A new year in oil and gas investing (part II)

End-of-Year Musings: 2024 Recap and a Look Ahead to 2025

"Markets price negative surprises instantly, yet often fail to promptly re-rate the upside on transformational news. Ride that inefficiency."

As another trading year draws to a close, I’ve been reflecting on a strategy shaped more by experience than by planning. 2024 has been exceptional—a 65% return across the portfolio tells part of the story, but the real victory lies in ending the year as a sharper, more focused investor than when it began. You can read Another oil and gas tourist’s comments about his portfolio in 2025 in the first part:

A new year in oil and gas investing (part I)

This is the first post of our series with our personal portfolios and why we hold these companies. This one is about my holdings, Name will soon publish the second post with his own commentary. We haven’t exchanged any ideas for writing them, so we aren’t biased by each other’s opinions. Subscribe if you still haven’t for receiving Name’s follow-up post:

If you've followed my posts on ZeroGCoS or Twitter/X, you know I'm not one for conventional wisdom. As a value speculator, my playground has been what most would call "shitcos," "junk," and "hated" sectors—particularly energy. Rather than rehash the market narratives you've heard a thousand times already, I want to share how this approach evolved and why it worked.

At the core of this year's success lies a simple yet powerful insight: markets fail to efficiently price positive transformational events. While negative surprises get priced in instantly, the full impact of major acquisitions, resource discoveries, or strategic pivots often takes weeks or months to be reflected in valuations. This creates a unique opportunity to enter positions after the risk has passed but before the market fully recognizes the improved business reality.

For those brave enough to venture into the market's unloved corners, there might be something useful here. At worst, it should make for an interesting read.

Finding an edge: The evolution of a strategy

2024 has been transformative in crystallizing what actually works in my investment approach. As I dissect my returns, a clear pattern emerges: the majority of my gains came from "big" positions that delivered exceptional performance. This wasn't just about picking winners—it was about having the conviction to size them appropriately and the discipline to let winners run.

Valeura Energy exemplifies this strategy in action. When they announced Mubadala assets acquisition of 20k BOED almost for free (just for the AROs really), the market's initial reaction barely scratched the surface of the implications. Similar patterns emerged with Tenaz Energy's NAM acquisition - the market opened at EUR 85M despite the assets generating over EUR 100M in annual cash flow at almost any gas price. In these cases, anchoring bias seemed to lock the market into caution, giving us time to jump in and ride the further upside—without exposing ourselves to the risk of a negative binary event (like a botched exploration well).

Here's where my edge crystallized: by maintaining a broad understanding of many companies, I can quickly assess and act on significant corporate developments. While conventional wisdom suggests buying before major catalysts, I've found that waiting for concrete evidence offers a better risk-reward profile.

Of course, not every "transformational" event is automatically a buy. Sometimes the market response overshoots any reasonable valuation, or expected news has pushed up the price higher than what the actual event deserves. If my quick fundamental math suggests that the stock's current price fully reflects its newly enhanced prospects, I refrain from jumping in. I'd rather wait for further data points that justify a higher valuation. I only deploy capital when there's a clear margin of safety.

Looking at my portfolio today, I see a concentrated portfolio of high-conviction positions, each backed by concrete catalysts, yet initiated at points where market inefficiency provides a margin of safety. This approach has not only delivered superior returns but has done so with a risk profile I'm comfortable with—though it demands constant vigilance and readiness to act when market conditions shift.

Market Flows: Breaking Free from Sector Constraints

While identifying mispriced transformational events forms the foundation, understanding broader market dynamics and capital flows can amplify these opportunities. The energy sector in 2024 perfectly illustrated this - companies that merely maintained good margins often languished, while those that presented clear growth narratives attracted substantial capital flows. The market wasn't paying for stability—it was paying for stories of change and evolution.

This realization has been liberating. Instead of forcing myself to find the "least bad" energy stock in a challenging market environment, I can allocate capital to the most compelling opportunities regardless of sector. Whether it was the surge in drone-related stocks, the nuclear small reactor frenzy, the quantum computing wave, or the AI boom, social media—particularly Twitter—provided early signals of shifting capital flows.

However, these "vibes" can turn on a dime. To manage this risk, I treat momentum-driven trades as distinct from my high-conviction positions. I often start with modest position sizes and constantly monitor both price action and the broader narrative. If the story falters or the market's enthusiasm abruptly cools, I'm prepared to exit promptly. Take tactical positions like ASPI 0.00%↑ , $MOB.ST or even INVZ 0.00%↑ —these weren't traditional value plays, but rather opportunities where growing investor interest and consistent newsflow created compelling momentum-driven returns.

Value needs a vehicle—a reason for the market to care and reprice the opportunity. And while I particularly enjoy finding opportunities in "old economy" sectors like energy, commodities, or shipping—where I believe it's easier for a stockpicker to shine—I've learned to follow the capital wherever compelling setups emerge.

Portfolio Architecture: Core & Tactical

At its heart, my portfolio is built around core positions—high-conviction holdings where I've identified both fundamental value and catalysts for market recognition. These positions can command 5-25% of the portfolio because I understand not just what I own, but critically, why I own it. The current structure reflects this philosophy, with my largest positions as follows:

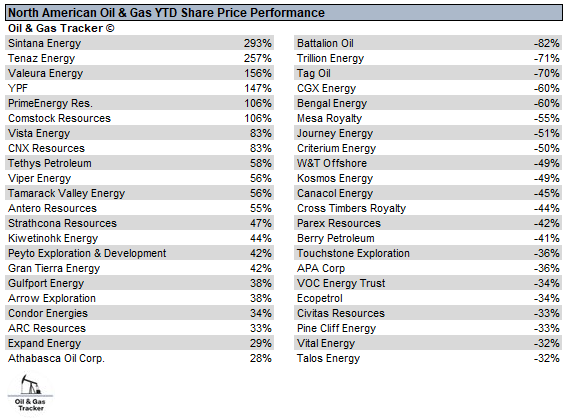

Notably, my three largest positions - Valeura, Sintana and Tenaz - were also the top performers in the North American Oil & Gas sector for 2024.

The math with Valeura is straightforward: annual Free Cash Flow of ~$160/180M (from 25k BOED at $75/bbl Brent) against a ~$280M EV (I don’t consider ARO, deferred taxes or inventory, but maybe you should). Add management's acquisition track record, active buyback plan and a strong cash position to fund further M&A.

Sintana's value lies in its 4.9% indirect stake in Mopane, which I believe could surpass the company's current market capitalization. They also hold a carried 4.9% indirect stake in PEL90, where Chevron is currently drilling Kapana. This Namibian acreage represents an asymmetric bet—minimal downside due to the carried interest and existing discoveries, but substantial upside with any incremental positive developments. While its performance last month has been disappointing, and Shell's exit will attract pessimism, I am confident that at some point this year, the share price will align with where it should already be.

Tenaz has delivered exceptional returns, and while the current valuation could fairly reflect existing operations, it undervalues three key elements: a cold winter that guarantees strong pricing for the whole of 2025, the growth optionality within their NAM portfolio, and their acquisition potential, as evidenced by their recent $140 million private placement of Senior Unsecured Notes.

NGEx might appear fully valued by conventional metrics, but I maintain my position for one simple reason: the opportunity to invest alongside the Lundins in Lunahuasi. Their track record of success speaks for itself—winners win, and I don't know many winners as consistent as them.

Harbour Energy exemplifies how solid operations don't always translate to market performance. Despite headwinds from UK policy shifts, CEO Linda Cook's leadership remains underappreciated. Multiple catalysts paint a positive picture: their strong position in European gas, ongoing deleveraging, potential UK asset divestments, developments in Zama and Andaman, and likely M&A activity make 2025 particularly interesting. #BelieveInLinda - and personally, I'm hoping for a Talos Energy acquisition.

Sable Offshore is a trade that represents an interesting catalyst play. While California and oil might sound like an unlikely pairing these days, and there are certainly yellow flags (like your jet being sold for the company above market and keeping its exclusive use) the production restart case appears solid and imminent. The asset remains materially undervalued based on reserves alone. While there are compelling long-term angles to this story (well documented in various investment write-ups), my position is primarily focused on capturing the short-term revaluation and that’s the reason I hold it before the restart PR.

Another oversized trade is Nebius Group, which emerged from good ol’ Yandex's restructuring as an overlooked AI infrastructure play. I initiated my position after trading resumed, taking advantage of forced selling from long-term holders who had their shares frozen for nearly two years. The investment thesis here is multifaceted: strong management team, compelling sum-of-the-parts valuation, and validation from major tech players like NVIDIA taking strategic positions. Eagerly awaiting peer CoreWeave IPO and targeted Annual Recurring Revenue (ARR).

The rest of my positions are under 5% and represent trades where I see potential but lack the same level of conviction. The portfolio tries to maintain 60% allocation to concentrated core positions, with 40% reserved for tactical opportunities or smaller trades. These tactical positions might be momentum-driven, event-driven, or simply situations where I see a clear catalyst.

The Path Forward: Opportunities & Lessons from 2024

Before looking ahead, it’s worth reflecting on some notable exits from 2024. I closed my position in ZIM after the Q3 results, locking in an almost 50% profit in less than three months with a significant position. Maha Energy, however, was a different story. While the thesis remains intact and has even strengthened—Brava Energia is at an inflection point, with 2025 year-end production potentially reaching 100k boe/d, and rumors of a divestment of the onshore assets—I sold at a loss for tax purposes.

Maha is currently valued primarily on its stake in Brava and its net cash, offering significant optionality essentially for free. However, I had no plans to increase my position, and I remain uncertain about the Venezuela acquisition, as OFAC shows little urgency to allow Venezuelan oil trade to resume. If it were possible, I would take a long position in Brava Energy.

Seplat provides another valuable lesson in position sizing and patience. While I didn’t lose money on the trade, it clearly highlighted why one should avoid building positions without complete visibility on transformational catalysts. Had I waited for the acquisition RNS (Regulatory News Service) and prospectus, I wouldn’t have initiated the position at all. This experience reinforces my core strategy of waiting for full disclosure of pivotal news before making significant commitments—or at the very least, remaining flexible enough to exit promptly when an investment thesis is broken.

Afentra got the boot in August - price was fair for their current asset and oil price, but I'll be back when McDade lands another deal. Arrow Exploration, a FinTwit darling, was another August exit - water issues were getting worse, and yeah, the news since then proved that right. Still keeping an eye on it though - if they sort out the water problems, there's serious upside at these levels given their production potential and cash generation.

Looking ahead, I'm maintaining my focus on the energy space, where I believe current sentiment regarding supply/demand balance is unrealistic. While I don't expect oil to exceed $100, I also don't anticipate a price collapse. I expect last year's $70-$80 range to persist—levels at which my target E&Ps will generate substantial cash flow for both shareholder returns and/or growth - I’m looking at you, Spartan, Logan, Panoro, BW Energy …

Beyond energy, I’m exploring event-driven opportunities like Tinybuild—a nanocap whose upcoming game Kingmakers (they’re the publisher) could significantly impact results. I plan to sell before the release date to capture any pre-launch momentum. Nice article covering this type of price action:

I'm also considering a return to ZIM, given strong shipping rates (Q4 was incredible and Q1 will also beat estimates) and Kenon's complete exit (while I was writing this, the ILA strike was resolved). Additionally, the offshore drilling sector appears to have bottomed, so I'm looking at Valaris, Transocean, or even DOF.

Lastly, I am strongly bullish on AI. While investing in direct plays like NVIDIA is challenging—currently trading at 20x forward sales, which, despite my belief that they will exceed estimates for the current year, appears fairly valued—I'm exploring supporting infrastructure or power plays such as $KMI or $TLN. I'm actively seeking companies that provide both the AI exposure I desire and valuations I find compelling. If you come across any interesting opportunities, please let me know!

The increasing market volatility creates an ideal environment for my non-standard approach as I find interesting set-ups almost weekly. One key lesson from 2024 was embracing higher portfolio turnover—dropping the old stigma against active trading. The macro picture for 2025 reinforces this strategy. Europe's economic challenges (a particular concern as an Europoor myself) and broader global uncertainties suggest significant market dislocations ahead. Such periods of turmoil often present the best opportunities, but only for those willing to stay vigilant and act decisively.

Conclusion: Building in Success

As I noted at the outset, 2024 wasn't just about hitting a 65% return—it was about transforming into a sharper, more focused investor. This year's performance validated more than just the strategy; it confirmed an approach that aligns with how I naturally process information. While it may clash with some conventions—like focusing on "hated" sectors or maintaining a concentrated, levered portfolio—it works precisely because it meshes with my thinking style. In many cases, simple napkin math, market awareness, and swift action have trumped the most elaborate frameworks.

The journey wasn't without its challenges. Quick execution after "transformational" news often requires nimble position sizes, especially in less liquid or technically complex sectors like energy. Concentration magnifies both gains and volatility, and leverage must be managed with unwavering discipline. But learning to trust my own judgment while questioning conventional wisdom has been transformative.

For those interested in adapting this approach, I'd highlight three key principles:

Build a broad market understanding to quickly spot significant developments

Act decisively when value disconnects appear, even after major announcements

Focus on situations where market psychology creates pricing inefficiencies

Ultimately, the best strategy isn't the most sophisticated—it's the one you can execute consistently across market environments. As another trading year draws to a close, I'm convinced there will always be market mispricings for those willing to spot them and patient enough to exploit them. My plan is to carry these hard-earned lessons into 2025, keep learning whilst remaining open to unloved opportunities that defy conventional wisdom yet fit squarely within my own investing style.

The views expressed herein are personal opinions and do not constitute financial or investment advice. All investing carries risk, including potential loss of principal. Readers should conduct their own research or consult a licensed financial professional before making any investment decisions. The author may hold positions in some of the securities mentioned.

Well done, sir! Thanks for sharing

Great post, thanks!