Field notes: Introduction to Namibia

A Geologic and Historical Tour for Oil & Gas Tourists

As for myself, most Sintana Energy’s shareholders aren’t geologists and, sometimes, reading about the different basins located offshore Namibia can be confusing. This post aims to give some context on several pieces of information regarding the relevance of the discoveries in Namibia and why the Campos and Pelotas Basins could be good peers to compare with the Orange and Walvis Basins in Namibia. If this is confirmed, the potential for Namibia has just started and there could be many more discoveries to be announced in the next decade. This post is written from the point of view of an investor, so it provides a high-level understanding but without looking into the technical aspects.

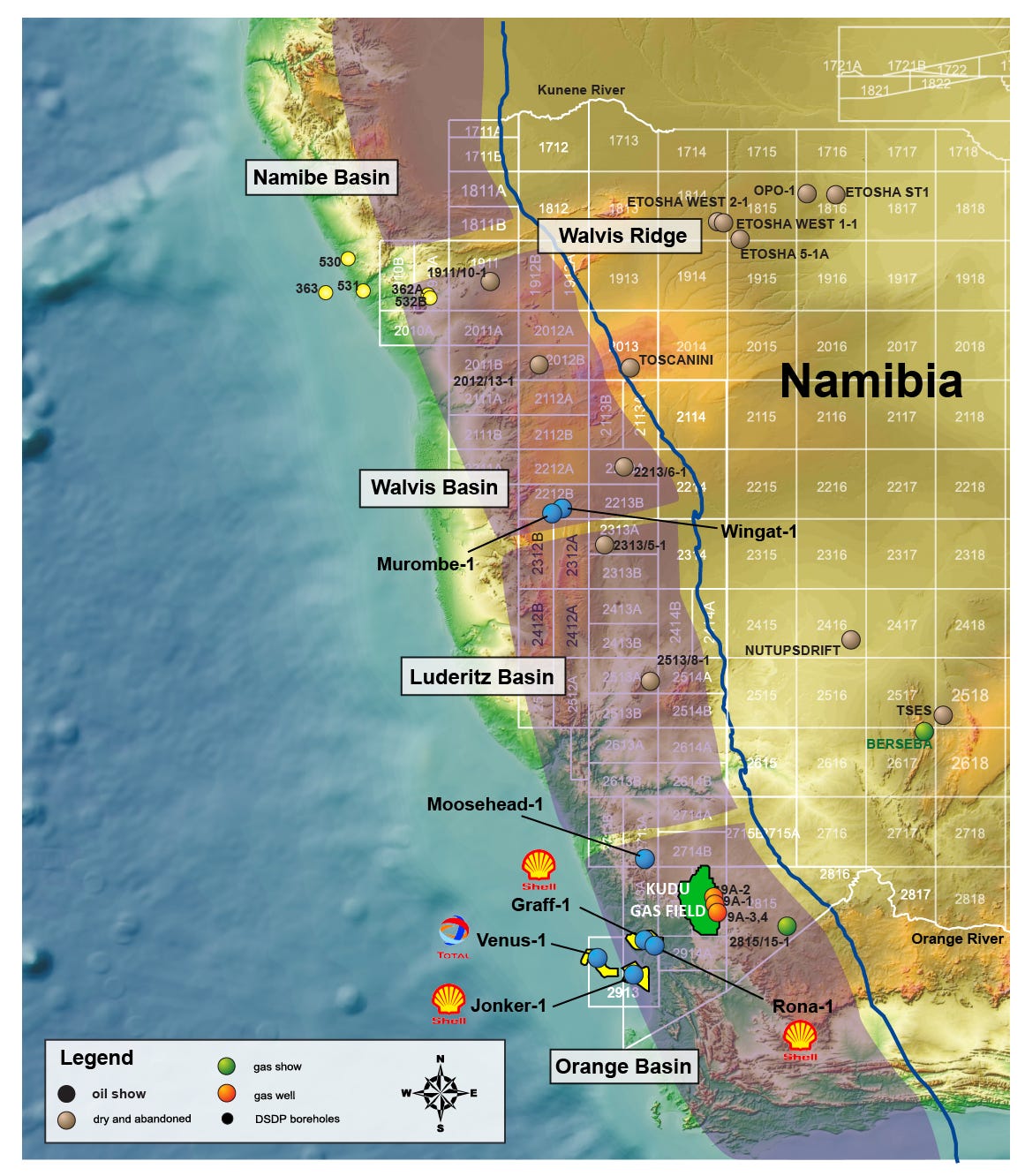

The first thing to notice are the different Namibian basins that are usually commented, as shown in the image below. Some geologists argue that the differences are minimal, particularly between Walvis, Luderitz and Orange, but they have been historically differentiated. The Namibe basin extends to the North into the Angolan waters, and it is the least explored area of the country, so there isn’t as much information as in the Lower Congo, Kwanza-Benguela Basins.

In order to understand the potential of the Namibian basin, I think it is necessary to review the history of the offshore exploration activities in Namibia.

A history lesson

All past efforts of finding commercial amounts of hydrocarbons in Namibia have been unsuccessful, so far. However, Namibia’s neighbor, Angola, has experienced a very different story, with many discoveries that transformed it into becoming the second largest oil and gas producer in Africa. Coincidentally, both countries share the Namibe Basin (like the Orange Basin is shared by Namibia and South Africa) and neither has paid much attention to it, so far.

The offshore exploration in Namibia started in the 1960s when seismic data revealed the presence of promising geological structures indicative of hydrocarbon accumulations. The studies and analyses led to the drilling of several exploration wells, all of which failed to find oil. The sole result of the efforts completed in the 1960s and 1970s was the discovery of the Kudu gas field in 1974 by Chevron Texaco.

For many years, these failures hindered the potential of the Namibian waters. Another event marked the end of the interest of majors in the country was the discovery in 1974 of the Campos Basin off the coast of Rio de Janeiro. This made Brazil an instant target for all majors. Hence, the interest in continuing the exploration in Namibia disappeared. The Campos Basin marked the beginning of Brazil's offshore oil exploration and production industry, hosting major fields such as the giant Roncador and Marlim.

From the 1980s to the 2000s, Namibia continued to be ignored by majors, with small companies trying to re-process the seismic data to confirm any potential lead or prospect. Another major discovery in Brazil took all the attention. The Pelotas Basin, situated along Brazil's southern coast, was identified in the early 2000s through seismic surveys and exploration drilling. This was followed by the discovery of the Santos Basin, considered the most prolific of the three due to its pre-salt discoveries. Santos quickly rose to prominence with the 2006 discovery of the Lula (now Tupi following a lawsuit to avoid using the president’s name) field, one of the largest deepwater oil discoveries in recent decades, confirming the basin's potential.

In parallel, the activity resumed in Namibia in the early 2010s, when the region caught the eye of several E&P companies, including Petrobras, BP, Chariot, Serica, Tullow or Repsol. One of the most active was the Brazilian company HRT (later renamed PetroRio), which acquired licenses in the Walvis and Orange basins. After completing the processing of the seismic data, HRT signed in 2012 a farm-out agreement with Galp for its three blocks in Namibia. Galp carried HRT through the 3 exploration wells that were drilled in 2013. Two wells targeted the Walvis Basin (Wingat-1 and Murombe-1) and one the Orange Basin (Moosehead-1); the results were disappointing with only Wingat-1 finding hints of an active Petroleum System but it was deemed a sub-commercial oil discovery. Murombe-1 and Moosehead-1 were classified as dry wells. These undesirable outcomes, along with the 2014 oil price crash, reduced interest in frontier exploration while many oil companies struggled or went bankrupt.

The Wingat-1 well penetrated two well-established source rocks, both saturated with organic carbon and situated within the oil generation window. Around 30 oil extracts were retrieved from this well from various sandstone side wall cores for further analysis. The assessment of these samples confirmed the presence of two active petroleum systems in the Walvis Basin. This finding underscores the potential for successful oil and gas exploration in the future, providing some cause for optimism.

Other exploration wells drilled in the 2010s include:

Kabeljou-1 well (Orange Basin) drilled by Petrobras in 2012 on Block 2714A, which today is PEL72, that only found gas shows;

Welwitschia-1A well (Walvis Basin) drilled by Repsol in 2014 on Block 2011A, which today is PEL 94, that failed to encounter hydrocarbons;

Cormorant-1 well (Walvis Basin) drilled by Tullow Oil in 2018 on Block 2012B, which today is PEL 37, that failed to find hydrocarbons.

There are other exploration wells drilled in the Walvis Basin, such as 2213/6-1 and 2213/5-1, but there is little to no information publicly available, but neither found hydrocarbons or source rock.

The recent history

In the 2010s, when production from the Campos Basin started to decline and E&P companies began to run out of new licences in the Santos Basin, companies turned back to the Pelotas Basin to run seismic surveys and exploratory drilling to assess the hydrocarbon potential of the region. The initial results showed promising signs of hydrocarbon potential in this new frontier basin. However, only a handful of wells have been drilled in the Pelotas Basin as of today, with the southern area mostly unexplored and with very limited available information. The seismic data company PGS requested in 2023 the permits for conducting 2 seismic campaigns in the NW and SW of the Pelotas Basin, due to the increased interest in the area.

The Santos and Campos Basins contain some of the largest deepwater oil fields with 14 fields within the Top20. The picture below shows the Top20, including the reserves and the discovery year:

Many geologists began to compare the data from the Santos, Campos, and Pelotas basins with another one, with the difference that it wasn’t in the American section of the Atlantic Ocean, but in Africa. The seismic, gravity and magnetic data collected were similar to the data from the Namibe and, particularly, Walvis Basins. After the discovery of Venus, the eyes turned to the Orange Basin.

A new theory started to gain traction. The coasts of Brazil and Namibia and Angola had been separated when the Atlantic Ocean originated, and the sediments had accumulated during the process. This would have resulted in a similar Petroleum system with the same source rock and reservoir at both sides of the ocean. So, all these basins could have a common origin and the same source rock and petroleum system. Paradoxically, the success of the Brazilian basins that took all the attention from Namibia in the 1970s sparked the case for a productive petroleum system in both Walvis and Orange.

Since then, several studies (Webster Mohriak 2013, Geo ExPro or Brazil Petroleum Studies) have delineated significant parallels between the Walvis and Santos basins. Many experts have continued to analyze the data, finding evidence of a similar petroleum system offshore Angola, Namibia, Brazil and Uruguay.

These initial assessments of the presence of marine source rocks related to Aptian-Albian, Cenomanian-Turonian and Paleocene sands at both sides of the Atlantic Ocean have been considered behind the productive hydrocarbon systems present in both coasts. The picture below shows a model connecting the Orange and Pelotas Basins:

Coming back to Namibia

Right now, all discoveries have taken place in the Orange Basin, but the interest is progressively extending to the North. The success of Mopane in PEL 83 is being compared with existing seismic data showing a high number of leads far from the border with South Africa. One interesting aspect would be the confirmation that petroleum system that has been confirmed in the Orange Basin reached the Walvis Basin. If true, this could come with more multi-billion discoveries.

Just to show the high likelihood that the Walvis and Orange Basins are similar (again, this is not the work of a geologist, so don’t expect an in-depth analysis), the pictures below confirm the presence of the Aptian-Albian play found at the Orange Basin also in the Murombe-1 and Wingat-1 wells drilled by HRT with Galp.

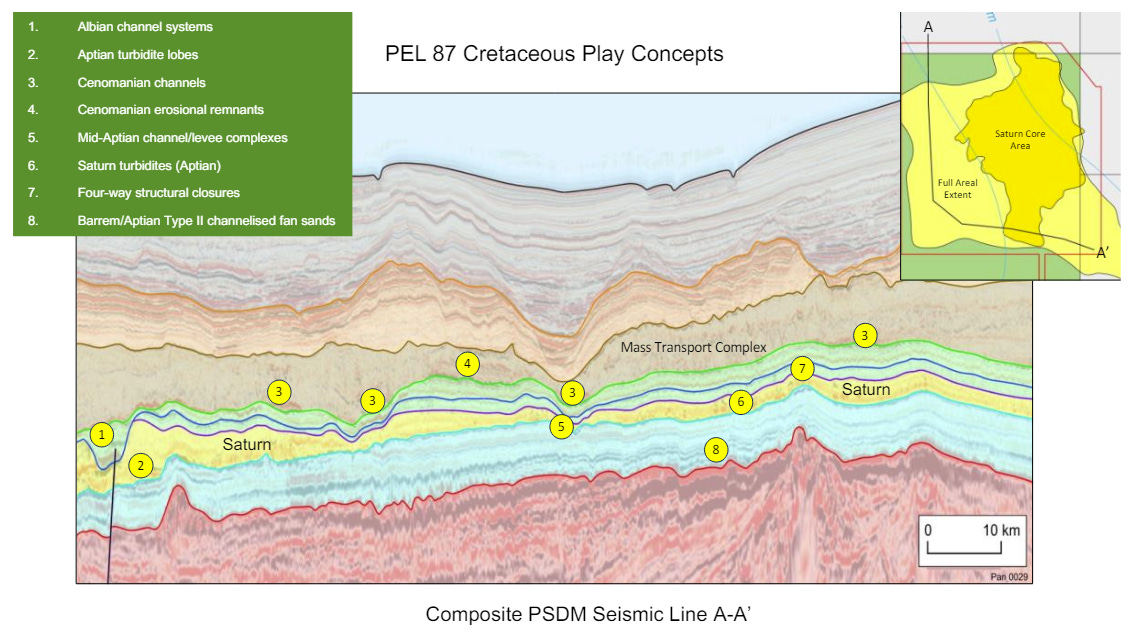

To summarise this, the image below shows a high-level stratigraphic analysis of the Orange Basin from the drills completed in the last 2 years. The discoveries are marked to the right, showing the overlapping discoveries that extend across the different licences that Total, Shell, Rhino, BW Energy, Galp and Sintana hold. The play concepts that are expected to be found in PEL 87 are showed to the left. PEL 87 still remains unexplored and is the most northly licence that will be explored in the next 12 months. It is held by Woodside, Pancontinental, Sintana (through Inter Oil) and NAMCOR.

The presence in PEL 87 of the same discoveries that were found to the south will support the idea that the petroleum system in the Orange Basin could extend towards the Walvis Basin. If this is confirmed, Namibia could count on a gigantic basin to the south of the Walvis Ridge, extending along most of its coast. This would make Namibia compete with the Brazilian in terms of oil in place and, given that the leads and prospects are derisked and deemed commercial, reserves. It is highly speculative, but the chances are not 0.

This theory is supported by the seismic data shot at PEL 87, so there isn’t any well confirming it. One important aspect of this licence is the presence of the Saturn superfan, which could become an excellent oil trap. If the presence of hydrocarbons were confirmed in the Saturn superfan, the volumes could be massive due to its size of 2,400 sq km. The future well anticipated to be drilled by Woodside in 2025 within the PEL 87 license area holds paramount significance in increasing confidence regarding the potential extension of recent discoveries beyond the Orange Basin. The two pictures below display the play concepts and a seismic section that tentatively support the continuation of the Aptian-Albian play.

If we want to confirm that the Orange and Walvis Basins are the same, we also have to look at Walvis. The recent farm-in announced by Chevron in PEL 82 in the Walvis Basin demonstrates that there still is some confidence in finding hydrocarbons in the Walvis Basin. The presence of the Aptian-Albian play in PEL 82 has been confirmed, but additional data is required before confirming it is the same petroleum system as in Orange Basin. Remember that Sintana Energy holds a 4.9% carried interest in this licence through Custos Energy.

Should this theory be confirmed, Namibia still has a large number of licences that aren’t controlled by E&P companies, particularly in the Luderitz Basin. All the attention has been put onto Walvis and Orange, as the picture below with the different licences shows. This wasn’t always the case, in the 2010s most licences in the Luderitz were awarded to different companies, but the didn’t extend them as they failed to comply with the work programmes. This was a result of the lack of interest by majors, but this could change now.

Additionally, another important aspect for oil production is the water depth, as the amount of oil that is produced will depend on the extraction cost. Typically, shallow waters are more economically developed as drilling is less expensive and they present less operational challenges. Hence, would the oil- or gas-bearing sands already identified in deepwaters extend closer to the coast? Recently, Sintana entered into one of the shallowest licences, PEL 79. There exists information from a 3D seismic that HRT completed in 2013. Below we show a section of the 3D survey, showing the presence of the Aptian-Albian play that was the found at Venus, Graff, La Rona and Mopane discoveries. The image is not very clear but it shows the presence of the Meerkat prospect (see bottom left). This prospect was already considered by HRT when it held the licence as the most promising one of many identified in PEL 79.

Additionally, the presence of hydrocarbon in shallow waters is supported by the simplified stratigraphic cross section shown below, where different migration paths are identified. In this diagram, the Aptian-Albian play is displayed overlaping the Kudu sands - the only discovery confirmed before Venus in 2022. Should the same Albian oil-charged sands extend over BW Energy’s Kudu gas field, both Kudu and Pel 79 licences would represent another major opportunity. BW Energy has anounced its plans for drilling its block using Galp’s results at Mopane; the discovery of oil above Kudu would increase the likelihood of fiding commercial volumes of hydrocarbons in shallow water in Namibia, particularly in PEL 79.

Conclusion

I must insist that this not the work of a geologist, but the result of analysing the existing data and my own conclusions from what I have read about Namibia and the Namibia-Brazil similarities. I am somewhat confident that there will be more discoveries in the Orange Basin, but I acknowledge that the extension of the same plays from the Orange Basin into the Walvis Basin is a long shot. The next few years will see many exploration efforts in Namibia, which still is a very exciting region for investors in Energy. One thing is for sure, E&P companies will spend billions of dollars in the country in the next decade.

Namibia will continue seeing new exploration wells in the coming years. For example, Rhino Resources and Chevron have plans to drill up to 10 wells each in their respective PEL 85 and 90 licences. The announcement by Baker Hughes that it will install a drilling mud plant in Namibia shows the high expectations that the industry has in the future of the country. There is no doubt that Namibia will continue to be a hotspot in oil exploration. Nevertheless, exploration is very hard, thus, it will come with new discoveries and, also, disappointments, but the country is poised to become a relevant global oil producer at some point in this decade.

As always, please, reach out in the comments and let us know what you think about Namibia and its potential of becoming a substantial oil producer.

Stay tuned for an upcoming article detailing Sintana Energy's presence in Namibia! Furthermore, there're more posts regarding this area brewing on the horizon... If you're eager to be the first to read what else is in the oven, hit that subscribe button!

If pel 87 is be the next santos type oil play hence could hold 40 billion BOIP , what is PCL worth per share ?

What about onshore Namibia, are there any updates on discoveries onshore?