Vikings in Espirito Santo: another Petrobras' divestment story

A new player in Brazil that is quickly increasing production with a low risk strategy

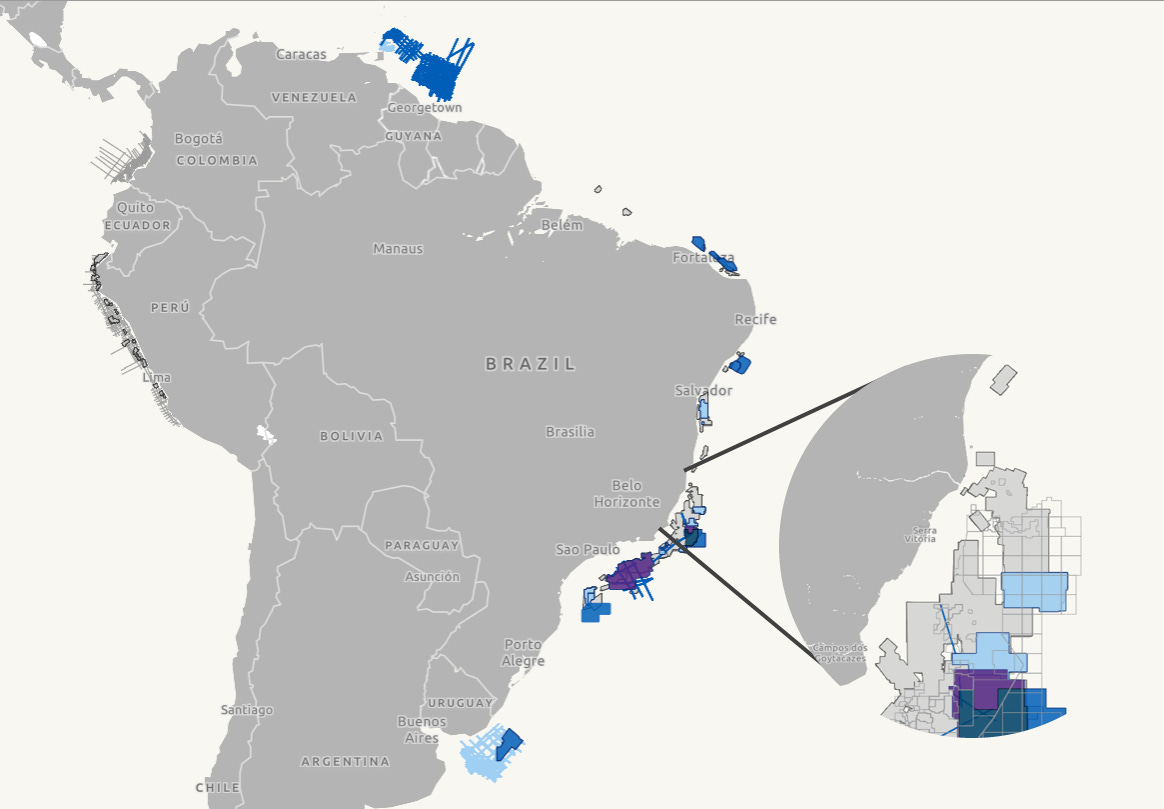

Seacrest Petroleo (OSL:SEAPT) is a new E&P company with mid-life onshore assets in Espírito Santo, Brazil. It completed its IPO in Oslo last February to fund its last acquisition from Petrobras. The company expects to triple its production by 2025. Its key shareholders include Mercuria, Ivanhoe Capital and co-founders of OKEA (OSL:OKEA) that bring new ideas and abilities to the company.

Origin

The current company was established in 2020 with the purpose of acquiring the Cricaré and Norte Capixaba Clusters from Petrobras, but it began operating in 2014. Initially, the company was called Karavan SPE Cricaré, and it was a joint venture between Karavan O&G Participações e Consultoria (51%) and Seacrest Capital Group (49%). It was later renamed Seacrest Petroleo. The objective of the company is to become an active M&A player in Brazil.

IPO in Norway

The company decided to list on the Oslo Exchange in order to raise funds for the second acquisition of the Norte Capixaba Cluster. A total of 443,666,666 shares were sold in the offering at a price of NOK 6 per share, resulting in a total of NOK 2.66 billion, including the over-allotment option of 40,333,333 shares. The IPO was successfully completed in February 2023. Shortly after the IPO, the company announced a reverse share split with a ratio of 2:1, which was completed in April 2023. The originally announced price was higher (e.g., NOK 10 per share in the prospectus supplement dated February 8th), but the need to close the Norte Capixaba transaction forced a lower price.

The company is led by a group of investors that are well-known in Norway thanks to being the co-founders of OKEA ASA, such as the Chairman, which, in our opinion, explains why Seacrest Petroleo chose to list the company in Norway instead of Brazil or the US.

Relevant shareholders

Before the IPO, the list of relevant shareholders included some interesting names: Seacrest Capital (32.22%), Commandery Investment Holdings Ltd. (23.1%), High Power Petroleum (SeaPulse) UK Ltd (9.72%), and Mercuria (9.01%). The IPO diluted the previous shareholders by 64.4%, including the conversion of warrants, notes and share option plans. However, some shareholders, like Mercuria, also acquired shares and converted their warrants during the IPO.

It is not totally clear how the current shareholding structure is at this moment as there is contradictory information in different sources. But the company recently confirmed that Mercuria and Ivanhoe Capital own 29.7% and 9.72%, respectively. Not even the information that the company shows in its website correctly identifies the actual main shareholders, as that information just shows the holding entities, not the actual owners.

Aside from the lack of information, the shareholding structure seems a bit complicated with Seacrest Capital, i-Pulse and Ivanhoe Group involved directly and indirectly in the ownership of the company. Seacrest Capital and i-Pulse created SeaPulse with the aim to develop offshore assets. Also, i-Pulse and Ivanhoe Group partnered in High Power Petroleum to apply i-Pulse’s technology for the exploration and development of o&g assets. There seems to be several transactions involving each company and the interests seem mixed and not totally clear.

Seacrest Capital

Seacrest Capital invests in the global offshore oil and gas industry, targeting high-value growth opportunities by founding and building new companies and leveraging strategic partnerships and its global network of resources. Its two major investments in the o&g sector are Seacrest Petroleo and OKEA. Seacrest Capital (Mr. Paul Murray and Mr. Erik Tiller) co-founded OKEA in 2015 with Erik Haugane and provided $200m of capital. OKEA has been a successful stock since its IPO in June 2019, with a gross return of 71% including dividends. The company has also been active in M&A, growing its production from around 20,000 boepd to around 35,000 boepd after the latest acquisition from Equinor announced in March. A similar success could be in the making with Seacrest Petroleo. Seacrest Capital is still heavily involved in OKEA with Mr. Paul Murray being a director in both companies. Erik Tiller currently is the Executive Chairman of Seacrest Petroleo.

Due to the IPO, this company has substantially reduced its ownership in Seacrest Petroleo, from 32.08% to 9.6% of the total number of outstanding shares and votes. Seacrest Capital and its related parties hold in aggregate 10.4% of the total number of shares and votes in Seacrest Petroleo.

Seacrest Capital launched another company, Azimuth Group, in 2011, which followed a similar strategy as Seacrest Petroleo. The company aimed to build a diversified, global portfolio of regional oil and gas assets. In 2015, it obtained through a subsidiary called AziLat Ltd a participation in 2 licenses, Block CE-M-603 in the Ceará Basin and Block POT-M-475 in the Potiguar Basin. However, these licenses were not developed and the rights transferred back to ANP. That failed attempt was useful to design the current Seacrest Petroleo, with a shift of strategy from exploration assets to mature fields being offered by Petrobras. The Azimuth Group also obtained offshore licenses in Namibia through its subsidiary AziNam, which was acquired in 2022 by Eco (Atlantic) Oil & Gas in exchange for equity. AziNam currently is the 2nd largest shareholder in Eco (Atlantic) Oil & Gas.

Mercuria

Mercuria provided financial support for the acquisition of both Cricaré and Norte Capixaba clusters, including a minority equity investment, warrants and a convertible loan note. Seacrest and Mercuria also entered into an off-take contract for the marketing of oil production from both clusters and have signed hedges until 2026. We cover this in detail below.

Prior to the IPO, Mercuria held approximately 9.01% of the equity and $60 million in debt across 3 different notes. During the IPO process, $15 million worth of notes were converted into equity, leaving $45 million of outstanding notes held by Mercuria, which were paid in full with the $300 million credit agreement signed with banks. In addition, Mercuria had received 5.2 million warrants that were converted in 2022 and during the IPO process. During the IPO, Mercuria was also allocated 194,306,689 shares. As a result, Mercuria owns 29.69% of the outstanding shares thanks to the shares acquired, conversion of notes and exercise of warrants.

In the CC of the 2022 results, Scott Aitken (president of the Executive Committee) was asked about the relationship with Mercuria, now being a significant shareholder and in charge of the marketing and hedging of the production. He insisted on Mercuria’s offer being the best among all offers received and a key, trustworthy stakeholder for the company’s future. It's worth noting that Mercuria recently partnered with Serica Energy and merged its North Sea offshore oil business (Tailwind Energy) with Serica’s gas business under the same company. Following the logic behind that transaction, Mercuria may be interested in granting other companies the operational role of its O&G assets, while focusing on marketing the production, the activity where it excels. We will see in the coming quarters what role Mercuria plays as a shareholder, it will be critical for future operations.

Ivanhoe Capital

Recently, one of the previous largest shareholders, High Power Petroleum (SeaPulse) UK Ltd, transferred its shares to Ivanhoe Capital Holdings based in Singapore, which was created at the same time as the IPO in February 2023. The Ivanhoe Group of companies is based in Singapore and includes, among others, Ivanhoe Capital, Ivanhoe Mines or Ivanhoe Electric. These companies have been founded by Robert Friedland, a billionaire that has amassed his fortune in the natural resources sector, becoming one of the most successful investors in copper. Friedland’s enterprises have been responsible for several of the biggest recent discoveries like Oyu Tolgoi in Mongolia or Kamoa-Kakula in Democratic Republic of Congo (DRC).

Although the Ivanhoe group is not currently active in the o&g sector, it once had a Canadian subsidiary, Ivanhoe Energy, that pursued the development of different o&g prospects in Canada, Ecuador, Mongolia China or the United States. The company ceased to exist in 2015 after important delays in Ecuador and Canada causing it to be unable to obtain the funds for the development of Block 20 and Tamarack, respectively. Ivanhoe Energy’s focus was the maturation of its heavy oil to light oil (HTL) technology, which would have improved the economics of heavy oil fields compared to the alternative technology at that time. Ivanhoe Energy’s development of the Tamarack oil sands project involved steam assisted gravity drainage, a solution that is implemented in Seacrest’s clusters.

Despite the technology proposed by Ivanhoe Energy is not relevant for Seacrest Petroleo, Ivanhoe Energy accumulated an important expertise in the potential of heavy oil, and this could be a new opportunity for the group to re-enter into the o&g sector.

The Ivanhoe Group seems to have received the shares from High Power Petroleum (SeaPulse) UK Ltd (100% owned by i-Pulse) as part of the settlement with i-Pulse for exchanging a debt with High Power Exploration for equity in i-Pulse, which was announced in mid-June. Although, this is just a speculation. The whole i-Pulse-Ivanhoe group relationship is quite complex, as it extends through different sectors and companies, and we will not cover it in detail, but we thought it worth being mentioned to explain the direct participation of Ivanhoe Group since the 30th June.

Management & Board of Directors

Seacrest is led by Michael Stewart, the CEO, who has been president of Seacrest Petróleo in Brazil since the foundation and has managed the participation in Petrobras’ divestment process. Michael has played a fundamental role in closing both Cricaré and Norte Capixaba acquisitions from Petrobras, as well as obtaining the support from Mercuria to finance the first transaction and the syndicate of banks & IPO for the second.

Among other team members of the management team, we would like to mention:

Rafael Grisolia, Brazil CFO, who has been CEO and CFO of Vibra and CFO of Petrobras before joining Seacrest.

Thomas Kandel, Asset Investment Director, is supervising the asset management strategy, including the reactivation of wells and preparation of the M&A strategy. He was part of the Azimuth Group.

Guilherme Santana, Senior VP Production and Operation, who was General Manager of Strategic Studies and Planning and Research of ANP and must have a deep understanding of the regulatory framework.

Juan Alves, Senior VP Production and Operation, who was a process engineer at Petrobras, as a production engineer and general manager at Petroreconcavo S.A, and as general manager at Potiguar E&P. His extensive experience in Brazil is particularly strong in mature and marginal oil fields management, revitalization, development and optimization works.

The BoD is composed by:

Erik Tiller, Executive Chairman, elected June 2019, he is co-founder of OKEA and a person instrumental for Seacrest’s medium term plans, in our opinion.

Paul Murray, Board Member, elected June 2019, another co-founder of OKEA, he will also be fundamental for the company’s success.

Scott Aitken, Board Member and President of the Executive Committee, elected October 2020. Mr. Aitken is CEO of High Power Petroleum, which transferred its shares to Ivanhoe Capital and has ceased to be a shareholder. He was appointed pursuant to a letter agreement between Seacrest Partners III, L.P and High Power Petroleum (SeaPulse) UK Ltd. That letter agreement terminated on 30 December 2022. His future in the board seems questionable.

Pedro Magalhães, Board Member, elected March 2022, a lawyer with expertise in Brazilian Energy regulations.

Rune Olav Pedersen, Board Member, elected January 2023. He is President & CEO of PGS ASA (formerly known as Petroleum Geo-Services). PGS is a global geophysical company that gathers offshore survey data and has one of the most important databases of offshore geophysics data. Why would a person with his expertise join a BoD of an onshore E&P company … ? The picture below shows the datasets and surveys available in PGS ASA’s database from Brazil and, particularly, Espiritu Santo.

Paulo Ricardo da S. dos Santos, Board Member, elected January 2023, he was VP of Exploration at Azilat Ltd that tried to develop the 2 licenses in Brazil as part of Azimuth Group.

Denis Chatelan, Board Member, elected January 2023. He is Head of Business Development at Perenco, an independent Anglo-French oil and gas company very successful in West Africa.

The BoD shows an unique set of skills with some seasoned directors in the sector, many of whom have more expertise in offshore rather than onshore o&g operations. This could mean nothing or be an indication of the future of the company, once it has completed the optimisation of the Cricaré and Norte Capixaba Clusters. Time will tell…

O&G assets

Seacrest has completed 2 different acquisitions from Petrobras to date:

Cricaré Cluster (~270 km2) in December 2021) including 27 onshore fields. Seacrest paid $24 million with $118m in contingent payments related to future oil prices. Licenses expire between August 2025 and April 2037, with the possibility of extending them to 2052 or later. This asset pays a 10% royalty that is lowered to 5% for quantities associated with all incremental activity

Norte Capixaba Cluster (~60 km2) and Norte Capixaba Terminal (NCT) in February 2023, including 4 onshore fields and an export Terminal with 500,000 bbl storage capacity. Seacrest has paid $478 million ($35.85m upfront + $442.15m at closing) with $66m in contingent payments related to future oil prices). The effective date of the transaction was 01/07/2022. The license for the Fazenda São Rafael field expires in May 2025 with the rest expiring in 2034 or later. This asset pays a 8.5% royalty that is reduced to 5% for quantities associated with all incremental activity in the Fazenda San Rafael and Fazenda Santa Lucía fields for 5 years starting in 2023.

In addition to these clusters, Agência Nacional do Petróleo, Gás Natural e Biocombustíveis (ANP) - the Brazilian o&g regulator - notified on November 2022 the company and its partners, Imetame (30% WI) and ENP Ecossistemas (20% WI), of the award of the ES-T-528 block, which has an area of 20.64km² and is geographically close to the Cricaré and Norte Capixaba Clusters. This block is in exploratory stage and could provide Seacrest with additional growth opportunities.

The company already submitted the license extension requests for 3 fields in the Cricaré Cluster and is working on a merger of licenses/fields that will reduce the bureaucracy and extend the effective expiration date. For the remaining licenses expiring in August 2025, the company is currently preparing a new Development Plan until the end of their economic life. The company has estimated a savings of 15% in operational expenses only from the consolidation of fields and the use of the common infrastructure, such as the export Terminal.

Another synergy generated by the acquisition of both clusters comes from the Norte Capixaba Cluster requiring natural gas to operate certain fields. The Cricaré Cluster does produce natural gas, and this production will be used at Norte Capixaba to reduce the purchase of natural gas from third parties at least until 2030. However, the natural gas production levels at the Cricaré Cluster does not seem to decline and this date may be postponed. Should the gas-producing fields increase the gas-oil ratio (GOR), any excess of natural gas not consumed by the processing facilities could be treated and exported using the nearby natural gas pipeline crossing the Espírito Santo state.

As an example of the lack of investment by Petrobras before the acquisition, below we show the production of the Capixaba Norte Cluster, showing a decline despite all the 2P reserves in the different fields. Petrobras simply did not invested in any new wells or optimisation of existing wells. Even using the current setup of the clusters, the production will still last until 2044, another 22 years of production. This will be extended as Seacrest completes its development and optimisation plans.

Petrobras wasn’t interested in increasing the production and recovery rates from the different fields. Another example is that the oil stored at Norte Capixaba was being diluted with naphtha, which caused it not to meet the specification for marine fuel usage. This was addressed by Petrobras during a maintenance campaign completed in March 2023 and now a different solvent is used.

Seacrest is not currently operating the fields, as it lacks the “Operator C” license, instead, Transpetro - a Petrobras’ subsidiary - will continue as operator under the same terms as under Petrobras’s ownership. The company commented in the Q1 2023 CC that they could operate the fields in the future, but keeping the previous operator was the best alternative to avoid any disruptions of the production during the handover process.

Reserves

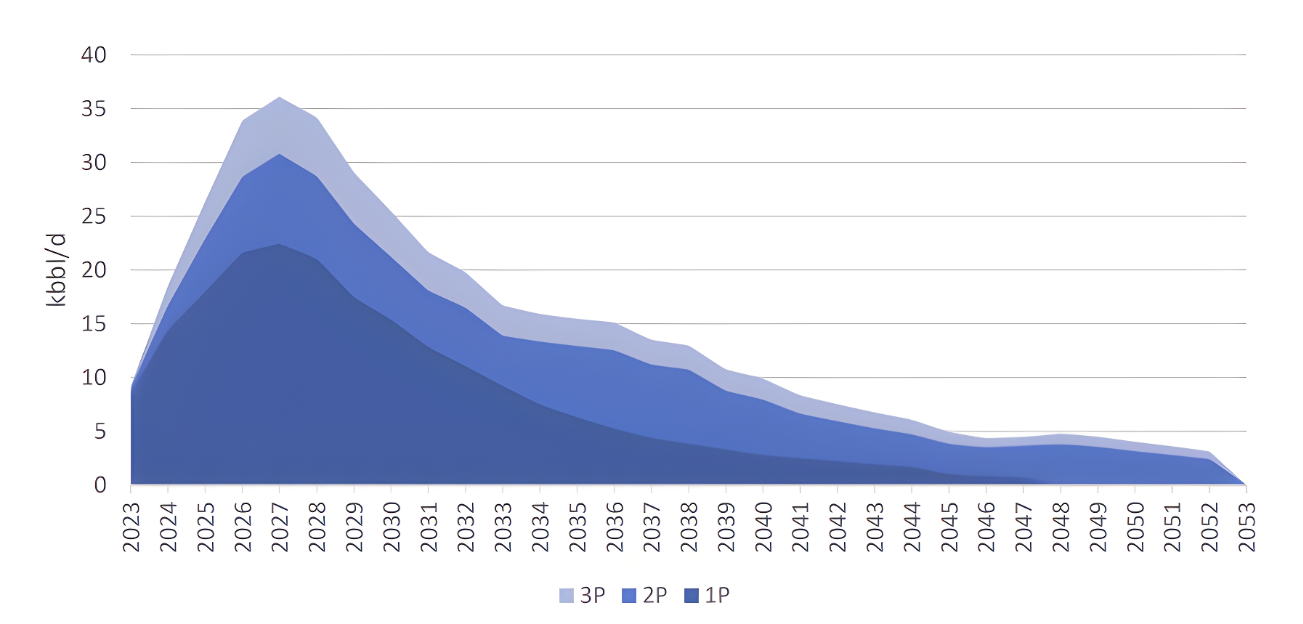

According to Seacrest’s Competent’s Person Report, both clusters combined accumulate 139.6 million boe (130.4MMbbl oil & 9.2MMboe gas) of Proved + Probable reserves with an estimated amount of 1.2 billion boe of oil and gas in place. The fields have experienced decades of under investment by Petrobras, with an average recovery factor of only 17%, extremely low compared to other fields close to Cricaré that achieved 50% RF. The oil in both clusters is mostly low-sulphur heavy oil, compatible with marine fuel. There is some medium-light, low sulphur oil that represents ~10% of oil production. The development costs are also very competitive with $4/bbl including abandonment costs and $15/bbl of opex.

The CPR has estimated the value of the proven reserves using three scenarios, below we summarize them including NPV10, NPV15 and the oil prices used in 2023, 2024 and 2025 and beyond:

The estimations above consider production since 1st January, 2023 and include the initial 15% savings in opex estimated by the company. Both base and high price cases look too optimistic considering the current environment and should be taken with a grain of salt. In our opinion, the low case is the more realistic and prudent of the three, and it should be used to estimate the value of the reserves, which is far greater than the current enterprise value.

Should the company achieve the goal to increase recovery to 50%, the amount of oil and gas to be produced is estimated at 384MMboe, which is 2x times the production achieved by Petrobras before the sale of these assets. If this RF was close to the 70% RF achieved at Kern River (CA, USA), another heavy oil (14º API gravity) producing area, the total volumes to be produced would increase to 613.7MMboe, 3.2x times the previous production. In any case, the company has a substantial potential to increase both production rates and reserve life beyond the current 2044 target.

Production and pricing

Currently, all oil production is sold domestically in Brazil until the maintenance and improvement programme to reach IMO 2020 VLSFO spec is finalized. The availability of the NCT allows Seacrest to directly serve tankers to transport the oil to bunkering hubs or refineries, without any intermediary other than the marketeer (i.e. Mercuria or Morgan Stanley).

Seacrest has received the licenses but also all the midstream infrastructure, which includes the reception, storage and processing equipment across the two clusters with a gross treatment capacity >115 kbbl/d. This infrastructure is not as old as the equipment acquired from Petrobras by other Brazilian companies. Norte Capixaba is only ~20 years old and Cricaré 30 years old vs up to 60 years for peers. Seacrest agreed with Petrobras the execution of important maintenance actions in Norte Capixaba before the completion of the deal, whilst Cricaré has already been massively revamped by Seacrest since the transfer of ownership.

Another relevant aspect is the reduction of the royalty rate from 8.5-10% to 5% for all incremental production, for a period of 5 years. This will reduce the payback time and improve the initial profitability of the production growth plans. In addition to the state royalty, there is a 1% landlord fee payable and an annual Retention Area Fee, R$2,637.28 per square kilometer for Cricaré Cluster and R$2,483.98 per square kilometer for Norte Capixaba Cluster. The total retention area fee for both clusters is estimated at R$899,496/year ($187,473/year). Finally, Seacrest does not pay the Special Participation Fee and is not liable for Social Contribution Taxes payments. Regarding the corporate tax, the company has applied for the Superintendência do Desenvolvimento do Nordeste (Sudene), a 10-year reduction of the income tax from 34% (base tax rate of 15%, a surtax of 10%, and a social contribution a.k.a. PIS & COFINS of 9%) to 15.25%, starting in 2023. The outcome of the Sudene application for Norte Capixaba is still pending, and it was already approved for Cricaré.

The majority of production is heavy oil with most fields showing an API gravity between 13º and 24º and the São Mateus Leste Field showing some production with 31º API gravity. The production requires artificial lift and enhanced recovery techniques like steam injection, a process using steam to heat the oil and improve its production. Steam is generated from water and then it is injected into the producing formations in cycles (injection, soaking, and production) or continuously. Natural gas is necessary for the steam generators.

After both acquisitions, the company operates 13 steam generators with a total capacity of 625 mmbtu/h. The oil extracted is mixed with water, from the steam and the aquifer, and natural gas. Thus, the liquid is introduced into a gas-oil-water separator which allows the decanting through gravity and density difference and, finally, dehydrated by inserting surfactants to eliminate the water micro droplets. Seacrest owns all the midstream infrastructure to treat its oil and, thanks to the NCT, offload it into tankers (Panamax class) for its shipping to local or international markets.

Heavy sweet oil represents approx. 90% of the Group's total oil production, combining high density and lower sulphur content, which provides a high refining potential and lower treatment requirements. Thanks to these unique features, sweet oil has historically achieved a premium to crude oil. Despite this oil meeting the marine fuel usage specs and Petrobras completing the required maintenance, the company hasn’t reached the required specifications and the oil is not being marketed as marine fuel, but it will by the end of Q3 2023 or early Q4 2023.

Although it is currently trading at a small discount to ICE Brent Crude, Rotterdam 0.5% sulphur (or Very Low Sulphur Fuel Oil, VLSFO) contracts traded at $5.8, $7.3, and $7.7 average premium per barrel to ICE Brent Crude in 2020, 2021 and 2022, respectively. Also, there is an agreement with Mercuria for the marketing of all heavy and medium-light oil produced (no mention to any natural gas) for 6 years or reaching 50 million bbls. We compare the prices of Rotterdam VLSFO (red) and Brent (grey) prices in the last 3 years in the picture below:

Seacrest has a 6-year offtake take-or-pay agreement with Mercuria for the marketing of the oil production from both clusters. Until it reaches IMO 2020 VLSFO specification, Mercuria is entitled to a marketing fee of $26/mt (~3.54$/bbl) for the heavy oil and 13/mt (~$1.77/bbl) for the medium-light oil. When the heavy oil gets to the specs, the marketing fee will depend on the amount of oil delivered, Brent oil price and 0.5 FOB Rotterdam Barges Fuel Oil Index. The specific calculation has not been made public.

Aside from this contract, the company has hedged part of the production, using Brent oil swaps for the Cricaré (p. 108 of the Prospectus) - signed with Mercuria - and hedges for the Norte Capixaba as part of the syndicated credit agreement with banks. Additionally, the company reduces the FX risk by acquiring RBL/USD futures, as most of its expenses are in RBL and its revenue is settled in USD.

In the case of Cricaré, the company has acquired monthly commodity price swaps for 2,791,880 barrels between September 2022 and February 2026, representing 2,240 bbl/d using a linear estimation. The price of these swaps go from $67/bbl in September 2022 to $61/bbl in February 2026.

After closing the Norte Capixaba transaction, Seacrest signed 2 different tranches of hedges to fulfill its commitment with the syndicated credit agreement:

First, Seacrest announced in April the hedging of 1,238,922 bbl of its future production over a 36-month period (1,131 bbl/d) with Mercuria. The company reported that this deal was the result of a competitive bidding process, and Mercuria had made the best offer.

Later, Seacrest announced the hedging of 96,878 bbl (1,064 bbl/d) of its future production for the period from April to June 2024, 77,183 bbl (848 bbl/d) for the period from April to June 2025 and 154,293 bbl (1,695 bbl/d) for the period from April to June 2026. These hedges were signed with Morgan Stanley for the 2024 and 2025 periods and Mercuria for the 2026 period. We believe that next quarterly hedges for the next periods will be announced as they are signed.

Unfortunately, the company has not made public the prices of these hedges, which we find odd.

We have made the following projection considering the company gets to 20,000 bbl/d in 2025 and 30,000 bbl/d in 2027. Using the current hedges, the company will get to the maximum hedged production in Q2 2023 with slightly more than 38% of the production. The company will get to a hedged position of less than 25% of its production by Q3 2024, however, we expect the company to continue announcing more hedges in the next months. In our opinion, hedging 25-30% of the production is reasonable as it has important capex and debt commitments.

Production growth plans

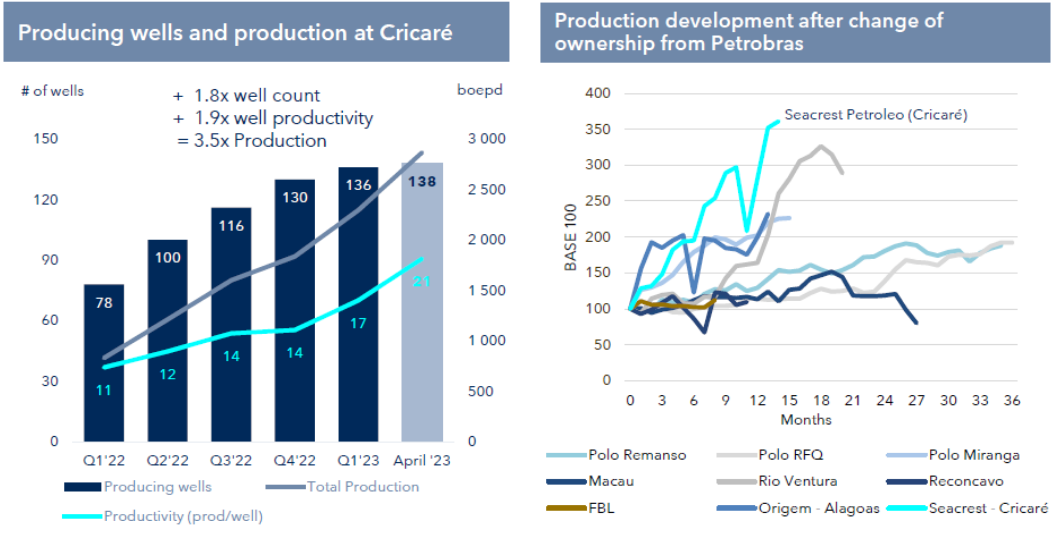

The most relevant part of the company lies on its plan to rapidly increase production in the coming years. Otherwise, it won’t be able to assume all its present liabilities. Seacrest plans to raise production to more than 20,000 bbl/d by 2025 and 30,000 bbl/d by 2027 from its present 8,795 boepd in Q2 2023. Seacrest plans to invest $400M in the 2023-2027 period to achieve this goal, with $27M of CAPEX in 2023.

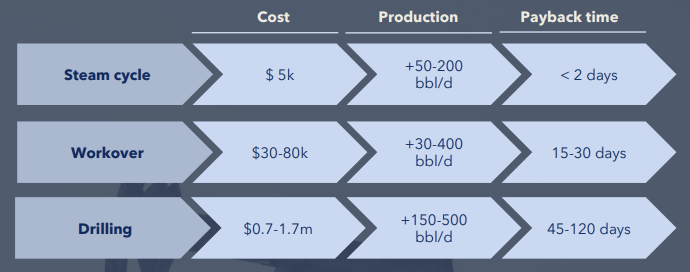

This will entail reopening shut-in wells in the first stage, then recomplete existing wells into new formations and, finally, drilling new wells, combining infill wells with development of probable reserves, adding more than 200 producing wells in only 4 years. Aside from increasing the number of wells, the productivity and the time between failures will be enhanced. They are working to improve their performance with pump and operational optimization that enable production 80% above their historical performance.

To show the ability of the company to increase the production, the daily production levels in the Cricaré Cluster grew from less than 700 boepd in January 2022 to 2,297 boepd on average for the Q1 2023 (+228%). The average production in 2022 of the Cricaré Cluster was 1,375 boepd, despite some weather-related production issues in December. This rapid recovery of the production seems to be common in all Petrobras divestments due to the little attention put in maintenance and production optimisation, as Seacrest himself shows.

The company has a two-fold strategy, including workover/recompletion of existing wells received from Petrobras (currently ongoing) and the drilling of new wells to develop Proven reserves and convert Probable into Proven. The payback times of every added well are measured in days or weeks, not in months or years like other companies, which show the superior economics of the Cricaré and Norte Capixaba clusters. The company is employing 2 workover rigs at this moment for the reopening and optimisation of existing wells. A drilling rig will be added in H2 2023 to quickly increase the inventory of new wells. All rigs are provided by external contractors.

Besides developing the currently identified formations from the existing locations, Seacrest has already assessed the potential of new wells that could target zones not included in the 2022 CPE. This will significantly increase the recovery factor, with increased exploration/geological risk, of course.

In April, the company published its production guidance for the whole year in a Q1 update:

The actual production in Q1’23 came a bit lower, at 7,074 boepd. However, just last week, the company published the Q2’23 production from Norte Capixaba and Cricaré fields, reaching 8,795 boepd, a 25% growth QoQ; thereby exceeding its earlier projections in less than 3 months. The increased production is attributed to the efficient takeover of Norte Capixaba operations and the successful implementation of the company's well repair and optimization program, which resulted in doubling its gas production.

Oil sales volumes for the quarter stood at 777 kbbls, including 100 kbbls of third-party oil and diluent. The net average realized oil price for the Q2 2023 was $69/bbl, after PIS and COFINS taxes, and before hedging. Looking at the disaggregated numbers expressed in boepd, we find the following.

Despite the company not disclosing the monthly production in Q2, knowing the average production of the quarter and the one provided in the last company presentation (which stated the April and May numbers) we acknowledge that the company is getting close to the 10,000 boepd mark.

If the company keeps growing the production at the current pace, which we strongly think it will, the guidance provided seems quite conservative. Production in Q2 was ahead of guidance and in the Q1 Conference Call the company confirmed its intention to maintain the guidance until further notice. We believe such a moment will be in the Q2 report due in August or briefly after that. In our opinion, year-end production could be close to 13,000 boepd, if they manage to maintain the current trend, a more than feasible achievement considering the arrival of the aforementioned drilling rig in H2.

Apart from oil, the gas production in Q2 was 762 boepd, a ~137% increase since Q1 2022, which is currently being used to satisfy its own needs (e.g. gas for the steam generators). The rapidly growing number of wells will affect the associated gas rates. The company confirmed in the last CC and has mentioned it in the last presentation that it is analyzing alternatives to valorise any future excess of gas after satisfying the demand of the company’s assets. The hook up to the pipeline of the national gas transport network passing close to the two clusters will allow for this surplus of gas to be exported and sold, while recognising additional reserves.

To complement this strategy to increase production, Seacrest also plans to add more reserves by applying 3 concrete measures:

expand steam injection at Cricaré Cluster.

begin commercialisation of gas.

develop new prospects in both Clusters, such as Cancã.

The reserve increase plans are yet to be confirmed. This strategy could begin execution as soon as H1 2024. Below we show the projected production for the Cricaré and Norte Capixaba Clusters according to the IPO prospectus, which show the 3 scenarios depending on the reserves considered. The projections use the reserves in the 2022 CPR as the baseline, before all the work being done by Seacrest at Norte Capixaba. We could see an even more optimistic scenario in the 2023 CPR, if the company manages to demonstrate that its strategy is sound and reserves may be considerably increased. The drilling of new infill wells plus the completion of existing wells into new formations will unlock a significant volume of Probable reserves.

Capital structure

After the IPO, and later share reverse splits, the company has 374,062,500 common shares (~$446 million of Mcap), and 75,000,000 undesignated shares, of par value $0.00002 each. The two largest shareholders are Mercuria Energy Group Limited (29.69%) and Seacrest Capital (9.67%). And the members of the management and BoD with significative shareholding includes Michael Stewart (CEO, 0.9%), Erik Tiller (Executive Chairman, 0.44%), Paul Murray (director, 0.26%), Thomas Kandel (Asset Investment Director, 0.28%)

The company drew USD 300 million from its credit agreement, which was used to restructure existing interest-bearing debt and to fund the Norte Capixaba closing consideration. This loan has a maturity of 5 years (3 February 2028), a grace period of 2 years, followed by an amortization period with flexibility to adjust to cash availability. The interest rate is adjusted term SOFR (as in effect from time to time) plus 7.50% per annum payable on February, May, August and November until the maturity date.

Additionally, the company has important contingent payments worth $184 million from the two acquisitions, $154 million linked to the reference price of Brent reaching a moving average equal to or greater than $50 per barrel in the respective payment years and $30 million linked to the approval of the concession term extension by the ANP.

The company is also obliged until the 10th October, 2024 to acquire from Petrobras the oil produced by the Lagoa Parda Cluster, which relies on the NCT for transportation of its production. The company estimated the cost of this agreement at $23.5 million, excluding any revenue from the sale of the oil. It is not clear if this oil is part of the 100 kbbl of third party oil mentioned in the Q2 2023 results.

Risks

Since winning the election, Lula has demanded a halt to the divestment process that Petrobras has carried out in recent years. As a result, many observers were skeptical that transactions like the Norte Capixaba acquisition, the Potiguar Cluster acquisition by 3R Petroleum, and the Golfinho acquisition by BW Energy would reach satisfactory conclusions. Despite these concerns, Seacrest managed to successfully complete the Norte Capixaba transaction, demonstrating a resilience that bodes well for its future prospects.

Lula’s government has initiated a revision of the o&g regulations, mainly related to the fiscal framework. A cancellation of the Sudene regime would be the most harmful decision for Seacrest. Should the government increase taxes or royalties, as it did in the beginning of this year with the 9.2% export tax, Seacrest’s ability to reach pay back of the acquisition would be seriously damaged. In the past, Lula hasn’t been particularly aggressive with reforming the o&g sector, in the case of Petrobras, his previous ruling was positive, but it is an aspect that must be carefully monitored.

Nevertheless, Seacrest faces a steep path ahead. The company has committed to significant future obligations in the form of contingent payments and debt. To meet these obligations, it is paramount for Seacrest to accelerate its production—a task fraught with challenges and uncertainties. Ramping up production involves navigating operational risks, including the potential for technical failures, delays, cost overruns, and unforeseen geological or environmental challenges. Although we consider Norte Capixaba and Cricaré as low risk developments - mainly because they are well-known mature fields where the strategy is pretty straight-forward - the possibility that the ramp up of production fails or gets delayed must be pondered.

Seacrest's relationship with Mercuria, though complex, has thus far proven to be valuable. As both a major shareholder and provider of key marketing services—including hedging—Mercuria is a critical ally for Seacrest. Although this related-party transaction calls for scrutiny due to potential conflicts of interest, Mercuria's role in financing the Cricaré Cluster acquisition and conversion of notes and warrants during the IPO for the Norte Capixaba acquisition offers a positive indication for the future. We anticipate that this relationship, if managed with strategic acumen, will yield mutual benefits for both parties.

As with any E&P company, Seacrest's future is also tied to the fluctuating prices of oil. Currently it is sold domestically but due to the ongoing operations to obtain VLSFO spec; in the coming months most oil will be sold internationally. In any case, the VLSFO market brings with it specific opportunities and risks. Historically, HSFO (High Sulphur Fuel Oil) was typically priced at a discount to Brent of 15-30%. However, with the advent of the IMO 2020 regulation, HSFO / Brent relationship changed completely, as VLSFO emerged as the primary solution for ship operators looking to comply with stricter sulphur emission standards without significant modifications to their vessels. Hence, VLSFO price kind of converged to Brent price, having small premiums or discounts in the last year. Although this would look extremely positive for the oil produced by Seacrest, this reliance on VLSFO also presents risks. The long-term operational impact of VLSFOs on marine engines remains an area of uncertainty, which could affect demand, as competition from alternative low-emission fuels like LNG and methanol could potentially exert downward pressure on VLSFO prices, affecting Seacrest's profitability.

In conclusion, Seacrest's path is laden with a blend of operational, financial, regulatory, and market risks. It is essential for the company to maintain a robust risk management framework that can adequately navigate these challenges while capitalizing on the opportunities that lie ahead.

Conclusions

At first glance the company doesn’t look attractive, as it has accumulated important liabilities with Petrobras and its lenders. However, the production growth could support both continuous capex and payments. Seacrest expects to start generating FCF by the end of 2024, when dividend payment could begin. Nonetheless, there are several short-term milestones that the company that are important to begin materializing the value in Cricaré and Norte Capixaba Clusters:

Sudene for Norte Capixaba, lowering the effective tax rate across the company to 15.25%. This could be imminent and announced as soon as early August.

Release Q2 results and, shortly after, increase guidance for FY 2023. Under the current trend, the company could reach a daily production of almost 13,000 boepd already in Q4. This will demonstrate the company can achieve the goals of 20,000 boepd and 30,000 boepd even before than currently planned 2 and 4 years, respectively.

Achieve IMO 2020 VLSFO spec to increase the realized price of the unhedged production. This could be announced as soon as September 2023.

Renegotiation of credit agreement with lower interest and removal of certain covenants. As the limitation to distribute dividends is softened after the 1st October, 2024, the company could still pay dividends without this renegotiation. This amendment could be announced in Q4 2023.

Announcement of the sales of natural gas and connection to the transport pipeline that crosses Espiritu Santo. The timeline for this is less clear, but it could be announced during H1 2024, as gas production outpaces Seacrest’s own necessities.

The EV of the company including the debt and all contingent payments is ~$850M, which is quite high compared to the current production level. However, the opex is quite low, capex has utterly compelling economics and the increase of the realized price by achieving VLSFO spec will help to increase the profitability of the business. The renegotiation of the conditions of the $300M loan and the increase of the netback per barrel will ease the payment of the contingent liabilities in the next few years.

The company has stated that it wants to be an active M&A player in Brazil, but Petrobras’ divestment strategy seems to have changed since Lula was elected president. Should the process resume, Seacrest may benefit and close additional acquisitions (knowing many players are now following the same strategy). Nevertheless, the focus shall be on the organic growth of the business, which is needed to progressively reduce the financial leverage, before making any further investment.

The relationship with Mercuria is a love and hate history. It is a very important shareholder, but it is also consolidating a control of the company’s sales via the offtake agreement and hedging strategy. Mercuria will prioritize its profits over Seacrest’s, and it is something that shouldn’t be overlooked. The participation of Robert Friedland’s companies in one way or another shows that Mercuria’s involvement is not a NO GO for one of the best investors in natural resources in the last decades. The stake that Ivanhoe group has taken in the company since its inception is a signal that there is value in the assets and the strategy that Seacrest is implementing.

The participation of OKEA’s founders ought to be more recognised as they already applied this strategy in the North Sea. In OKEA, they have mastered the offshore segment and that could be the next stage for Seacrest’s growth. With Norte Capixaba, Seacrest has all the required onshore infrastructure necessary to receive, process, store and process oil from producing fields in the Espiritu Santo Basin, which include some like 3R Petroleum’s Peroá or BW Energy’s Golfinho-Camarupim. This is yet unknown, but it could be part of a larger picture that is not yet announced.

There are several aspects in Seacrest that attracted our attention: the way in which they have managed to increase production, the support from Mercuria and Friedland and the involvement of OKEA’s founders. The assets are mature but they still have decades of production ahead, they have a low breakeven, all in a jurisdiction which currently seems very attractive tax-wise speaking. If the team manages to make Seacrest a well-oiled machine that manages to financially deleverage and implement a M&A strategy following OKEA’s example, Seacrest will be beginning its journey to become an important independent E&P company in Brazil.

In summary, Seacrest's journey ahead is replete with myriad challenges and potential rewards. The company's ability to balance its financial obligations, enhance its production levels, and strategically manage its relationships with key stakeholders will be pivotal in shaping its future. Cricaré and Norte Capixaba clusters have proven in the short time that Seacrest has held ownership that they are utterly overlooked assets, where a growth development is possible. And although we see it as a less compelling investment compared to other peers in the region, the involvement of key industry players and the potential for expansion into offshore operations provides a cautiously optimistic outlook for Seacrest's path forward. Next few quarters are critical to confirm that the low-risk, low-cost production growth program can offset the financial burden assumed with the two acquisitions. We recommend watching out for a potential guidance beat and raise in the coming months.

Disclaimer: at the moment of writing this article, we don’t hold shares of Seacrest Petroleo. However, we may buy or sell shares at any time. This document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Bankrupted. So much for the low risk strategy lol