Those who follow me on Twitter might remember that I sold my BWE shares in January when I saw contradictory messages during BW Group’s tender offer. It is important to keep in mind that the BW Group owns 74.5% of the shares outstanding, and the Top 10 shareholders (which includes the CEO) as of February 15, 2024, control 86.5% of the company. Thus, the free float is minimal and a reaction can be exponential.

Before we start, I want to share a reflection… This substack has a mixed audience, and most of you are from the US (29%) or US+Canada (36%). Hence, many may not want to or cannot buy the stock. I think that’s part of the problem here. BWE doesn’t attract non-Norwegian investors. BWE was a spinoff of the BW Group, and I suspect that many bought the stock just because of the track record of the BW Group. Most of these investors are not very savvy in oil and gas, but in shipping (BW LPG, Hafnia…), just look at the list of BW Group’s businesses. The CEO, Carl Arnet, doesn’t have a background in oil, so he hasn’t built a reputation around a previous company that he managed to scale and sell. I’m fine with that, but I’d ask you to reconsider this because I believe that when the market opens its eyes, BWE’s rerate will be very fast and steep.

One of the contradictory messages that made me say enough was the CFO’s decision of selling his shares at NOK 27. I fed up with all the confusing messages that the company, BW Offshore and BW Group were sending. I began to suspect that the BW Group could play some dirty tricks to bring the share price to an even lower price before taking the company private.

One aspect that I particularly disliked was how the companies were changing their public statements during the tender offer. First, the price of the tender offer was surprisingly high, NOK 27 vs. NOK 24 that most people expected, as it had acquired a small package to get to the level required to prepare the offer. One could think that this was a trick to increase the number of tendered shares, while it was preparing a higher offer to BW Offshore. Four days after closing the tender, BW Offshore announced the agreement with the BW Group for selling its shares at NOK 32. To me, this looked like the BW Group was preparing to acquire all the remaining shares and was not shy about playing dirty, if necessary.

It was funny that the price didn’t get closer to that NOK 32 price after the transaction was announced; I think NOK 30 was the highest price on the day of the announcement. This confirmed that the market wasn’t eager to pay that price. Poor CFO who sold his shares at NOK 27 …

Everything seemed like an improvisation, and nobody was completely telling the truth, or at least that’s how I saw it. I have come to the conclusion that, despite not liking how the whole process was managed, there wasn’t a hidden plan. So, I decided that this could be another case of Hanlon's razor:

Never attribute to malice that which is adequately explained by stupidity.

How is the sector

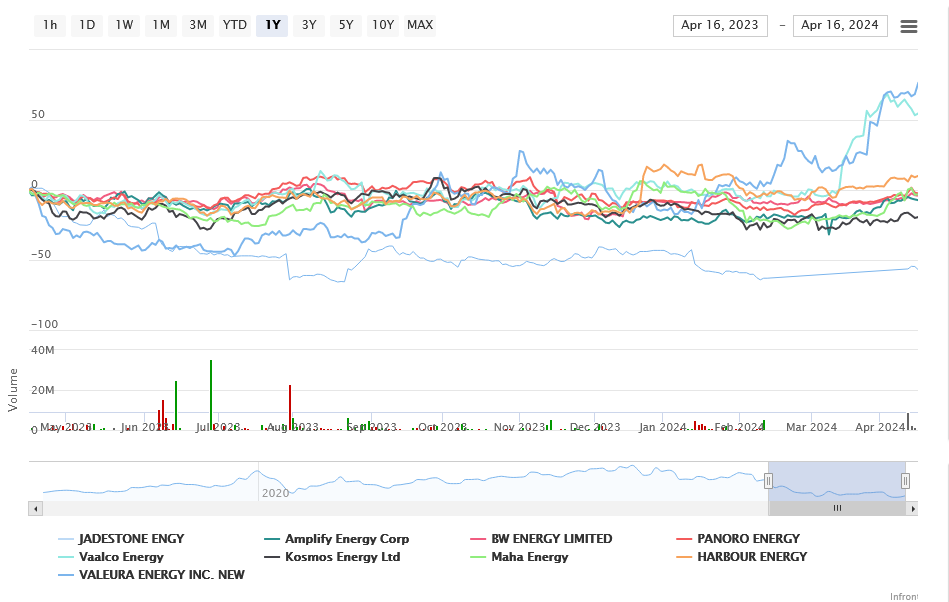

Despite Brent has been above $80/bbl for 2 months and a half and above $85/bbl for a month, not all E&P companies have shown a great performance. There are quite a few oil companies I follow, and I can see that there are two very different groups: those which have performed and those which haven’t. Both BWE and its partner in crime, Panoro Energy, belong to the second group with their share price below the level it was a year ago.

As you should know now, I decided to sell Vaalco and keep Valeura. Just because I see their capital cycles for the next years at very different stages. How little BWE’s share price has moved in the last year is one of the reasons that have led me to buy some shares again. I see an scenario that combines a tiny free-float with a stream of good news making this jump to the NOK 40 level, easily. However, the poor performance of the share is not the only reason why I have decided to return to BWE. This is a quick summary of these other drivers.

Hibiscus-Ruche drilling program is progressing

This was the reason I bought BWE in the first place. he program has experienced many problems with the casing and the ESPs, but it should be completed by year-end. After drilling the Hibiscus South prospect, the company confirmed that the remaining program will consist of a fifth Hibiscus well, finalization of the Ruche well with the issue of the casing, and a Bourdon prospect test well. Hence, we will have during 2024 another 3 producing wells that will contribute to BWE’s revenue.

Interestingly, the planned Bourdon well is an exploration one, so it could confirm an additional expansion target for the future Hibiscus-Ruche phase 2 campaign. I’m confident that if the results at Bourdon are positive, they will progress with the analysis of other prospects and the drilling of the most promising ones. You can see below the list of prospects that the company published in 2020, with Bourdon (Prospect B) showing 50 MMbbls of P50 resources. There are many potential new developments that can be brought into production in the next decade:

The Hibiscus South is online

Only a few would remember the announcement on the 8th of March:

BW Energy is pleased to announce that production has safely started from the

DHBSM-1H well in the Hibiscus South field on the Dussafu Licence offshore Gabon

five months after the initial discovery was made in November 2023. Production

performance from the well has been in line with expectations and is currently

stabilised at approximately 5,000-6,000 barrels of oil per day.

Here, BWE managed to confirm and put into production a prospect in just 5 months. This is a VERY SHORT SPAN OF TIME for the industry, so kudos to the team in charge. This well doesn’t seem to experience the same ESP problems as the previous wells. I just wish they keep finding these low-cost growth opportunities. The Bourdon prospect could be the next one.

The ESP problem will be solved soon

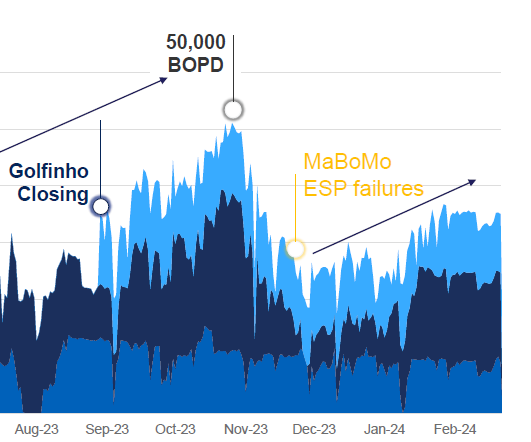

During Q4 2024, they replaced the pumps with a similar model than the one that failed, but they think they have found the cause of the problesm (downhole components). Nevertheless, they have received new pumps from Baker Hughes and are planning to replace them with a more traditional solution. Solving this issue is essential to ramp up the cash flows. This graph from the last presentation sums it up:

The company achieved a gross production of 50,000 boepd (circa 40,000 boepd net) before the ESP crisis began. If this is solved and all wells at Dussafu plus the new wells that the company will drill in 2024 (Hibiscus South + fifth Hibiscus well + completion of the pending Ruche well), the company will easily achieve a net production around 45,000 boepd.

The 2024 guidance said that, in the mid range, the company will produce over 30,000 boepd, but the resolution of the ESP issue is key to confirm whether it will get to the guidance or produce below/above it … Hopefully, we will hear good news soon.

Golfinho now is very profitable

The high OPEX of this field ($44/bbl in Q4 2023) benefits from the high oil prices we are seeing now. This will significantly increase the cash generation. The company took over the FPSO used in this field, so it can introduce cost-efficiency measures to reduce the OPEX to a more reasonable level. The company doesn’t plan to drill any wells here until 2027, so the only progress will come from operational enhancements for lowering the OPEX.

Galp’s and Sintana’s success in Mopane

The 2 exploration wells that Galp has completed in PEL83 have found significant columns with light oil in reservoirs of high quality. These wells aren’t exactly close to Kudu, but they still are in the licence adjacent to BWE’s. These are very good news, as the company had already announced that they have seen “several layers that could contain gas and oil in the Northern quarter of the licence”.

Galp’s updates on Mopane-1X:

Galp (80%, operator), together with its partners NAMCOR and Custos (10% each), has drilled and logged the first exploration well (Mopane-1X) in block PEL83, offshore Namibia.

Building on the previous announcement dated January 2, Galp now confirms the discovery of a significant column of light oil in reservoir-bearing sands of high quality.

Galp (80%, operator), together with its partners NAMCOR and Custos (10% each), has successfully drilled, cored, and logged a deeper target (AVO-2) of the Mopane-1X well in block PEL83.

In AVO-2, Galp has also discovered a significant column of light oil in reservoir-bearing sands of high quality.

Galp’s update on Mopane-2X:

Drilling encountered a significant column with light oil in reservoirs of high quality.

The AVO-3 exploration target, the AVO-1 appraisal target and a deeper target were fully cored and logged.

The AVO-1 appraisal target found the same pressure regime as in the Mopane-1X discovery well located around 8 km to the east, confirming its lateral extension.

Galp is now completing the DST on Mopane-1X and will perform another DST on Mopane-2X. Should these two DSTs confirm that the discovery is commercial and of a size similar to Venus, we are talking about a MONSTER field right next to Kudu.

We already know that they are preparing for drilling a well that will “take multiple bites of the apple”. They have already started acquiring long-lead elements for that well, as I reported on my notes from the Q3 2023 call post (one of the posts with the least amount of reads of this humble substack). In that post, I made a failed assumption, I tried to guess that a positive result at PEL83 could increase the excitement for Kudu, but I was wrong, as the share price has ignored all the positive news reported by Galp:

In the same area, there are other two wells planned within the next 8 months and 18 months, respectively. Chevron has already committed to drilling a well on PEL90 in Q4 2024. Woodside will decide soon on drilling an exploration well on PEL87 next year. These drills will generate additional data that BWE has foreseen to incorporate to the ongoing analyses.

Disclaimer: I own some Sintana Energy, so I’m looking forward to a positive outcome from these DSTs and wells.

My guts tell me that the well that BWE is planning to drill will be included in a multi-well campaign with either Chevron or Woodside. I also think that they aren’t in a hurry, because they are searching for a farm-out to reduce the WI and share the cost with a major. Currently, I observe the presence of Shell, Galp, Woodside, and Chevron, with limited representation from US companies and no presence from the Middle East or Asia. I wonder whether Petrobras would be also interested. Therefore, I believe there could be a lot of bidders for this farm-out and the conditions may be extremely beneficial to BWE, who has the upper hand here. If I had to guess when this farm-out will close, I think it will be after Galp’s DSTs and before Chevron’s well. If you want to wait for this to be announced, I think that this summer - late Q2 or early Q3 - could be when they finally decide on the strategy, keep the majority of the licence or bring in another partner.

Maromba FID

This seems to be finally progressing after many, many, many years of delays. The financing has been the major hurdle in the last few years, but this could be soon over.

The company announced that it has signed a MoU with Cosco Shipping Heavy Industry for the upgrade of the FPSO BW Maromba. The vessel is already in Dalian, where the work will take place. The first oil for Maromba now looks to be 2027, which isn’t close, but BWE could for once get to FID and start considering Maromba something that will actually happen.

At the time of the IPO in 2020, Maromba's first oil was originally planned for early 2024. The FID was planned for 2021, so the development time of 3 years seems to have remained the same:

The estimated cost is $1.25 billion, with $1 billion required for reaching first oil. With the development expected to last 3 years, this results in an annual expenditure of $300-350 million in the 2025-2027 period.

What about Q4 2023?

The company didn’t perform particularly well during the last quarter of the year, with a production slightly below that of Q3 and no cash generation as a result of the asset acquisition (FPSO Cidade de Vitoria for Golfinho) and the committed CAPEX:

How is 2024 looking?

The 2024 guidance isn’t super exciting, but it is contingent to the resolution of the ESP issues and the completion of the Hibiscus-Ruche campaign:

With the guidance provided, the company could generate a FCF of approximately $60-80 million at an oil price of $82.5/bbl, which isn’t great compared with its $765 million of EV. However, the oil price seems to be very solid and the Brent futures are above $82 for the next 12 months. Hence, my estimation of FCF for the company could be overly conservative, as well as the production during the year.

Furthermore, I expect CAPEX to still be high in 2025 due to the Maromba development. The higher production since mid-2024 will also result in higher cash flow generation for the next few years, which will improve the financial situation of the company.

But this is not everything, Vaalco announced upcoming news regarding the exploration Blocks G and H in Gabon. Maxwell mentioned that the situation may advance to a decision by the end of Q2. These are early stage blocks, so their development is still very far in time.

Remember what I said at the beginning, the BW Group may intervene here at any time and take the company private. Why wouldn’t it? As BWE gets closer to a stable net production of 50,000 boepd with enough FCF generation to expand in Dussafu and Brazil while progressing towards drilling at Kudu. Similar moves of the BW Group should be carefully monitored, because it has minor incentives to allow BWE to continue trading as a public standalone company.

As we said in the last post, feel free to subscribe to this substack, but please understand that there won't be a regular schedule for posts, as explained here. I welcome your feedback on these companies or any others you own or have analyzed. I hope posts like these will increase engagement with readers. You can also share your thoughts with me on Twitter or by email to anotheroilgastourist@gmail.com

Disclaimer: the author owns the company mentioned in the post that has been prepared only for informative purposes. This is not investment advice.

The presentation from 28th Feb mentioned that Dussafu YTD production was 16,200 bbld net which seems to suggest the ESP issues were far from resolved at that point. I saw you mention in one of the posts last year that guidance then didnt include Hibiscus South coming online. Do you think the 5-6k bbl/d that came online 8th March is included in the most recent 2024 10-12m production guide ? If so, then isn't the guidance really conservative (or the ESP issues are permanent)? Has the management any history in terms of over/underpromising wrt production? Thanks for the post, good to look at this name again.

Thank you for good article! Always, I have been wondering what is the incentives that BW Group keeps BWE tradable in stock market. What could be such incentives?