In search of the Sjøormen

A new chapter for a successful team that has been unfortunate so far

Longboat Energy plc (LON:LBE) is an E&P company focused on acquiring assets and pursuing exploration opportunities in Norway and Malaysia. Longboat Energy was established in May 2019 by the former management team of Faroe Petroleum, including CEO Helge Hammer and CFO Jonathan Cooper. The company was admitted to trading on the AIM market of the London Stock Exchange in November 2019.

After an initial period as an investment company, LBE became a full-cycle E&P player in September 2021 following the acquisition of a portfolio of exploration assets from Delek Group on the Norwegian Continental Shelf. This marked Longboat's entry into active exploration and operations in Norway.

LBE's vision is to build a significant, cash flow generating, full cycle E&P company. The company aims to grow production and reserves through a combination of exploration drilling and accretive M&A, and has a proven track record of doing so. Divestments of de-risked licences and prospects is another way of generating value.

Recently, LBE has been in the spotlight following the formation of a joint venture (JV) with Japex, which not only provides the vehicle with cash, but also allows for further M&A activity in Norway. In this context, we believe that the current capitalisation may not reflect the full potential value of the company.

Strategy & Outlook

The team

LBE’s executive team is the same that led Faroe Petroleum before the acquisition. It is an experienced team that has worked in the Norwegian Continental Shelf for decades. They seem to be aligned with the shareholders, but their shareholding is not as high as one would expect. To show their honesty, they didn’t receive a bonus in 2022, as the evaluation resulted in a score of 47.5%, which did not meet the minimum threshold of 50% required to achieve the minimum 20% payout. Most companies grant bonuses starting from 0%.

The main executives in Longboat are:

Helge Ansgar Hammer, CEO: Helge has a vast technical and business background. He served as Chief Operating Officer at Faroe Petroleum and held positions like Asset Manager and Deputy Managing Director at Paladin Resources. He worked for Shell for 13 years in various capacities including Reservoir Engineer, Team Leader, and Business Manager across Norway, Oman, Australia, and the Netherlands.

Jonathan Robert Cooper, CFO: Jonathan's experience includes a broad spectrum of mergers, acquisitions, public offerings, and financings. He is a chartered accountant who began his career with KPMG and then joined Dresdner Kleinwort Benson in their Oil and Gas Corporate Finance and Advisory Team. Jonathan served as CFO of Faroe Petroleum and has been involved with companies like Gulf Keystone Petroleum, Sterling Energy, and Lamprell.

Nicholas Andrew Ingrassia, Corporate Development Director: Nick's 19 years in the oil & gas industry started in banking at Morgan Stanley and RBS. He later worked in business development roles with Valiant Petroleum, Salamander Energy, and Faroe Petroleum. Most recently, he acted as UK Country Manager for DNO ASA.

Main non-executive roles include:

Graham Duncan Stewart, Non-Executive Chairman: Graham is the founder of Faroe Petroleum, where he served as Non-Executive Chairman and later as CEO until January 2019. He has had previous roles with Dana Petroleum, the Petroleum Science and Technology Institute, and Schlumberger. Graham is also Chair of AEX Gold Inc.

Brent Cheshire CBE, Senior Independent Non-Executive Director: Brent began his career with Shell and spent 14 years with the group. Later, he joined Amerada Hess and then DONG Energy, where he held positions like Managing Director of UK E&P business and Chairman of UK operations. He was also a Director of Faroe Petroleum and was made a CBE in 2018 for services to the Renewable Energy Sector.

Katherine Louise Margiad Roe, Independent Non-Executive Director: Katherine's career includes investment banking with Morgan Stanley and as a Director of Investment Banking at Panmure Gordon, where she led the natural resources team. She is the current CEO of Wentworth Resources and was an Independent Non-Executive Director of Faroe Petroleum.

Jorunn Johanne Saetre, Independent Non-Executive Director: Jorunn is a chemical engineer with a 30-year career at Halliburton, serving as Director of their European Research Centre and Head of Scandinavian operations. Currently, she's a project manager with Energy Transition Norway.

Strategy

Longboat’s strategy is straightforward and simple:

to create significant value for shareholders by building an E&P business through value accretive M&A transactions and with the exploration drill-bit.

The company implements the strategy through participation in licence rounds, completion of farm-in or acquisitions from other companies. This strategy is not unique, as many other companies offer the same value proposition. But in the case of LBE, they are building on a proven strategy that was successfully implemented in a previous company.

The selection of new licences is infrastructure-led, as most licences have available nearby infrastructure that allows for multiple tieback opportunities and cost-savings measures for the development. For example, Kveikje and Lotus licences are likely to form part of the new Equinor operated Ring Vei Vest (“RVV”) cluster development project, which will develop multiple oil discoveries made west of the Troll field in recent years.

As an active M&A player, they are at both sides of the negotiation table, acting as acquirer or acquiree. After a successful exploration well at the Kveikje discovery, the company has announced it is actively pursuing monetisation options for its position in the area.

LBE also has a different approach compared to other companies, first it explores an area and, after making a first exploration effort, then it pursues extensions of licences, searching other prospects around the first target. The extensions of their licences target adjacent prospects identified from the seismic or geophysical data. In case of a successful appraisal and Final Investment Decision, this ensures better economics for the development, as the step-out discoveries can be connected to central production, processing and storage facilities.

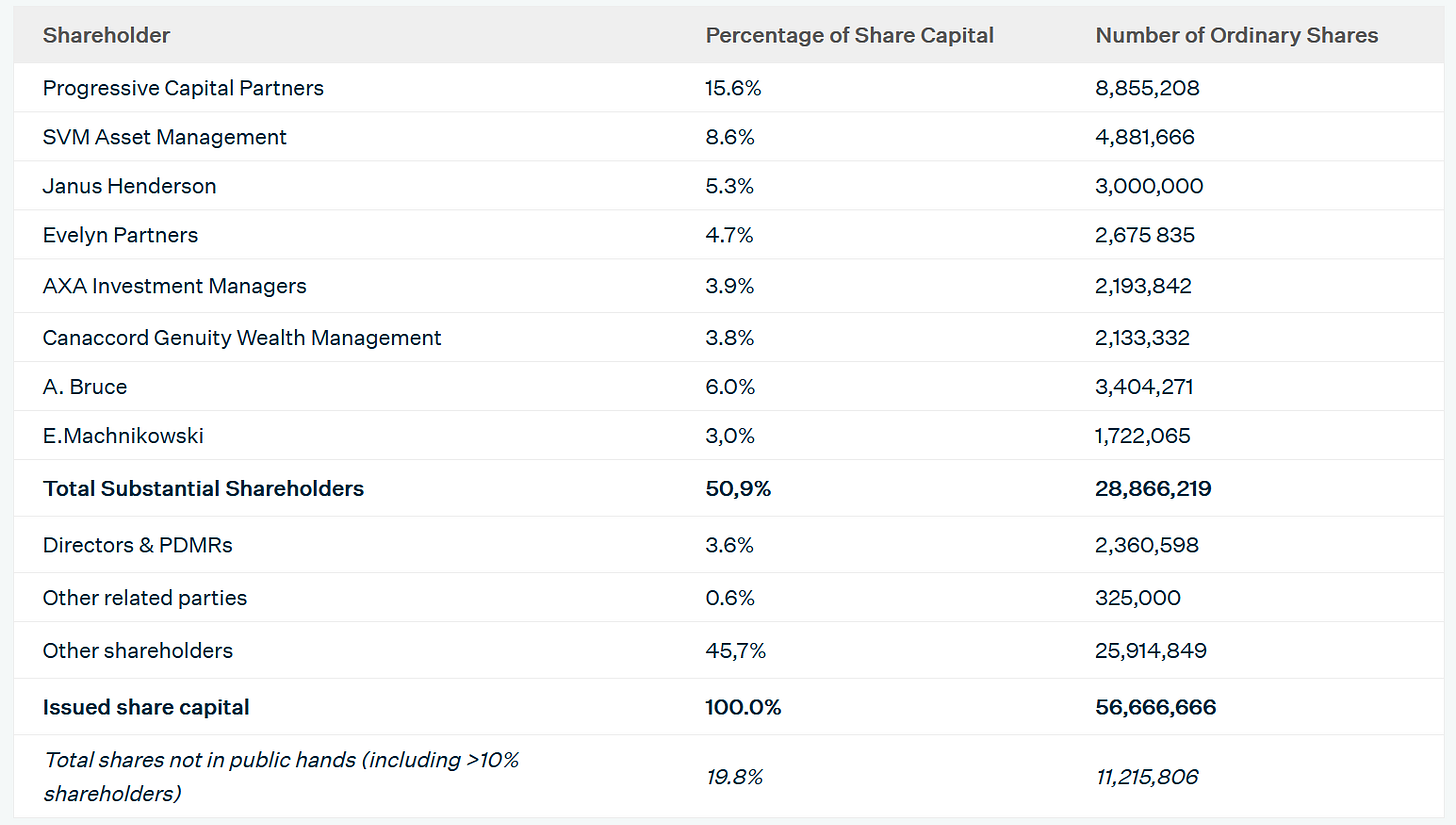

Major shareholders

The list includes some institutional investors, and most of the shares are in public hands. Directors just own 3.9% and have a co-investment plan that provides 1 option for every share purchased, if the Company’s shares increase by at least 30% over a three year period.

In December 2022, the number of options in the Long Term Incentive Plan was 1,560,600 (2.75% of outstanding) and the shares in Co-Investment Plan (CIP) awards represented 794,505 (1.4% of outstanding). The weighted average exercise price of outstanding options is £0.10.

Building on its past

As it can be seen from their expertise, the team comes from a previous venture, Faroe Petroleum, which was another exploration-focused oil and gas company that was active in the UK and Norwegian Continental Shelves. Faroe’s strategy was the same as LBE: Win licences, Drill and discover, Monetise assets, and Generate revenue and create value for stakeholders. It owned stakes in Brasse, Cassidy, Agar/Plantain or Rungne fields, among others.

In November 2018, DNO (one of the largest shareholders at that time) made an unsolicited offer for the whole share capital of Faroe Petroleum plc of 152p per share. This offer was first rejected by the board: “opportunistic and substantially undervalues Faroe”, and didn’t receive enough support among shareholders. Later that month, DNO raised the offer to 160p (£641.7 / $816 million), which granted DNO enough support, given it had accumulated a control position. Subsequently, the executive directors, Graham Stewart (Chief Executive), Jonathan Cooper (Chief Financial Officer) and Helge Hammer (Chief Operating Officer), resigned from their positions. Faroe Petroleum was delisted from AIM in February 2019 and changed its name to DNO North Sea.

To showcase how active Faroe Petroleum was at that time, when the acquisition was completed, it had a production of 11,896 boepd in 2018 across 35 licences in the NCS and UKCS, with 21 licences in the NCS and 2 in the UKCS at exploration stage.

The strategy of LBE is clear, and it is the same they executed at Faroe Petroleum: focus on exploration of prospects with above-average chances of success, de-risk them with the first exploration well(s), analyse other adjacent prospects and then make a decision on how to unlock the most value: to develop or sell it. For example, Faroe sold a 17.5% WI in the Fenja licence for $68 million ($54.5 million plus all capital expenditure incurred since the effective date), which started production in April 2023 and it is expected to produce up to 35,000boepd (85% oil). Other discoveries such as Oda have produced 15.2MMbbl in just 3 years of operation.

However, it is important to bear in mind that Norway is NOT the only target for the company, but it is also focused in South-East Asia, particularly Malaysia.

Is Norway the best jurisdiction for o&g exploration?

In June 2022 the Norwegian Parliament enacted a new cash flow based special tax regime in the Norwegian Petroleum Tax System (NPTS). In the cash-flow based special tax, the tax value of any losses will be settled by cash the following year.

For tax purposes, all cash spent on exploration activities is immediately deductible in both the corporate tax basis and the special tax basis, regardless of capitalization. The combined overall tax rate in the new regime is 78.004%, consisting of an effective corporate tax rate of 6.204% and a special tax rate of 71.8%.

The new NPTS enables the repayment of 71.8% of all losses in the following year (compared to previously 78% of exploration losses only) with corporate tax at 6.2% carried forward against future profits for 6 years. The total rebate is 78% over 6 years.

Costs related to abandonment (ABEX) are deductible when incurred with an effective running tax shield for ABEX of 78%.

A new stage in Norway

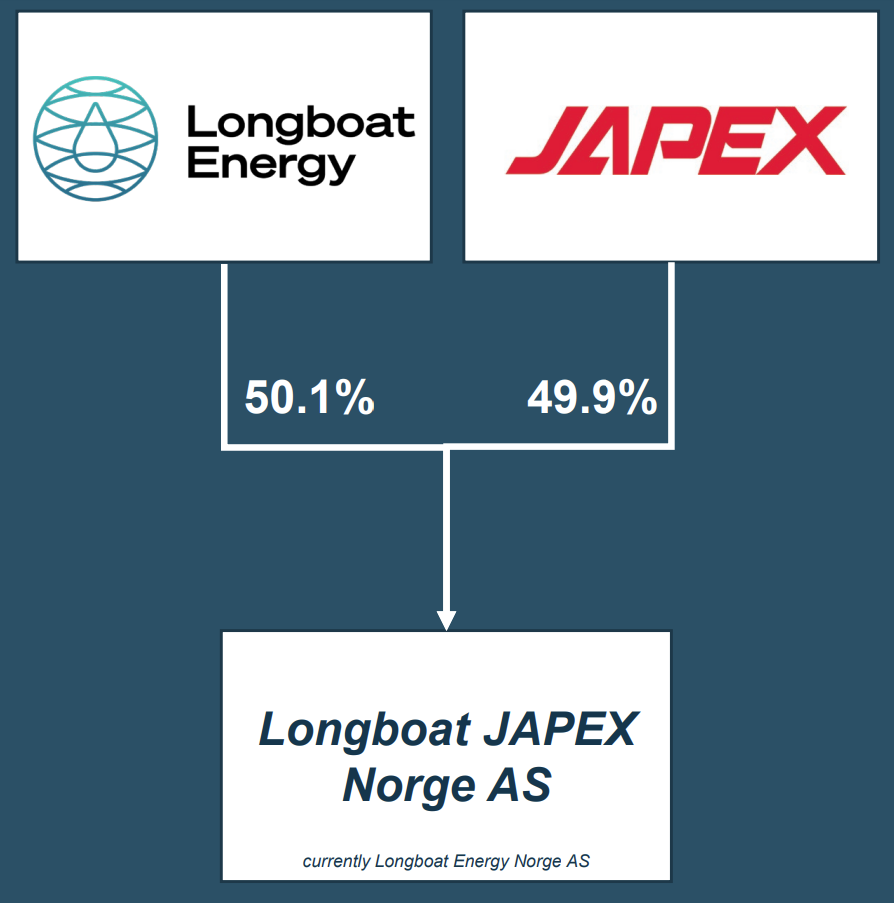

LBE has created a Joint Venture between its Norwegian subsidiary andJapan Petroleum Exploration Company (Japex, TYO:1662), Longboat JAPEX Norge AS, in order to continue exploration in the Norwegian Continental Shelf (NCS). This confirms the opportunity that the portfolio of Norwegian licences offer. The deal also included among its conditions the acquisition of producing assets - to generate a baseline revenue inflow - and has a contingent payment subject to the results of the Velocette exploration well.

LBE contributed with all the licences and personnel in its subsidiary, Longboat Energy Norge AS, and Japex provided cash for advancing the work on the licences. The terms of the transaction were:

Initial cash consideration: US$16 million (c. £12 million)

Contingent payment on completion of a production acquisition: US$4 million (c. £3 million)

Contingent payment on Velocette exploration success: US$30 million (c. £23.5 million). The final amount is based on a sliding scale applied to the gross resource resulting from the well and approved for development by the Norwegian regulator.

5-year financing facility of up to US$100 million (c. £78 million) for acquisitions and development costs with sliding interest <10%

Part of the money was used to repay an intercompany loan of NOK 45.5 million (c. £3.5 million) to the British parent company. The remaining funds will stay in the JV and will finance its operation.

The creation of this JV allows LBE access to an important amount of capital, US$150 million (c. £118 million) of equity+facility, which will avoid LBE going to the market for financing the exploration campaigns. These conditions provide a relief to LBE’s financial position and enable an acceleration of the exploration efforts on top of its existing financial support.

In our opinion, the transaction seems a win-win situation for both parties: JAPEX accesses to all the Norwegian licences carefully selected by a seasoned and successful team, and LBE secures enough funds for the next years without depending on the financial markets.

Financing the exploration work

Before the JV with JAPEX, LBE had signed a Exploration Finance Facility (EFF) with a pool of lending banks to finance its working capital requirement for future exploration expenditure. The mechanism allows drawdowns until December 2024, repayment of final drawdowns due by November 2025

In order to reflect the better conditions introduced by the new NPTS, the EFF was extended and increased to NOK 800 million (c. £67.5/US$76.5 million) from NOK 600 million.

By the end of 2022, LBE had drawn £36.8m from the EFF, which will be repaid by the tax rebate in December 2023. This strongly allows for continuous investment in exploration and appraisal of wells, as the financial effort is lowered with the periodic reimbursements. The conditions of this EFF could be renegotiated and improved after the investment made by JAPEX in the Norwegian JV, but this is speculative.

After the reimbursement of the 2022 exploration expense, signing the JV with JAPEX, repaying the inter-company loan and closing the first acquisition, the Norwegian JV will have access to US$191.5 million (c. £151 million) of equity and debt for financing its exploration efforts in the 2023-2024 period, minus all investment done so far in the year, which will be public with the interim results in September 2023.

Hence, LBE and its Norwegian JV are well capitalised to continue investing in additional exploration and appraisal efforts in the next few years, expecting to continue delivering positive results.

Recent activity

LBE is continuing its operations in Norway, but now the South-East Asia area is also of interest. In February 2023, LBE was awarded a Production Sharing Contract in Malaysia by Petronas. In the last year, the company also closed completed a farm-in with OMV for the Oswig and Velocette prospects.

Farm-in with OMV

In July 2022, LBE signed a farm-in agreement with OMV in Oswig (20%) and Velocette (20%) that include two near-term, gas weighted exploration prospects on the NCS. At the time of the agreement, both prospects contained combined gross unrisked mean prospective resources of 223 MMboe (45 MMboe net to Longboat). The Oswig’s exploration well and sidetrack were completed and the results weren’t as expected, the Velocette exploration well has just been spud and results are expected in late Q3 or Q4, depending on the outcome.

First acquisition of Longboat JAPEX Norge

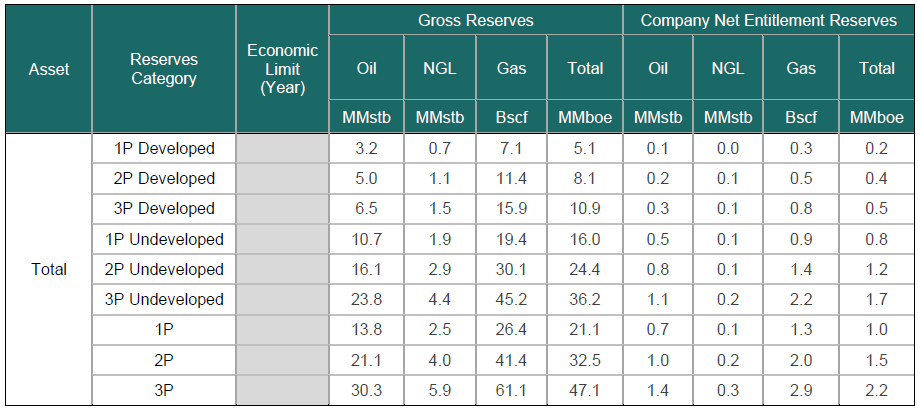

In July 2023, LBE announced the acquisition of the producing assets by the Norwegian entity: “4.80% unitised interest in the Statfjord Øst Unit and a 4.32% unitised interest in the Sygna Unit” from INPEX Idemitsu Norge AS, which is another company created with Japanese capital operating in the NCS. This transaction hasn’t been completed, it was expected in the first-half of July, but it hasn’t been announced, but we are confident it will occur in Q3. The highlights are:

Cash consideration of $12.75 million, funded by JAPEX’s financing.

Production of ~300 boepd net to Longboat Norge (based on NPD figures to 30 April 2023)

Production anticipated to approximately double in 2024 following a five well in-fill drilling programme, which is currently underway, and gas-lift installation which is complete

Payback expected in 2 years with production until late 2030s.

Acquisition price equivalent of US$8.2/2P boe, in-line with recent NCS transactions

Audited 2P reserves of 1.55 mmboe net to Longboat Norge, of which approximately 77% is oil and NGLs

The price of US$8.2/2P shows that there is a premium to be paid for a safe jurisdiction and there are many bidders. If it actually doubles production next year, the production could cover a significant share of the company’s expenses.

Another interesting aspect of the transactions are the partners in the licences, which include Equinor, Petoro, Vår Energi ASA, Wintershall Dea Norge. These companies represent the largest combined production in the NCS, positioning LBE with the ideal partners for further acquisitions or JVs in future licence rounds. Now LBE is in contact with both exploration and production teams of these essential partners for conducting business in the NCS.

Assets and activity

Norwegian producing assets

The acquisition of these two assets is not yet completed, but it is expected to be closed soon. The reserves of the two fields were estimated by ERCE and shown below (all undeveloped reserves assigned to Statfjord Øst’s infill drilling programme):

Statfjord Øst (Longboat 4.8%): The Statfjord Øst field is located in the Tampen area of the North Sea, 7 km northeast of the Statfjord field in water depths of 150 – 190 m. The field was discovered in 1976 and the plan for development and operation (“PDO”) was approved in 1990. The field has been developed with two subsea production templates and a subsea water injection template. In addition, two production wells have been drilled from the Statfjord C platform. Production commenced in 1994 and peaked in 1998 at an oil rate of approximately 82,000 stb/d. The average wellhead oil and gas rates in December 2022 were 3,360 stb/d and 12.8 MMscf/d respectively; the water cut is 82%. Cumulative oil production from the field is approximately 240 MMstb, which represents a recovery factor of 58% against the RNB2023 Best Case STOIIP (410 MMstb). A revised PDO was submitted in 2020 which includes a gas lift project. The gas lift project comprises a new gas lift system to be installed for the subsea templates and five infill wells to be drilled from the subsea templates. Each infill well is planned as a sidetrack of existing subsea template wells.

Sygna (4.32%): The Sygna field is located in the Tampen area of the North Sea, 18 km north of the Statfjord field in water depths of over 300 m. The field was discovered in 1996 and the PDO was approved in 1999. The field has been developed with a four-slot subsea production template tied back to the Statfjord C platform. Production commenced in 2000 and peaked in 2001 at an oil rate of approximately 46,000 stb/d. The average wellhead oil and gas rates in December 2022 were 950 stb/d and 0.3 MMscf/d respectively and the water cut was 96%. Cumulative oil production from the field is approximately 70 MMstb, which represents a recovery factor of 54% against the RNB2023 Best Case STOIIP (131 MMstb). Reserves in Sygna comprise production from the existing wells. There are no planned development projects.

Norwegian exploration assets

LBE currently owns 7 licences in the NCS, with WIs ranging from 10% to 40%. LBE doesn’t assume the operatorship role in any licence.

LBE hasn’t been particularly successful to date, with Rodhette, Ginny/Hermine, Cambozola, Copernicus, Egyptian Vulture or Oswig falling short from the initial estimations of oil and gas in place. To date, only the Kveikje exploration well achieved better than expected results.

The main discovery is the Kveikje oil discovery, followed by the Oswig gas-condensate discovery. The company has recently relinquished the licences for the Mugnetind and Egyptian Vulture (to be applied for in next round) prospects.

In the case of the Egyptian Vulture, partners decided not to progress with the appraisal well due to the suboptimal reservoir quality penetrated by the discovery well. The discovery well encountered 13 metres are sandstones with poor to moderate reservoir quality and oil was detected down to 3719.5 metres below sea level. ERCE provided an independent assessment with the 1C-3C size of the discovery at gross 4-68 MMboe. However, LBE will seek to re-apply for the acreage in the forthcoming 2024 licence round.

In 2022, the Copernicus exploration well in licence PL1017 (LBE 10%) and the Cambozola exploration well in licence PL1049 (LBE 25%) came dry, with background gas readings but without an effective reservoir.

Below we provide a summary of each main licence, omitting Copernicus, which we think that will be relinquished soon, and Rødhette, which has oil volumes between 9 and 12 MMboe and it is unlikely that will not be developed in the medium-term:

Kveikje: Operating in licences PL293 B, including the original Kveikje discovery, and PL293 CS, which includes 2 additional extensions covering other potential oil prospects. Equinor is the operator in partnership with Longboat (10%), DNO, and INPEX Idemitsu. Situated in the Norwegian North Sea, the well, drilled in March and April 2022, confirmed an oil-filled reservoir of exceptional quality in the primary Eocene target, Kveikje Main. The preliminary estimate of recoverable resources in Kveikje Main, being the primary target of the exploration well, is 28 to 48 MMboe (gross), above the pre-drill expectation. Additional layers, such as the gas layer in the overlaying Kveikje Hordaland, and secondary targets, such as Rokke and n'Roll, further underline its potential. The ERCE's Competent Persons Report estimates 2C to 3C contingent recoverable resources ranging from 35 to 60 MMboe gross. Kveikje lies c. 8km from the Swisher discovery and c. 10km from the Toppand discovery, enabling a cluster development.

Oswig: Operating in licences PL1100, PL1100B, and PL1100C, Longboat (20%) is partnering with OMV (operator), Wintershall Dea, and Source Energy in the gas-condensate Oswig prospect, discovered during the exploration well, with a subsequent sidetrack confirming its ability to flow hydrocarbons from poor-quality reservoirs. The well test achieved 2.1 mmscfd (60 kSm3d) of gas and 280 bpd (45 Sm3d) of condensate – around 650 boepd in aggregate. The recoverable resources were estimated between 10 and 42 MMboe (c. 50% of pre-drill estimate) based on in-place volumes of between 100 and 215 MMboe with a condensate/gas ratio of 110-130 bbl/mmscf. The PL1100C licence extension was successfully requested, containing Oswig South that has the potential to double the size of the existing discovery and is expected to have better reservoir quality. The result of the flow test was disappointing and the share price sharply fell by 45%, beginning the decline from 45p to less than 10p. However, the company expects that the field can still be developed with horizontal drilling and stimulation.

Velocette: Operating in licence PL1016. The operator, OMV, is joined by partners Longboat (20%) and INPEX. Following seismic reprocessing, this gas-condensate prospect, targeting Cretaceous Nise turbidite sands, exhibited seismic amplitude anomalies indicative of gas-filled sands. Its strategic location within tieback distance from the Equinor operated Aasta Hansteen field enhances its appeal. The Velocette exploration well has been spud and its duration is estimated at 50.8 days if the well is dry, and at a maximum of 117 days if hydrocarbons are discovered, including well testing and drilling of the sidetrack. Hence, the results will be available in late Q3 or Q4 2023 depending on the result. This well could significantly de-risk potential follow-up opportunities within the licence.

Lotus: Within licence PL1182 S, the Lotus prospect in the Norwegian North Sea is partnered by DNO (operator), Aker BP, and Longboat (30%). Sharing similarities with the Kveikje discovery, Lotus targets Paleocene injectite sandstones with excellent reservoir properties and seismic amplitude support. This promising prospect holds a gross mean prospective resource estimate of 27 MMboe, with potential upside reaching 44 MMboe with a chance of success of 56%. Lotus and Kveikje could become part of Equinor’s Ringvei Vest cluster development. A driller has been hired to drill the Lotus exploration well in Q3 2024.

Jasmine and Sjøkreps: Located in licence PL1049S, Longboat (40%), DNO (operator), and Petoro are collaborating in the Jasmine and Sjøkreps prospects. Last July, LBE announced that a new licence group has been formed and an extended work period has been granted in the PL1049 licence, renamed PL1049S, targeting the Jasmine and Sjøkreps prospects. LBE has increased its interest in the new licence group from 25% to 40%. The focus has shifted to shallower levels following the unsuccessful Cambozola prospect drilling in 2022. Sjøkreps, targeting a fault-bounded three-way dip closure at Palaeocene level, presents preliminary estimated recoverable volumes ranging from 20 to 300 MMboe (P90-P10). Similarly, the Jasmine prospect, an injectite target at Eocene level, carries a recoverable volume range estimate of 10 to 30 MMboe (P90-P10). The key risks are reservoir quality. A drilling decision is expected by February 2025.

Malaysian Asset:

The addition of this Malaysian licence is a move to increase the exposition to other geographies. This licence is held 100% by LBE, as it doesn’t belong to the Norwegian JV. LBE’s team saw some similarities with the early exploration in the NCS, and decide to participate in Petronas’ licence round:

Kertang: Operating in Block 2A, Longboat (operator 36.75%) collaborates with Petronas, Petros, and Topaz. Positioned northwest of the Central Luconia hydrocarbon province and encompassing an area of around 12,000 km², Block 2A lies at water depths of 100-1,400 meters. Its primary focus, the Kertang prospect, is a large anticlinal structure spanning over 100 km² at multiple levels, showcasing significant volume potential, potentially involving trillions of cubic feet of gas. Indications of gas through seismic indicators and geochemical analysis further bolster the case for this gas-prone area, which is strategically close to the Bintulu LNG plant.

Drilling operations

Last week, the company announced the start-up of the drilling operations on the Velocette exploration well, targeting gross unrisked mean resources of 35 MMboe net to Longboat JAPEX Norge AS with a geological chance of success of 30%. More about this licence in the asset section. This well has been labelled by Westwood Global Energy as one of the key wells to watch in 2023 within proven plays:

In February, the semi-submersible Deepsea Yantai rig was assigned for the drilling of the Lotus exploration well in Norway. The Lotus prospect will be drilled in Q3 2024.

Looking at the company’s plans in early 2023, if the Velocette well is successful, there could be a couple of appraisal wells before starting the Lotus well. This plan changed in February after the acquisition of the Malaysian licence. The changes of the planning during the year are shown below (i.e. January, February, and May):

The focus in the company is in Velocette, a successful exploration well may revive the appraisal campaign initially planned, but it is too early to say. The decision on a potential monetization of the Kveikje discovery during the year may also affect the work plan. In addition to the existing portfolio of licences, the JV may decide to farm-in into imminent drilling campaigns thanks to the available funds. We suspect that the current planning is not definite and it will be modified soon, but this is a speculation.

Risks & Challenges

LBE is a high-risk company, it is not a company for everyone, as its focus in the identification and exploration of prospects is prone to failure. The list of main risks to consider includes:

Oil and gas exploration is inherently risky, in general, chances of success are typically at ~30%. Converting a prospect into a discovery is complicated but then transforming resources into reserves are even more complicated. LBE has already obtained lower than expected results in many exploration wells, particularly in Rodhette, Ginny/Hermine, Cambozola and Copernicus. However, LBE is still targeting several multi-MMboe prospects, such as the Oswig discovery. In the case that only 1 or 2 prospects end up being commercial, LBE’s low valuation will still pay for itself. The geological risk is the most important aspect here, but the team is extremely capable and knows the business and the geology of the NCS like no others. Thus, this risk must be monitored and some exploration wells will come up dry, but it is a risk that any investor must foresee before buying shares of the company.

The company must have access to external financial resources to finance its wells. Although, at this moment, it counts with important resources from JAPEX and the EFF. With available resources of c. US$191.5 million (less the expenditure in 2023 so far), the company has enough financial support for meeting all its commitments, including drilling Velocette and Lotus and continuing the analysis of seismic and data. Additionally, it will soon close the first acquisition of producing assets, which will provide a steady income for paying for the structure costs. These resources could grow with up to US$30 million if the results of the Velocette well are positive. We don’t think that funding will become an issue in 2023 and 2024, and the company has enough financial strength to continue investing in the meantime.

LBE is actively searching for M&A opportunities in Norway, like the recent acquisition of producing assets, and beyond, such as the acquisition of the Malaysian licence. Kveikje could be sold at any moment, as the company said in early 2023 that it was looking at how to monetize its position. We expect that the company will continue analysing further acquisitions, thus, there is a risk that the transactions aren’t accretive and draw financial resources that could be used somewhere else. In our opinion, this is a low risk; LBE’s leadership has shown that they are prudent, they usually partner with top-class o&g companies and take minority stakes to lower the exposure.

The undervaluation and low Mcap of LBE could make it a target for an acquirer, such as JAPEX or DNO. This is not a significant risk at the moment, but it could become very real in the case that LBE obtains some good results from at least one of the exploration or appraisal wells. Hence, the situation that occurred at Faroe Petroleum could repeat itself. At that time, DNO had a majority stake and forced the company to accept the price, which meant that the executives left the company. We hope that they learnt from this mistake and don’t let the company be acquired at a low multiple again.

The stock is listed in the AIM, which is far from ideal. It is one of the worst exchanges for any stock. We’ll rather see LBE listed in Norway than in the LSE AIM, and I’ll be glad to read at some point that’s something being considered as the British roots are gone.

Conclusion

We must insist: Longboat Energy is a company that should not be considered by risk-averse investors. Its future depends on the results of the next drills, as it hasn’t been very successful so far. Having said that, LBE is a small but important player in the exploration of new oil and gas resources in the NCS. In the case of LBE, the team is applying the same playbook used in Faroe Petroleum before its acquisition in 2019 for US$816 million (£641.7 million). Right now, LBE has barely booked any reserves, but it has successfully completed some exploration wells like Kveikje and Oswig, and partially successful drills like Egyptian Vulture or Rødhette.

The discoveries at Kveikje and Oswig may seem small, but they were among the best results in the NCS during 2022:

The company has an important financial package to finance next exploration and appraisal drillings and M&A. Thanks to the excellent fiscal framework provided by the NPTS, most expenses employed in exploration will be reimbursed the following year. Norway has confirmed one more time that it is the safest jurisdiction for o&g, with a stable and supportive legal and fiscal framework. This creates a virtuous circle in which funds spent in drilling is mostly recovered the next year in cash, enabling the reinvesting of tax rebates in additional exploration. This leverages the amount the company can invest in exploration versus the equity, and investors can expose to this inefficiency thanks to LBE.

The share price has almost tripled in the past 3 months, but the capitalization is just £14.8 million. Most of its debt will be reimbursed by the end of 2023, hence, it is virtually no-debt, considering JAPEX’s initial investment into the JV. On top of this, there are up to $30 million contingent on a success at Velocette, which will be equivalent to 160% of LBE’s current Mcap, or 80% considering only LBE’s 50%.

The company is out of the radar of many investors, and there is some selling pressure from shareholders that bought the shares at much higher levels. In the past, Faroe Petroleum was also active in the UK, so it attracted the interest of British investors, but the current setup is exclusively focused in Norway. The low reserves (1.55 MMboe 2P) make it uninvestable for most Institutional Investors, yet there are some boutiques and small IIs who have invested in the company. So, retail investors can expose themselves to what we consider a market inefficiency, where value of cash, funding and rebates makes the EV to be negative, offering all the upside from the exploration business.

LBE has a seasoned team who already built a profitable company following the same strategy, a large portfolio of licences, support of top-class partners and adequately funded to cover all the expenses in the next few years. The future is uncertain and o&g exploration is a high-risk activity, but LBE has only to hit 1 ball among all in the basket to multiply its current valuation. In this case, the odds of generating value from LBE’s exploration portfolio seem quite high for investors.

In our opinion, Longboat Energy possesses most pieces of the puzzle that make it an interesting investment, which however may require some patience. The closing of the recent acquisition, the Velocette well, the future Lotus well and M&A could act as catalysts in the next 12 months.

Disclaimer: at the moment of writing this article, we don’t hold shares of Longboat Energy. However, we may buy or sell shares at any time. This document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Went straight to 7p after recommending it at 26p. Good job again.