The dormant fish

Large undeveloped acreage and the support of Vermilion Energy

Coelacanth Energy (CEI) is an E&P company operating in the British Columbia province in Canada, which owns 151 sections of land, mostly undeveloped. The company has initiated the drilling of wells and prepared the expansion of its reception, storage and transportation infrastructure. Vermilion is one of the largest shareholder and has been acquiring CEI’s shares in the open markets since its listing.

The origin

CEI is a company that officially began operations the 1st of June, 2022. CEI was spun-off from Leucrotta Exploration, which was acquired by Vermilion, and received C$44 million in cash and acreage in the Two Rivers area of British Columbia they are now trying to develop.

These Montney lands are estimated to contain over 11.2 billion bbls of Original Oil in Place (“OOIP”) and 8.1 trillion cubic feet of Original Gas in Place (“OGIP”). CEI aimed to reach production of 25,000 boepd within a 4-year period at the time it was listed, however, these plans have been delayed due to the pending trial with the Blueberry River First Nation.

The big brother

First thing many people comment about CEI is Vermilion’s continuous acquisition of shares. Vermilion acquired its stake in CEI as part of the Leucrotta transaction, when it received its stake of CEI’s shares and participated in a placing. As a result, CEI was created with a large acreage in Montney and enough cash to begin the development.

To acquire Leucrotta, Vermilion offered to Leucrotta’s shareholders: (i) cash consideration of $1.73 per Share or $0.76 per FT Warrant; (ii) one common share of CEI; and (iii) 0.1917 of one CEI share purchase warrant for each CEI share held. As part of the transaction, VET received 7,536,800 shares and 1,444,804.56 warrants in CEI. The acquisition was complemented with two private placements for Vermilion (C$14.3 million in exchange of 53,303,668 shares) and the management that raised C$21.9 million. At the time of the listing, Vermilion had accumulated 18.0% of the outstanding Coelacanth Shares on a partially diluted basis, becoming CEI’s largest shareholder.

In the last update, Vermilion has amassed 64,303,190 shares, representing 15% of the outstanding shares or 13.7% of diluted shares. Considering all shares and warrants received at the time of the spin-off, Vermilion has increased its ownership by slightly more of 2 million shares. Hence, there is still plenty of shares the company can still acquire.

Reserves

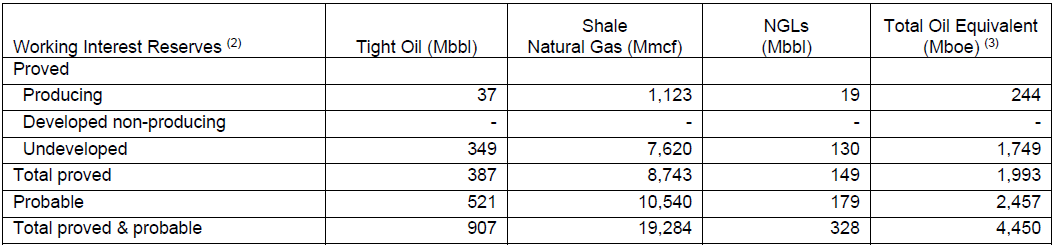

In the last update corresponding to year-end 2022, the company reported:

• Total Proved reserves of 2.0 million boe.

• Total Proved plus Probable of 4.5 million boe.

• Total Proved plus Probable Reserve value (net present value discounted at 10%) of C$32.2 million (Note: this is worthless as it estimates a WTI of $75/bbl and AECO of C$4.36/Mmbtu with an annual growth thereafter of 2%).

It is important to remember that CEI is not a pure natgas player, oil represents 19.5% of proven and 20.4% of proven+probable reserves. So, the ~20% of liquids in the area gives a small diversification from the natural gas.

However, the potential amount of oil and gas present in CEI’s acreage is enormous. As we mentioned before, its lands accumulate 8.9 billion bbls of OOIP and 8.6 trillion cubic feet of OGIP. This oil and gas will require continuous exploration and development to be recognised as resources or reserves. CEI’s focus is on this task, investing to increase production from its acreage. As Vermilion has an important stake and is also operating in the Montney region, it is unlikely that it will embark on a M&A frenzy.

The right team

The leading team in CEI is the same that also led Leucrotta. The president and CEO, Robert J. Zakresky, the COO, Terry L Trudeau, and the CFO, Nolan Chicoine, also served in the same positions at Leucrotta since 2014. Thus, they have been involved in everything related to CEI’s acreage, and this ensures a deep understanding of the land and its possibilities.

CEI is Robert Zakresky’s 8th company, starting the first company with other founders with $800,000 in the late 90s. The strategy of the core management group is to grow production, and they are not thinking of commencing a dividend or a share buy-back program in the future. During an interview last year, the CEO stated that they are not for all types of investors, as he prefers to re-invest the earnings into the company. Hence, CEI is in a very concrete strategy: to grow production until a bigger fish comes to eat it.

Besides, the company hired Bret Kimpton as Vice President Operations last September. This person will have a key role in the company’s plans to increase production, as it managed to grow Storm Resources’ production from nil to 35,000 boepd.

The cap table

There are 2 major institutional shareholders, GMT Capital (multibillion-dollar global long/short equity investment manager based in Atlanta, GA) and Vermilion Energy. These two entities are represented in the Board of Director, GMT Group’s representative has been appointed as Chairman and Vermilion has approinted its President/CEO, Dion Hatcher.

The picture above doesn’t account for the warrants and options, for example, Robert J. Zakresky owns 10% of the diluted shares.

The Canadian dilution

One thing I don’t understand of all the E&P companies in Canada is how much they love issuing stock options and, particularly, warrants. As an example, the first thing the company did when it hired Bret Kimpton was to give him 525,000 options plans and 275,000 restricted share units. I understand it is good for the company to increase ownership of key employees, but most Canadian E&P companies abuse this.

Most warrants issued to Leucrotta’s shareholders in the Vermilion-Leucrotta transaction were converted by August 2, 2022, but some shareholders didn’t exercise 1.3 million warrants and they expired.

The units issued in the posterior placing for the managements included flow-through (FT) warrants, which entitle their holders to some deduction from the capital expenditure in the oil and gas sector. The Canadian government eliminated on March 31, 2023 the flow-through share regime for oil and gas activities. Thus, CEI converted all unexercised FT warrants to warrants, and the company will now receive all deductions it generated from the capex.

Last Q1 2023, the fully diluted shares were 469.3 million (vs. 462.5 million in Q2 2022), after the company awarded its top employees and officers 5.3 million RSU and options. The last updated figures show 10,991,600 Options, 5,480,300 RSUs outstanding and 27,780,000 warrants.

This is making Vermilion’s efforts to continue growing its % a bit more complicated, as today its shareholding is lower than it was at the listing of the company.

The financials

Well, this may seem like a new to most readers, but CEI is a rara avis in Canada, the company had NO DEBT and cash & cash equivalents of C$54 million by the end of Q1 2023.

During 2022, the company obtained significant funds from the Vermilion and management placing, together with the exercise of the warrants issued at the time of the spin-off.

Currently, the company has a very modest production, with slightly less than C$1 million of revenue in Q1 2023, yet it spent C$5.1 million in capex. To see how relevant that figure is, revenues in 2022 were C$7.8 million. The company will continue investing in the development of the Two Rivers area, and its first relevant increase of production won’t reach until Q4 2023.

The company has provided some estimation of the profitability and payback of the new wells, but it still has to confirm the actual production from the first wells that it has planned for 2023.

The regulatory framework

The company has historically paid a huge royalty rate: 28% in Q1 2023, 26.4% in FY 2022 and 28.5% in FY 2021. An important contributor is a 20% gross overriding royalty on two legacy wells. This level is damaging for a profitable business, as it goes against the topline. For example, companies like Hemisphere Energy or Crew Energy (another Montney play) pay 17.5% and 12.1%, respectively. The gross overriding royalty will become less important as it drills more wells. This reduction in the royalty rate was already shown in the production forecast provided in the prospect for the listing:

The B.C. government approved in May, 2022 new Petroleum and Natural Gas Royalties. The new framework provides 2 levels of royalty, a flat royalty rate of 5% until the capital spent on drilling and completions is recovered, and a price sensitive and by commodity type (natural gas, ethane, propane, butane, condensate and oil) royalty rate (between 5% and 40%) after then. The new framework is based on a revenue-minus-cost royalty system, instead of just royalty like in the past. The change also removed the previous minimum royalty rate at 3% and the deep well program to provide a lower royalty to those wells. The wells drilled on or after September 1, 2022, will pay a 5% royalty rate for the equivalent of the first 12 production months. At the end of this period, these wells pay royalties based on the current royalty framework until September 1, 2024, when all wells transition to the new framework.

These are mixed news for CEI, the Crown royalty rate will be adjusted to market conditions, which will help when the prices lower and the payback time is reduced by the lower initial royalty. Furthermore, the royalty rate for natgas at C$4/GJ will be 12.85 and at C$6/GJ will be 21.35% and for oil at C$100/bbl will be 29.6%, which kills most of the upside in the case of high energy prices. The royalty will not be applied to revenue but revenue-minus-cost, which reduces the impact of the higher rates and is a relief for the high-opex producers (e.g. Pieridae's NEBC assets). I could see the royalty rate lowering if the price keeps at “normal” levels (<C$4.5/GJ for natgas & <C$100/bbl for oil), but if it goes above it, the royalty rate will be even higher than it was before.

However, the largest contributor to the reduction of the effective royalty rate will be the Non-crown royalty, but I haven’t seen an estimation yet as it will depend on the production from the new wells.

My take is that the only positive news is that this new framework is supportive of further development efforts and lowers the downside if there is another major drop in prices, but it hurts the future. Maybe I have skipped some aspects that make this less damaging, but it is weird how B.C. is taxing a “transition, clean fuel” like the natgas at such ridiculous levels when it is more needed (higher price due to higher demand or lower offer). This goes against any climate policies at global levels, because it will lower the availability of natgas (or LNG) to replace more-polluting fossil fuels like coal or diesel being used in developing countries. Canada wants a green-transition and I guess they want other countries to do their part to fight global warming, but reducing the profitability of natgas in a traditional net-exporter of energy will only be harmful for any GHG emission avoidance target at global stage.

The First Nations conflict

Why hasn’t the company already drilled the Two Rivers area and increased the production? Well, CEI hasn’t been able to begin the development of the area due to a previous conflict between the permits issued by the B.C. province and the rights of the First Nations over their claim areas. For decades, the B.C. government encouraged industry to extract resources from First Nations’ territory. In 1899, Canada made a commitment to the Indigenous Peoples who lived in B.C.’s northeast region. Signing what’s known as Treaty 8, the colonial government promised to protect their rights to hunt, trap and fish. Blueberry River First Nations’ ancestors formally agreed to the treaty in 1900.

The Blueberry First Nations filed their case in March 2015, challenging the authorisations that the B.C. province had issued to exploit the natural resources. In 2018, the nation entered talks with the province to try to settle the case, but those talks failed. In 2021, a provincial court ruled that the B.C. government breached the Treaty 8 rights of Blueberry River First Nations, impacting oil, gas, forestry, and hydroelectric development.

The court highlighted the province's failure to address cumulative effects and encouraged aggressive development. The ruling emphasized that the province must stop authorizing activities that breach the promises included in the Treaty, but she suspended this declaration for six months “while the parties expeditiously negotiate changes to the regulatory regime that recognize and respect Treaty Rights.”

In January 2023, the B.C. government and Blueberry River First Nations reached a historic agreement for land, water, and resource stewardship. The agreement ensures the meaningful exercise of Treaty 8 rights by Blueberry River members and provides stability for the o&g industry. It addresses the cumulative impacts of industrial development and aims to heal and restore the land while protecting ecosystems, wildlife habitat, and old forests. The agreement includes a $200-million restoration fund, an ecosystem-based approach to land-use planning, limits on petroleum and natural gas development, protections for old forests and traplines, land protections in high-value areas, and wildlife co-management efforts. Blueberry River First Nations will receive $87.5 million over three years, with potential additional benefits from revenue-sharing. The agreement promotes reconciliation, strengthens government-to-government relationships, and supports sustainability for future generations. It also aligns with the Province's climate change strategy.

This agreement was followed by agreements with other four neighbouring nations: Doig River, Halfway River, Saulteau and Fort Nelson. Collectively, the agreements represent a way out of conflict and a shared goal to heal the land. Thus, CEI shall be free of hassle and the agreement dismisses any uncertainty in amounts and timing of royalty payments and risks associated with potential future law suits and regulatory actions challenging CEI’s permits.

The acreage

The assets in the Two Rivers area produced 365 boepd in Q1 2022, just before the acquisition by Vermilion. However, the acreage included 151 net sections of Montney land, mostly undeveloped.

Although the lands that CEI received at inception had been geologically delineated and production tested with vertical and horizontal test wells, there was significant infrastructure and corresponding pad drilling required to increase production at a lower cost. The area presents 3 main horizons: Upper Montney, Lower Montney and Basal Montney. There is a fourth potential horizon that is less known, Middle Montney, and requires additional study before confirming it is a viable resource.

To achieve its plans, CEI has geographically divided up its two projects as Two Rivers West (“TRW”) and Two Rivers East (“TRE”). At TRW, a small pad has already been licensed and is producing from two Montney wells into a small battery facility owned and operated by CEI (the source of the original 365 boepd). A battery upgrade was also initiated to accommodate additional volumes.

The picture above shows how undeveloped CEI’s acreage is, with the area to the South being heavily drilled, and Vermilion now planning to develop the land to the Southeast that it acquired with Leucrotta. Thus, the potential of CEI is immense as it combines the potential of developing a mostly immaculate acreage with the benefits of all the infrastructure and service companies already operating in the area. The location benefits from having access to the West coast and Alberta markets, which enables CEI to maximize the return in case there is a price difference. Also, the connection to Station 2 gives CEI access to the natgas prices at Sumas, which are above the AECO, NYMEX or HH markets.

The last update

Once the dispute with the Blueberry River First Nation is over, CEI announced last week that it has already begun the drilling of 2 new wells and has received regulatory approval to drill and complete 14 additional wells. This update is extremely positive, as it seems that the company can begin with the development of the 151 sections it received from Leucrotta.

I think it is important to know that the new wells will be drilled with horizontal legs that double the legacy wells (now 2 miles) and will be completed with approximately 165 fracs, almost 4x times the number of fracs in the legacy wells. The aim is to increase the productivity and payback. This same configuration is being applied by Vermilion Energy in the territory adjacent to CEI’s, showing that the 2-mile (~3,220m) lateral increases production while lowering initial decline, and higher liquid production than CEI has forecasted. The work being done by Vermilion is ahead of CEI’s campaign in the east of the acreage and will also contribute to the optimisation of the drilling and completion works in Montney.

In the Two Rivers East, CEI has received regulatory approval to drill and complete up to 14 wells on its 5-19 Pad. CEI has already secured a drilling rig and will proceed with 5 initial wells comprising 3 Lower Montney wells, 1 Upper Montney well and 1 Basal Montney well. Completion and testing of the 5 new wells at 5-19 Pad is expected in early Q4 2023. Leucrotta had drilled and completed a Lower Montney well at the site that tested over 1,000 boe/d (42% light oil). They plan to drill additional pad wells in 2024 before the facility start-up.

In Two Rivers West, CEI has already drilled 2 Upper Montney wells at Two Rivers West, to be completed in mid-August. These wells, which utilize current drilling and completion methods, are expected to enhance production rates and reserve recoveries. Considering the legacy wells produced at an IP30 of 716 boe/d with 52% light oil, the new drilling and completion method gives hopes of large initial production, even above the guidance, that lower payback even below the estimated 0.8 years ($US 65/bbl WTI; $US 4/mmbtu Nymex).

CEI is also working on obtaining final regulatory approval to expand the reception, storage, processing and transport infrastructure with the construction of an oil battery and compression station called the Two Rivers East Facility. This facility, along with sales and gathering lines, will handle production from the 5-19 Pad and subsequent pads. It is expected to be completed by late 2024 or early 2025 and will be able to handle over 20,000 barrels of oil equivalent per day (boe/d). I expect that almost all 14 wells in Two Rivers East will be completed at the time of the entry into operation of this infrastructure.

To support its operations, Coelacanth has entered into an agreement with NorthRiver Midstream Inc. to secure processing services at NRM's gas processing facility. This agreement will commence after the construction of the Two Rivers East Facility. Coelacanth has also secured long-term takeaway capacity for gas delivery.

As a result, the company will soon increase the number of wells and the infrastructure connecting the wells and the transport infrastructure across the acreage. The current development plan can be summarized as in the picture below. As it can be seen, the number of pads and wells is still a small fraction of those present in acreage to the South. This is a very good indication of all the untapped value in CEI.

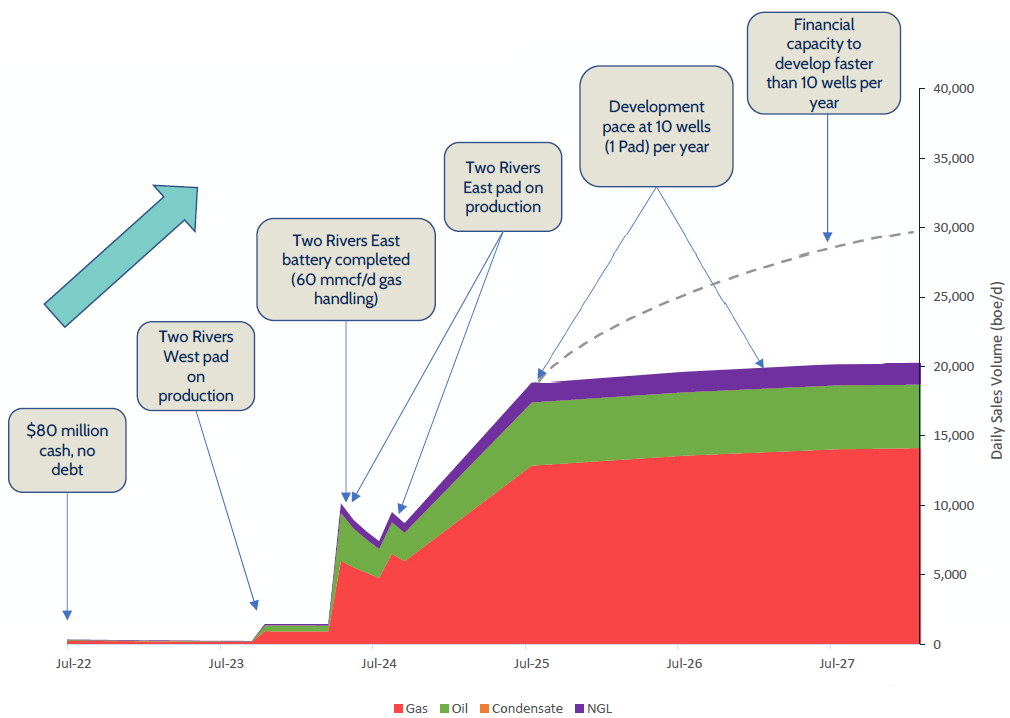

Due to the delays in securing the approvals for the drilling, the company has been delaying its plans. Below we compare the different forecasts produced in the last months. In the last update, the production forecast shows the 20,000 boepd goal by mid-2025. The main change was produced in the May presentation when the first increase to 10,000 boepd was delayed from beginning of 2024 to beginning of 2025, lowering it slightly below that level as well.

The last production profile is less attractive than the previous one, the initial production is below 2,000 boepd and meaningful production won’t be reached until 2025. It is obvious that there have been changes to the whole project, but it is not clear what these changes have been. Maybe the drop in the hydrocarbon prices have deemed the company less prone to invest heavily in the first stages of the development? Funding is now a bit of a concern due to the delays since the spin-off more than a year ago, which has lowered the available cash resources.

Also, the last update confirmed a reduction of the plan for the next 4 years. The target now is to reach 22,000 boepd in 4 years instead of 25,000 boepd. Interestingly, the production forecast doesn’t reach these levels in the next 4 years, it is obvious there is more than the eye can see. However, the creation of the infrastructure across the acreage will lower future development expenditure. The current plan may be replaced by a second plan that is more ambitious, but that’s something yet to be confirmed, particularly as the cash resources do not look enough to expand their plans and make a faster development.

The opportunity

The company is in the process of developing its acreage with the 151 identified section that can be brought into production progressively in the next few years. The modern drilling and completion techniques provide an additional upside. Owning the reception, storage and transportation infrastructure to the main pipelines is a plus.

The delays and lack of revenue have hit the production forecast, with the first relevant production growth still 18 months from today. This is an important setback, but the company is committed to the development plan. If I was a shareholder since the listing, I’d be pissed off. Now it seems to be a better moment to become a shareholder in CEI, thanks to the approvals received.

Despite the natgas prices in North America have massively dropped since the highs in 2022, CEI will be less exposed to the regions where the prices have fallen the most, thanks to its location, connected to the West Coast of the US. The commitment of delivering 60 mmcf/d of gas to the Westcoast system will help in increasing the realized prices. Price at Sumas is the second largest for all points of entry of the Canadian natgas into the US. This benefits most of Montney players, but as a company with mostly undeveloped acreage, CEI does not have any legacy contracts to serve and it is ready to capitalize new market opportunities.

Regarding a potential acquisition by Vermilion, it keeps increasing the stake but at a slower pace than the company issues options and shares. However, the company has been hit by the windfall taxes in Europe, which have particularly impacted its Corrib acquisition in Ireland. When Vermilion launched the offer for Leucrotta, it controlled just 2.9% of the outstanding shares, now it is 13.7%, so if it wanted to launch an acquisition offer for these assets, it currently is at a better position than it was before the Leucrotta acquisition. Whether Vermilion’s ultimate plan is to integrate CEI into its holding or not, it is yet to be seen, but it is a likely scenario considering the CEI’s acreage is adjacent to the Mica lands that were part of Leucrotta.

I’d prefer that the CEO was more open to dividends in the future. I understand that he wants to build the company and then sell it to a bigger player, which is what he has done in his previous 6 companies. He is not in the business for building an empire, but in the creation of a growth-story that attracts bidders; he is very clear about it (I recommend to hear the interview I shared before, he doesn’t want to run a company with hundreds of employees), so don’t blame him if he actually does what he said he will do. If I become a shareholder (to be decided very soon), I won’t complain if he manages to sell the company at a multiple of my price in 1 or 2 years. I think the strategy is clear and it seems that Vermilion is consolidating a position to become the buyer in the future, but maybe another company makes the first move.

In summary, CEI offers a positive outlook for the next few years, when they will implement the current development plan. The first milestone is the result of the recently drilled wells in Two Rivers West in August, which together with the result by Q4 2024 in Two Rivers East will confirm the viability of the approach and de-risk the whole acreage. Furthermore, this doesn’t mean it will be easy, because CEI will not be immune to the natgas prices and its price volatility. The company has an important amount of capex to deploy, and the revenue will be greatly required to reduce the need of additional placings. The good news is that the company expects to enter the winter season with a significant production at 10,000 boepd, and it will capitalize on higher prices to speed up the development pace.

CEI is a very unique play in Montney, with a leadership that has a clear plan and some pre-existing interest in the acreage it owns. After the Treaty 8 agreement with the Blueberry River First Nations, the company can begin the development of its 150 sections. I think natgas may have stabilized and could recover after summer, so this seems to be a good moment to look at this big, old fish that has lived with the Dinosaurs and it is ready to be captured.

Disclaimer: this document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes. Please, make your own due diligence and analysis.