Update: we have included the position that Carlos Slim, the Mexican tycoon, is building in HBR.

Rumors have been circulating about Harbour Energy (LON:HBR) seeking an acquisition or merger to diversify from the UK. The speculated deal was announced this week: Harbout Energy will acquire the majority of assets from Wintershall DEA (WDEA), formed in May 2019 through the merger of Wintershall Holding GmbH and DEA Deutsche Erdoel AG.

Before this acquisition, there were some speculations about an offer for Neptune Energy or a merger with Talos Energy. Instead, HBR has made an all-in bet and has chased the take over of a larger company. For those who don’t know HBR, we wrote about it at the beginning of this substack. Take a look at the write-up where we covered the origin of the company and why we think that its CEO, Linda Cook, deserves to be recognised as one of the best CEOs in the o&g sector in Europe:

Harbour Energy - Believe in Linda

What is Harbour Energy? Harbour Energy is the largest London-listed independent oil and gas company, producing approximately 200,000 barrels of oil equivalent per day (Mboed) and is a constituent of the FTSE 250 Index. Its current market cap is around £2bn. The company was established in 2020 through the merger of Chrysaor and Premier Oil, combining the …

Thanks to this deal, HBR will increase its production to 500,000 boepd (from current ~190,000 boepd) and reduce the opex to $11/boe (from current $15/bbl). Besides, it increases the life of the reserves and gets access to one of the best jurisdictions for o&g like Norway.

The structure of the acquisition is the following:

HBR assumes all WDEA’s existing debt ($4.9bn).

HBR issues 921.2 million shares to the previous owners of WDEA, BASF and LetterOne ($4.15bn at 360p/share).

BASF and LetterOne receive cash ($2.15bn).

Contingent payments of up to $300m to BASF and LetterOne over the four years following completion, linked to the price of Brent oil.

Hence, the deal is worth $11.2bn (plus earn-outs of $0.3bn) and HBR is obtaining in return a diversified portfolio of assets across America, Europe and Africa that complements HBR’s assets in the UK and Asia to achieve a strong global footprint:

WDEA initially owned assets in Russia but deconsolidated them in late 2022 due to a series of decisions by the Russian government aimed at controlling assets held by western companies. In January 2023, it declared its intention of exiting Russia, facing continuous challenges from Russian authorities, resulting in numerous obstacles. Just before the announcement of this deal, Vladimir Putin declared that the Russian government would seize all WDEA’s remaining assets in the country, redistributing them among local companies.

Prior to HBR finalizing the deal, reports in the German media suggested that TotalEnergies, Equinor, or Abu Dhabi National Oil Co (ADNOC) were well-positioned candidates for acquiring the company. We're relieved that none of these negotiations materialized.

Why is WDEA in the market?

The deal seems to good to be true, so, why are BASF and LetterOne selling? Well, only they know the real reason, but in the case of BASF it seems to based on a strategic decision to move away from the energy sector (potentially caused by the €7.3 billion write-off of its Russian assets). Contrary to this, LetterOne (a company founded by Mikhail Fridman) doesn’t plan to leave the sector, but it is under the scrutiny of the EU. Many people related to it have been sanctioned due to their links with Russia, including Mr. Fridman. This dichotomy may have been an obstacle for closing the deal, but HBR has found an structure to work this out:

BASF will receive the cash and ordinary shares and commits to a six month lock-up period after the completion of the transaction. After the announcement of the change of strategy, BASF considered exit WDEA by a public listing, but later it decided that a merger or sale of the company would be more benefitial. In the end, BASF has achieved this, as WDEA’s shares are listed through HBR, and it can progressively sell or reduce its position.

LetterOne will receive the cash and non-voting shares, which are stripped from any political rights and receive a 13% premium on every dividend distributed to ordinary shares. This way, HBR aims to avoid being in conflict of the sanctions over LetterOne’s related persons that have been targeted by the EU sanctions. This non-voting shares can be converted into ordinary shares, conditional to the approval by the regulators. These shares will not be listed. HBR also limits the right of LetterOne to increase its shareholding above 19.99% of all HBR’s issued shares.

Main shareholders in HBR NewCo will be BASF and LetterOne with 39.6% and 14.9%, respectively, of all issued shares. HBR’s shareholders will keep 45.5% of the enlarged company. Another relevant shareholder is Carlos Slim, who has amassed a 5.1% position through several trusts. He has also acquired the 49.9% of Talos Energy Mexico, which owns Talos’ stake in the Zama field.

Another masterstroke by Linda is that the company has been acquiring shares at a price well below the 360p accepted by BASF and LetterOne. The last $200m buyback program completed in September bought 65.7 million shares at an average prive of ca. 240p, a discount of 33% over the price of the shares being given for WDEA. This is a perfect example of Linda and her team's ability to generate value through diverse strategic maneuvers.

M&A has been key for HBR

It is important to remember that HBR has been a serial acquirer since its foundation, you can check our previous article, and this picture from the last presentation summarises it:

With this deal, HBR becomes much more than the largest independent o&g company in UK, but a company with a global presence similar to most majors and supermajors. The key for being successful in the implementation of this strategy has been Linda Cook, who has mastered both the acquisition and the operational optimisation of the acquired companies/assets. HBR has satisfactorily navigated through periods with high debt levels and has managed to maintain the shareholders’ remuneration while reducing the financial leverage.

To be honest, we were on point when we wrote that previous article and, if any, HBR has surpassed our expectations on the kind of operations that should be expected:

As a general rule, Linda Cook is a tough negotiator and we doubt she will open a negotiation for small projects that are little accretive to the company. Instead, medium- to large-scale transactions involving large independent E&P companies or large divestment blocks from major players are more probable. Such deals would likely involve hundreds of millions of barrels in reserves and a production capacity of at least several tens of thousands of barrels of oil per day, as exemplified by the Chrysaor-Premier Oil merger. Rumors of potential Harbour acquisitions in Norway have been persistent over the past year (Note: Kuwait's overseas oil and gas division has just begun a sale process in Norway), and the company has expressed its interest in the jurisdiction on multiple occasions. Regardless of whether a transaction occurs in Norway or the APAC region, investors can be confident that only deals that are value accretive to shareholders will be carried out.

We said you should believe in Linda and, despite it took a bit more than desired, she has finally delivered.

A step forward to increase the financial stregth

An $11.2 billion acquisition by a $2.2 billion market cap company seems farfetched, right? However, HBR will benefit from a debt with very soft conditions: an interest rate of just 1.8% and a maturity of 4.5 years. Yes, HBR is assuming lots of debt, $4.9bn is not a negligible amount, but it is below the current interest rates of all national banks. This 1.8% rate is a bargain compared to the 5.5% rate of HBR’s current bond maturing in 2026.

The transaction also enables HBR to mature as a company even more and get closer to the financial conditions offered to majors. Now, HBR’s debt reaches investment-grade rating that comes with another benefit, it can use unsecured debt and the covenants do not require it to hedge a substantial amount of production. Yet, the company confirmed in the recent webcast that it will keep a hedging policy of aminimun of 25% and a maxium of 50% on a rolling 3-year basis.

As Linda mentioned in the webcast, the increase in debt will not force HBR to change its dividend policy or to complete any divestment to improve the financial situation after the deal is closed. It’s the opposite, the company plans to increase the dividend by a 5% to its common stock and no divestment is planned.

HBR estimates that the acquired assets include $300-400 million in cash, but it is meant for working capital needs. Nevetherless, the effective date of the transaction is the 30th of June 2023, so all cash generated between that date and the moment the deal is closed will correspond to HBR. Considering a conservative netback of $20/boe, the assets can accumulate more than $2.7bn in cash until the end of Q3 2024, which will be more than enough to pay the cash consideration to BASF and LetterOne without using the bridge facility that HBR has included in the deal as a precaution.

Adding significative reserves for the next 10+ years

HBR and WDEA are not total strangers, they already share some licences in GoM (Zama and Block 30/Kan) and Norway (1055 and 1055 B). Nonetheless, they complement each other well since HBR has a limited presence in Norway with a few exploration licenses, whereas WDEA is a well-established player in the region. Additionally, WDEA lacked a foothold in APAC and it just owned one producing asset in the UK, making the merger between the two companies exceptionally strategic. Consequently, the combined reserves, an aspect that had been consistently criticized regarding HBR, substantially grow:

Now, the NewCo has a Reserve Life Index (RLI) of 8 years (+2 years), but this is excluding the 2C contingent resources that are yet to be developed. Additionally, the drills completed during 2023 in Zama in Mexico (more than 170 metres of net pay) and Andaman in Indonesia (potential for an initial 3.3 Tcf recoverable) haven’t been incorporated to the 2C volumes. Therefore, HBR does not account for the prospective volumes in the exploration licences that are yet to be explored. Consequently, the 2C resource estimation could potentially multiply in the next few years:

Could there be something else in the making?

In the recent webcast, Linda confirmed that this wasn’t the only deal that they were exploring, but it was part of the 2-3 options they were considering. She justified that the good metrics offered by the WDEA transaction made it outstand over the others. Thus, she confirmed that there have been other alternatives that were not as exceptional as this one, but she didn’t mention that these other conversations were over.

Here is when we want to bring the name of Talos Energy (NYSE:TALO), a GoM-focused E&P company that has been rumored to be a potential target for a merger with HBR. Interestingly, Talos had acquired another company, EnVen, that was closed in just 6 months for a price of $1.1bn. Besides, Carlos Slim is taking a position in both sides of the transaction, and HBR is the cheaper company to buy and maximise his stake post-merger. Hence, we have 2 active M&A players in Talos and HBR that share some assets in the GoM and both would benefit from a diversification of their assets. In fact, Talos shown in its last presentation the areas where it is interested in M&A:

Not a lot of US-based E&P companies include the North Sea as a target for its M&A strategies, and it shows how complementary both Talos’ and HBR’ strategic M&A objectives are. After the acquisition of WDEA, the position of HBR is stronger than ever, and it means that Talos would join a larger portfolio that now also includes Africa (but not the Atlantic Margin) and APAC. And last, but not least, both Talos and HBR share plans to develop a large-scale carbon storage network, thus, both entities are working to abate part of the emissions from the use of fossil fuels. The same expertise will be necessary to develop the CO2 reservoirs at both sides of the Atlantic Ocean.

Aside from Talos, both Linda and Alexander (the CFO) insisted that the deal will not restrict the financial strength of the company and it will be ready to continue with M&A. The company has signed a $3.0bn unsecured Revolving Credit Facility that replaces its previous $1.5bn Reserve-Based Lending that is available for M&A, in any case, it could be revised upwards after closing the deal:

we’ll have the option and will be ready and prepared should the right opportunity present itself from a financial standpoint even after completing this large transaction.

So, we have a team that just closed a transaction that increased its production by 170% and yet they insist that they are working on additional opportunities. We have not doubt that they will press the buy button on any deal that is sufficiently appaling. Considering that the WDEA’s deal can take up to 1 year to close and the ambition of the team, we think that it is realistic to expect at least another operation during 2024 from the 2-3 options mentioned by Linda. The enlarged scale of the company will also create new M&A opportunities that were not available to HBR before this deal, particularly when there are other companies where the financial situation is complex, like Kosmos Energy, or the partners are looking for an exit, like SapuraOMV (~60kboepd with mature and exploration assets in Indonesia and New Zealand). There are plenty of opportunities available for HBR that could grow the group even more.

Where does HBR stand over other peers?

After acquiring WDEA, the 500,000 boepd production can only be matched by majors or NOCs. In the last presentation, HBR compared itself with other independent companies in both the UK and US. However, we think we also have to look at Norway, where the NewCo will have an important weight.

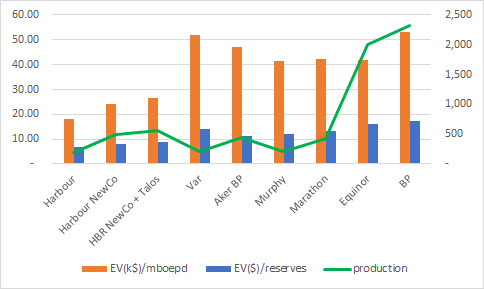

We have used some basic valuation metrics of the current and future HBR to compare them with other companies (Var Energi, Aker BP, Murphy Oil, Marathon Oil, Equinor and BP). The case of Var Energi is a bit different as it hasn’t yet completed the acquisition of Neptune Energy Norway assets, which would add ~60,000 boepd, so its metrics are a bit higher than they will be once the integration is completed. We also wanted to include a hypothetical merger with Talos, considering a 80:20 equity distribution between the two companies and Talos’ existing debt. Talos would add just 67,000 boepd of mostly oil, which is complementary with HBR NewCo’s 40% oil. We compared the EV versus production and proven reserves, adding the total production to add some context about the size:

As it can be seen, HBR’s metrics in all three scenarios are the lowest ones, despite we believe that it deserves a valuation higher than other independent companies (Var, Murphy and Marathon) and a bit lower then the European majors (Equinor and BP).

There is not another peer with a similar distribution of assets outside majors, which made the comparison a bit complicated. We find Aker BP as the most similar peer in terms of production and the high weight of the Norwegian production. However, Aker BP has some advantages over HBR in terms of liquids production (86%) and opex ($6/bbl). Based on the average metrics of comparable peers, HBR NewCo is estimated to potentially have a share price between 728p and 823p, offering a potential upside of 132% to 163%. However, this valuation might not materialize until the deal is closed, considering the inherent risks of delay or cancellation. Therefore, a share price range of 350-400p seems more plausible at present, above the 52-week high of 335p. Even post-deal closure, immediate recognition of value is not expected. However, we anticipate the share price to narrow this gap and stabilize around 500-550p by Q3-Q4 2024. Hence, despite the recent spike in the share price, there exists a substantial potential for appreciation from the current 312p.

Conclusion

HBR has entered into a new chapter of its short-lived history. The company now enjoys improved access to favorable financial conditions and operational synergies. Linda Cook is an excellent leader and will continue creating value for shareholders.

There is a risk that the sanctions over LetterOne’s related persons affect the deal, but we are confident that HBR’s legal team has prepared a strong case and the use of the non-voting shares ought to help in circumventing any regulatory concerns. Although, there is no zero risk due to the involvement of Mikhail Fridman and his affiliates.

The company's valuation metrics remain below those of many peers, and we anticipate the market will recognize this eventually. Moreover, the NewCo might attract institutional investors interested in a diversified producer boasting one of the largest productions outside major companies. We don't expect the share price to stay much longer at current levels, considering Brent remains above $70/bbl.

We are confident that this deal is not the end of the road, with more positive surprises ahead. We're enthusiastic about the potential for further M&A operations—those that are not substantial enough to attract majors yet too large for smaller independent companies, much like the case of Talos Energy, Kosmos Energy or SapuraOMV and their 60-70 kboepd productions. Now HBR is poised to become a new major, the only one created in XXI century and without the foundations of a NOC. Maybe we are dreaming too high, but, as we previously said:

Believe in Linda

Disclaimer: this document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes. The authors of this article own shares in the company, and both could sell or buy shares in the future. Please, make your own due diligence and analysis.

Lots of valuable information in this article. Hope to see HBR in 500p range by end of Q1 2024