BW Energy: does the market care about it?

It keep being ignored despite its strong operational performance and high oil prices

The Brent is currently at $93 a barrel, and this level doesn't appear to be at risk in the coming weeks. Brent was several times close to $70/bbl during H1 2023, but it has been above $75/bbl for all H2 2023. On the other hand, BW Energy (OSL:BWE) has declined in the last months since the highs at NOK 31.5/share, even though I believe it has demonstrated strong operational performance. It has met several key milestones in Gabon and Brazil aside being challenged by a coup in Gabon, where most of its production comes from. I may be a fool that is not seeing something that the market does, but I wanted to share some of these milestones and show how the stock has barely reacted to them.

The current stock price is currently ca. 10% higher than the closing price in 2022. Well, there are some reasons why it may not attract a huge number of generalist investors. BWE is not a dividend stock, oil is a non-ESG sector and there are fears that the demand could plummet to the $60s. Nevertheless, I don’t think all these aspects can be considered relevant enough to cancel the progress of the company in the year.

This is the third article we wore about BWE, the first one described the company and its main assets, and the second one covered why the company has a path of growth until it can start paying dividends.

This is a comment about a specific company, but it doesn’t mean this is the only E&P company that isn’t reflecting the last rise of the oil prices or a superb operational performance. There are other companies that can be considered undervalued, but I think the case of BW Energy is one of the most obvious.

Key events in 2023

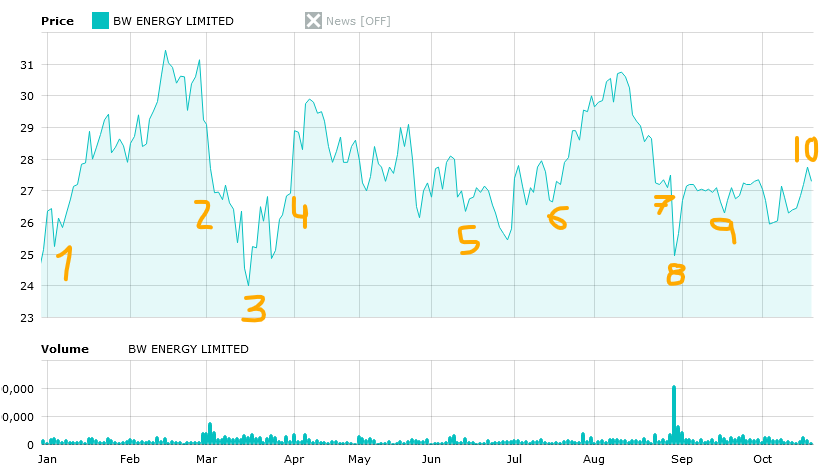

In the following figure, I have marked over the share performance the 10 events ocurred in 2023, which I think that have been more important for the company. Below it, I summarise them and compare the situation of the company and the oil price, trying to add some context and, in some cases, trying to explain the lack of positive response.

First Hibiscus production well spudded: BWe announces the beginning of the drilling campaign with 6 total producing wells, expecting to add approximately 30,000 bopd by early 2024.

Golfinho transactions impacted by temporary suspension of Petrobras divestment program: the Brazilian government announces the halt to all divestment processes, and the market reacts to the suspension of the Golfinho deal. At the same time, the Brent price droped below $80/bbl and the fearmongering brought a lot of negative perspectives about the future of the sector. Some even predicted oil prices going below $60/bbl.

Golfinho transactions proceeds towards closing: Petrobras confirms that the sale of Golfinho is not affected by the suspension and BWE can carry on with the process. The Brent keeps the downtrend and momentarily goes below $75/bbl, but it reaches an inflection point and begins recovering from here.

First oil from Hibiscus / Ruche development: the first well of the drilling campaign begins production at 6,000 bopd, above expectations. The Brent keeps recovering and goes above $80/bbl.

Starts production from second Hibiscus / Ruche well: the Brent declines again and stays in the $72-77/bbl range, BWE reports that the second well is brought onstream, again at 6,000 bopd and above expectations. The market reaction is none, in fact the share price declines, ignoring the increase of production.

Start-up of the new gas lift compressor on the BW Adolo FPSO & Starts production from third well in the Hibiscus / Ruche development: This time the market reacts positively to the news as the production from Tortue increases and a new well at Hibiscus / Ruche adds another 6,000 bopd. Additionally, the Brent begins an uptrend and the fear of seeing it at $60/bbl begin to be dismissed.

Second quarter and first-half 2023 results & Completes Golfinho acquisition and becomes operator offshore Brazil: A surge of the share price after the last increment of production is followed by a progressive decline. The company announces the Q2 results (weren’t great due to additional costs, a problem with an ESP and the delayed production from Tortue) and the long-awaited closing of Golfinho deal (which added 10,000 bopd at closing). These news made the net production from Dussafu and Golfinho to be above 30,000 bopd. However, the market didn’t have much time to process it as the next event unfolded right after.

Gabon coup: The former president of Gabon, Ali Bongo, suffered a coup by part of his own family. In the end, the situation didn’t change much; the production wasn’t affected in any way and everything is business as usual.

Starts production from fourth well in the Hibiscus / Ruche development: another successful well is completed with 6,500 bopd added. The company also provides more details about the issues withe ESPs of DHIBM-3H and -4H, which expect to solve. BWE reports gross production is at 26,500 bopd, inclusive of these technical issues.

Update on the Hibiscus / Ruche development program: the company announces that the troubles affecting the DHIBM-3H and -4H wells have been solved and production is at 30,000-35,000 bopd in Dussafu. Hence, BWE’s net production is at 32,000-35,000 bopd. The market reaction is minimal.

Situation and what to expect

While the Brent has had its swings in the year, it still is $12/bbl above the closing price in 2022. Doubts surround the demand for oil due to persistent recession fears, but the supply remains constrained by OPEC, primarily Saudi Arabia. The risk of a decline in oil prices is currently lower than it was a few months ago, with most estimates hovering in the $80-100/bbl range.

During Q3, the company has been producing at record-level, and it has planned a lifting that ought to have been sold around $85/bbl. The current quarter looks even better, thanks to the monthly liftings that will reduce the exposure to the volatility of the oil market, with the first one expected this month with the price around $90/bbl.

I must insist, the performance of the underlying business is not reflected in the price. To add some context, the production in Q4 2022 and FY 2022 were 9,600 bopd and 10,600 bopd, respectively. Currently, BWE is producing three times what it produced in FY 2022 after closing Golfinho while continuing the Hibiscus / Ruche campaign, yet the stock is just 10% above the closing price of 2022.

I may be absolutely wrong about this one, but there seems to be a disconnection between the company performance and the market. I know that many E&P companies haven’t seen the gains in the oil price in H2 2023. Other E&P companies operating in Gabon (e.g., Vaalco Energy or Maurel et Prom) have also been disconnected from the surge in the oil price since the coup, but they haven’t increased production as BWE has. Hence, this decorrelation may continue and the stock price may stay at the current NOK 26-27 levels, or the market may at some point realise that it has been missing on a very good opportunity.

After the IPO, the company was above a “fair value” and the production increase in Gabon was already priced in. I think right now the valuation of the company has gone to other extreme; it is producing above the expectations in Gabon and has closed the Golfinho deal. Right now, it has a series of catalysts in the next months: is nearing a FID for Maromba and could announce soon the results of the analysis of the seismic data from Namibia.

In any case, I am confident in the company’s future. It is currently performing well, although it may encounter some challenges along the way. I plan to hold my position, I could even increase it if the market keeps ignoring it, as I’m sure that BWE will deliver a substantial return through either dividends or share price increase. If you have other opinion, please, feel free to share it in the comments.

Edit: BW Offshore has distributed 2.15% of BWE’s equity to its shareholders in February, June and September. It is a noticeable amount but not enough to justify the underperformance.

Disclaimer: at the moment of writing this article, I hold shares of BW Energy. However, I may buy or sell shares at any time. This document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes.

I also own Panoro and had be energy on watch list. They are at an inflection point of more oil and less cap ex and many more lifting in q3 and q4. Ty for comment

I’m long Kosmos that is a partner in some of these plays. Good update