What is Harbour Energy?

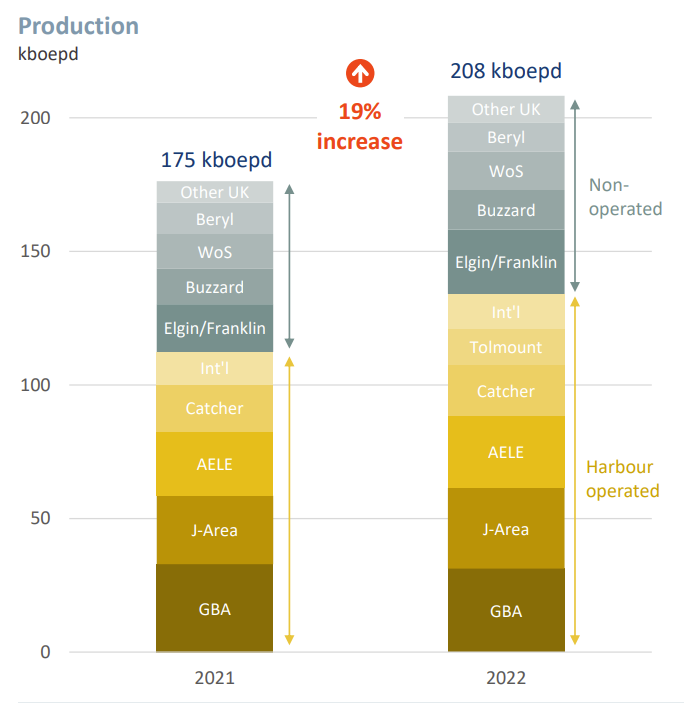

Harbour Energy is the largest London-listed independent oil and gas company, producing approximately 200,000 barrels of oil equivalent per day (Mboed) and is a constituent of the FTSE 250 Index. Its current market cap is around £2bn. The company was established in 2020 through the merger of Chrysaor and Premier Oil, combining the assets and expertise of both entities. In 2021, a new management team was appointed to steer the combined organization.

The company's diversified portfolio spans across the United Kingdom, Mexico, Vietnam, Norway and Indonesia, with significant operations in key oil and gas fields such as the North Sea's Britannia, Elgin-Franklin, and Schiehallion fields. Additionally, Harbour Energy holds exploration licenses in Mexico's Tampico-Misantla and Sureste Basin areas and maintains interests in Indonesia's North Sumatra and South East Sumatra basins.

Recently, Harbour Energy has faced challenges due to the implementation of the Energy Profit Levy (EPL), which increased tax rates for oil and gas companies to 85%. However, the EPL also introduced additional reliefs for investment in production expansion and renewable energy projects.

The market perceives Harbour Energy as a UK pure-player, but it is more than that and the quality of the assets and management stand out over any of other peers. The company is aligned with shareholders, is buying back shares and has several attractive growth opportunities (away from the UK) to reduce the impact of the EPL on its business.

Everybody has a past …

Harbour Energy emerged from the merger of Chrysaor, a UK-based oil and gas company, and Premier Oil, a highly leveraged historic oil and gas company. Both businesses experienced significant losses in 2020 due to the COVID-19 pandemic, with Chrysaor and Premier Oil reporting pre-tax losses of approximately $980 million and $1.3 billion, respectively. As a result of the merger, Harbour Energy assumed Premier's debt and has since focused on debt reduction, lowering operational expenses (OPEX), and increasing production.

Several factors drove the merger, primarily the depressed oil prices in 2020, which eroded Premier Oil's profit margins and left the company burdened with significant debt. Premier Oil's £2.2 billion enterprise value consisted mostly of debt, characterizing the deal more as a debt workout than an equity takeover. Creditors of the company would be repaid between 60 and 75 cents on the dollar as equity owners in the newly combined company. The combined company's net debt would amount to 1.5x EBITDA, diluting Premier's debt problems.

Before the merger, Premier Oil had planned to refinance its borrowings and raise money from shareholders to fund the acquisition of North Sea assets from British Petroleum (BP). However, the all-share deal offered by Chrysaor was a less risky and more profitable venture given the market conditions.

Chrysaor had been on an M&A spree, acquiring a large North Sea portfolio from Shell for $3 billion in 2017 and a portfolio from ConocoPhillips for $2.7 billion in 2019. Chrysaor's private equity ownership by Harbour Energy motivated these acquisitions, and the merger with Premier Oil allowed Chrysaor to go public and gain synergies.

Upon completion of the merger, $2.7 billion of Premier's gross debt was repaid and canceled. Financial creditors of Premier and its subsidiaries received a cash payment of $1.2 billion, while Premier Group's cross-currency hedge counterparties received shares in the combined group. Premier's $400 million of letters of credit were refinanced, and its $4.1 billion tax shield played a crucial role in attracting Harbour Energy.

Although the deal may have seemed one-sided for Chrysaor, Premier Oil had limited alternatives after creditors rejected an earlier restructuring proposal involving a $500 million rights issue. With these choices, investors would have had to pay for an out-of-the-money call option on oil prices, they were in a dead end. At the end of this merger, we found a company overleveraged but capable of paying debt down, ownership of some of the best assets in the UK Continental Shelf (UKCS). The deal closed with Brent at around $65 and the National Balancing Point (NBP) at approximately 50p/therm.

The assets

The majority of the company's production is currently concentrated in the UK Continental Shelf (UKCS), which accounts for over 90% of its output and 93% of its reserves. However, due to recent political instability in the UK and the promising potential of their international assets, the company is looking to diversify geographically over time. While the production mix used to be more heavily weighted towards oil, it has now shifted towards a balanced 50/50 split between oil and gas. The company categorizes its assets into two groups: UK-based and international.

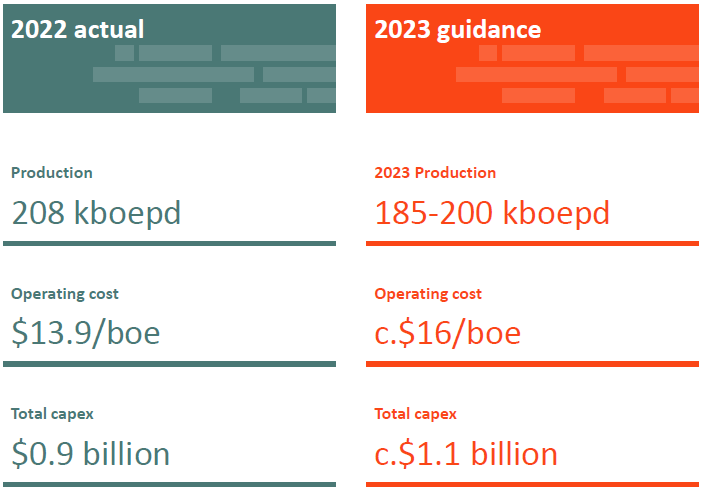

The guidance provided by the company for 2023 (and confirmed in the update with the results of Q1 2023) is 185-200 Mboepd, slightly lower production. The company has announced the cancellation of several investments in UK in a response to the increased fiscal burden.

UK

Greater Britannia Area (Producing Assets: Gas and Condensate)

The Greater Britannia Area consists of several producing assets, including Britannia (58.7% operator), Brodgar (93.75% operator), Callanish (83.5% operator), Enochdhu (50.0% operator), Alder (26.3% non-operated), and Finlaggan (third party tie-back). These assets are located in the UK central North Sea and primarily produce natural gas and condensate. Britannia is a large gas and condensate field with a complex infrastructure, while Brodgar, Callanish, and Enochdhu are subsea developments tied back to the Britannia platform. Alder is a high-pressure, high-temperature gas condensate field tied back to the Britannia BLP, and Finlaggan is a gas condensate field operated by Zennor Petroleum.

Greater Tolmount (Producing and Exploration Assets: Gas)

The Greater Tolmount Area in the Southern North Sea consists of the Tolmount gas field (50.0% operated) and Tolmount East (exploration asset). Tolmount was discovered in 2011 and started production in April 2022 as a consequence of several delays. Reserves have been written down after disappointing performance but the area also includes the Tolmount East discovery, which is planned for development drilling in 2023. Additionally, the Johnston gas field (28.75% operator) is part of this area, with production commencing in 1994 and tied back to Ravenspurn North.

Catcher Area (Producing Assets: Oil and Gas)

The Catcher Area (50.0% operator) is situated in block 28/9a of the UK central North Sea and comprises the Catcher, Varadero, and Burgman fields. These fields produce oil and gas from 18 subsea wells, which are tied back to a leased floating, production, storage, offloading (FPSO) vessel operated by BW Offshore. Production began with Catcher in December 2017, Varadero in January 2018, and Burgman in May 2018.

J-Area (Producing Assets: Oil and Gas)

The J-Area consists of several producing assets, including Judy/Joanne (67.0% operator), Jade (67.5% operator), and Jasmine (67.0% operator). Judy/Joanne, Jade, and Jasmine are tied back to the Judy platform, where production is processed and exported. The Talbot field development (exploration asset) is also part of the J-Area, with first oil expected in 2024.

This is one of the most promising areas in the UK part of the portfolio, as management believes recovery factor could be largely improved and, as a consequence, add a significant amount of reserves to the company.

Other Producing Assets (Gas, Condensate, and Oil)

The Aele Hub contains various producing assets, such as Armada (100.0% operator), Everest (100.0% operator), and Lomond (100.0% operator), which are mainly gas and condensate fields in the UK North Sea. These fields are connected to the CATS pipeline system for gas export to Teesside and the Forties Pipeline System for liquids export to the Kinneil processing plant. The West of Shetland assets include the Solan field (100.0% operator), located in Block 205/26a, which is a producing oil asset situated in the UK continental shelf, northwest of the Orkney Islands. The field consists of three producing wells and two injector wells tied back to a normally unmanned conventional steel platform. Oil is produced into a subsea storage tank and offloaded via shuttle tanker. The East Irish Sea assets primarily produce gas, with the sweet gas Millom, Dalton, and Calder fields (100.0% operator) being the key contributors. These fields are tied back to the Barrow Gas Terminals, which process and transport gas to the UK market.

International

Indonesia - Producing and Exploration Assets

Harbour Energy has a dominant position in the Natuna Sea, delivering gas to Singapore. In Natuna Sea Block A (28.67% operated interest), which lies near the maritime borders between Malaysia, Indonesia, and Vietnam, the company operates seven producing fields: Anoa, Gajah Baru, Pelikan, Naga, Bison, Iguana, and Gajah-Puteri. These fields are developed through platforms and subsea tiebacks, and gas is delivered to Singapore via the West Natuna Transportation System. Harbour Energy also has a 50% operated interest in the Tuna offshore block, awarded by the Indonesian Government in March 2007. The Tuna field, discovered in April 2014, was appraised in 2021. The company’s partner in the Tuna block is Russia-based Zarubezhneft, which holds the remaining 50% stake. Knowing this, the company has stated they are having difficulties to provide engineering services to their partner even though it is not sanctioned. Nevertheless, the company has secured the Initial Plan of Development or IPD from the government, first production is expected in 2026. Additionally, the company has built a material position in the Andaman Sea were the Timpan gas discovery is located, with interests in Andaman I, Andaman II, and South Andaman. Further exploration drilling is expected this year, as they have de-risked many prospects across their acreage.

Vietnam - Producing Assets

In Vietnam, Harbour Energy's operations are focused on the operated Chim Sáo and Dua oil fields in Block 12W (53.13% operated interest). The Chim Sáo oil field was discovered in 2006, with first oil production achieved in October 2011. Oil is exported via a floating production storage and offloading (FPSO) vessel, while gas is exported by pipeline to Vung Tau near Ho Chi Minh City. The Dua oil and gas field was developed as a subsea tie-back to Chim Sáo, with first production achieved in July 2014.

Mexico - Exploration Assets

Harbour Energy has interests in Mexico's giant Zama field in the Sureste basin. The company holds a 25% non-operated interest in Block 7, located in the shallow water Sureste Basin in the Gulf of Mexico. Block 7 contains the giant Zama field, which extends into the neighboring block that is 100% owned by Pemex. The Block 7 partners and Pemex are working to progress Zama towards a targeted late 2021 final investment decision (FID). They are currently drilling 1 exploration prospects near Zama. The company has stated that FDP is near and FID could be possible next year. This would translate into 80M barrels of 2C being moved to 2P, or more than a year of current production. In addition to Zama, Harbour Energy also has a 30% non-operated interest in Block 30, located directly south of the Zama field in the Sureste Basin, where Wintershall DEA announced last April an oil discovery in tje Kan-1 exploration well. The well is located in 50 metres of water, was drilled to a total measured depth of 3,317 metres and encountered more than 170 metres of net pay. Approximately 250 metres of core was recovered and is being analysing.

Norway - Exploration Assets

Harbour Energy first entered Norway in March 2018 by acquiring an interest in the PL038D license, which holds the Grevling discovery located about 28 kilometers northeast of the Armada facilities in Block 15/12A of the UK Continental Shelf. In October 2018, the company completed a Sale and Purchase Agreement (SPA) to acquire equity in Grevling, with an option to extend equity and assume operatorship of PL973, which they did in 2019. On January 19, 2021, Harbour Energy was awarded six licenses with various work programs in the Norwegian APA 2020 Offshore Licensing Round (Awards in Predefined Areas). Three of these licenses are operated (PL1114; PL1093; PL1087) and the remaining three are operated by Lundin (PL1092; PL1089) and Neptune (PL1113). The six licenses cover 18 blocks, with Chrysaor Norge holding an average working interest of 45% in these blocks. Harbour Energy drilled its first operated Norwegian well on PL973 (at the Jerv prospect) in 2021. Two wells are set for drilling towards the end of the year, the Equinor operated JDE-Triassic prospect and the Vår operated Ringhorne North prospect.

What is the Outlook for Harbour Energy?

Operational

In the last CC, the company confirmed their plans to keep returning excess cash while safeguarding their balance sheet, investing wisely on their portfolio and maintaining capacity for M&A. A $100M dividend and a $200M buyback plan for 2022 were announced with the FY2022 results.

In the FY2022 conference call, the company commented that it has completed a 3rd technical review of their portfolio, aimed at focusing on those opportunities with higher returns and lower risk, due to the new fiscal regime and political uncertainty.

While most of their spending is still in the UK, the situation has dramatically changed since 12 months ago. Now their UK projects will increasingly have to compete for capital with those in other countries where they are active, highlighting Tuna and Zama. In short, they want to focus on high return (>20% IRR) considering Brent at $65, low breakeven price, quick payback of 1 or 2 years (again, with low oil prices) and low risk developments.

Hedging

At the moment of the Chrysaor+Premier combination, Harbour Energy began its operations with oil and gas hedges that reflected the low prices during 2020:

Oil:

2021: 22mmboe (34.4% of production) @ 58$/bbl

2022: 12mmboe (15.8% of production) @ 60$/bbl

Gas:

2021: 25mmboe (~1,560 bn therms) [39% of production] @ 44p/th

2022: 25mmboe (~1,560 bn therms) [33% of production] @ 44p/th

2023: 23mmboe (~1,435 bn therms) [31-34% of guidance] @ 41p/th

The high hedged volumes for 2021 and 2022 limited the margin for the management to optimize the realized price and impacted the profitability of the company in those two years. Hedges resulted in a negative impact during 2022 with realized prices of 78$/bbl for oil and 86p/th for gas, versus averages of 101$/bbl and 198p/th, respectively. Due to lower levels of debt, Harbour Energy now has more flexibility to manage its hedging policy.

The situation for 2023 onwards is very different to previous years with lower hedged volumes, particularly for oil, and the announced opportunistic approach to gas hedging by using zero cost collars, when available. It can be expected that the realized prices will reduce the gap versus the actual prices compared to 2022 or 2021. The current hedging position of the company is shown in the picture below, with hedges still representing 47-51% of the guidance.

Shareholders’ return

During 2022, the company spent $600m in distributions, combining the buyback programme and the dividend. In the last FY22 CC, the company announced another buyback programme of $200m, in combination with the $200m dividend, providing an initial shareholders’ return of $400m. This represents a confirmed return of £0.365 per share, equivalent to a 15% of current share price.

In June 2022, the company announced its first buyback program worth $200m, which was extended in August to $300m. Subsequently after completing the first program, it announced in October a second buyback program worth $100m. Hence, the chances that the current buyback program is increased above the current $200m target are high, in our opinion. However, we must acknowledge that it will be dependent on how the M&A situation plays out, as if a major transaction is closed, all the cash generated would be allocated to paying down debt and paying the established dividend.

Debt

Current debt levels are reasonable. The company has reduced its net debt from $2.9 billion in April 2021 to $0.8 billion in Q4 2022 and $0.2 billion in Q1 2023. Compared with the FCF generation (Note: most of the impact of the EPL in 2022 was a deferred tax), the ability of the company to repay the debt is not in doubt; the debt might be canceled whether the company decides to do so instead of shareholders’ returns or growth opportunities.

Harbour Energy has projected a $1 billion FCF generation in 2023, after capex and before shareholders’ return. Hence, if we estimate the total shareholders’ return at the same level than in 2022, i.e. $600m, the additional cancellation of debt can lower it below $400m, which would result in a debt/EBITDA ratio below 0.1x.

M&A

Regarding M&A, the company acknowledged that few M&A transactions were agreed during 2022 compared to other years. In the FY22 CC, management commented that in 2022 they felt that the price volatility affected both sellers and buyers. The former increased the ask price and the latter were impacted by their ability to hedge material production at these levels. The company looked for opportunities during 2022, but it was a year in which being disciplined with capital allocation was more important. Hence, they decided to prioritize reducing debt levels and focusing on their existing portfolio. With oil prices stabilizing in a lower and narrower range, Harbour Energy now believes that conditions for M&A have improved. The company's criteria for M&A remain unchanged, focusing on transactions that

Are accretive to reserve life, as they know current reserves are in the lower range of what they would like to have

Enhance ongoing cash flow and credit metrics

Support their net-zero goals

Expand outside the UK to build a more diversified portfolio that increases shareholder distributions over time

The company has confirmed its plans in combination with BP for developing the Viking Carbon Capture and Storage (CCS) project in the Humber region, East UK, but it is a matter where politicians have a heavy weight, and it could be a weapon that the company could also use in its war against the EPL. Thus, we don’t see it as relevant in the coming years.

As a general rule, Linda Cook is a tough negotiator and we doubt she will open a negotiation for small projects that are little accretive to the company. Instead, medium- to large-scale transactions involving large independent E&P companies or large divestment blocks from major players are more probable. Such deals would likely involve hundreds of millions of barrels in reserves and a production capacity of at least several tens of thousands of barrels of oil per day, as exemplified by the Chrysaor-Premier Oil merger. Rumors of potential Harbour acquisitions in Norway have been persistent over the past year (Note: Kuwait's overseas oil and gas division has just begun a sale process in Norway), and the company has expressed its interest in the jurisdiction on multiple occasions. Regardless of whether a transaction occurs in Norway or the APAC region, investors can be confident that only deals that are value accretive to shareholders will be carried out.

FCF

The company has been able to manage debt and capex to achieve a robust FCF generation, which has enabled it to lower the debt, increase capex and remunerate the shareholders. Depite the impact of the EPL and portfolio of exploration and development assets, the company expects to achieve $1,000 million of FCF in 2023.

Leadership, who is Linda Cook and why you should care about her?

Linda Cook has been the CEO of Harbour since 2021, previously, she was Chairman of Chrysaor. She had tenures in majors and supermajors before joining Harbour Energy. She retired from Shell in 2010, when she was a member of the board of directors and the Executive Committee. At Shell, she held positions including Chief Executive Officer of Shell Gas and Power (London); Chief Executive Officer of Shell Canada Limited (Calgary); Executive Vice President Strategy and Finance for Global Exploration and Production (The Hague). In 2009, she was close to the nomination as CEO of Shell.

Linda played a critical role during the merger as the Chairman of Chrysaor, and following the successful combination of Chrysaor and Premier Oil to form Harbour Energy, she was appointed as the CEO of the new entity. As CEO, she has been instrumental in improving the operational efficiency of the company, showcasing her ability to combine long-term strategic vision with operational expertise. The continuous operational improvement in opex and production are usually given for sure, but it is not always the case. Harbour Energy inherited two different companies with different assets and policies, which is sometimes the cause of underperformance.

Contrary to other CEOs and leaders, she has been very vocal against the EPL and its failed structure. Shortly after the tax increase was announced, she was quoted in an article saying: “A higher tax burden will make it more challenging for new oil and gas projects to meet investment hurdle rates, meaning fewer projects will be sanctioned”. She also reacted by announcing potential employment cuts for the operations in the UK, focused on the Aberdeen area, as a direct consequence of the EPL. However, this could also be used by the company as an excuse to reduce staffing in some areas, as some roles may still be duplicated after the merger with Premier Oil.

Linda reinforces her position against the new tax regiment on every occasion she has. In the announcement of the 2022 full year results, she was quoted saying “the UK Energy Profits Levy, which applies irrespective of actual or realised commodity prices, has disproportionately impacted the UK-focused independent oil and gas companies that are critical for domestic energy security … Given the fiscal instability and outlook for investment in the country, it has also reinforced our strategic goal to grow and diversify internationally.”

Her focus is not only on the hits for the financials of the company, but on the employment levels, are a clear indication that this is not a bluff. We are confident that if someone can force the politicians to fix the problem they created, that is Linda Cook.

Our take on HBR

Harbour Energy has been severely impacted by the Energy Profit Levy (EPL) in the UK, as almost all of its production is located in the country. This has caused the company's stock to drop by 50% from its highs last year, along with the impact of commodity prices.

The company has important ARO liabities (~$4,000 million) and its 2P reserves are not as high as other peers, which we think that are the main reasons behind the underperformance of the share price (apart from the EPL, of course). However, the company is already using part of its capex program for decommissioning, $200 million in 2023, which will progressively lower this burden. The company has demonstrated that its ability to generate FCF can outshine the debt and generous capex and yet allow the company to provide a substantial shareholders’ remuneration. Harbour has reduced the net debt from $2.9 billion to $0.2 billion in less than 2 years (April’21 - March’23). This gives us assurance that it will be able to deal with the ARO liabilities while maintaining capex, dividends and buybacks.

Management has demonstrated that is highly aligned with shareholders. They have an active share buyback program and are actively seeking M&A opportunities in other jurisdictions, in addition to advancing the development of their licenses in Mexico and Indonesia. Besides the success at the Kan-1 exploration well, ENI reported a discovery of 200 million barrels of oil in the block adjacent to Harbour's license. Hence, we are confident that the company will be able to replace and increase 2P both organic and inorganically.

The company's future will depend on its ability to make M&A deals outside of the UK, as it is assumed that a price cap will not be introduced to the EPL and it may not end in 2028. Of course, it will also depend on oil prices. Nonetheless, the company has significantly reduced its debt over the past few months, which has reduced its overall risk. We consider the company to have a favorable risk/reward profile compared to other Oil & Gas players.

We will continue to monitor the company and provide a valuation once there are M&A movements.

Disclaimer: this document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Guess what? -40% from article date.