Kolibri Global Energy is an US company based in California that is listed in the Canadian (TSE:KEI) and US ($KGEI, OTCQB:KGEIF) markets. It is producing mostly oil from its Tishomingo field in Oklahoma, where there are 2 main reservoirs, Caney & T-zone, with 2 untested reservoirs, F. Caney & Sycamore.

The company still produces a modest amount of oil and gas, 3,194 BOEPD in Q1 2023, but it has considerably grown from the 1,640 boepd in 2022 or 975 boepd in 2021. Nevertheless, it counts with a drilling plan for 2023 and has already identified 60+ locations to develop the proved reserves to grow the production in the next years, to 3,600-4,000 boepd in 2023 and above 4,000 boepd in 2024 onwards.

The company is well capitalised, with a small debt below the projected 2023 EBITDA, and a low number of options that could dilute current shareholders. Hence, there is plenty the company can do to increase the production in the coming years.

Note: all amounts in $ shown in the article in US dollars, as it is the currency the company uses to report.

Not a young company

KEI was born as BNK Petroleum, a spin out of Bankers Petroleum to explore for shale-gas in the US and Europe. The idea was to apply shale techniques from the US to the tight oil and gas reservoirs in Europe. Due to the hype, its shares grew over 4000% from 2009-2011, with a peak Mcap of $900 million. It expanded its exploration efforts across 6 countries and accumulated an immense amount of licenses in different European countries, including Germany (now some former directors are trying again at MCF Energy, good luck, pals!), Poland and Spain. After a series of regulatory setbacks in Europe, including the ban to shale exploration and production, the company decided to abandon Europe and focus on its acreage in Oklahoma, where it has put all its efforts since then.

Its subsidiary operating in Oklahoma still is BNK Petroleum (US) Inc. showing its legacy as the spinout company from Bankers Petroleum. The corporate structure is lean and simple, without any complexity:

In 2013 KEI made a deal with Exxon Mobil’s XTO Energy and sold all the Woodford shale gas assets for $147.5M, while retaining the rights over the Caney and Upper Sycamore formations, where the company has been drilling since then. However, the company acquired a small interest in some Woodford wells in 2015. Thus, KEI’s main assets are the production rights over the Caney and T-zone reservoirs.

In my opinion, 2013 is the year that the current KEI was born, as it changed its strategy and focused the resources in the development of the acreage in the Tishomingo field.

Team

The leadership is composed by:

Wolf Regener, President and CEO, he has been the CEO since the spinout, which could be positive as he has overlooked all the different stages of the company and has a deep knowledge on the potential of the acreage. He served at Bankers Petroleum before the spinout.

Gary W. Johnson, CFO, joined the company in 2013, when the company shifted its strategy. He worked before at the US company operating in Oklahoma and has experience at OXY.

Steve Raunsbak, Controller, has been in the company before the spin-out.

Greg Presley, VP Engineering, there isn’t much information about him.

Allan Henny, Sr. Geologist, in the company since 2010, thus, a truly expert in the geology of the Tishomingo field.

Dalia Isaas, Landman, in the company since 2007, she has a deep understanding of the lease contracts, division orders, field personnel management, regulation, and royalty management.

Most of the team has been in the US company before the spin-out, which shows that there is kind of loyalty to the company, as they went through a number of setbacks and stayed. I also understand that others could see this as negative, because this team has not been capable of unlocking the potential of the Tishomingo Field. I’m in the middle myself, I like that there is a continuity even before the listing as a separate company, but I would have liked that the person in some roles related to the engineering/geology would have changed to bring new knowledge, experience and contacts into the company.

I find a bit misleading when companies include in their updates the following sentences, like KEI did in the update of 2022 year-end:

The production exit rate as of December 31, 2022 was over 4,000 BOEPD which exceeded management’s forecasted guidance of 2,700 BOEPD.

Exit production is a good indication for the production in the following months in conventional production, as decline is lower than in unconventional fields. At that time, the Brock 9-3H and Glenn 16-3H wells had began production in November-December 2022, which inflated the exit production numbers. For example, January 2023 production was 3,600 boepd and average production in Q1 2023 was 3,194 boepd. Any company can report particularly high production right after drilling new wells (they could even artificially increase it by disregarding reservoir management policies, but I’m not saying this is the case), but it is not indicative of a sustained production. I’d have preferred if they had put more context to that 4,000 boepd production figure.

Ownership

This is one of my main concerns about the company. Insiders have a minimal position with just 1.1% of the outstanding shares among all of them, and institutional investors hold a large parte of the company, 46%. Thus, there is slightly less than 53% on the hands of retail investors. The positive side is that the stock is very liquid, which will allow high-net-worth individuals (clearly not my case though) and small family offices to add KEI to their portfolios.

An important aspect is that the number of options issued is moderate compared to other US or Canadian public companies. The existing 869,300 options represent only 2.4% of all the fully diluted shares. Fully diluted shares are 36.5 million at May 2023. As at December 31, 2022, there were a total of 776,000 Options outstanding with exercise prices ranging between C$0.80 and C$5.70 and expiry dates ranging from 2023 to 2027.

One of the institutional investors s, Livermore Partners, holds the Chairman position and has been adding shares in the last 18 months, but it seems to have stopped this month, will he (David Neuhauser) continue buying shares? A bit offtopic, but he has done a terrible job at Jadestone Energy, where he's also a director, with one of the worst financings I have ever seen in the sector for a company of its size and production.

Acreage and reserves

KEI’s main acreage consists of 17,171 net acres in the Ardmore Basin, which lays in South-Central Oklahoma. This basin is mature, with oil production for more than a 100 years. Differently to other basins like the Anadarko basin, west of Oklahoma, the production is oil with low volumes of natural gas. Thus, its more valuable under current price levels than other basins with higher natural gas production. This also protects the company from the swings in the natural gas prices in the US.

In the case of KEI, its reserves consist of tight oil, shale gas and NGLs. Below you can find the reserves in the last independent reservers report (Netherland, Sewell & Associates, Inc., NSAI), 88% of which are liquids:

Total Proved Reserves 33.3 million boe (26.2 million boe net), after tax NPV10 of $428M and NPV15 of $318M.

Proved plus Probable Reserves 54.4 million boe (42.9 million boe net), after tax NPV10 of $599M and NPV15 of $420M.

Proved plus Probable plus Possible Reserves 77.5 million boe (61.4 million boe net), after tax NPV10 of $770M and NPV15 of $510M.

NSAI assigns 27.4 million boe (gross WI) Proved Undeveloped and 21 million boe (gross WI) Probable Undeveloped reserves to the Tishomingo Field. Most of the reserves are yet to be developed, which makes the results of the next wells very important not only for converting undeveloped reserves into developed but also to increase the Probable and Possible reserves.

Drilling matters

KEI began the development of the Caney formation after closing the transaction with XTO in 2013. Since then, the company has gone through the oil prices in the 2015-2017 period and the covid-19 price drop. This has affected the initial plans and the number of wells drilled have been lower than initially anticipated. With the recovery of the oil prices since 2021, KEI has accelerated the drilling program, combining increase of production with the exploration in the T-zone formation.

You can see below the historic of wells drilled by KEI in the last years, reflecting the struggles with the low-prices, as commented before:

In the last reserves report, NSAI estimated that the reserves are forecast to be recoverable from the drilling of:

Proved Undeveloped: 62 (51.96 net) wells in total, 11 (10.92 net), 27 (26.77 net), 19 (13.07 net) and 5 (1.2 net) wells in 2023-2026, respectively.

Probable Undeveloped: 61 (29.89 net) well in total, 9 (7.67 net), 30 (15.77 net), 15 (4.12 net) and 7 (2.33 net) wells in 2025-2028, respectively.

It seems there is a slight difference between these NSAI calculations and KEI’s last estimation of wells, which shown 60 proved locations and 63 probable locations. This difference could mean that the number of wells to be drilled in the next 2 years may be a bit lower.

Thus, the company has already identified all potential locations to fully develop the 77.5 million boe in the next 6 years. With an average cost of $6.5 million per well (according to the estimated cost for the initial wells in the 2023 campaign) and an average inflation of 3%, the total cost for KEI would be $560 million ($71M, $179M, $142M, $120M, $30M and $17M in the 2023-2028 period, respectively).

The plan is to drill up to 6 wells per section for each of the 4 reservoirs, bringing an average of 24 drills per section. This drilling plan includes also the possible resources, which have not been included in the locations shown above, but the company estimates in 57 wells, but this will be greatly modified from the results of the Barnes 8-3H well and the data collected from the T-zone well.

The company will embark in a drilling frenzy with a large numbers of wells being drilled and brought into production. I think we are on the verge of a new stage for the company, when all the reserves will be developed and, potentially, even more reserves from the T-zone are added. The large unknown here is Sycamore, will KEI be able to successfully explore and develop it? Maybe, but it is a zero right now, and pure upside.

2022 and 2023 drilling programs

The company has already announced a drilling program including 14 wells in the 2023-2026 period, with 3 already drilled and completed in 2023. The results were announced this week and the wells are still cleaning drilling fluids, but the initial results are:

Barnes 8-1H: upper Caney reservoir, IP12 465 boepd (80% oil).

Barnes 8-2H: lower Caney reservoir, IP12 565 boepd (80% oil).

Barnes 8-3H: T-zone reservoir, IP11 445 boped (70% oil), which improved to 570 boepd (68%) in the last 2 days before the release of the results.

The result of Barnes 8-3H is particularly important, because the T-zone reservoir is largely untested and underdeveloped, due to the high decline that previous wells experienced. It shows a higher gas content but it still is a oil, gas-rich well. KEI insisted in its last updates that this well is applying a new type of stimulation to improve the economics. In Barnes 8-3H, a different proppant has been used, high-viscosity friction reducers (HVFR) fluid instead of high-viscosity gel. KEI had previously drilled the Barnes 6-2H (2012), Barnes 6-3H (2013), Dunn 2-2H (2013) and Hartgreaves 5-3H (2013) wells using the techniques available at that time, with fewer fracs and shorter laterals.

The company has already constructed the pads for the next two wells (Barnes 7-4H and Barnes 7-5H), and drilling will begin the next week.

Last year, KEI drilled 5 wells, which allowed the production to grow above 3,000 boepd:

Brock 9-3H: Caney reservoir, IP30 970 boepd (820 bopd).

Glenn 16-3: Caney reservoir, IP30 990 boepd (805 bopd).

Emery 17-2H: Caney reservoir, IP30 715 boepd (560 bopd).

Barnes 8-4H: Caney reservoir, IP30 605 boepd (515 bopd).

Barnes 7-3H: Caney reservoir, IP30 940 boepd (740 bopd).

The initial production from these wells has been above the expectations, for example, the Emery 17-2H and Brock 9-3H wells ended up with IP30 rates that were about 1.8 and 2.5 times higher, respectively, than the Reserve Report IP30.

Despite the initial productions from all wells drilled in 2022-2023 are considerably high compared to the current production, it is important to stress that these are unconventional formations of tight oil and gas. Thus, decline from initial production is rapid (~50% in 6 months), but this however means that the company can continue building its production baseline. The graph below compares the actual production achieved by the 5 wells drilled in 2022 with the expected production profile, showing how KEI is being above NSAI’s and management’s expectations:

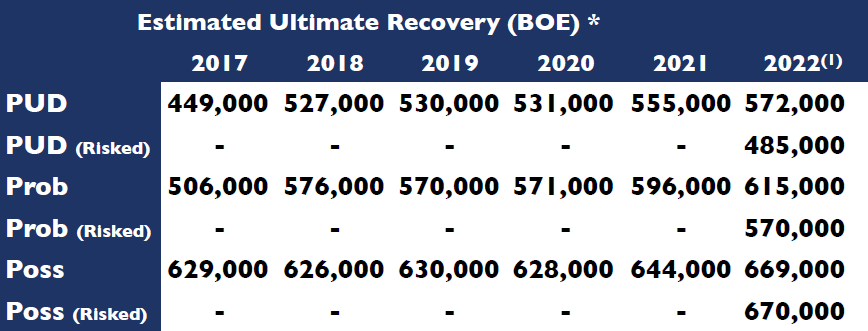

This way, the company can grow its production by the addition of more wells, knowing that in 3 years, production may still be at 100boepd, at least. So, it is important to remember that the most relevant aspects of every new well are payback time and ultimate recovery. The first assures that the capex is quickly recovered and the second that the economics of the well will sustain the company’s long-term profitability. NSAI’s estimation of the ultimate recovery per well has been growing as the company shows it has been improving the drilling and completion techniques, which is supportive of future enhancements of this metric. The evaluation of NSAI’s estimation is the following (Note: this numbers shall be compared with a NPV10/15 in order to get a full understanding of the actual profitability):

The figures shown above indicate that the company may keep improving the production as more wells are drilled using the latest configuration. The EUR for the Glenn 16-2H well, which used the early version of KEI’s new completion technique, are 30% more boes produced than the NSAI estimation. Also, the better economics will reduce the payback time and the financial stress due to the capital expenditure.

If the next wells show that KEI can successfully develop the T-zone and, potentially, Sycamore, then older wells can be recompleted to produce from these formations. In general, the company has an historic of drilling wells on or under budget, which provides some guarantees that future drills are likely to be at least on budget. It.has also managed to lower the drilling and completion costs from $11 million per well to $6.5 million in the last three wells

In conclusion, this is the part of the company I like the most. The engineering and geology teams seem to have found out how to crack the Caney formation and they are now advancing the development of the T-zone. If the company keeps drilling with this successful trend, I could see it beating the 2023 guidance of 3,600 to 4,000 boepd with exit production of 4,500 to 5,000 boepd.

A low-cost producer

In 2022, the company experienced an important increment of production, which together with higher oil prices allowed it to lower the opex per barrel.

Netback including commodity contracts for 2022 was $47.79 per BOE compared to $26.05 in 2021, an increase of 83% from the prior year.

The company experienced a huge reduction of operational expense in Q1 2023 thanks to the higher production (203% over Q1 2022), achieving an average opex of $6.04/boe, a decrease of 37% from a year ago. This allowed the company to reduce the breakeven point and get a netback of $43.67/boe (excluding G&A).

Being a low cost produce of shale oil is a big plus for KEI, as many other players have much higher breakeven points. This also provides a protection to potential oil price drops to the $60 a barrel, or below, foreseen by the most bearish theses.

An important aspect to mention is that the company decided to stop reporting the funds from operations (adjusted funds flow) after it entered into the stage of higher capex in mid-2022. It is not a big issue, as all other metrics and figures are there, but changing the way it reports without a reason does not look positive, in my opinion.

Financial situation

The situation of the company has dramatically changed in the last 24 months, as it has transitioned from an indebted company with little production and capex to a growth story, with a 3x production increase in the period from Q1 2021 to Q1 2023. A summary of key metrics is shown below:

The change in the G&A expense is particularly relevant, as it represented an unacceptable level of 23% in Q1 2021 and now it is at a more reasonable 6.5%. The logic means that this % should keep lowering as more wells are brought into production and revenue growth. Expecting a growth of 5% QoQ, and achieving an average production in 2023 of 4,000 boepd, the weight of G&A expense will be just 4.5% (@ $60/boe realised price), which is a reasonable level for a small producer, and below most of its peers sub 5,000 boepd.

The company recently redetermined if borrowing capacity with its banks, resulting in an increase from $25 million in Q1 2023 to $40 million in May 2023, from which $18.1 million have been drawn. The company has a small amount of cash, $3.7 million on the 31 March. Thus, net debt is approximately $14.5 million.

The best is yet to come

In my opinion, there are two potential outcomes arising from KEI’s huge opportunity at the Caney and T-zone formation, as it will lead to an addition of even more reserves. The first alternative is the organic growth, KEI keeps drilling and increasing production with a low opex, instating a shareholder remuneration policy. The second options it that the increment on PUP or 2P reserves and de-risk of the T-zone formation will attract the interest of a larger company (e.g. Ovintiv, ExxonMobil, Marathon, Devon, Crescent, Continental operate in the area) willing to increase reserves and production in Oklahoma. In my opinion, I think the second is the more likely, but it cannot be considered until 2024, as soonest. At a price of $6/boe for proven and probable reserves (despite I expect an increment in the 2023 reserves report), the offer would be 55% above KEI’s current Mcap.

However, this is not the first attempt to develop its acreage, and past wells have not lived to the expectations. The decline in the Tishomingo field has been particularly high. The use of a new drilling and completion technique could have finally become the answer to the challenges, but is yet to be confirmed as we have limited data from the last 3 wells. 2023 marks the 10th year since the creation of KEI, its path has been full of different challenges, fracking-ban in Europe, low oil prices, a pandemic … but most US-based companies have gone through the same.

The 2023 drilling program could be transformative in two different ways: it will show that the company can compound production, and will build the reputation of the team. The guidance for 2023 (3,600-4,000 boepd) seems to below the current outlook, and it could be revised soon above 4,000 boepd in the low end. Besides, the cost per well at $6.5 million is competitive and enables quickly achieving payback.

The company has projected to generate a small FCF in 2023 ($3-5 million). Thanks to the expected production growth in the next months and years, as the company drills all the 14 wells in the current program, and the cost of each new well stays on or below budget, FCF could beat this estimation and steadily grow the next years.

KEI shows some features of a much larger company in the making, having learnt from previous mistakes to embrace the opportunity. It could be the target of an acquisition by another company in Oklahoma, or it may try to develop the acreage, either way there is a lot of value, if the company excels operationally.

I have taken a small position that I intend the re-evaluate as the situation folds and more data is available.

Disclaimer: at the moment of writing this article, I hold shares of Kolibri Global Energy. However, I may sell my current holding or add more to it at any time. This document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Thanks, added to my knowledge of KEI.V / KGEIF