Pharos Energy: a far east turnaround story

A troubled company that is struggling to recover old glories

Summary

Pharos Energy (LON:PHAR) is an independent oil and gas exploration and production company with current production of 6,900 boepd in Vietnam and Egypt. Most of the production comes from Vietnam, one of the best jurisdictions under the new Petroleum Law, while Egypt looks less appealing in comparison due to fiscal conditions, domestic market obligations and the usual delay in payments.

The company has sailed through troubled times, but it has completed the turnaround and has reinstated shareholders’ remuneration. Now the market seems to have forgotten about it despite being close to reach a net cash position. The company changed the people at top positions and is now trying to find new partners for its next adventure in Vietnam.

PHAR has the inherent risks of a small cap E&P, with the added hazards of depending on offshore exploration to continue its operations due to the low reserves it has. This company may not be interesting to risk-averse investors, but there are several aspects that have called for my attention.

The past

The company was founded as SOCO International in the early 90s by Ed Story, ex-employee of Exxon, and completed the IPO in London in 1997.

After making the entry into Vietnam with initial high production rates SOCO International was in a very strong position. Then, it engaged in different operations in Congo, D.R. Congo, Angola, Russia, or Yemen, but with a main focus in Africa. In 2018, it even evaluated a merger with Middle East oil and gas firm Kuwait Energy.

SOCO International became an infamous company when it tried to produce oil in the Virunga National Park in the Republic of Congo in an area that is the habitat of gorillas. After a series of accusations and international pressure from ecologists, the company canceled any plans and, later, left the country in 2018 by selling its operating stake in Marine XI block, a deal that was accused of corruption.

Coincidentally with the exit from Congo, the company sold its Angolan subsidiary, SOCO Cabinda, for $5 million to Quill Trading Corporation and WMLC Resources, another suspicious move as the buyer was accused of being a shell company of some Angolan politicians.

Then, 2019 was a transformational year for the company, it completed a farm-in in Egypt, which instantaneously increased its oil production, the company restructured the board and changed its name to Pharos Energy, kind of a “phoenix moment”.

In 2021, PHAR obtained 8 licenses in the 2nd offshore bid round held by the country together with Cairn Energy (now Capricorn Energy) and Israel's Ratio Oil Exploration, which was seen as the next key area of attention by the company. The licenses were relinquished in 2022 by the partners. This shows how the company has stumbled since the decision to develop the Vietnamese assets, lacking a clear strategy and chasing vey different licences across disparate jurisdictions and continents. This looks a lot like what an oil tourist would do …

Last year, the company completed the farm-out process of the Egyptian assets, which will be discussed later. As part of the transaction, Ed Story stepped down as CEO and Director and was appointed President of the Vietnam business. He will still be part of the future of the company, but not be at the strategic decision-making level.

Team

Jann Brown replaced Ed Story as CEO in March 2022, initiating a new age for the company, as he had been the CEO since the IPO. However, Jann served as CFO since 2017, then she was also part of all the decisions in that period of time. Before joining PHAR, she was CFO of Cairn Energy plc (an historic player in Egypt) from 2006 to 2014. She has extensive experience in O&G operations in both Southeast Asia and the Middle East, but always in financial roles.

John Martin was appointed in October 2019 as the new Non-Executive Chairman, at the same time when the company changed its name trying to make a new start after the previously troubled years. He has a past in international banking in the oil and gas industry and has served as Chairman or Director at Falkland Oil and Gas, Bowleven or, more importantly and farther in time, Total E&P UK Limited. His curriculum is not impressive, to be honest.

The remaining directors have been appointed between March 2019 and July 2021, which shows that the company has worked to remove from the management all those involved in the previous scandals and accusations. This is a positive aspect for us, as it seems clear that there has been some accountability and that there is no trace of those involved in actions that could potentially harm the company. Well, Ed Story is still in Vietnam …

The team is not the strongest aspect of the company. I don’t see it as skilled as in other o&g companies. For instance, there isn’t any geologist or petroleum engineer on the board, all have financial backgrounds. Also, there is a lack of “wow” achievements in their curriculums and most relevant highlights are from many years ago.

One positive aspect is that the number of members was reduced in 2022 from 9 to 6 members and the executives from 4 to 2, following the closing of the farm-out deal. This helped in saving some money as both cash and share-based payments were reduced. However, CEO’s salary in 2022 was £927,000 (ca. $1.1 million) that is totally unacceptable for a company with a market cap of £100/$125 million. It is particularly infuriating as both CEO and CFO are yet to reach the 200% shareholding requirement set in the policy for Executive Directors. At least, both CEO and CFO have been acquiring shares in the open market to increase their shareholding during 2023.

This is the composition of the BoD (it is up to you to read the profiles, I don’t find any very compelling):

Current assets

Currently, the company is producing oil from 2 different countries with totally different configurations. PHAR completed a farm-out of its Egyptian onshore assets and transferred the operatorship. This deal also included a carry of PHAR’s share of capex, which $20.5 million was outstanding at the beginning of 2023 and are expected to be fully utilised until year-end. In the case of Vietnam, PHAR owns offshore licences, both production and exploration, that have a very particular geology with a series of reservoirs due to an overlap of sedimentary layers on top of fractured “buried hills” of granite as basement.

According to the 2022 report, the current 2P reserves and 2C resources of the company are:

PHAR has revised the guidance for 2023, confirming that decline is not solved:

Net production: 6,350 - 6,750 boepd from 6,050 - 7,500 boepd

Vietnam production: 5,000 - 5,300 boepd from 4,700 - 5,700 boepd

Egypt production: 1,350 - 1,450 bopd from 1,350 - 1,800 bopd

Hence, Egypt is in the lower band of the initial range and Vietnam is within the initial range but far from the high band. This represents a decline between 11.4% and 5.8%, which is far from ideal after a capex of $24.4 million (ca. 11% of 2022 revenue).

Egypt

The licence was acquired in April 2019, and PHAR farmed-out of 55% of the concession and control over the Petrosilah JV (operatorship and 50% owned by the Egyptian state) to IPR Lake Qarun. The farm-ot was completed in March 2022. The terms of this farm-out were:

Economic date of 1 July 2020, with completion on 21 March 2022 (ouch!)

Firm consideration of $5m in two tranches: $2.0m in September 2021 and $3.0m on 30 March 2022.

Carry of $36.3m to fund PHAR’s 45% share of the cost of future activities, after working capital and interim period adjustments from the effective economic

Contingent consideration of up to $20m depending on the average Brent Price each year from 2022 to the end of 2025 with floor and cap at $62/bbl and c.$90/bbl respectively ($5m were received in 2022)

This farm-out agreement was positive, as the IPR Energy Group is a consolidated player in Egypt with interest in 11 concessions and ample expertise in extending fields' life with enhanced recovery techniques. This allows IPR to benefit from the access to suppliers and authorities, while PHAR just receives its economic interest. The total value between $46.3 and $61.3 million seems like a fair price for an asset in Egypt, a jurisdiction that is not among the best.

There is an ongoing exploration effort in both North Beni Suef and El Fayum to comply with the conditions set by the Egyptian state to extend the concessions, including the acquisition of seismic data and the drilling of exploration wells. The operator has secured a rig on a long-term contract until December 2024, which will continually work on the field. Additionally, the partner has hired 2 workover rigs to perform low-cost well repairs, recompletions, and deployment of water injection in the acreage.

The production in H1 2023 (1,349 bopd) was almost within guidance (1,350-1,800 bopd), but PHAR expects production to grow in H2 2023 above the H1 levels and reach the FY guidance. So, the actual H2 2023 production could grow to 1,400-1,500 bopd.

The licence has produced 26 MMboe until 2022, and the FDP includes the 15 MMboe 2P reserves. The company and its partner have identified the infill locations for the conversion of the 9 MMboe 2C resources into 2P reserves. Aside from this, the Egyptian government approved the Third Amendment to the El Fayum Concession in January 2022 with improved fiscal terms, retroactively effective from November 2020:

Full cost recovery mode increases from c.42% to c.50%

3.5 year extension to the exploration term of the El Fayum Concession, conditional to drill 2 exploration wells (Abu Roash G and Upper Bahariya formations) and acquire additional 3D seismic data.

The El Fayum multi-year and multi-well development programme commenced in Q2 2022. Seven wells were put on production in 2022 (including one well drilled in 2021), and one additional well was drilled in Q4 2022 and completed in Q1 2023. The first of the 2 exploration wells included in the extension of the concession has been drilled and encountered oil-bearing reservoirs in the Abu Roash G and Upper Bahariya formations. The results of the production test are yet to be published.

In the North Beni Suef (NBS), the concession was extended in 2022 subject to completion of 2 commitment exploration wells, which will be drilled in 2023 after completing the acquisition of 3D seismic data in Q1 2023. The first exploration well was a success, encountering multiple pay zones in the Abu Roash G formation with pre-frac gross 470 bopd. The second exploration well is planned for H2. After completing this well, an application will be made for the approval of the NBS Development Lease.

An important aspect of the region is the low drilling costs. The estimated cost of a dry well is below $1 million and a drilled and a completed well is $2-3 million. Alternatively, there are new techniques that can be applied to Egypt in order to reduce drilling and completion costs with improved recovery rates. For example, Vaalco Energy has drilled, fracked and completed its first horizontal well, Arta77 HC, with very promising results, and the application of new drilling (multilaterals or fishbone) and completion (new fracking fluids) techniques can bring additional production enhancements.

So far, I have covered the least attractive part of the company, now things start to get more interesting.

Vietnam

In Vietnam, PHAR holds production and exploration licences, which supports the future growth of the company in the next decades, should the exploration works turn positive.

The geology in the East Sea close to Vietnam is dominated by the Red River Fault, which goes along the coast, creating the different basins due to the fractures of the basement.

Production

The producing assets include the TGT and CNV fields in the East Sea in the Coo Long Basin (this report summarises the main geologic features of the basin). These fields are mature, being in production for +10 years. The oil from these fields receives a premium to Brent: $4/bbl in 2022 and $2/bbl in 2021, achieving a record premium of $7 in 2012. The gas produced is sent to shore and sold to the local market (this is important as natural gas represents 15.6% of 2P&2C).

In H1 2023, both blocks produced 5,566 boepd, which is within the 2023 guidance (4,700-5,700 boepd). The CNV-9PST1 well was completed in H1 with an initial gross production of 3,000 bopd (above the expectations), which could lead to finishing the year in the high range or above the guidance, with H2 production in the 5,500-6,000 boepd range. However, the company hasn’t commented about beating the guidance, so, I’d assume the full year production would be closer to 5,700 boepd.

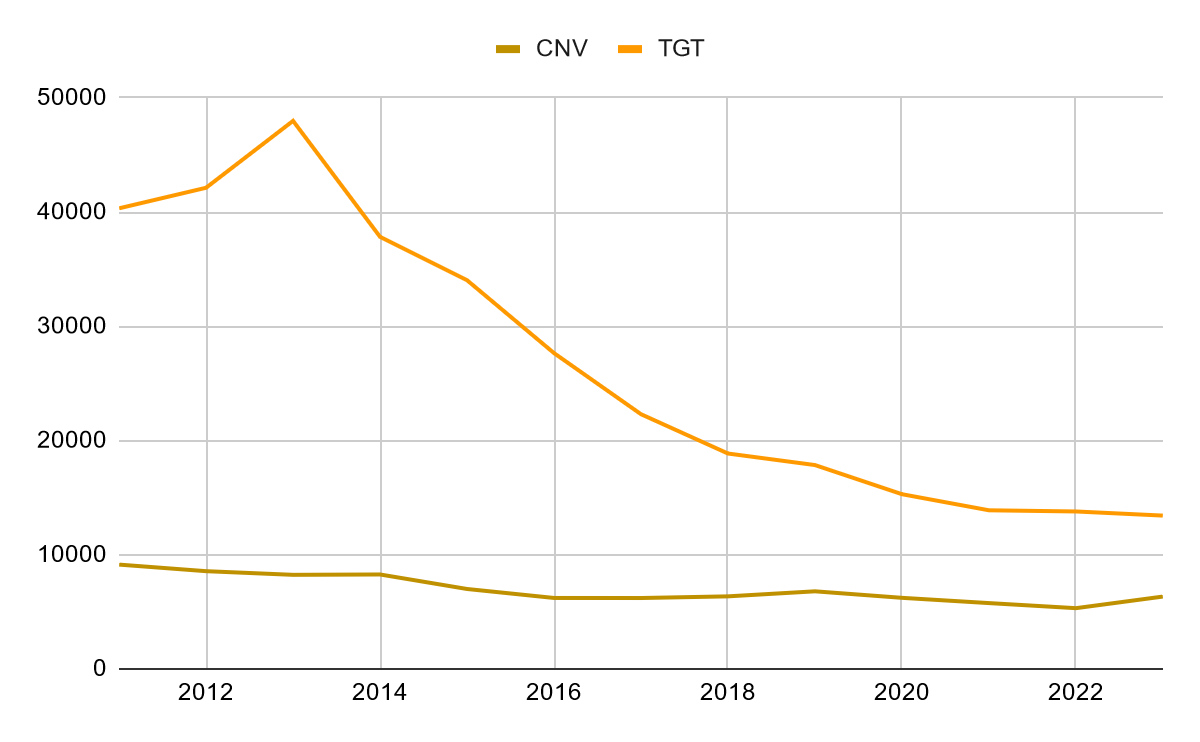

The production from these fields in the 2011-2023* period shows the constant decline, particularly in TGT, but they are still producing at noticeable levels:

Despite the decline, the fields are very profitable. The operators are controlling expenses, and the opex per barrel was kept at $16.367boe in 2022 and $16.05/boe in 2021, a slight increase YoY but nothing worrying. In H1 2023 the cash opex was even lower at $13.4/boe (-18.8% H1 2022), but opex usually increases in H2. Part of this low opex is achieved thanks to sharing the O&M costs of the FPSO vessel with other fields.

Also, the JV partners continue to invest in maintaining production and are now preparing the application for extensions to TGT & CNV licences, which are subject to new commercial terms and work programme commitments.

These fields have been a great success since their entry into production. Some wells delivered astonishing flows, for example, the TGT H5 well drilled in 2014 tested over 27,600 boepd. Coincidentally, while we were preparing this write-up, the YouTube channel ‘1st Subsurface - TROVE’ published a video about a field that is adjacent to TGT and CNV, Bach Ho. That field is a monster that is much bigger than PHA’s fields, as it reached a maximum production of 400 kboe/d, but it shows that the whole area is prolific and it has very particular features. The area is younger than most o&g producing areas and is highly-fractured granite basement rocks. The experience amassed by the JV partners will be critical for the exploration efforts.

Thus, the decline is evident and the end of their economic life is getting close, but the future of the fields is granted for the next 3 to 5 years. The partners in these licences have also identified infrastructure-led exploration opportunities in both assets. Nevertheless, with diminishing production, PHAR’s long-term value doesn’t lie in these 2 fields as the infill and nearby development opportunities would not extend its life beyond 10 years from now.

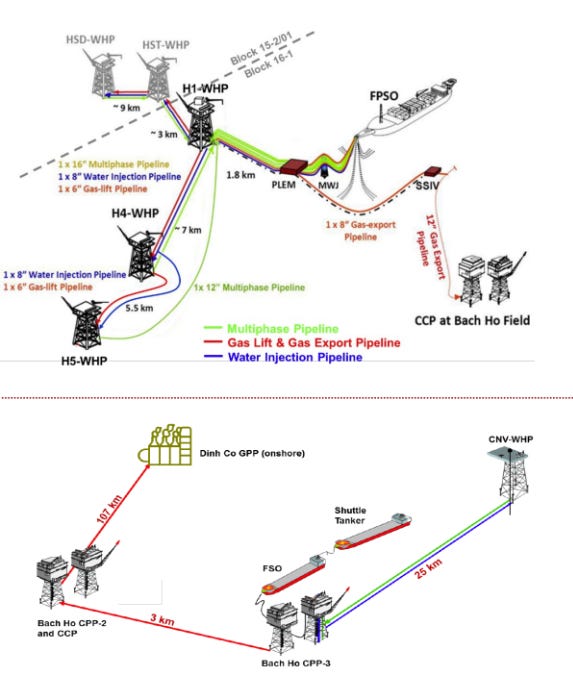

Both fields have been developed with a combination of platforms and FPSO/FSO vessels, including shares infrastructure with other adjacent blocks (something that is promoted by the Vietnamese o&g legislation):

Te Giac Trang, TGT, Block 16-1

The field is operated by Hoang Long, a JV between PetroVietnam-41%, Pharos-30.5%, PTTEP-28.5%. First oil was achieved in Oil in 2011 with cumulative production of 34 MMboe.

The oil is transferred by a subsea pipeline to a nearby FPSO vessel, where it is processed and then exported by tanker. Gas from TGT is processed at nearby facilities and transported by pipeline to shore.

The field contains 8.7 MMboe of 2P reserves, and a TGT Revised Field Development Plan (RFDP) for two new wells has been submitted to the regulator for approval targeting 7.4 MMboe to be added to 2P reserves. Drilling expected to commence in Q2/Q3 2024

Ca Ngu Vang, CNV, Block 9-2

CNV is operated by Hoan Vu, a JV between PetroVietnam-50%, Pharos-25%, PTTEP-25%. Production began in 2008 with cumulative production of 10MMboe.

Oil is transported by subsea pipeline to a nearby central processing platform operated by Vietsovpetro, where gas is separated and transported to shore, while oil is stored on a tanker.

The last well drilled in CNV, CNV-2PST1, was completed and put on stream with a flow of ca. 3,000 bopd, three times the pre-drill estimates of ca. 1,000 bopd.

The field still has 3.4MMboe of 2P reserves and infill drilling can add up to 3.4 MMboe to 2P reserves.

Exploration

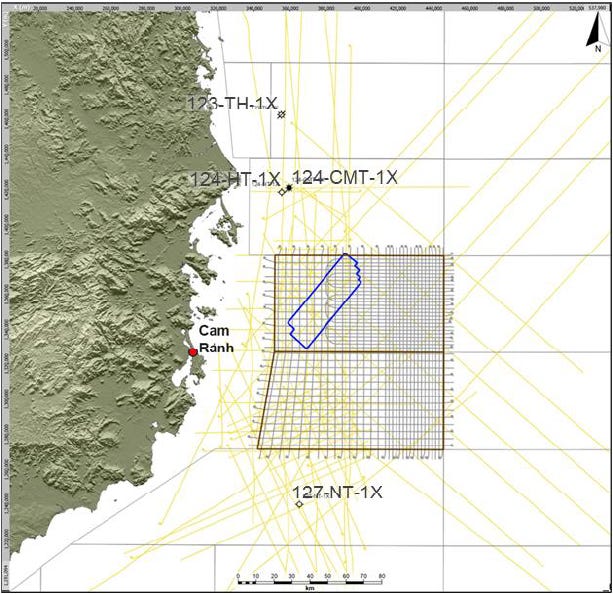

PHA holds 70% of the licences and operatorship for blocks 125 (5,213 km2) & 126 (5,474 km2) in Vietnam in the Phu Khanh Basin with water depth from 50m to 2,800m with the closest offset wells approximately 30km to the north (124-CMT-1X) and south (127-NT-1X). To the south are the Cuu Long and Nam Con Son Basins which contain multiple oil fields that are producing at various stratigraphic intervals, and oil and gas discoveries have been made to the north. The TGT and CNV fields belong to the Nam Con Son Basin.

The Phu Khanh Basin is undeveloped, but the presence of the hydrocarbon system was confirmed in 2009, when a well drilled in the Block 124 (currently held by ENI 100%) at a water depth of 182m discovered oil in the Miocene carbonates and a thin overlying sandstone. A quick description of the petroleum system is:

Active oil seepage within fractured granite, observed onshore at the Quy Nhon locality, is interpreted to be through lateral hydrocarbon migration from the Tertiary succession in the offshore Phu Khanh Basin. Fluvio-deltaic to lacustrine claystones and coals in the Upper Eocene-Upper Oligocene successions are expected to be principal source rocks. Potential reservoirs in the basin include fractured basement rocks, sandstones in the Upper Eocene to Miocene and carbonates in Miocene successions. Tertiary shales and claystones drapes could provide the top and flank seals for the fractured basement reservoirs. Interbedded shales and siltstones in the syn-rift succession provide the intraformational seals and local syn-rift highstand shales provide the top seals for the clastic reservoirs within the succession.

Initial oil in place is estimated in the range of billions, but the area is considered frontier exploration, as there has been very few wells drilled so far. No wells have been drilled in either block, they have been only covered by a combination of 2D and 3D seismic data and gravity and magnetic data. In July 2022, PHAR announced the completion of its 3D seismic acquisition programme on the western part of Block 125, which complemented the mesh of 2D seismic data that the company already possessed. In July 2023, PHAR published the CPR completed by ERCE for the 3 leads identified in the area covered by 3D seismic data.

The CPR covers the prospects A Drape, A North, D and E1 and lead A South (note: a prospect has slightly less uncertainty than a lead), and it gives important volumes of 1.7 billion gross risked barrels of prospective resources with CoS between 8% and 22% across different 13 horizons. The most relevant aspect is the high number of numerous structural and stratigraphic prospects and leads in these blocks that have been identified by the seismic data. Two leads show important volumes in the basement (same characteristics as described in TROVE’s video).

The two blocks show analogies to other Lower Miocene (TGT, Rang Dong, Bach Ho, Su Tu Den) & Oligocene (Su Tu Trang) clastic reservoirs that have been commercial fields. The image below shows the leads and the 7,107km of 2D seismic lines acquired by Pharos are shown in grey and the 909 km2 of 3D seismic data acquired by PHAR is shown by the blue polygon.

The licences have been recently extended by 2 years, until October 2025. The company has been working to drill an exploration well in the blocks, and tried to find a drillship for the exploration campaign, but it didn’t sign a contract due to the high cost. Instead, it has decided to find a farm-in partner to support the funding of this well (it is not clear whether in full or partially). A number of parties have been invited to review data and discussions are ongoing

SOVICO Holdings Company owns 30% of these blocks, and I think it is not the best partner for the current stage, because it cannot provide knowledge on the planning and implementation of the exploration campaign. In the past, SOVICO has participated in several exploration and production projects in offshore basins of Vietnam in partnership with PetroVietnam (PVN) and other international oil and gas companies. Thanks to its operations across different sectors in Vietnam, SOVICO could help in the negotiations with PVN and the Ministries involved using its contacts and influence with the authorities to bring Blocks 125 & 126 to production.

Vietnam’s fiscal framework

The country sanctioned a new Law on Petroleum in 2022 - effective on July 1, 2023 - to reduce the import of hydrocarbons and to increase the local production. The new law has introduced positive changes that support investments in the country. This law complements the previous 2021-030 National Energy Master Plan, which aimed to annually increase production in 16-22 million tons by 2030 and in 16-27 million tons by 2050. I insist: per year. Thus, Vietnam is a safe country for the o&g industry, giving an ambitious multi-decade plan to grow production.

The main change was the reduction of the % and the introduction of “Special investment incentives”. The new tax incentives include:

corporate income tax rate of 32% (previously 50%), 25% for special investment incentive blocks.

A crude oil export tax rate of 10% (previously 6 - 25%), 5% for special investment incentive blocks.

A recovery rate up to 70% of the petroleum output exploited in a given year, 80% for special investment incentive blocks.

Another positive change is that PVN will provide funding for “basic petroleum investigation”, involving researching, surveying, and investigating the geological formations, material composition, and conditions for assessing the prospects of producing petroleum. PVN together with the Ministry of Industry and Trade have to approve the development of any block or field.

In Vietnam, PSC contracts will normally have a term of 30 years, of which the exploration phase is up to five years. For those projects eligible for the special investment incentive, the terms are extended to 35 and 10 years, respectively. All contracts can be extended up to 5 years.

There is another relevant aspect, existing infrastructure must be made accessible to other companies. All contractors are obligated to share the use of oil and gas works and existing infrastructure with third parties.

Two negative aspects of the new law are PVN’s priority in the purchase of extraction rights in the case a contractor wishes to leave a PSC and the easing of the requirements to participate in future bid rounds, removing the former requisite to have participated in at least 2 petroleum contracts. This may increase competitors for future licensing rounds, but it is not something to be worried about in the case of PHAR.

Financial situation and capital structure

All revenue is generated from oil and gas sales. The company achieved the following financial highlights in H1 2023:

Total production 6,915 boepd (-13.2% YoY)

Revenue of $86.2 million.

Realised prices of $84.9/bbl for oil and $76.3/boe for oil & gas.

Cash opex $14.1/boe (-11 YoY)

After-tax cash from operations was $21.3 million.

Administrative expense of $4.6 million (-$0.5 million YoY).

Repaid $22.4 million in debt.

CAPEX of $15.4 million ($7.2 million carried in Egypt).

Received first contingent payment of $5m from the Egypt farm-out.

Cash position of $35.9 million.

Debt of $52.3 million ($42.6M to a Reserve Based Lending [RBL], $9.7M to an uncommitted revolving credit facility [National Bank of Egypt - NBE])

Net debt of $16.4 million.

Despite the declines in production the opex is well under control with G&A also reducing despite the inflationary pressures that other companies are experiencing. The cash position has been reduced by $9.4 million mostly due to the repayment of debt and increase of receivables. The RBL and NBE bear an interest of Compound SOFR plus CAS (Credit Adjustment Spread) plus 5.25% (ca. 10.6%) and SOFR plus CAS plus 3.50/4% (ca. 9.1%), respectively. The company still can draw up to $23 million from these facilities, which last until July 2025 and March 2024, respectively.

The company is still owed a huge receivable from the Egyptian state, $30.9 million (+$6.7 million since end of 2022 and +$23.7 million since end of 2021), with just $1.9 million received in H1 2023. It is not clear what PHAR is doing in this regard, as Egypt has paid (or reduced the amount owed) to other E&P companies. The only positive aspect is that the receivable is denominated in US dollars. The company keeps being “optimistic” in the recovery of the outstanding receivables, but not much is said, their hopes are in a $3 billion loan by the IMF.

Nevertheless, the company does not have any important commitments in either Egypt or Vietnam, and the higher oil price will help the company continue reducing the debt levels. Also, the exploration drilling program for the blocks 125 & 126 is not expected to begin until mid-2024, at the earliest.

2023 CAPEX program

The planned CAPEX for 2023 is $27.4 million, split as follows considering the situation pre- and post-carry at Egypt (showing how accretive the deal was):

The CAPEX excluding Block 125 is $24.4 million pre-carry and $9.2 million post-carry, which is manageable.

Hedging

The covenants of the RBL require that PHAR hedges 35% of the volumes of the oil production in Vietnam (not Egypt). In H1 2023, hedges represented 28.7% of all production at boe level. Thus, PHAR has exposure to any surge in oil prices even above the current $94/bbl of Brent.

The graph below shows the volumes and prices of the hedges that PHAR has published. In my opinion, the volumes cover all the capex commitments and almost all the debt repayment, which is an assurance that a sharp drop of Brent will not destroy the company. The hedged volumes have decreased significantly since the last report, and production is mostly exposed to the spot market. However, I think the next update will report more hedges signed at higher prices for both floor and ceiling prices:

Shareholder remuneration

Since mid-2022, PHAR has resumed shareholders’ remuneration. In my opinion, this is contradictory, the same company that is looking for a farm-in partner to finance a exploration campaign and is paying more than 10% interest for its debt is also paying dividends and buying shares. These are the conditions approved:

$6 million in buyback: $3 million announced in July 2022, extended last January with another $3 million

10% of Operating Cash Flow to be paid as dividends: in the last AGM, shareholders approved a dividend policy, with the first interim dividend of 1p/sh paid in July 2023, with a cost of $5.3 million. Next dividend to be paid in January 2024.

Currently, PHAR has 437,952,530 Ordinary Shares and holds 9,122,268 in treasury, hence, the buyback program may acquire ca. 5% of the shares. At current levels, the dividend yield is ca. 10%, as the OCF for H2 should be at least as high as in H1 ($53.4 million).

Main shareholders

The list of main shareholders has evolved during 2023, with 2 shareholders increasing their positions. The recent largest shareholder, Bradley Radoff, is a private investor that has been investing in other E&P companies, but it is not the only focus of his investments. He has been constantly increasing his position from the first notification in September 2022. Lombard Odier Asset Management has also increased its position during the year, but is cannot be considered a reference shareholder:

The current largest shareholder, Bradley was an activist shareholder at Vaalco Energy before Maxwell’s tenure. At that time, he and other shareholders forced a modification of the composition of the BoD, which was suspiciously followed by changes at both CFO and CEO positions. He has prompted activist actions in other companies he has owned, such as the recent open letter to Pitney Bowes’ independent directors asking them to remove the CEO of the company.

I like seeing Bradley as the new major shareholder, because I think he’ll pay attention to the day-to-day activity of the company, contrary to other large shareholders that have shown little interest. Sincerely, I think that a similar action could also be repeated at PHAR and make a positive change in the company, as BoD and executive positions don’t seem to be covered by the best candidates.

Share performance

The company is listed in London, but in the premium segment, not in the (hateful) AIM, without the auction system and the low liquidity. The share price has fallen considerably since the all-time highs in 2014, when the oil price was at $100/bbl and quickly fell to $40/bbl by the end of 2015. Since then, the share hasn’t been able to recover and it has continued to decline as production fell.

The performance of the share hasn’t only been affected by the declining production or oil price. As it can see below (production, revenue and oil price), the share price has underperformed the underlying business:

The logic would say that the share would react positively if the production and revenues are more or less stable since 2017, but the share price has kept failing in that period. 2018 was an infamous year for PHAR (SOCO at that time) and the reputational damage could explain part of the underperformance. However, the share price has continued falling to 25p (-52% versus end of 2019), and has been virtually flat in the last 2 years, despite a series of good news and the increase of oil prices in 2022 and current quarter:

Hence, the share price is not performing according to the business evolution or oil price. Now, the valuation of the company is cheaper than in the last 2 years, as the farm-out deal and oil price has allowed a substantial debt reduction without the share price reflecting it.

Metrics

The company’s market capitalisation is just £97.8 (ca. $121) million, which together with the $16.4 million results in an Enterprise Value of $138 million. The guidance for production (ca. 6,550 boepd) and after-carry capex ($13.2 million) plus the projected opex ($17.5/boe, slightly above H1) and realised price ($80/boe, slightly above $76.29/boe in H1) has projected a FCF of $75 million, before working capital adjustments, for the full year.

Considering that Egypt is consistently NOT paying the bill, we can estimate that the receivables will increase again in H2. Hence, the actual FCF can be in the range of $37-55 million subject to the receivables in H2 increasing between 50% and 150% of the amount in H1. This is an exercise of divination, but even in the worst case, the FCF/EV ratio is 26%, and more realistically at 35% considering the increase of receivables in H2 will be similar to H1. This is higher than most E&P companies operating in other “safer” jurisdictions.

Conclusions

PHAR is a company with a healthy financial position and declining production with plans for a frontier discovery in the range of hundreds of millions of barrels. It is in the middle of a potential radical change if it secures a farm-in partner and completes a successful exploration campaign in Vietnam. There is an inherent risk as in other frontier exploration, but in this case, we are not talking about a “parachute landing”; PHAR has been operating in Vietnam for more than 15 years. The experience acquired with CNV and TGT grants access to the best knowledge in the geology of the area and contacts among experts, authorities and key suppliers.

It is important to remember that the new fiscal terms in Vietnam are great news and provide the perfect framework for the required investments in the exploration and, potentially, development of blocks 125 & 126. This aspect is currently ignored by the market and it shouldn’t.

The Egyptian production is still very economical, with the potential to continue adding reserves and increasing production, if the ongoing exploration drills are successful. The farm-out conditions were very good and the carry is paying off this year. In my opinion, the sale of 55% and the operatorship role was a good decision that marked a “new beginning” together with the changes at top executive positions and the entry of a new CEO. The cashflow from these assets can be used to finance the development in Vietnam, thus, PHAR should try to minimize investment there as much as possible. Having said this, Egypt is a problematic jurisdiction: the conditions offered are not great (even after signing the new terms), domestic quotas limit the ability to capture international prices and the delayed payments are a growing problem. Nevertheless, I would keep those assets in the company, unless there is a very good offer for the remaining 45%, which I doubt.

I would like to see a different capital allocation, as debt is presently costing 10%. The dividend and buy-backs are not excessive, but they should not be increased from current levels, as the addition of reserves shall be the first priority, in my opinion.

The most obvious catalysts is the liquidation of the pending receivable, which should happen at some point (call me naive). That amount could be used for the exploration in Vietnam, reducing the outstanding debt or making an acquisition - I just hope it is not used in an extraordinary distribution. Unfortunately, I don’t see this happening in the next 12 months, receivables will most likely increase in H2. An alternative use of this cash could be to increase the stake in both TGT and CNV JVs by acquiring PTTEP’s share, which is a supermajor producing 466,000 boepd that may not be interested in keeping these mature assets. It is important to remember that PVN has pre-emption rights over any offer over the PSC, not about shareholders in the JV, and this acquisition would increase PHAR’s stake to 50% in CVN and 59% in TGT. Nevertheless, that PHAR matches or surpasses PVN’s stakes may not appeal to the Vietnamese authorities.

One of the things I like the most about PHAR is the new largest shareholder, Bradley Radoff, because the company has lacked a clear direction in the last years. Now he can supervise the strategic decisions and make the BoD and executives accountable for the consequences. This is a very positive aspect that can bring new ideas with him and better control over the company’s performance and, potentially, attract more experienced profiles to the company. He could even increase the stake above 10% as last purchases were reported in August. He already fought against the BoD of Vaalco and won. I hope he makes a similar move and shakes the tree to remove the bad apples.

One aspect that could be interesting is a change in the listing of the company. UK retail investors don’t seem to be very interested in the company, but some UK institutional investors have been shareholders for a substantial time already. Maybe a new listing could attract a different shareholding base. Currently the average daily volume is ca. $50,000, which may not be enough to acquire a large position. This is not a priority but could be considered.

In my opinion, investing in PHAR isn’t currently worth it until the exploration campaign in Block 125 is confirmed. PHAR would become particularly attractive in the case that the new partner is a major with frontier exploration experience and enough financial resources for the drilling campaign. I can wait until the announcement of a farm-in partner that will reduce this uncertainty, which is the main catalyst, in my opinion. However, the existing company is not an absolute zero and its valuation cannot be considered “expensive”.

Other investors may be attracted by the buy-backs and dividends, expecting that the company cancels most debt and increases the pay-out ratio above the current 10% of OCF. The company can still produce for more than 5 years without adding any more fields to the portfolio. Both Egypt and Vietnam count with several infill and re-development opportunities from the existing producing fields. So, this company can be interesting from different angles, it is just that I'm more keen to invest in companies with clear paths of growth.

In summary, Pharos Energy is a company that is currently undervalued with an interesting FCF/EV ratio above 25% and several opportunities to reduce indebtedness and increase shareholders’ remuneration. The future lies on blocks 125 and 126 in a promising frontier basin that is underexplored but shares some similarities with other productive basins offshore Vietnam. Pharos Energy could be approaching an inflexion point where the company starts a new chapter where the risk of declining production and high debt disappears. I will monitor Pharos Energy’s evolution and will decide in due couse if it is attractive enough for me.

Disclaimer: at the moment of writing this article, we don’t hold shares of Pharos Energy. However, we may buy or sell shares at any time. This document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.