2-3 MMcf/d, but current wells with 5.5-inch casing and 15,000-psi fracturing equipment have shown 65% higher flow rates.

Completion practices have evolved similarly, with the SS-2H ST1 well employing significantly higher proppant loading than previous wells—exceeding even U.S. Lower-48 averages. The team is evaluating tighter stage spacing while already achieving completion speeds approaching U.S. shale basin efficiency standards.

Phase 1: The Pilot Project (2025-2026)

The first phase focuses on proving commercial viability through the Shenandoah South Pilot Project. Targeting first gas in early 2026, this ~40 MMcf/d (gross, ~19 MMcf/d net) development will supply the Northern Territory market through a binding 15.5-year gas sales agreement with the NT Government. A Final Investment Decision (FID) is expected in mid-2025, marking a crucial milestone.

Stimulation operations on both the SS-2H and SS-3H wells commenced in January 2025, though the program has encountered some technical challenges. A detected stress in the SS-3H well's casing connection prompted a temporary pause in completion operations, with reinforcement work scheduled for Q1 2025 and stimulation operations expected to resume in Q2. The stress shadowing issues would likely be addressed with minimal intervention in mature basins like the Permian, but Tamboran has opted for a more methodical approach in the Beetaloo. These adjustments have pushed the testing timeline, with IP30 flow test results now expected in April 2025 for the SS-2H ST1 well and mid-2025 for the SS-3H well.

Beginning with the Northern Territory market provides strategic advantages: the smaller scale allows operational refinement before larger expansions, while the binding agreement with the NT Government provides revenue certainty that could help secure financing for subsequent phases.

While the base plan involves six wells from a single pad connected to the existing Amadeus Gas Pipeline via a new 20-mile connector, the flexibility built into Tamboran's strategy is already proving valuable. The company is now advancing discussions on the data center opportunity mentioned earlier - a potential 5 billion dollar project with U.S. hyperscalers, major data center providers and fiber companies that would require approximately 100 MMcf/d of gas—equivalent to 2.5 times the size of the NT government contract.

However, a reduced four or even two well development might be sufficient to achieve commercial production. If April and June results prove successful, the company may accelerate the development timeline by conducting only IP90 flow tests rather than traditional 12-month extended tests. The final well count will directly impact the project's Capex requirements and could influence the timing of the farm-out, which may actually precede the FID.

This potential data center project represents a perfect symbiosis of energy supply and high-value consumption. The Beetaloo's remoteness presents an advantage: combining reliable gas power with the NT's abundant solar resources could create a hybrid energy solution offering both reliability and sustainability that data centers require. The economics are compelling—data centers typically pay premium rates for guaranteed power, potentially accelerating Tamboran's path to profitability.

Infrastructure development has gained momentum through binding agreements with APA Group for the 12-inch Sturt Plateau Pipeline, connecting the Shenandoah South Pilot Project with existing infrastructure. These agreements ensure the necessary infrastructure will be in place to support both the base pilot project and potential expansion opportunities.

Despite the promising outlook, Phase 1 faces several key challenges: uncertainties regarding final flow rates, potential regulatory delays in pipeline approvals, technical challenges in maintaining consistent well performance at commercial scale, and seamlessly integrating gas processing facilities in a remote location. Mitigation strategies include modular processing facilities that can be expanded incrementally as production grows.

Phase 2: East Coast Market Entry (2027-2030)

As operational improvements drive down costs, the second phase becomes increasingly viable. While current wells cost approximately $26-27 million—more than twice the $10-12 million typical for a comparable Marcellus shale well—Tamboran has identified a clear pathway to reduce this to $15-16 million.

A major component of this cost reduction strategy is the domestication of sand supply, projected to reduce costs from $26 million to $19 million per well. Additional savings will come through doubling stage completion speeds and implementing multi-well pad development, leveraging economies of scale.

These cost improvements enable Phase 2's ambitious target of up to 1 Bcf/d of production to supply Australia's East Coast market. Tamboran has already secured non-binding letters of intent from six of Australia's largest energy retailers for up to 875 MMcf/d of gas supply.

However, there are critics of the expected domestic shortfalls. Australia's eastern states are setting ambitious emissions reduction targets and increasing support for electrification—potentially eliminating residential gas demand within two decades. AEMO expects gas use for power generation to decrease significantly, while industrial gas consumption could be reduced through energy productivity improvements and demand destruction driven by high prices.

The 2027-2028 window represents a critical inflection point as existing Bass Strait fields continue their production decline while LNG export obligations remain firm. This creates not just a volume opportunity but potentially a price premium opportunity, as domestic gas prices could spike during peak demand periods.

This phase requires significant infrastructure development, including a new ~1,000-mile pipeline to connect the Beetaloo to Australia's East Coast gas grid. The proposed pipeline represents one of Australia's most significant energy infrastructure projects in decades. While challenging, Tamboran's partnership with APA Group leverages existing corridors and regulatory frameworks established during previous pipeline developments.

Phase 3: LNG Export (2030)

The final phase aims to position the Beetaloo as a significant player in the global LNG market, producing 2 Bcf/d by 2030. Tamboran has secured a 420-acre site in Darwin's Middle Arm precinct for a proposed 6.6 MTPA LNG facility, with non-binding memoranda of understanding already in place with BP and Shell for 20-year purchase agreements.

Strategic partnerships continue to play a vital role in this vision, including a non-binding MOU with Santos to evaluate the potential expansion of Darwin LNG and collaboration in joint asset EP 161. This agreement could provide additional optionality for LNG export infrastructure, potentially accelerating the timeline for Phase 3 development.

The development timeline coincides with projected global LNG demand growth from Asian markets seeking cleaner alternatives to coal, particularly as older LNG supply contracts expire in the 2028-2030 period.

Financial Progression and Strategic Integration

While the three-phase development strategy provides a clear operational roadmap, its successful execution depends on a corresponding financial progression that minimizes capital risk. The phased approach creates a self-funding pathway that reduces capital risk. Phase 1's estimated capital requirement of $300-400 million (including wells, processing facilities, and pipeline connection) could generate sufficient cash flow to partially fund Phase 2's larger infrastructure investments. By the time Phase 3 requires major capital for LNG facilities, the established production and cash flow from earlier phases should support more favorable financing terms, reducing the overall cost of capital for the project.

Strategic partnerships extend beyond infrastructure agreements to include potential equity participation. Although the official farm-out process hasn't formally launched, it is rumoured Tamboran has already engaged in preliminary discussions with multinational oil companies. These discussions could culminate in a finalized farm-out agreement by Year End 2025, providing crucial capital for accelerated development while validating the basin's commercial potential. Interest extends beyond traditional oil majors, with Japanese and Korean companies expressing interest in both gas purchase agreements and potential equity stakes. All potential partners are waiting for the critical flow test results expected in April and June before making firm commitments.

Each phase must comply with environmental requirements, requiring innovative solutions for power generation, emissions monitoring, and carbon offsets. The evolution of Phase 1 to potentially include the data center project demonstrates the flexibility of this approach, allowing Tamboran to capitalize on new opportunities while maintaining the strategic framework of the three-phase development plan.

This three-phase strategy differs notably from the development of major U.S. shale plays, which often saw chaotic, competitive development driven by multiple operators. The Beetaloo's more coordinated approach, dominated by fewer players with larger positions, could avoid the infrastructure bottlenecks and price volatility. This measured expansion more closely resembles Qatar's LNG development model—starting with a solid foundation before scaling to world-class volumes.

However, significant challenges remain. The company needs to secure substantial additional funding for each phase, continue driving down well costs, and maintain community support throughout the development process. Success will require executing on multiple fronts simultaneously—technical, financial, and social. The recent expansion of strategic partnerships and infrastructure agreements suggests progress on these fronts, but the path to full-scale development remains complex and demanding.

The Bigger Picture

The Beetaloo's development sits at the intersection of several crucial dynamics shaping Australia's energy future. This basin represents more than just another gas project—it's a test case for how frontier fossil fuel resources can be developed in a climate-conscious world, with implications for global energy markets, environmental policy, and regional economies.

The looming gas supply crisis adds urgency to the Beetaloo's development. The Australian Competition and Consumer Commission forecasts shortfalls beginning even earlier than initially predicted, creating a stark irony: Australia, one of the world's largest LNG exporters, faces domestic gas shortages while selling record volumes abroad. With Australian domestic prices often trading at three times U.S. Henry Hub rates, Beetaloo gas could benefit from premium pricing to offset frontier development costs, though critics increasingly demand prioritizing domestic users over exports.

Tamboran Resources has committed to Net Zero Scope 1 and 2 emissions through electrified facilities, renewable integration, low-flaring technology, strict methane leak detection, and offsetting unavoidable emissions.

Social and Environmental Stakes: Beyond the Resource

The Beetaloo's development is inseparable from indigenous engagement and community impact. With indigenous people representing over 25% of the Northern Territory's population—five times the national average—development requires careful navigation of native title rights. Tamboran's approach extends beyond royalty payments to Indigenous Land Use Agreements with specific commitments for training, employment, and business development.

The economic potential is substantial: government and industry studies project over 13,000 jobs by 2040, with a Deloitte study suggesting up to A$17 billion in economic impact and A$1 billion in tax revenue. With the NT's 10% wellhead royalty, the project could generate hundreds of millions to fund regional infrastructure, schools, and health services.

Environmental concerns remain significant, however. Climate Analytics has labeled the basin a "climate bomb," warning that full development could generate emissions equivalent to 10-13% of Australia's total—comparable to adding 30-38 million cars to the road. Critics cite the International Energy Agency's position that limiting warming to 1.5°C requires no new oil or gas fields beyond those already approved as of 2021.

Local ecological concerns focus on water impacts, with the basin sitting above important aquifers. While the NT's Pepper Inquiry (2018) examined these risks and implemented a regulatory framework, critics propose alternative development pathways leveraging the region's solar potential, with a 2024 "Recharging the Territory" report suggesting a $1.5 billion renewable investment could create 7,000+ jobs while lowering energy costs.

Critics also highlight limitations in the Safeguard Mechanism meant to ensure "no net emissions increase," noting it only requires baseline compliance rather than zero emissions, applies only to facilities exceeding 100,000 tonnes of CO2e annually, and doesn't address downstream emissions from gas consumption.

Asia's Energy Gateway: Darwin's Strategic Advantage

Darwin's unique position as Australia's northernmost major port creates a strategic advantage for Beetaloo gas that transcends the commercial benefits outlined earlier. Located just 2,700 km from Singapore and under 3,500 km from major Asian demand centers, Darwin serves as Australia's literal gateway to the fastest-growing energy markets in the world. This proximity reduces shipping times to Japan, South Korea, and China to 7-10 days compared to 20+ days from Qatar and U.S. Gulf Coast facilities—cutting transportation costs, methane leakage, and the overall carbon footprint of delivered LNG.

China's shift away from coal, Japan's post-Fukushima energy strategy, and emerging Asian economies' growing demand create strong long-term fundamentals that Beetaloo gas could help satisfy, particularly as some Southeast Asian exporters face declining output.

Timing, however, is critical. Large-scale Beetaloo production won't materialize until the late 2020s or early 2030s, when the global LNG market could be well-supplied due to Qatar's North Field Expansion and numerous U.S. Gulf Coast projects. This creates both a challenge and an opportunity: Beetaloo must compete in a potentially crowded market while targeting emerging Asian economies where gas demand continues climbing into the 2030s.

The economics remain challenging—Australian LNG production costs of US$8-10/MMBtu delivered to Asia face stiff competition from US$6-7/MMBtu for U.S. Gulf Coast LNG and US$4-5/MMBtu for Qatari LNG. This differential could prove decisive in an oversupplied market focused increasingly on price.

Investor wariness toward fossil fuel investments adds another hurdle. With institutional investors aligning portfolios with Paris climate goals, Beetaloo must demonstrate both environmental responsibility and financial viability. Australia's last LNG investment boom saw 7 out of 10 projects exceed budgets and "destroy shareholder value," making investors burned by cost overruns on projects like Gorgon or Ichthys cautious about remote ventures requiring massive capital.

Nevertheless, gas's status as a "transition fuel" remains influential, as evidenced by its inclusion in the EU's sustainable finance taxonomy. The Australian federal government's Beetaloo Strategic Basin Plan further helps lower risk and attract capital.

Darwin's infrastructure advantages complement these factors. Its deep-water port can accommodate Q-Max LNG carriers, while the established Middle Arm industrial precinct offers expansion potential without greenfield development challenges. The Northern Territory's pursuit of economic diversification ensures supportive regulatory frameworks not guaranteed in other Australian states with tightening fossil fuel restrictions.

For Beetaloo specifically, Darwin's existing LNG infrastructure offers brownfield expansion advantages. The Santos-led Darwin LNG facility is already planning for backfill as existing fields deplete, potentially offering Beetaloo gas a faster path to international markets. These facilities also create opportunities for carbon capture integration, with Middle Arm identified as an ideal location for a major CCUS hub.

Despite Qatar and U.S. cost advantages, Beetaloo's security premium, reduced shipping emissions, and integration with advanced carbon management could create a differentiated market position—particularly for buyers valuing supply diversity, lower carbon intensity, and geopolitical alignment.

Looking Forward

With the SS-2H ST1 and SS-3H flow tests approaching and a potential FID in mid-2025, we'll soon know if this geological promise will finally translate to commercial reality. Several catalysts could accelerate development in the near term: successful resolution of SS-3H technical challenges, conversion of preliminary Asian LNG agreements into binding contracts, progress on East Coast and Darwin pipeline infrastructure, and advancement of new opportunities like the data center project and Darwin LNG expansion through the Santos partnership.

While major players watch from the sidelines and infrastructure plans advance, Tamboran's financial trajectory demands attention. The company has burned through over A$300 million without commercial production, and its share price has fallen almost 50% since its 2021 IPO—mirroring the capital efficiency challenges that plagued earlier Australian LNG projects.

I've been following this story for years, and while I currently hold no position, I've identified a clear investment trigger: the SS-3H well's IP30 flow test results. Strong performance could make this asset an extraordinary multibagger over the next 3-4 years, especially if it catalyzes a farmout deal that addresses existing financing and execution risks. Conversely, underwhelming results would suggest continued caution despite the promising technical indicators.

If successful, Tamboran's approach of combining American operational expertise with Australian environmental standards could establish a template for future resource development worldwide while solving Australia's looming energy challenges.

Disclaimer: at the moment of writing this article, we don’t hold shares of Tamboran Energy or any Beetaloo Basin E&P. However, we may buy or sell shares at any time. This document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Great summary - from a technical perspective only - this is an Australian national hydrocarbon resource treasure than many nations would love to have.

As always, impressive detail.