Logan Energy Corp. is a Canadian company based in Calgary that will be listed next 18th of July on the TSX Venture market under the ticker LGN. It currently has a modest production of around 4500 boe/d from its Pouce Coupe, Simonette and legacy BC Minors assets. Additionally, it has 55,769 net undeveloped acres in the Flatrock property, which stands in the North East part of the British Columbia Montney formation.

The company is a result of the spin-out of Spartan Delta Corp’s before-mentioned assets after the restructuring that took place with the sale of Gold Creek and Karr properties to Crescent Point Energy (CPG) last 10th of May. Hence, Logan Energy Corp. is the latest iteration of a strategy that has proven successful time and again.

With a clear vision, high-quality assets, and a disciplined financial strategy, Logan Energy Corp. is poised to become a significant player in the E&P sector. Hence, we will present all the aspects around the company so everyone knows the catch as this new E&P titan in the making makes its debut, should opportunity arise.

Note: all amounts in $ shown in the article in CAD dollars, as it is the currency the company uses to report.

If it works, don't change it

Logan Energy is the latest brainchild of Richard McHardy and Fotis Kalantzis, and it represents the opportunity to expose yourself to a winning strategy. Their approach is elegant in its simplicity: amass an inventory of premium assets and boost production through efficient practices to generate value for shareholders.

However, this strategy extends beyond mere asset development. Both McHardy and Kalantzis have demonstrated a remarkable skill in identifying and acquiring undeveloped or undelineated acreage in British Columbia and Alberta provinces, subsequently transforming them into highly productive assets. Hence, their strategy is fundamentally rooted in the conviction that expansion and outlining of drilling inventory are key to delivering robust equity returns. This ability has become even more critical given the increasing scarcity of high-quality drilling inventory, though Spartan's team has demonstrated through the years there is still good acreage.

Amidst pursuing growth, Logan Energy maintains an unyielding commitment to operational excellence and cost discipline. By implementing reliable execution strategies and maintaining rigorous cost control, the company ensures optimal well delivery.

Logan's strategic approach is further highlighted by its careful assessment process for capital deployment and potential acquisitions. The company adheres to a high full-cycle investment hurdle rate, ensuring that all investments yield a high rate of return on a full cycle and risk-adjusted basis. Furthermore, Logan prioritizes maintaining a conservative balance sheet and appropriately sized contractual commitments. This approach enables the company to support production growth while providing a safeguard against potential downturns in the volatile commodity market.

Logan Energy gets its name from Mount Logan, Canada’s highest Mountain in Yukon’s Kluane National Park. Mount Logan was named after Sir William Edmond Logan who was a Canadian-born geologist and the founder of the Geological Survey of Canada. However, they are not rookies but rather the new company of the Spartan family of companies, which applied the aforementioned strategy successfully.

McHardy and Kalantzis have been through several companies that were matured and exited in the last 13 years:

Spartan Exploration

Spartan Exploration embarked on an ambitious strategy of asset accumulation between 2008 and 2010, acquiring valuable Cardium, Bakken and Shaunavon properties. This was followed by a significant reverse takeover (RTO) recap transaction of a TSX listed company. The outcome of this RTO in the first quarter of 2011 was a remarkable performance; production per share growth exceeded 425%, and cash flow per share growth soared past 650%.

Spartan Oil

Spartan Oil was established through the spin-off of certain assets from Spartan Exploration. The company quickly established a large, contiguous position in the Pembina Cardium, drilling 80 gross wells. Within a span of less than two years, Spartan Oil demonstrated phenomenal growth with production per share increasing by more than 500%, and cash flow per share soaring by over 1000%.

Spartan Energy

The company adopted an acquisition and development strategy that propelled its growth from a modest 650 boe/d at its inception to approximately 22,750 boe/d in just a four-year period. During a period of commodity volatility, the company demonstrated effective capital stewardship in a time where the cycle was not favorable. The strategy yielded above-market returns in an era when the overall sector was struggling to stay above water.

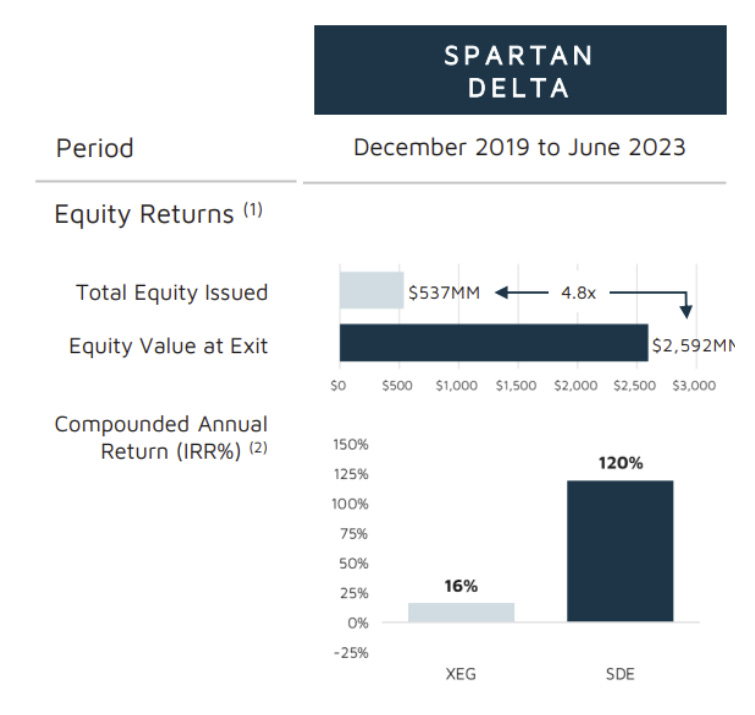

Spartan Delta

An astute acquisition and development strategy catalyzed the company's growth from a mere 250 boe/d at its inception to over 80,000 boe/d, using $537 million of raised equity to create ~$2.7 billion of equity value. The company's knack for identifying and acquiring high-quality undervalued assets contributed to its success, as it gathered an important position in Gold Creek and Karr, through several acquisitions (e.g. Velvet Energy for US$595M in 2021).

The assets recently sold to Crescent are currently yielding the majority of the top oil and condensate wells in Montney in terms of production and IRR, and that’s not an accident or serendipity.

The team behind this well-oiled machine

The secret behind the Spartan Family of companies is the role of Richard McHardy and Fotis Kalantzis who have designed and implemented this successful strategy. However, the rest of the management and board of directors shouldn't be underlooked.

Richard (Rick) McHardy is President and Chief Executive Officer (CEO). It has been Executive Chairman and co-founder of Spartan since December 19, 2019. Prior thereto, President, Chief Executive Officer and a director of Spartan Energy from December 2013 to May 2018. He holds 23,660,822 shares or 4.88% of the fully diluted shares if all the warrants are exercised.

Brendan Paton serves as the Vice President, Engineering and Chief Operating Officer at Spartan. Prior to this role, he was the Vice President, Engineering, and also served as the Manager (Engineering). Before joining Spartan, he held the role of President at Canoe Point Energy Ltd. and worked as a Production Engineer at Shell Canada Limited. He owns 10,268,640 shares, equating to 2.12% of the fully diluted shares.

Ashley Hohm holds the position of Vice President, Finance and Chief Financial Officer at Spartan. Before assuming this role, she served as the Vice President, Finance and Controller. Prior to joining Spartan, she was the Vice President, Finance at Kelt Exploration Ltd. She possesses 8,493,262 shares, which represents 1.75% of the fully diluted shares.

Craig Martin serves as the Vice President, Operations at Spartan. Prior to this, he held roles at Spartan as Manager, Drilling and Completions, and before that, he was a Professional Engineer with Vermilion Energy Inc. He holds 11,564,184 shares, accounting for 2.38% of the fully diluted shares.

The board of Directors is composed of distinguished individuals but all related to the Spartan family. The board includes:

Fotis Kalantzis, Chairman, 20,946,030 shares (4.32%).

Donald Archibald, president of Cypress Energy Corp. and on the board of many companies of diverse nature, 7,009,420 shares (1.45%).

Reginald Greenslade, independent businessman and director of Cleantek Industries Inc., 6,983,668 shares (1.44%).

Geri Greenall, CFO of Spartan and director at Kelt Exploration Ltd, 6,125,190 shares (1.26%).

Sanjib Gill, Corporate Secretary and Partner at Stikeman Elliott LLP, a national law firm, practicing primarily in the areas of corporate finance, securities and mergers and acquisitions transactions, 2,857,200 shares (0.59%).

Pat Ward, president, CEO, and director of Aqua Solutions Inc., previously, founder, director, President and CEO of Painted Pony Energy Ltd. until it was acquired by Canadian Natural Resources Limited, 1,438,600 shares (0.30%).

Ron Hozjan, director, VP of Finance and CFO of Aureus Energy Services Inc., previously, CFO and VP of Tamarack Valley Energy, 1,000,000 shares (0.21%).

In total, management and the BoD own 11.13% and 9.57% of the company, respectively. With over 20% ownership, there is a clear alignment of interests with the shareholders.

Logan Energy will build on 13+ years of experience in the same area and sector. With this seasoned team with a large ownership and a strong back-record, Logan is in the best hands. The strategy is clear: excellent capital allocators with a roll-up plan to grow both production and acreage until the inherent value is recognised by the market.

Assets, acreage and reserves

Logan’ assets span a triad of properties, covering the north-east British Columbia Montney acreage of Flatrock, and the Pouce Coupe and Simonette fields in Alberta’s Montney.

All the assets are in the volatile oil to wet gas window of the Montney, with Simonette covering more of the spectrum.

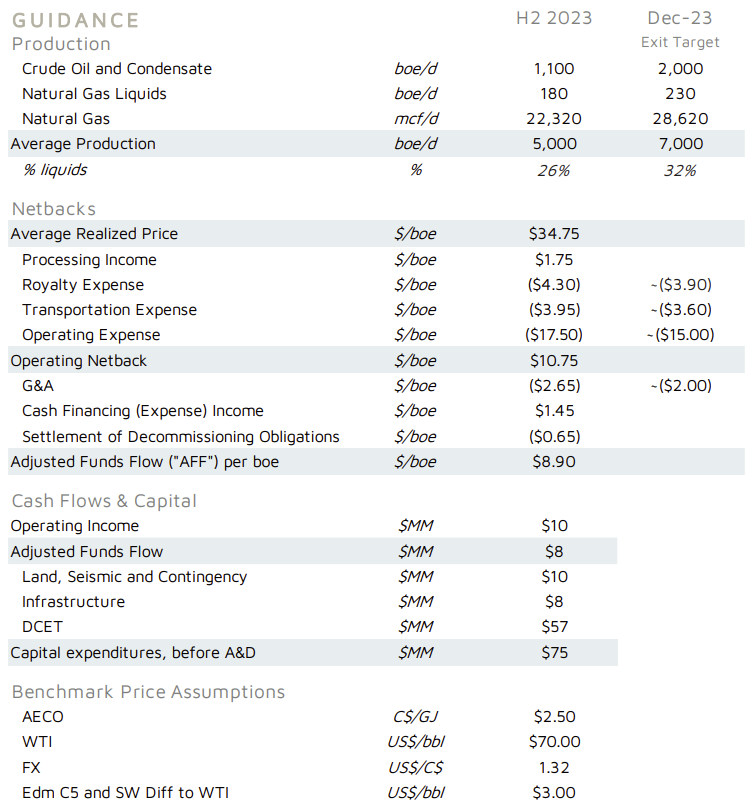

The company's management has envisaged that these assets are a perfect target to apply their strategy for its future growth. The focus in the near term is on revitalizing the historically underinvested asset base. Modern well designs are planned to deliver significant production growth, particularly by targeting liquid-rich opportunities within these assets. This focus is expected to lead to outsized growth in liquids production and an increase in operating netback. Within this time frame, a significant focus will be on Pouce Coupe and Simonette due to their promising potential for development and expansion, building on the existing processing and transport infrastructure. As part of this initial stage, drilling operations will commence in July 2023, with the first new production anticipated in Q4 2023. The budget includes growth-oriented non-DCET (Drill, complete, equip and tie-in) investments, a quarter of which will be directed towards initiatives like debottlenecking infrastructure, capitalizing on land opportunities, and implementing opex reduction measures.

As the company moves into the mid-term, the strategy shifts towards large-scale drilling and infrastructure buildout, which will support continued growth and help drive down the cost structure, enhancing netback. A significant aspect of the mid-term plan is to increase the liquids yield over time, thereby improving the cost structure even further. Additionally, Flatrock is expected to see a significant increase in capital allocation from the third year of the plan onwards, after a near-term emphasis on land retention and delineation. The only planned well in the Flatrock area during H2 2023 is for land tenure.

Looking ahead to the long-term, the company aims to maximize the potential of its assets and transition to free cash flow generation. It has confidence in the high-quality inventory's capacity to sustain the business for over a decade and is committed to continuous improvement and expansion of the inventory. However, if Logan managed to quickly increase production and complete opportunist acquisitions of land like in the past, this new venture could be exited before than expected.

In terms of budget considerations, while well costs may be elevated due to single well pads in this first drilling program, the G&A, operating, and transport costs are predominantly fixed. As production grows, these costs will be significantly diluted on a per-unit basis. Additionally, the budget accounts for contingency capital to ensure preparedness for any unforeseen circumstances. Based on these strategic plans, management expects growth of over 50% into 2024. Future drilling programs will benefit from the existing pads and infrastructure being constructed, increasing the efficiency of the development CAPEX.

Current reserves look like this:

As the acreage has not been delineated, reserves should be taken cautiously, as they are a conservative value, for example no reserves are assigned to Flatrock. Little to none drilling has taken place in recent years and thus, reserves values are hugely affected. Once they start drilling again, reserves will see a dramatic shift upwards that will be reflected on the 2024 Reserves Report.

Also, current liquids percentage of around 25% is not indicative of future weight on the mix. It is the consequence of (again), a lack of drilling on the assets. With shale/unconventional sandstone wells, Gas/Oil Ratio (GOR) increments through time, as gas declines slower than oil. We expect liquids to reach 30/35% once they start their growth-oriented drilling campaign. Also note management knows the upside comes when growing production focusing on the more liquids rich areas.

But in any case, let’s explore the assets one by one so everyone can understand the rationale of the growth plan.

Pouce Coupe

The Pouce Coupe estate is characterized by low risk, high return development opportunities, especially in the Southern oil play segment. Located in Pouce South, this play offers repeatable production growth and strong cash flow generation, mainly owing to the substantial inventory of our highest ranking wells.

Currently there are 7 Logan Montney wells utilizing modern designs and 9 traditional Logan Montney wells, producing a net output of 1,516 barrels of oil equivalent per day (boe/d) with 36% liquid products. Pouce Coupe covers 74 net Montney sections and approximately 98 net Mid Montney locations identified.

However, it's worth noting that infrastructure and gas egress are likely to constrain the near-term growth. To address this, Logan is currently developing long-term infrastructure solutions. Several viable options are under review, which, once implemented, will ensure that the asset's growth is elevated to an appropriate plateau.

The Pouce Coupe estate is divided into three primary play segments. First, the Southern oil (D1) play segment is poised to receive all near-term Pouce capital due to its high-ranking inventory. Second, the Northern gas condensate (D1) play segment, defined by high porosity and gas migration, adds significant inventory depth and provides an optionality to higher gas pricing. Lastly, the Upper Montney (a secondary target) presents an additional opportunity, suggesting a broader spectrum for development.

The asset also houses the Charlie Lake formation, a potential additional source of growth, as some peers have already explored with huge success. BOEreports has highlighted how Charlie Lake oil wells are consistently becoming one of the lowest breakeven plays, with the 2 most productive wells drilled in the formation by Kelt Exploration. This shows how prolific the acreage is and all the hidden upside that it can deliver.

More specifically, for Pouce South oil, they have a well-defined play segment and type curve, controlled by well regulations, 3D seismic data, and several modern design producing wells. The go-forward plan includes multi-well pad development, leveraging the plug and perf approach.

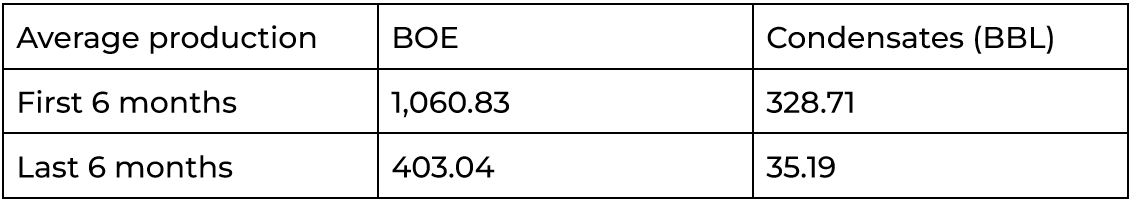

We could not find any information regarding operating wells available in the tools we use (don’t have yet a subscription to Petro Ninja or similar options 🙁), but if we look at some wells drilled recently by neighbors Birchcliff Energy or Canadian Natural Resources, we can see how wells drilled in 2021 like BIR 5-7 HZ PCOUPES 13-13-79-12 achieved exceptional production rates:

CNRL HZ PCOUPE 13-8-79-12, drilled in 2018, also offered impressive rates in the last 6 months after 4.5 years in production:

Wells drilled later on like BIRCHCLIFF HZ 102 PCOUPE 12-12-79-13 which was brought to production in 2023 offered worse initial production rates (certainly affected by the less percentage of condensate) but in any case, offering a good IRR at current strip prices.

We hope that the new strategic development approach management’ mentions will unlock the estate's full potential. The infrastructure is the real bottleneck here and thus, addressing the limitations that the asset currently faces is the priority.

Simonette

The Simonette estate is characterized as an opportunity-rich asset, with existing infrastructure providing a compelling growth opportunity. The asset was initially developed by Cequence Energy and later acquired by Spartan. This play, with its 51 Montney wells, forms a promising asset for oil and gas production. These wells are situated primarily within the gas condensate window. Despite the absence of drilling activity since 2017, these wells delineate the fluid properties and reservoir quality of the Simonette property. Their key function has been to accurately define the asset's subsurface properties.

Logan holds net rights to 141 Montney sections, with approximately 214 net Montney drilling locations identified. The percentage of liquids produced stands at 18%. As of June, Logan's production in Simonette was 2,636 boe/d. Nowadays, there are no wells drilled and completed with the modern design chosen by the team, instead there are 32 producing wells with the legacy design. The natural gas in Simonette has less than 15 ppm of H2S, making it cheaper to treat and less prone to cause sour gas associated damage, without any revenue from sulphur sales though.

However, Logan perceives the well designs and the drilling depth of these legacy wells as suboptimal. These wells were completed with outdated landing depth and low-intensity fracs, which could be significantly improved. Even so, the legacy well results could potentially turn a profit in today's market. Taking this into account, Logan sees an untapped opportunity to enhance these historical outcomes. Logan plans to apply a new development strategy across both the gas condensate and oil windows of the Simonette property.

More specifically, in the north oil window of Simonette, the existing wells have legacy low-intensity frac designs. However, these wells have been producing some of the highest oil Estimated Ultimate Recoveries (EURs) on a per-frac basis in the Montney fairway. For instance, a 2013 analog well, with 12 fracs, is projected to recover 200 mbbl. Drawing from their experience in Gold Creek, Logan plans to implement a well design with more than 100 fracs, expecting an increase in oil recovery.

On the other hand, in the south gas condensate window of Simonette, the legacy wells are largely under-stimulated and landed very high in the section. Logan believes that a modern well design with a new landing depth should yield better overall recoveries and increased liquid yields deeper in the section. Offsetting wells provide support for this thesis.

Regarding infrastructure, Simonette counts with a 50% working interest in a 120 mmcf/d gas plant and an extensive network of gathering and disposal infrastructure, Logan is well-positioned for the property's development and expansion plans. Major infrastructure is already in place, only requiring debottlenecking and gathering expansion going forward.

The 50% of this plant was sold by Cequence to Kanata Energy in 2015 for $54M, a year in which the facility was enhanced to provide dual access capabilities to both TCPL (NGTL) and Alliance transportation systems and adding a new shallow cut refrigeration process to increase the condensate recovery. Although those are sunk costs, we should consider the working interest on infrastructure as the Simonette Gas plant when trying to assess the value of Logan. For instance, the expansion of the near Keyera Simonette Gas Plant cost $90M in 2015 for a 100 mmcf/d processing addition. All this infrastructure owned now by Logan, such as pipelines, compression stations or oil batteries, seems to be currently priced by the market as a 0. However, Logan has already recorded revenue from its processing business, thanks to previous investment.

As mentioned before, Simonette was first developed by Cequence Energy before its acquisition by Spartan, and the development plans are still available online in old presentations, which show the value that Cequence, and later Spartan, assigned to the area:

Just with these two slides we can gather a lot of information. In our opinion, the most notable one is the contrast between the 2018 and current reported reserves and NPV10. In fact, using the numbers of Cequence, Simonette has more value than the total Logan company nowadays, which we believe makes little sense.

This deep knowledge about the acreage is also represented by Donald Archibald (chairman of Cequence Energy), who has been part of the Spartan Family since its beginnings as a director, becoming a director of Spartan and now Logan. Hence, Logan has amassed a deep understanding of Simonette, where substantial infrastructure capex has been deployed also during Spartan ownership, as can be seen in Spartan’s “Corporate Update” in February 15, 2022 (although no wells were finally drilled, preparation capex was spent):

As part of the Company’s revised 2022 capital budget of $330 million, Spartan plans to complete three Montney wells drilled in the fourth quarter of 2021, drill an additional 19 net wells in the Montney focused in the oil-weighted areas of Gold Creek and Karr and 18.5 net wells targeting both light oil and liquids-rich gas in the Spirit River and Cardium horizons within the Deep Basin. The addition of $30 million of capital to the budget for 2022 compared to prior guidance of $300 million will be used primarily for facility preparation ahead of the 2023 program and the drilling of two wells at Simonette, which are expected to demonstrate the property’s unrecognized value through an improved development strategy and will produce to Spartan owned infrastructure with excess capacity.

Also, we can see how Simonette’s condensate production is around 35 bbl of condensates per mmscf of natgas. So, every 5 mmscf of natgas results in ~185 bbl of condensates with the old design. Future wells should show even better production curves and better economics.

In conclusion, the Simonette property presents significant potential for improved results, with the opportunity to optimize the development strategy and well design. By leveraging the available infrastructure and their rights in multiple prospective horizons, Logan plans to tap into this potential. The capital needed for the proper development of the asset was never deployed until now. Logan has both the knowledge and the capital to materialize Simonette's inherent value.

Flatrock

The Flatrock property is an undeveloped Montney tract, ripe for gas condensate and oil extraction. The subsurface properties in Flatrock compare favorably with other successful Montney projects and with successful delineation drilling, Logan is confident that the potential in Flatrock is significant.

The asset in question is a large, contiguous land base spanning over 55,000 acres, all of which hold 100% Working Interest with no encumbrances. Easily accessible throughout the year, the majority of this expanse lies on freehold surfaces, outside the high-value regions of Blueberry River First Nations (unlike Coelacanth Energy, as we explained in the article, which experienced huge delays due BRFN’s claims for the application of Treaty 8). This property boasts of high-potential greenfield development in the Montney gas condensate and oil window, promising rewarding opportunities. The subsurface properties exhibit high-quality characteristics, with a multilayer Montney potential. The Upper Montney mirrors the gas condensate of Kelt Exploration’s Oak asset located to the north, while the Lower Middle Montney (D1) resembles Vermilion Energy’s Mica asset (oil) situated to the south. The asset also has an exclusive advantage of proprietary 3D seismic coverage, providing invaluable geological insights.

Today, Logan’s strategy for this vast asset primarily aims at land retention, delineation, and proving out well economics in the near term. As part of these plans, one land tenure well is budgeted for drilling in the latter half of 2023. Over the long term, Logan will be responsible for full field development, which includes the construction of a central battery and implementing efficient multi-well pad drilling processes. The asset holds a significant portfolio of Montney potential with 87 net Montney sections and approximately 244 net Montney drilling locations. These elements in combination offer a robust framework for successful development and high returns.

As it is surrounded by Kelt Exploration to the northwest and Coelacanth Energy to the south, Logan will apply the learnings of these companies and will benefit from the service companies experienced in drilling and completion operations within the same reservoirs. Similarly, Coelacanth will apply the techniques being currently mastered in Vermilion’s Mica development, so once we see the curves of the first Coelacanth wells, we could try to estimate how Flatrock’s production could look like. Regarding Kelt’s Oak, the operator announced in its Q1 report:

After more than a year of production history from wells that were put on production in late 2021 and early 2022, Sproule has increased their EUR estimates with an improved type-curve forecast on a Montney horizontal well. At December 31, 2022, Sproule’s estimated EUR per well is 1.3 million BOE, up 34% from their previous estimate at December 31, 2021 of 968,000 BOE.

Of course, these are promising results, but furthermore they state:

During Q1, Kelt put on production two additional Montney wells at Oak that were the first to be drilled in a wine rack methodology. Wine racking wells in the upper Montney will allow for increased inventory. After just over 90 days, both wells are currently exceeding the latest Sproule type-curve estimate. Kelt expects to drill five wells and complete six wells at Oak during 2023. Kelt has arranged for gas produced from its Oak property to be sold at various pricing point hubs including Station 2, Chicago ACE, Marcellus TZ4-L300 and Sumas. With recent weakness in Station 2 prices and with anticipated further volatility during the summer relating to industry pipeline and facility maintenance, the Company has temporarily deferred the drilling of seven wells at Oak that were previously planned for 2023. The Company’s capital expenditure program remains flexible, and the drilling and completion of these wells could be reinstated with positive movement in Station 2 gas prices.

Thus, productivity is high and there are several hubs where the natgas can be sold, but still low prices are impacting the financials and Kelt Exploration decided to postpone capex. Kelt hasn’t yet reported the information regarding production on those 2 wells, at least in the well information provider we use. However, wells drilled in 2020 and 2021 such as KELT LNG HZ OAK A05-33-086-18 and KELT LNG HZ OAK B06-35-086-18, which are expected to be worse than the newer ones, achieved respectively:

Impressive numbers where the percentage of liquids in the early stages of production accounts for 35% of total production.

Future pricing or oil and natgas

Kelt’s decision to halt the drilling of new wells is a good indication of future pricing, as it is a trend among many US and Canadian producers. Logan will begin its venture with substantial cash in hand and a drilling program when natgas prices could recover above the $3/mcf thanks to capex cuts. There already is a progressive recovery of the prices at some hubs, for example Sumas in the Northwest US-Canada border.

In addition, as we explained in the Coelacanth article, we think that the Station 2 and Sumas hubs are price indexes more interesting than AECO, not only in the midterm, but also to gain exposure to the Canada LNG west coast thesis in the coming years.

One aspect to consider is the completion of the Transmountain Pipeline Extension (TMX), expected in Q1 2024. The TMX will increase the export capacity by 590,000 bbl/d of Western Canada, and there will be an excess export capacity of 200,000-300,000 bbl/d in 2024. Thus, producers could increase production in 2024-2026 without the bottleneck of the export infrastructure, until the excess capacity is filled. TMX will impact the Western Canada Select (WCS) geographical spreads in the US Mid-Continent and Rockies. Despite the different oil natures of WCS (heavy sour) vs. WTI (light sweet), the availability of the TMX will potentially lower the spread to US$10-12/bbl. The situation in 2024 will depend on the decision of the OPEC+ regarding production cuts of heavy or light oil. Also, the overrun costs in the construction of the TMX have increased the transportation costs, with a toll of between US$8/bbl and US$10/bbl for heavy oil. As of today, only Cenovus, CNQ, Suncor, and MEG Energy have committed capacity, consuming 60% of the total capacity. Nevertheless, the TMX will benefit all Western Canada producers.

Financial situation and valuation against peers

As part of the listing process, Logan has closed two placements:

non-brokered private placement of 64.3 million Logan Units at a price of $0.35 per Logan Unit (one Logan Share and one Logan Financing Warrant) for aggregate gross proceeds of approximately $22.5 million; and

non-brokered private placement of 74.3 million Logan Shares at a price of $0.35 per Logan Share for aggregate gross proceeds of approximately $26.0 million.

Thus, the company will be listed with $47.5M of working capital surplus, with plans for using $42.3M for its CAPEX program and $5M for G&A expenses. Logan didn’t pay any finders' fees or commissions in connection with the Financing. At this moment, the company doesn’t have a shareholder remuneration in place and it contemplates that all available funds will be invested to finance the growth of Logan's business.

The vesting of the Financing Warrants issued with the first placements is subject to reaching $0.7 (⅓), $0.7875 (⅓) and $0.875 (⅓) in the next 5 periods after the issuance. Hence, the first level doubles the price of the placement, showing how ambitious the founders are. In our opinion, the initial price should be above $0.35 and below $0.7, but it will depend on the premium that the market assigns to Logan, which is difficult to estimate right now.

In addition to these placements, Spartan issued 173,201,341 Logan Transaction Warrants to its shareholders as part of the spin-out, which can be exercised at $0.35 per Logan share before 31 July, 2023. If all Transaction Warrants are exercised, Logan will receive another $60M, increasing the combined funds received by Logan to $100M in cash, plus the future exercise of the Financing Warrants, which will result in an additional $50M in total.

In addition to this cash, Logan will have approximately $60.6 million of tax pools available, primarily Canadian Oil and Gas Property Expense and Capital Cost Allowance deductions. However, the Canadian federal government may change the fiscal framework to avoid the use of such tax pools in the o&g sector.

Considering that Logan is relevant in both production (~4,500 boepd estimation for June 2023) and exploration (556 drilling locations), we have looked at two E&P peers in Montney to compare Logan against:

Kelt Exploration, E&P company with production and acreage in Montney, production in Q1 2023 of 31,833 boe/d. Kelt can be seen as a more mature version of Logan, or, how Logan could look like in 5-7 years from today. Currently, Kelt has a Mcap of $1,165M and a net cash position of $5M, hence, Kelt is currently trading at $36,440 per flowing barrel. This multiple is similar to the one that Spartan paid for Velvet (when it acquired Flat Rock, Pouce Coupe and, mainly, Gold Creek and Karr) of $36,083 per flowing barrel. However, Kelt has already grown its production in the last years with 40% of liquids and this deserves a premium; hence, applying a multiple of $30,000 per flowing barrel to the YE production target, the valuation of Logan would be $210M.

Coelacanth Energy, junior E&P company with all its acreage in Montney, recently received the approval for its drilling program and had a legacy production of 290 boepd in Q1 2023. All its acreage is adjacent to Logan’s Flatrock, and it is applying Vermilion Energy’s drilling and completion technique from its Mica field. It expects to end the year with less than 2,000 boepd but progressively increase it to 20,000 boepd by 2026. The Mcap is $365M with no debt and $61M of working capital surplus. As in the case of Logan, its reserves are underestimated, as more drilling is required to transform the OIIP and GIIP into Proven and Probable reserves. With just 4.5Mboe of Proven+Probable reserves, the EV per 2P barrel is $67.5/boe. Applying this multiple to Logan’s 14.47Mboe of net Proven+Probable reserves (93% WI Pouce Coupe, 92% WI Simonette and 100% WI BC), the valuation would be $971M, and Mcap of $1,019M considering the $48.5M from the placement, which is insane.

As it can be seen, there is a large uncertainty of the potential valuation of the company. Coelacanth could be seen as the more similar peer, but it has a lower initial production base than Logan, so its valuation multiple should be lower than Logan’s, which wouldn’t make sense. The listing will include 549.2 million shares, fully diluted, and using the valuation from Coelacanth this will result in $1.77 per share, which is obviously excessive. On the other hand, using Kelt’s reduced multiple of $30,000 per flowing barrel, the valuation would be $0.25 per share. To be more realistic with the short-term drilling plans, the exit rate for 2023 could be more meaningful to this valuation effort, as the company targets 7,000 boepd, increasing the liquids to 32%. Using these figures, the valuation will grow to $0.38 per share, which is closer to the price of the placement of $0.35 per share.

The higher valuation multiple of Coelacanth shows the upside of the Flatrock acreage alone, which is not even providing any reserves to the company, yet. Hence, the Flatrock area alone could justify a valuation of $200-300M once its development begins, in the case it demonstrates a similar potential than Coelacanth’s acreage.

The reserves report by McDaniel results in a gross NPV10 of $54.9M ($0.1/sh) and a NVP15 of $45.5M ($0.08/sh) of the Proven+Probable reserves in the BC Minors, Pouce Coupe and Simonette areas. This calculation does not include any reserves from Flatrock. This shows how difficult it is to estimate the true value considering all variables. Making a SOTP analysis could be the right way to approach the valuation, but the total number of available locations is huge and there isn’t a drilling program in place for the development of all the areas, which would make it a theoretical effort of little value.

Keep an eye the first trading days

In conclusion, Logan Energy Corp presents a compelling investment opportunity in the energy sector. Its strategic positioning in the Montney formation, coupled with its robust portfolio of assets, positions it well for significant growth. The company's successful development strategy, focused on land retention, delineation, and proving out well economics, further underscores its potential for high returns.

Logan's financial situation is also robust, with a working capital surplus of $47.5M - assuming no warrants are exercised, an idea we find utterly improbable - which will be invested to finance the growth of Logan's business.

The valuation of Logan is difficult to estimate and thus, we will be observing the initial price next Tuesday to see whether opportunity arises. We think little attention has been paid to these properties and many retail and institutional investors aren’t long in the o&g sector, particularly in dry or wet gas producers in Canada. Besides, having a different name (Logan instead of the common Spartan) may confuse some investors although the strategy and the players involved are the same. Some former Spartan shareholders may decide to sell part of their shares in Logan during the first days of listing to use the funds to exercise the warrants, which will not be listed. Nonetheless, the company's significant growth potential, inventory and exploration optionality, as well as its strategic positioning, suggest a promising future.

Finally, it's worth noting that one can see Coelacanth Energy as an acquisition target in the near future, replicating the “Land Position Assembly” strategy that Logan completed Gold Creek as Spartan Delta. Although the market is expecting Vermilion to buy the acreage they could not get with the Leucrotta acquisition, we believe they are playing too many games simultaneously, and thus, Logan could take advantage and consolidate their position there. A common development of Coelacanth’s Two Rivers and Logan’s Flatrock shall yield improved economics, particularly related to infrastructure across both acreages. We believe such conversations should happen in the near future if Logan is interested at all in this development. We are sure they will follow this blueprint of “Land Position Assembly”, although we do not know which area they see to have such potential. In any case, this transaction would be massively accretive for both Colecanth’s and Logan’s shareholders.

In the grand theater of the energy sector, where fortunes are made and lost on the whims of nature and market forces, Logan Energy Corp stands poised on the stage, ready to deliver a performance that could very well steal the show. And while we may not have a crystal ball to predict the future, we can certainly appreciate the artistry of a well-executed strategy. So, let's grab our popcorn and keep our eyes on Logan Energy Corp. After all, in this industry, the show must go on, and Logan seems ready to play its part to perfection.

There's talk on the street, it sounds so familiar,

Great expectations, everybody's watching you.

Companies you meet, they all seem to know you,

Even old rivals, treat you like you're something new.

Logan-come-lately, the new kid in town,

Everybody loves you, so don't let them down.

Disclaimer: at the moment of writing this article, we don’t hold shares of Logan Energy Corp. However, we may buy or sell shares at any time. This document only represents the opinion of its authors; its content cannot be considered investment advice and it has been prepared only for informative purposes.

Another hit. Straight flushed down 60% off from article date