Vaalco Energy (NYSE: EGY) announced on the 9th August the results of Q2 2023. The accounts included some positive surprises that weren’t expected. 2023 is the first year in which Vaalco is operating the assets it acquired from TransGlobe Energy, so the setup is radically different than in previous years.

An introduction on Vaalco

Before we jump into this quarter’s results, I have to insist on my reservations on Maxwell and his team, who haven’t behaved in the best way possible and haven’t provided shareholders with critical information on time. An example of this, a well came offline in Gabon in September, and shareholders weren’t informed of the issue until months later.

Despite I have seen some indications of better practices and more willingness to engage with the public, I still stand with the criticism that I included in the first write-up in Zero GCoS: Vaalco Energy - An broken African dream. I have to insist on its executive team’s lack of fulfillment of the stock ownership requirement approved by the shareholders. Although, they have 5 years to comply with the requirements - which sounds like a joke - and they are still very far from the required ownership levels. On top of this, Maxwell and Ron Bain insist during the conference calls on the undervalue of the shares …

Additionally, Vaalco generated some doubt in the operational side. The 2021-2022 CAPEX campaign started with 2 very good drills, but it ended catastrophically with a drill not being commercial (South Tchibala 1HB-ST well) and another performed very poorly (North Tchibala 2H-ST). It is not clear whether 2H-ST has been brought to production. The CAPEX program came to an end with the use of 2 drills in the contract to perform workovers, which is not a good use of a rig.

Vaalco’s surprising quarter

Coming back to the purpose of this article, Vaalco’s last quarter surprised me for the better. I didn’t expect many positive news, as the oil prices tanked in Q2 and there weren’t any catalysts that could change the downwards trend of the company and its stock.

For some context, this year Vaalco hasn’t new wells coming online in Gabon, the main asset. The CAPEX program for the year targeted new wells in Egypt and Canada and workovers across all three locations. Thus, there were little hopes that the production could be maintained during the year. Increasing the reliance on Egypt and Canada didn’t sound like a great plan due to the low price of oil in both countries and the natural gas production in Canada.

Thanks to better than expected results in both Egypt and Canada, the production grew above expectations, which obviously helps in increasing sales and reducing the expense per barrel. This was extremely beneficial in a quarter with very poor pricing. The prices were particularly negative in Egypt, where all oil was sold locally, and Canada, due to the oil differential and AECO heavy drop:

Despite this environment, the higher production and lower cost base and reasonable CAPEX enabled Vaalco to generate a free cash flow for equityholders of $6.7 million, when many expected a negative result. In total, the company has generated ~$21 million in FCFE in H1 2023, when many (including me) thought that this semester was lost. The company still reports some one-off costs due to the change of the FPSO for a FSO in 2022 and the integration with the TransGlobe. Also, it suffered a breakdown in the gas line that powers the FSO and it is burning diesel, at a much higher cost of $0.5-0.6 million per month. This will be resolved in Q3 and the gas supply will be restored, Q4 should not be affected by this problem

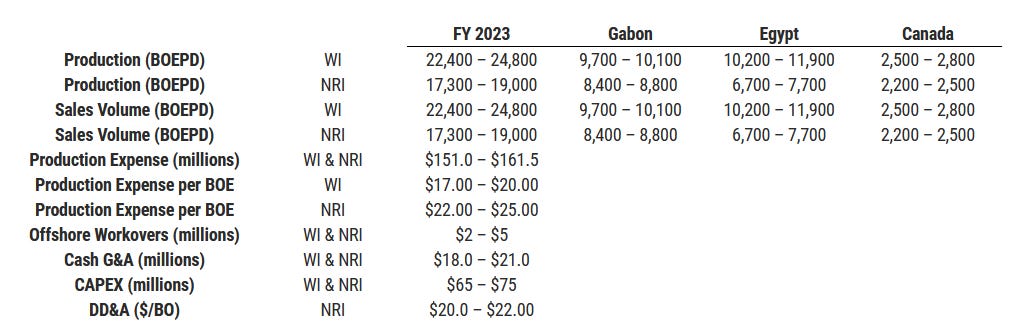

As a result, the company has provided a new guidance for the whole year:

The revised guidance increases sales volumes by 2,000 boepd in the low case and 400 boepd in the high case. This is achieved with a CAPEX program that is revised downwards, with a high case almost at the previous low case, lowering the high case by $15 million. Also, the high case of the production expense is lowered by $2/boe, unfortunately the low case increases by $1/boe. The offshore workovers are halved with just $5 million in the high case. The worst bit is G&A, which will increase between $3 and $1 million in the low and high cases, respectively.

Another important aspect is hedging, with only 95,000 bbl/month hedged in Q3 at a range of $65-96/bbl. Vaalco hasn’t added any hedges to Q3 and it has signed 85,000 bbl/month for Q4 with a range of $65-90/bbl. This leaves Vaalco’s oil production 80% unhedged in Q3 and slightly over that for Q4. Also, Vaalco has received the authorization to sell an export cargo in Q3 in Egypt and is working to get the permission for another cargo in Q4, which will enable selling that oil (~500,000 bbls) at international prices. Should the Brent price continue increasing, Vaalco’s realized price will significantly benefit in H2 2023.

CAPEX

The 2023 CAPEX amount is half of last year’s, despite now being a larger company than in 2022. Yet, the company will increase production along the year.

In Egypt they accelerated the drilling and completion of wells in H1, including a horizontal well, which have been drilled within budget and ahead of schedule (up to 60% reduction). The company also completed an exploration well, but we don’t have much details on the purpose and outcomes. Also, they introduced improvements to the equipment, which enabled further increases of production, up to 500 bopd.

Maxwell mentioned that they are working to secure land in Canada for drilling more 2.75-3 mile horizontal wells in H2 203. He confirmed that they have included the cost of these wells in the CAPEX program, but what is really important is that any production from these 2 or 3 wells is not accounted for in the production guidance. I can only speculate why, but I think it is due to not having secured the land yet.

In Gabon there won’t be any new wells this year, but they have already submitted an expression of interest for the driller. Once they complete the selection of the driller, including capacity, availability and cost, they will refine the design of the 2024 drilling campaign.

Shareholder returns

The current dividend policy and the buyback program represented $25 million of cash outflow during H1 2023. The buy-back program is not expected to last much after it reaches the goal of $30 million, which was a commitment for TransGlobe’s shareholders to approve the transaction. Now Vaalco has accelerated the buy-backs from the initial $1.5 million to $1.75 million per month, which is a good signal.

The total expense is reasonable when compared to the free cash flow of ~$20 million that Vaalco generated in the first half of the year when the commodity prices were not particularly high. Now that most analysts expect higher oil prices and even AECO points towards surpassing the C$3/GJ level in Q4, the dividend and buy-backs should allow for cash generation in H2 2023.

I doubt we will see an announcement of an extension of the buy-back program in 2023, but I do think that the monthly amount could be further increased to $2 million per month, which will complete the whole program by Q1 2024. Also, the dividend looks like it will stay at the current ¢6.25/sh per quarter (or ¢25 per year) in the near future, giving a nice yield for those who have the shares since 2021 or earlier.

Other aspects

Some other important remarks in the CC were that both Block P in Equatorial Guinea and G12-13 and H12-13 licenses in Gabon are advancing well and there will be announcements in Q3 or Q4. Maxwell mentioned that there were less acquisition opportunities now due to majors reducing divestments and more UK companies willing to acquire mature assets in Africa. He also acknowledgde that they could be the target, becoming the acquired instead of the acquirer, but he said that it wasn’t part of the plan as it was in the past.

Conclusion

Despite I’m very dissappointed with Vaalco’s performance and Maxwell’s team in particular in the last year, I think they are being able to generate value in a quarter then it was difficult. The assets acquired from TransGlobe are beginning to become more interesting and the situation now looks very good, if they continue delivering at this level.

The guidance for Q3 and Q4 is also encouraging of more cash generation and potential cost savings with the end of integration-related costs and recovery of the gas line in Gabon. Aside from the business as usual, there could be positive news in the Block P to advance the Field Development Plan already approved by the regulator. Also, any additional production in Canada on top of the current guidance will be the cream on top of the cake.

In my opinion, Vaalco is poised to do another beat & raise in Q3, and it still is greatly exposed to the recovery of AECO and Brent prices. Next quarter, Vaalco will continue paying a quarterly dividend (¢6.25/sh) and monthly share purchases.

I have particularly liked the communication strategy, release of positive results, giving a good CC and publication of buy-backs in three days in a row show that there is interest in changing the narrative and increase the interest among investors. Having said that, I’ll critize any movement made by Maxwell and his gang that deserves it … However, now it is time to congratulate them.

Disclaimer: this document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes. Please, make your own due diligence and analysis.