Investors in the oil and gas sector have been battered in the last few months with oil and gas prices plummeting and confusing messages being sent from major players. Although OPEC+ has attempted to halt the downward price trend, including voluntary reductions (this could be the subject of another write-up) by the Sauds, but their efforts have proven insufficient. China's demand for oil hasn't recovered as quickly as many bullish investors had anticipated. Despite the air traffic data showing a return to pre-COVID levels, this hasn't translated into improved share prices for oil and gas companies. Russia has gained entry into the dark fleet club, successfully shipping its oil to Asia to bypass US and European sanctions, and remarkably increasing production against almost everyone's expectations. Iran continues to offer its oil in the market, while concerns about a potential deal on its nuclear efforts with the US cast a shadow over the sector. Consequently, I present a new approach to investing in the oil and gas sector that offers reduced volatility, thanks to long-term lease contracts that are not exposed to the fluctuations of oil and gas prices, unlike exploration and production (E&P) companies.

Onshore versus onshore production

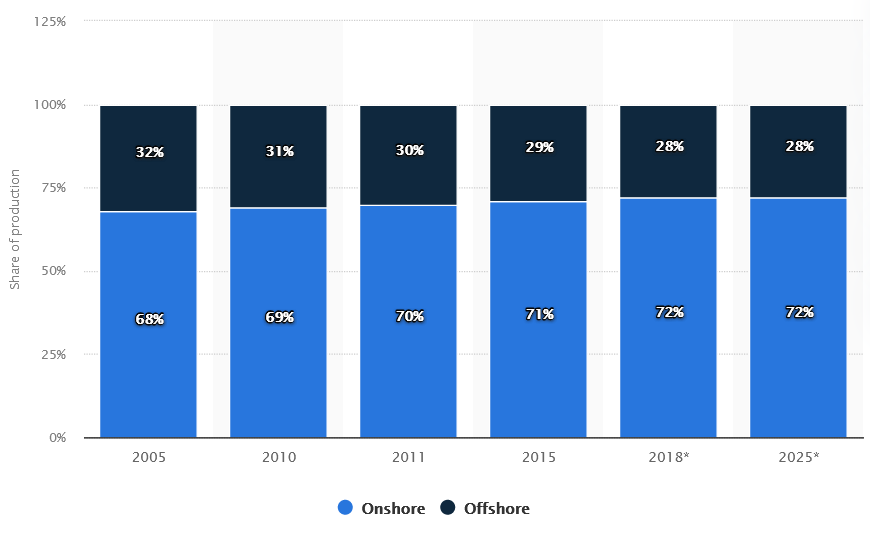

As offshore exploration keeps receiving more and more attention, thus, the need for FPSO and FSO is increasing. Without a place to store and process the gas and liquids, the production of hydrocarbons from the Santos basin or Guyana will not be possible. However, the share of onshore production has grown globally in the last years, as Statista’s shows:

Nevertheless, has this been a global trend or led by a single producer like the US? In the last decade, onshore production in the US has increased considerably. Now, onshore production in the US represents ~80% of the country’s total production, above 11 MMbopd, more than a 100% increase in 10 years. During this time, the US has transitioned from an importer to a net exporter, causing the end of the previous cycle due to the increase of shale oil production, mainly.

Hence, despite the share of onshore production of the global market has increased, this cannot be considered an even trend across the sector. In fact, largest discoveries in the last years have been done in the sea, with Guyana in America and Namibia in West Africa being the leaders. All these future fields will need FPSO and FSO to produce oil and gas.

FPSO - Floating Production Storage and Offloading

Fine, but, what’s a FPSO? They are standalone vessels able to directly operate the subsea wells, as they are equipped with hydrocarbon processing equipment for separation and treatment of crude oil, water and gasses, arriving on board from subsea oil wells via flexible pipelines. They can be newbuilts or repurposed tankers. FPSO have 3 main auxiliary elements, a mooring system to secure them in place (in deep & ultra-deep waters, they use a dynamic positioning system instead), a riser or fluid transfer system system connecting the FPSO to the wells (for the transport of o&g but also hydraulic fluids and reagents), and an offloading system for tankers or pipelines. The mooring and fluid transfer systems are combined in modern FPSO, forming the turret mooring system. The offloading system typically consists of a floating structure or buoy to which both FPSO and tankers connect for the transfer of oil or gas. Other systems include water pumps, gas turbines for re-injection into the reservoir, ballast and oil tanks.

A FPSO is usually designed specifically for a field, as each field produces different types of oil or gas and the equipment aboard has to be specifically designed for the expected gas-oil ratio, water cut or impurities (i.e. sulfur, nitrogen, and oxygen). Hence, a FPSO will reach the expected life of the field for which it was originally commissioned by design. In some cases, a FPSO can extend its life or be adapted for new specifications, such as for a new field or for changes of the oil or gas properties, but this requires a substantial investment. One example is the FPSO in Equinor's Peregrino field in Brazil that was commented on the previous article about BW Energy. Another example that readers from Europe may know is Vår Energi’s Balder X project that is refurbishing the Jotun FPSO to extend the life of the vessel toward 2045 and the redevelopment of the Balder and Ringhorne fields. The Jotun FPSO has experienced enormous delays and overrun costs (last estimate is at $4.3 billion, and could not be final). In general, adapting a FPSO for a different specification or extending its life beyond its original design is not a good idea, so majors prefer to design and commission new FPSOs.

One of the hottests spots for offshore o&g is Guyana, where oil discoveries have outshined other regions, taking the baton from Brazil’s Santos basin with its pre-salt reserves. Guyana is expected to progressively increase production from its main fields (i.e. Liza, Payara, Pacora, or Longtail) and reach a production above 700,000 bopd by 2030+.

All these developments will require one or more FPSO/FSO to operate due to their size. Recently, ExxonMobil signed a 10-year lease contract with SBM Offshore (AMS:SMBO) for most of its oil developments in Guyana. There are different providers of FPSOs for offshore fields:

Saipem (BIT:SPM), $2,924MM Mcap

SBM Offshore (AMS:SBMO), $2,503MM Mcap

Yinson (KLSE:YINSON), $1,727MM Mcap

Bumi Armada (KLSE:ARMADA), $602MM Mcap

MODEC (TYO:6269), $576MM Mcap

BW Offshore (OSL:BWO), $465MM Mcap

Altera Infrastructure, formerly Teekay Offshore and now controlled by Brookfield.

In this case, I am going to talk about SBM Offshore, as its contracts in Guyana and Brazil with oil majors guarantee a low-risk profile in the coming years. I plan to make a comparison of these companies, but if there is interest on one specific company you’ll like to analyze, do not hesitate to send me an email: anotheroilgastourist@gmail.com

SBM Offshore (SBMO)

SBMO is currently operating the equivalent of 1.5 million barrels of oil per day, around 1.5% of worldwide production. The portfolio of clients includes Petrobras, ExxonMobil, Pertamina, Shell, Noble and ENI. Most of these clients are recurring, for example, SBMO has recently signed with ExxonMobil a 10-year contract for Liza Destiny (which was the first vessel constructed for Guyana) and 2-year contracts for Liza Unity, Prosperity and ONE GUYANA. It has also entered into the offshore wind market by designing and constructing floating structures, SBMO calls this segment New Energies.

The core of the business consist of the design, commission, delivery and operation of FPSO for customers with multi-annual contracts. In this area, SBMO is operating a fleet of 16 vessels in Guyana, Brazil, West Africa and Southeast Asia. The existing contracts have a duration until 2050, in the case of the FPSO Almirante Tamandaré, with an average duration as of today of c.6 years. Most FPSOs operate in deep and ultra-deep water, which is a specialization of SBMO:

Each vessel has two different phases: lease and turnkey. Usually, SBMO signs the order for the construction, delivery and operation of a FPSO for a customer; this is called the lease phase. Nonetheless, SBMO may decide that it prefers to disvest a FPSO to a third-party or the client may exercise the purchase option after reaching the end of the lease period; this is called the turnkey phase. In many cases, SBMO keeps the O&M role of the FPSO also in the turnkey phase, but the margins are lower. The turnkey phase can also be done through a Special Purpose Company (SPC), in which SBMO may or may not participate, transfering the ownership to the SPC and booking all revenue and margin associated with the transfer in the turnkey segment. This gives the company flexibility to manage its revenue and debt positions, as it can begin the turnkey phase of a project even before the FPSO has been built or after completing the L&O contract. As examples of how different the turnkey phase can be:

The FPSO ONE GUYANA is now in construction and SBMO has already agreed with McDermott to create a SPC (SBMO will retain 70%) for the FPSO after expiring of its initial 2-year lease contract.

In Q1 2022, SBMO divested a 45% interest in FPSOs Alexandre de Gusmão and Almirante Tamandaré, which are still in construction, and resulted in a surge of the revenue of the turnkey segment from $153MM in Q1 2021 to $565MM in Q1 2022.

The hidden sauce

What makes SBMO special compared to other companies is the approach to the design of the FPSO, it created the Fast4Ward concept, which uses a Multi-Purpose Floater (MPF) hull design that can be adapted for different specifications. The Fast4Ward MPF concept allows to standardize and modularize several components and parts, which makes the fleet more homogeneous while lowering the total number of suppliers. The main purpose is to make the construction process more cost-efficient and reliable with assured delivery deadlines through standardization and repetition. The Fast4Ward is intended for newbuild FPSO that will operate in deep water, such as Brazil, West Africa or Guyana. Hence, this program allows the company to secure slots in different shipyards (e.g. 8 new Fast4Ward units were commissioned so far in Q1 2023), whilst offering the required features.

Once SBMO orders a new hull, it offers it to different clients ensuring a control over the costs (thanks to repetition) and delivery date (thanks to standardization). This allows the company to participate in the procurement process with much more certainty about the delivery times, up to 6 months less. Compared to the standard practice in the industry, the Fast4Ward program allows to reduce the time from discovery to first-oil by 2 years (7.3 vs. 9.3, according to the FY22 data).

This program is also relevant for the O&M stage, when processes, spare parts, and personnel can be shared among all Fast4Award FPSOs, as the standardization ensures the compatibility across different vessels.

As a result of the Fast4Ward program, SBMO achieves savings in both the construction and operation stages of the FPSO, lowering breakeven prices to ~US$25-35 per barrel with 40% lower emissions than the industry average.

Additionally, SBMO has begun a company-wide digitalisation effort to increase data-driven operations and decision making and created the Smart Enterprise, Smart Win and Execution and Smart Operations to cover each area of the company. The goal of this program is to increase efficiency at each FPSO but also as a company, enabling the identification of new business opportunities. The Digitalization of the EPCI and O&M will also reflect on the Fast4Awards program by improving completion times and operational breakeven, both key features appreciated by clients. The digitalisation effort is also linked to the emissionZERO program, aimed to reduce environmental impact of the o&g thanks to innovations aboard the FPSOs, decreasing CO2 emissions per barrel of oil produced.

Financials

It is important to bear in mind that the company reports using 2 different methodologies, Directional and IFRS. The distinction is due to the acceleration of recognition of lease revenues and profits into the construction phase of the asset under IFRS, whereas the asset generates the cash mainly only after construction and commissioning activities have been completed. In the Directional methodology, the Company only recognises any revenue at the start of the lease payments, which allows to improve the picture on the cashflows. Directional reporting treats all lease contracts as operating leases and consolidates all co-owned investees related to lease contracts on a percentage of ownership basis. Therefore, all financial reports include both methodologies for the sake of transparency. I’ll be using the directional financial figures in this article.

SBMO is a leveraged company as it uses debt ($6.7 billion) to finance the construction of the FPSOs. By the end of 2022, the majority of the debt consisted of non-recourse project financing (US$3.7 billion) in special purpose investees, which are reported on an equity basis. The remainder (US$3 billion) mainly consisted of borrowings to support the ongoing construction of five FPSOs, which will become nonrecourse following project execution finalization and release of the Parent Company Guarantee. Hence, the leverage ratio was ~6x debt to EBITDA at an average cost of 4.3%. The debt is secured against a backlog of $30.5 billion and the lease and O&M contracts in the case of the SPCs. As an example of how important and complex financing is in this business, in Q3 2022 SBMO completed the project financing of the FPSO ONE GUYANA for a total of US$1.75 billion provided by a consortium of 15 international banks.

The company has steady revenue from the leasing, operation and maintenance segment, which gives visibility over the company’s cashflows, providing and average net cas of ~US$475 million in the next 5 years (2023-2028)

The profile of the debt repayment extends until 2039 with payments of $520 million, or less, except in 2024, 2025 and 2027 when the company will pay $1.64, $1.47 and $2.22 billion, respectively. The repayment of debt can be handled by the revenue from the turnkey phase, when additional revenue is generated and a portion of the debt is transferred to the other equity-holders of the SPC or the client. SBMO which are expected to be covered from turnkey revenue of $1.5, $1 and $2 billion, respectively. The company had cash of US$615 million and total liquidity above US$3 billion by the end of 2022. In the current context, the company has already warned that financing is becoming increasingly complex, challenging and time-consuming. Although, SBMO managed to successfully complete the $1.75 billion project financing of the FPSO ONE GUYANA, thanks to the operational excellence and sustainability.

For 2023, SBMO has published its guidance for the full year:

revenue above US$2.9 billion, of which around US$1.9 billion is expected from the Lease and Operate segment and above US$1 billion from the turn-key segment.

directional EBITDA above US$1 billion.

Thus, the company expects to make a similar EBITDA than in 2022 even with a reduction in revenue of ~$400 million, caused mainly by the turnkey revenue in Q1 2022 from the FPSOs Alexandre de Gusmão and Almirante Tamandaré. The projected cash generation will be enough to cover the debt commitments and offer a dividend of $200 million for 2023 (7% return). The company has been paying a dividend in the last 6 years, and in the 2019-2021 period it also purchased shares. Shareholders approved in the last general meeting the authorization to repurchase the Company’s own ordinary shares, but there is not commitment or specific program announced as of today. It is unlikely they will purchase any shares as the same authorisation was also included in the 2022 resolutions.

The future

The company has planned to deliver 2+ FPSOs per year until 2030, which will increase the fleet significantly. The Fast4Ward program and other initiatives in the digitalisation and emission reduction areas are all critical to achieve this objective. The positioning in Guyana and the contracts with majors with ExxonMobil an Petrobras are also aligned with this goal.

The unique experience of SBMO with FPSOs operating in ultra-deep waters is also very relevant for the development of a new play in the Orange Basin in Namibia, where the water depth of the Venus discovery is 3,000 meters at 290 kilometers off the coast.

Recently, Petrobras announced plans to increase the investment in Guyana, Venezuela and Bolivia. Moreover, the president of Guyana himself contacted Lula to ask him to pressure Petrobras to reconsider the participation in the last licensing round in Guyanese waters. Just looking at the portfolio of FPSOs operated by SBMO, it is obvious to see how well Petrobras and Guayana match:

It is important to stress that the plans in Guyana for both ExxonMobil and Petrobras require the participation of the same company, SBM Offshore. This gives the company a strong backing that will ensure it achieves its plans to complete 2+ FPSOs per year in this decade. Few companies have the same experience designing, constructing and operating FPSOs in ultra-deep waters, which benefits SBMO.

Unlike many companies in the oil and gas sector, SBM Offshore's high leverage does not reflect its financial health. The recurring nature of its business and the optionality of the turnkey segment mitigate this risk. Furthermore, SBMO's operations in tier 1 jurisdictions for oil and gas, such as Angola, Guyana, and Brazil, contribute to further risk reduction. Outside of the Arab countries, these locations are considered among the safest for oil and gas E&P.

While still in its early stages, the New Energies segment is poised to achieve a significant milestone by the end of this year: the Provence Grand Large offshore floating wind project. This pioneering project, utilizing SBMO's technology, aims to generate 25MW of power from three turbines. Although this segment currently holds limited relevance, it bears great potential for the future, particularly if major players like Petrobras venture into this business. Notably, the fact that SBMO has designed structures at water depths beyond 50m offers a unique positioning for future wind offshore developments.

In my opinion, SBMO represents a less volatile investment in the o&g sector, but it is not the only one, other companies like BW Offshore, Saipem or MODEC are other players in this segment that are worth taking a look at. Hence, now that I have introduced SBMO, I plan to make a follow up article on these players to compare them and provide an overall picture of the different companies that could be interesting in this sector.

If you found this interesting, please, do not hesitate to share it or subscribe to this humble substack.

Disclaimer: this document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes. Please, make your own due diligence and analysis.