This second post continues with the production during 2023, the guidance for 2024 and the financial details of Jadestone Energy (LON:JSE), as its assets were covered in detail in the first one. I will first take a look at current and future production, then we’ll delve into the capital structure and financial situation, and we’ll finish with a comment about the risks and a general conclusion.

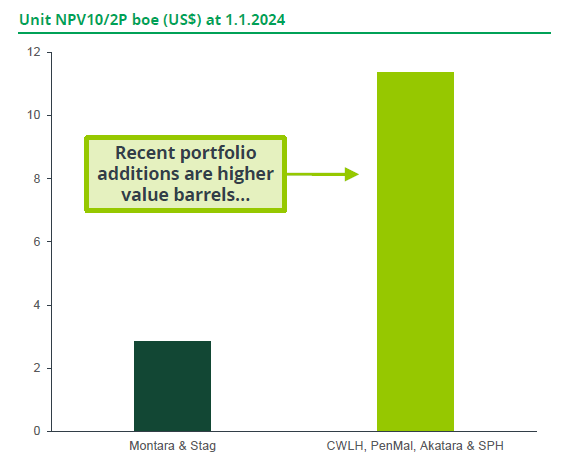

As a summary of the first post, Jadestone Energy has worked to diversify its producing assets, through both organic (Akatara) and inorganic (Montara, Stag, PenMal, Sinphuhorm, NWS) growth. Its CEO has been fundamental for the growth experienced by the company. However, a subpar risk and financial oversight has driven the company to overstretch the balance sheet until it required additional funds last June.

The company’s equity has been battered as a result, but the situation has improved since June, with Akatara nearing its first gas in early Q2 2024 and a superb infill drilling campaign in PenMal. It seems that the scenarios at Montara and Stag are not positive and there is more additional drama coming from these aging assets.

To be honest, I was tempted not to publish this second post as I got very pessimistic with the company. After some thinking, I have realised that the situation is dire but not definitive. There could be more than the company has told behind the decision regarding Montara and Stag, but that’s speculative. The company will reduce the weight of these assets in its production base, but it requires a supportive price level and an outstanding operational performance in Malaysia, Indonesia and NWS to make up for the damage created by Montara, mainly.

TL;DR thesis

I have been asked several times about what I saw in Jadestone Energy to write such an extensive write-up. Nobody can argue that the company screwed up during 2022 and 2023 managing Montara’s situation, but I expect them to have learnt from all the mistakes. Last week’s update hasn’t been helpful in that regard, as costs in the former two flagship assets (Montara and Stag) have increased compared to the previous years, and they are nearing decommissioning.

Currently, all that pain (some of which was self-inflicted) has been incorporated into the share price. Nonetheless, the market remains pessimistic (it has some reasons to think that way) and is ignoring that the company isn’t run by amateurs, like other o&g companies led by a former financial guy without actual field experience. If any, I think it is more likely that it will return to its path of growth, but 2024 will be another transition year.

This year could represent a change of pace for Jadestone Energy, transforming itself from ‘A troubled APAC oil & gas company’ into ‘An undervalued APAC oil & gas company’. Once the situation at Montara and Stag settles and Akatara is completed, the company will be free to focus its development efforts on Vietnam, which will be complemented by additional acquisitions (it’s very likely it completes another one in NWS).

Jadestone will see an increase in production in 2024 and will finally surpass the 20,000 boepd mark for the year. The increased volume and stability of the revenue might allow it to continue with its growth strategy and finance part of its ARO liabilities, but the resumption of shareholders’ remuneration is impossible under the current conditions. Only an average Brent oil price above $90/bbl during 2024 may relieve the company from the current pressure on its financial position. Jadestone is a leveraged bet to the oil price at this moment, but not as interesting as other plays like Valeura, because the current hedges limit its upside and reduce the downside.

Production

2023 production

The company completed the year with an average production of 13,800 boepd and an exit rate above 20,000 boepd. It had previously reported a production of 17,000 boepd during September, which shows that Montara’s progressive ramp-up continued during the period. That means that H2 production was 15,200 boepd, slightly above the last guidance of 13,500-15,000 boepd, which was lowered in September from 13,500-17,000 boepd after Montara’s second shut-down in July-September 2023.

This guidance beat wasn’t a surprise, as the company had announced on the 4th of December that production since April was in the upper end of the guidance. The last well of the PenMal drilling campaign was being tested at that time. Thus, PenMal’s fourth well should have also performed above the initial expectation.

As a result, JSE has achieved a record production level in 2023, but still very close to 2019 without including the acquisition of Mimi’s interest in NWS. Adding that production would make 2023 a record year for JSE at 15,686 boepd, but the effect is more evident by looking at the H2 numbers. The production during the second part of 2023 including Mimi’s NWS stake would be the highest to date by a huge margin, which shows that a turnaround is possible:

In September, the guidance for opex was confirmed at $180-210 million with a reduction of the capex to $110-125 million (85% for Akatara and 15% for the infill drilling in Malaysia), including an increase of $7 million in the infill drilling campaign in PenMal.

The company hasn’t provided any information about sales. In the last update in December, JSE mentioned sales during Q4 2023 of 1.4 MMboe with another 0.37 MMboe expected to be lifted in December. There is no detail about the prices achieved during H2 2023. The price obtained in H1 2023 for the oil was $86.2/bbl, including a premium of $8.9/bbl over Brent. This premium has continued during H2, with Montara’s and Stag’s oil obtaining a premium of $4.70/bbl and $14/bbl, respectively. Tapis has maintained a premium ($5-10/bbl) over Brent during the whole last quarter:

The proceeds from the liftings mentioned before are expected to be received before year-end, resulting in a net debt position of $5 million (cash balances of c.US$152 million and debt drawn of US$157 million). JSE began H2 with an inventory of 421,720 bbls (that had negatively affected the working capital in H1), which boosted sales in the period.

2024 guidance

The company has provided the 2024 guidance that included a very negative surprise:

Production: 20,000-23,000 boepd

Opex: $240-290 million

Capex: $80-110 million

Other cash commitments: $77 million, related to the abandonment funding payments for Mimi’s acquisition, and $30 million for royalties and carbon taxes.

The production guidance was lowered than expected and the opex came higher. The company signaled the worrying situation of Montara and Stag with an opex above the previous years at a staggering $60/bbl in 2024. In parallel, the production from Montara has been guided to 5,000-6,000 bopd, which is below the levels reported since re-start in H2 2023.

The graph below compares this guidance with the change compared to our estimation for 2023 based on the total production for the year. The opex per barrel is adjusted to remove the Sinphuhorm production from it, as it doesn’t contribute to the revenue or opex. The company has insisted that the 2024 opex is materially lower than in 2023. Akatara is a large contributor to the production growth, but it will also achieve a lower netback:

In conclusion, the guidance for 2024 is disappointing, there isn’t another way of presenting it. Besides the lower production from Montara, I can only speculate what other factors are below previous expectations, because the first-gas from Akatara was expected to increase production. This low increase in production doesn’t match with the better-than-expected performance of the infill drilling campaign at PM323, which could quickly fade during 2024. The picture that the company has provided in its guidance looks conservative in the production, unless there are more problems that haven’t been reported yet (I don’t think this is probable). It is important to remember that JSE could surprise for the worse at any moment, but the “Series of unfortunate events” must end at some point.

Current production

We’ve compared the production numbers from H1 2023 (last detailed production figures available, as if Sinphuhorm would have been producing for the whole period) with H1 2022 (before the problems began) and my estimations for H2 2023 and 2024. During 2024, I had to increase the decline compared to the previous estimations for Stag, Sinphuhorm and NWS (it had a very strong H2) in order to reach the projected midpoint of 21,500 boepd. However, there could be a series of planned maintenance shut-ins that could explain it, but the company hasn’t mentioned it.

In a previous forecast before the publication of the 2024 guidance, I estimated that production could reach 23,000-24,300 boepd. I wasn’t as bullish as the company’s projection for 2024-2026 that it published last June. In fact, I optimistically included some production from the PM318 and PNLP in 2024 already. That forecast put 2024 production at c.25,000 and 2025 production at c.30,000 boepd. Thus, the 2024 numbers are already materially lower than it was foreseen 6 months ago.

JSE hasn’t reported any recent operational issues that could be curtailing some production compared to the situation in June. In the coming weeks there will be a complete update with the data from 2023, where we will confirm the operational status and challenges at each field. I’m looking forward to reading the production breakdown per asset.

Despite being disappointing, the 2024 production will be the highest to date for JSE, 41% over H2 2023 production (23% if Mimi’s acquisition is considered already in 2023).

A comment on former non-op PenMal

Regarding the PM318 and PNLP licences, the Bunga Kertas FPSO, which I thought would be repaired during 2024, has been offered to Chevron to temporarily replace a FSO that requires a drydock for conducting R&M work. This postpones any plans that JSE might have for recovering production from PM318 and PNLP in 2024 or early 2025, subject to a positive outcome from the negotiations with Petronas for a new PSC for these licences.

Yesterday, the results of the Malaysia Bid Round 2023 were announced, and Jadestone and Petronas Carigali were awarded the PM428 licence, the largest PSC on offer. The status of the licence is in exploration, which doesn’t match with Blakeley’s strategy. However, the licence surrounds the PM318 and PNLP blocks and falls in between the PM329 and PM323 blocks. After this award, it is unlikely that the new contract for PM318 and PNLP will not be granted to JSE. The 4 existing licences and this new one share a similar geology, as can be seen below:

With the news of the Bunga Kertas FPSO temporarily going to work for Chevron, JSE ensures that it will receive an operational vessel after completing all the repairs necessary to recover the class. That way, JSE can return PM318 and PNLP fields back to production after signing the new PSC, and progressively connect to the FPSO (Burga Kertas or other) any discovery that is deemed commercial. This is what is called infrastructure led exploration and has the advantage of building upon existing knowledge of the area and assets in place. This approach does fit in Blakeley’s playbook.

The rest of the section has been added on the 27th January and wasn’t in the original version.

The PNLP (North Lukut, Penara, and Puteri) fields have been included in the MBR+ licensing round, renamed as simply Puteri. The deadline of that licensing round was on the 15th of January and participation was by invitation. A collaboration between JSE and Petronas Carigali (same partnership in current PM323 and PM329, former PM318/AAKBNLP and recent PM428 award) would make sense for this licence. However, this could signal that the application sent to Petronas for the PNLP license (expiring in 2024) wasn’t successful, or that this is the way that Petronas has to make the award official. In any case, the chances that JSE is awarded the ‘new’ Puteri licence in the MBR+ round are high. The outcome of the MBR+ round is expected in April or May, with the signature of the PSCs in June this year.

There could be another opportunity in the MBR 2024 round, the Korbu cluster (formerly known as the Diwangsa cluster), which lies in the middle of the PM428 block. The fields in the Korbu cluster thas been already explored and appraised, all of them include information from the logs, DST results and core data. Thus, this is not exploration but development. The licence was awarded to Rex International in 2021, which estimated the recoverable volumes in 10.7 MMstb. Rex Internationl relinquished it in August 2023 after failing to secure the financing for the development. This licence could be added to the hub that JSE is creating in the northern section of offshore Peninsular Malaysia, making the whole development much more economical:

As an example of the potential synergies created by having adjacent operations, Petronas has proposed that the Korbu development could use the FPSO operating in the Abu cluster.

In summary, combining all these licences, JSE could create a lot of value without increasing the risk. In adition, the Malaysian regulation requires licencees to finance through opex the cess fund for the decommissioning of the fixed infrastructure, which reduces the net increase of ARO liabilities.

Financial situation

2023 financials

The company reported last week that it will publish a trading statement summarising the main operational and financial metrics for 2023 within weeks. Until now, the only information available are the H1 2023 financial results and the updates regarding sales that JSE has reported.

The financial results from H1 2023 were particularly negative. Nevertheless, it is important to consider JSE’s large inventory build during that period that caused an impact of $24.9 million to the working capital. This effect should have reverted during H2.

There isn’t much information about the financials in H2 2023 so far. As I mentioned before, there were several million barrels lifted in Q4 2024 worth $130-160 million. Considering an average production for the year of 13,800 boepd, I estimate that the revenue can be in the $340-365 million range at an average price of $79/bbl, which reflects the impact of the hedges, premiums and PenMal’s gas production. The revenue is exclusive of Sinphuhorm, which is reported as a financial investment, and there isn’t information about the timing of dividend distributions to APICO’s shareholders. The actual revenue including the Thai asset would be $355-385 million.

However, the record levels of opex and capex, plus the additional financial costs due to the financing, have impacted the annual result. I estimate that the company might have ended the year with a loss of $10-15 million, and a negative Free Cash Flow of $70-80 million, before acquisitions. A potential dividend from Sinphuhorm could have helped to reduce the negative impact, as a distribution of $10-15 million would be reasonable, but the company hasn’t confirmed this.

The company began 2023 with a net cash position of $123 million, and it has closed it with a net debt of $5 million. This cash outflow ($128 million) is explained by the high capex ($117.5 million midpoint), NWS abandonment payments ($42 million), acquisitions ($27.8 million) and buy back programme ($1.8 million) during the year. This was offset by the placing completed in June, which generated $50 million of cash. Hence, the company managed to generate an operational cash flow of c.$11.1 million during 2023. This shows the resilience of the business even during one of the worst years with numerous setbacks.

The company has navigated through a difficult year with lower production than initially planned coincidental with the highest annual capex to date, while maintaining its acquisition strategy. It hasn’t been a good year and the share price has reflected the struggles. The lowest point was when it announced by surprise a financing (placement + facility) in June, at a moment when the market was finally expecting positive news.

I have modeled the potential outcome for this year and the following years, considering the current available plans and conservative scenarios of $78.6/bbl in 2024 ($75/bbl Brent + $3.6/bbl premium) and $72/bbl afterwards ($70/bbl Brent + $2/bbl premium). Vietnam’s first-gas could be in 2026 and it is reasonable to expect Akatara maintaining a decent production rate, which increases the share of natural gas in the production pool and affects the average price. I have accounted for the planned drilling campaigns in Montara, Stag and PenMal, and the resumption of production from the PM318 and PNLP fields in 2025 that will progressively grow thanks to the contribution from the recently awarded PM428. The capex after Vietnam’s first gas drops dramatically as there are no future projects after Vietnam and PM428:

The 2024 projections will result in an increase of the debt, as the M&A expenditure is not included in the FCF above. Hence, the cash flow for 2024 (without adjusting the working capital as the financials for the end of 2023 haven’t been published) will result in an outflow of $79 million during 2024, driven by Mimi’s acquisition and the contingent payments. I insist that the projections are based on a conservative scenario with oil at $75 and natural gas at $6.2/mcf, so there is upside to this scenario.

Capital structure

After closing the placing last June (see next section), the capital structure of the company is the following:

Equity: the company has 540,766,574 Ordinary Shares, as all the shares acquired in the buyback programme (2.1 million) have been canceled. By the end of H1 2023, the company had 6 million share options, 0.6 million performance shares and 0.2 million restricted shares that were dilutive. Additionally, there were 6.4 million share options, 0.3 million performance shares and 0.4 million restricted shares that were anti-dilutive. The diluted share count is 546.8 million shares outstanding, with the potential addition of 7.1 million if the share price recovers (1.2% dilution). Currently, the equity is worth c.$178 million.

Warrants: JSE issued 30 million warrants to Tyrus at an exercise price of 50p and exercisable until the 5th of June 2026. All warrants are anti-dilutive at current share level. However, using Black-Scholes, the current liability would be $0.53 million ($6 million in H1 2023). If all warrants and options were exercised, the total share count would grow to 587 million shares (8.1% dilution in total), but that would require a share price above £1.01/share and would result in a value of the equity of $743 million.

Debt: the company signed in May a $200.0 million RBL facility and has drawn $168.1 million from it (last redetermination was completed in October, and the result was above this amount). The last figure for the debt is $5 million, lower than the $7.8 million in H1 2023, despite most of the capex being spent in the second part of the year (c.$91 million). The important inventory build in H1 affected the working capital ($30 million) and should have been reverted. The debt position excludes any payments for Mimi's NWS acquisition, which are planned for Q1 2024.

Contingent payments: due to the acquisitions, JSE has accumulated a series of commitments with the sellers, totalling $19.3 million. The most important one was with the seller of Akatara, Mandala Energy, which amounted to $12.4 million by the end of 2022.

As a result of the calculations above, JSE’s basic Enterprise Value (EV) was $203 million by the end of H2 2023, an important reduction compared to the $273 million by the end of H1. The equity is the largest component, but there is another critical aspect to consider when looking at JSE’s value, more about this later.

June 2023 financing

Despite having signed a $200-million RBL in May, two weeks later, the company announced that it required additional financing. Some investors could have already foreseen it as the share price was on a downward trajectory since March, falling from 94p to 49p. Meanwhile, some directors (including Mr. Blakeley) continued buying shares with little impact to this downwards trend. The financing was provided by JSE’s largest shareholder, Tyrus Capital, and it included a placing and a facility with excruciating conditions even for the standards of the o&g industry:

$50 million in equity at 45p/share.

30 million warrants with an exercise price of 50p.

$35 million standby working capital facility with a 4.3% commitment fee ($1 million minimum) and interests of 15% & 5% for the drawn and the undrawn amounts, respectively.

Open offer for 14.8 million shares at 45p/share, which only covered 0.49% of the aggregate number of shares offered

Consequently, the share price fell from 49p to the sub 40p level where it has stayed since then (excluding Montara’s second shut-down in Summer and this week’s reaction to the guidance when it has traded below 30p). Retail investors didn’t see the need to go to the open offer, generating only $33,000 in new shares.

Initially, it was difficult to understand the urgency of this placing after signing the RBL. There were three components of JSE’s strategy that played against it: Montara’s production had been disappointing, JSE had continued acquiring assets and it was entering the most capex-intensive part of the year. Additionally, there was another acquisition being considered - later we knew that consisted of Mimi’s NWS stake. As I mentioned in the previous post, it seems they hadn’t included the impact of all the financial commitments in the calculations. The stress-tests related to the RBL might have revealed a very troubling financial situation that required immediate action and the company might not have had time to improve the conditions. The need was explained by a future redetermination of the RBL in Q2 2024 that would have resulted in a severe reduction (from $175 million to less than $100 million) that had forced JSE to reduce the pay an amount that was beyond its capacity.

Completing a financing in June 2023 for something that would happen in Q2 2024 doesn’t seem logical when the company was planning to increase production from PenMal and complete another acquisition that could be added to the asset base for the RBL. It was a perfect storm, Montara had been shut-down longer than expected, Stag’s 2022 infill drilling programme wasn’t successful, $27.8 million were spent in acquiring a non-cash flow generating asset like Sinphuhorm and $82 million had been paid for NWS’ abandonment costs, with an ongoing buyback programme until February and a record-level of capex. It looks like someone panicked and had to react, signing conditions that were harmful to the company and its shareholders.

Should the company have postponed or walked away from the acquisitions of Sinphuhorm? Maybe that was the prudent decision to be made as Akatara‘s capex couldn’t be delayed, but it had required a long-term vision on the financial situation, and it was already too late when the situation evolved in May-June. This financing was the result of a disastrous financial modeling and risk management, nobody pushed the brake pedal on time and JSE kept assuming financial commitments.

After the financing, the RBL banks seem to be fine with JSE’s current situation as all of them backed Mimi’s $111 million transaction (to be lowered as the abandonment funding payments seems to be inflated), so they don’t see the financial situation as risky at the moment.

Hedging

Under the RBL terms, JSE is required to hedge its future production for the next 8 quarters. The last update on the hedges is:

The company has confirmed that these hedges do not include the premium that PenMal’s, Stag’s or Montara’s oil usually obtain. The higher amounts in Q4 2023 and Q4 2024 are caused by the lifting of NWS’ oil. Now that JSE has doubled its stake in NWS, there would be 2 liftings per year that will smooth the production profile. The company will add more hedges once Mimi’s acquisition is completed.

ARO liabilities

JSE’s ARO liabilities are a red flag for many investors, because its aging assets are approaching decommissioning. That statement is not more relevant than ever after the last update, with opex for Montara and Stag revised upwards to ensure their operational status in this and following years. I am not going to downplay the relevance of these liabilities, this is a critical aspect of JSE and shall not be overlooked by any investors considering it as a potential investment. The total amount included in the balance sheet by the end of H1 2023 was $580 million with only $9.5 being current liabilities. The company also has $181.8 million in non-current liabilities to cover for part of the ARO liabilities, an increase of $98.5 million compared to the end of 2022, mainly driven by the payment for NWS. The increases of both liabilities and provisions come from assuming the 100% WI of PenMal PM 318 and PNLP licences. Hence, the net ARO liability was $398.5 million by the end of H1 2023. The ARO liability by the end of 2023 may increase after the announced non-cash impairment of Montara and Stag at year-end 2023.

The situation at other assets is different. JSE continually contributes to cess/abandonment funds for PenMal assets, and NWS abandonment costs are covered. In Thailand, APICO (as operator) must provide a security deposit approved by the Director General for not less than the estimated decommissioning costs set out in the approved decommissioning plan. Nevertheless, there is a small ARO for Sinphuhorm estimated at $2 million at the time of the acquisition.

Enterprise value

Once the ARO liabilities are accounted for, JSE’s current EV grows to $602 million:

As it can be seen, ARO liabilities (66%) and equity (30%) are the main contributors to the company’s valuation. Hence, the value of the ARO is affecting the company’s actual valuation more than any other element in the balance sheet. It is necessary that management and directors actively address this matter and come up with ways of generating value for the company by optimising the balance sheet, not only targeting production and debt.

There is a saying that I personally like: “Never take the last dollar off the table”. Despite Blakeley knowing better than most investors, the market is telling him to move away from Montara and Stag. They were great assets, but their time has come. Instead of trying to extend their life a couple of years, it might be wiser to use the cash position (c.$152 million) to lower the ARO in the balance.

There is another aspect that is ignored by most, JSE has accumulated more than $4 billion in fiscal assets that are outside of the balance and will offset any future PRRT payment. However, the high opex at both Montara and Stag will reduce the company’s ability to use them in the future. The effect of these fiscal assets in the valuation is negligible at the moment.

Valuation

Hence, I will assume that JSE’s EV is $602 million, which seems low considering the production, but it is not great when the ARO liabilities are the main contributor. By looking at the reserves and production, the current valuation would be:

EV/2P reserves: $8.1/bbl, using 2022 reserves

EV/boepd: it is not easy to choose a representative production level, considering the changes in the last year and the foreseen production growth. Thus, I have estimated it according to different production levels: i) average 2023, ii) 2024 midrange, iii) 2024 high range, iv) potential 2024 exit rate:

As the FCF that I have modeled is low, and there won’t be cash generation during the year, it doesn’t make much sense to compare it to other offshore peers like Valeura, Pharos, Tullow Oil, Enquest, Vaalco, OKEA, Africa Oil, Karoon or W&T Offshore. The case of Valeura is quite surprising, as a company with no producing assets managed to buy a set of mature assets from Mubadala at extremely beneficial terms. Another post will follow this one, once the financials for 2023 are available. The goal will be to look at JSE’s relative position compared to these peers in terms of production, reserve life, opex and FCF generation.

Future scenarios and risks

This year was expected to confirm the turnover thanks to Akatara finally reaching first gas and Montara’s problems ending. Now, 2024 seems to be another troubled year.

Considering the situation at Montara and Stag, most of this year’s performance will depend on these assets. The company must demonstrate that it can lower the opex and increase production, which would be possible if the company has intentionally underpromised in its guidance. I want to believe this is the case, but facts don’t support this scenario.

It was disappointing not seeing Vietnam mentioned in the guidance for the capex for 2024, not even for studies. It is clear that the negotiations for the gas sales agreement aren’t progressing towards enabling a FID in the short-term. (Updated on the 26th January) At least, Jadestone has finally signed the Heads of Agreement for the gas sales of Nam Du and U Minh Gas fields with Petrovietnam Gas Corporation and Vietnam Oil and Gas Group (Petrovietnam). This is an important step and will hopefully be followed by the gas purchase contract. Vietnam is supposed to become the next organic growth project for the company; now, it seems that the company is not pursuing its development at this moment.

As I mentioned in the previous post, I think that JSE could acquire the remaining 16.66% from Chevron in NWS’ CWLH fields during 2024. That is the most likely path of inorganic growth for the company, as I doubt that it has the ability to diversify its asset base even more given the financial situation.

At this moment, our model shows a severe cash outflow of $79 million in the year after including the payment of $77 million for funding NWS abandonment costs in Mimi’s acquisition and the contingent payments. There are several unknowns, like what will be the actual production from Akatara, the timing of the dividends from Sinphuhorm (if any) and the investment required for the PM318, PNLP and PM428 licences.

I don’t think anyone has high expectations for JSE in 2024. The company is cheap when looking at reserves and production, but the financial metrics do not support a recovery of the equity. The current share price is low even for JSE’s standards, but the only way for JSE to become an interesting investment must come from better than expected operational performance. The market will not be complacent with any mistakes in the future, and the share price could go below 20p in the case that JSE reports any bad news again.

After two years that have been terrible and the prospect of another ‘lost’ year, our faith in Blakeley’s ability to successfully manage the company is in doubt. The company announced the addition of a COO to the team, who will help but the impact will not be instantaneous. In fact, the search for the right person has taken more than 6 months already. JSE ended 2021 with considerable momentum, delivering on its goal to reach 20,000 boe/d by year-end. Now, 24 months later, more than $200 million spent in capex and $104 million spent in M&A, the production is again at 20,000.

Can we say that the company has lost 2 years due to an improper management of the situation? I think we can. Can we say that the company has learnt from its mistakes and a similar situation will not occur? I think we cannot 100% say it, but I hope it has.

The Montara and Stag conundrum

Montara and Stag have destroyed the market’s expectations in JSE’s return to a highly profitable year. The situation they are facing at the moment is the following:

Hence, we are looking at a scenario where 2 assets are responsible for 71.6% of all opex ($190 million out of $265 million) and c.60% of the capex (c.$57.5 million out of $95 million), while representing c.36% of the production. That is an anomaly. According to Blakeley, these costs will lower in the coming years, but they will still require capex to reduce the natural decline.

The situation at Stag is particularly harsh. The company still aims to invest to keep production in the 2,000-3,000 bopd range (where it has been in the last years). JSE has estimated that there is some value left in the assets, but it is difficult to justify keeping them in the company, as they are considered ticking bombs:

Even with a premium, Stag will hardly generate a profit when production comes below 2,000 bopd due to the high opex. Extending their production to 2035 would require a constant level of capex with diminishing netbacks.

The risk of incurring operational losses is minimal, as the expected production from Montara and Stag in 2024 is covered by the hedged production. This setup allows for the sale of these barrels with a minimal profit, while the remaining production remains profitable even in low-price environments. However, the return for the company and its shareholders will be conditional to the risk associated with retaining these assets. JSE's dependency on Montara and Stag is now lower than it traditionally was, and this trend is expected to continue in the following years.

Conclusion

The company has sailed through a sea of problems and wrong decisions over the last 24 months, yet no one has been accountable for these mistakes. The addition of a COO and the removal of some directors doesn’t seem enough to justify that leadership has learnt from its mistakes. Having said this, the company is cheap, very cheap, if one thinks that all problems are behind. Paul Blakeley is the right captain for that cruise.

I have seen some comments that suggest that JSE may need another placement in 2024. I would dare to say that the chances seem low at the moment. The company has more than c.$152 million in cash and liquidity of $43 million in a facility provided by Tyrus. With most capex expected in H2, it is unlikely that the cash position will get so weakened that it might require another placement. The major issue is the payment of the abandonment costs for Mimi’s acquisition, but the RBL banks approved the transaction, so it is unlikely the company would be financially stressed at current oil price levels of $75-85/bbl.

JSE has been working in the last year to expand the foothold in Peninsular Malaysia by adding more licences in the same area. This strategy could generate a great return, as the Malaysian teams knows the area, and the synergetic development can generate financial and operational synergies. This should be confirmed in the next 2 quarters, but it is a great decision by the company, as it demonstrates that it is working to diversify its production base without incurring in exploration risks.

If one believes that the situation at Montara has been controlled, NWS and PenMal will experience a reasonable decline, Sinphuhorm will generate an income, Stag’s decline will be under control and Akatara will be delivered on time in H1 2024 (… sorry, I’m lost with all the IFs …), then JSE is a no brainer with an average production in 2024 of at least 21,500 boepd that should be close to 25,000 boepd by the end of the year. The company beat its guidance for H2 2023, why couldn’t it repeat it in 2024?

This post transpires some contradictions, as I have heavily criticized some decisions but at the same time I think there is a potential gain to be realized for those who dare to invest together with Paul Blakeley. I find it very difficult to trust JSE. Would I like that the situation was managed differently? YES. But at the current price, I think that the company will beat the low expectations and, given that happens, investors will buy again. As a fellow investor usually tells me:

Investors like to buy higher, the more expensive, the more they buy!

I must insist that this is not advice. I reduced my position when the guidance was published. I will reconsider increasing it in the case that the share gets closer to the 52-week low point, or selling if I lose all the remaining confidence. Please, do your own analysis and don’t take this as a recommendation. Jadestone Energy remains as a risky investment at the moment and there is a huge speculative component in the expectations of a return. However, the company is not done as many think, but the path to the turnaround will be hard.

Thanks for the content! I feel overinvested here and wish I put a stop loss in for the last update after averaging down but never seem to have more than a few hours free to spend on investment research and usually after work. Took me 2 days to understand the last update and see I could be bag holding this for quite a while. Thanks for explaining the significance of Vietnam, missed that entirely.