Since part II of this series on the ITP situation in Kurdistan was published, a lot has been commented but the situation has changed very little. After all the fake announcements of the ITP reopening, it is a good moment to provide an update on how the situation is.

In brief, the standstill continues, but the Kurdish oil production has continued growing. This time the Kurdish oil hasn't been flowing through the ITP towards Ceyhan. One aspect has changed, both the KRG and Baghdad have unequivocally confirmed that the control and responsibility over the oil production in Kurdistan is in the hands of the federal government. This way, the KRG has distanced itself from the IOCs’ demands.

Hence, we will take a look at each of the actors involved in the situation: IOCs/APIKUR, the federal government, KRG, Iran, the US and OPEC. The post concludes with my view on the situation and a potential end to this stalemate that could satisfy most of the actors involved, at least those with the highest power here.

The IOCs

So far, Baghdad hasn’t displayed a cooperative attitude towards the KRG and the IOCs about the reopening of the ITP. As I explained in the previous article, the Iraqi federal government doesn’t sign Production-Sharing Contracts (PSC) but Profit Sharing Contracts or service agreements. This means that the company operating the field usually obtains a revenue (usually including an oil cost and a profit stake) for every barrel of oil produced, but they cannot sell part of the barrels. The negotiation with the IOCs is all about this aspect.

There isn’t much information about the details of the profit sharing agreements (TotalEnergies signed one last year with a 25% royalty), but the Iraqi Minister of Oil has offered in the recent Round 5+ and Round 6 licencing rounds. The IOCs would not market the oil, they would receive the petroleum cost and part of the revenue, which is then taxed by the corporate income tax. Below you can see the structure of this type of contract (in bold letters the income for the IOCs):

Royalty of 15% is payable from Deemed Revenues.

Petroleum Costs are payable from the Net Deemed Revenue (Deemed Revenue less Royalty)

Supplementary Costs are payable from Net Deemed Revenue less Petroleum Costs and Remuneration.

Remuneration is payable as a (bid) percentage of the Remaining Net Deemed Revenue (Deemed Revenue less Royalty less Petroleum Costs paid).

Contractor profits (Remuneration) will be subject to Corporate Income Tax in Iraq.

The Ministry of Oil has insisted that terms will be offered on a case-by-case basis, so stakes and percentages may vary from contract to contract. Hence, IOCs would receive cash from the sales of the oil or gas produced by them. They won’t be able to market the final product as SOMO is in charge of all the sales in Iraq. The oil or gas locally sold to refineries or power plants.

The IOCs have maintained that their PSCs signed with the KRG are valid and Baghdad should respect them. But an Iraqi federal court already ruled that the PSCs signed under the KRG petroleum law are illegal, so the IOCs are basing their case on a framework that isn’t valid anymore. Both IOCs and KRG haven’t shared the contracts with Baghdad, despite it has insisted on this over and over.

A recent meeting in Baghdad between the federal and KRG governments with the participation of some of the IOCs, because DNO decided not to attend. The initial reports were very positive regarding a solution, but as the previous article mentioned, the situation was far from ideal:

Again, this seems to be a fight over the narrative, to show who is working to solve the situation without actually committing to a resolution. These meetings and public displays of understanding and common support are just fake. The true purpose of the Iraqi Ministry of Oil doesn’t seem to be aligned with the IOCs operating in Kurdistan. Meanwhile, the oil keeps being sold to mysterious “local sales”, as it seems that Kurdistan now has become a refining powerhouse. The local sales reported by the IOCs have risen since they discovered this almost-infinite demand that was unaccounted for when the ITP was operating. See below the different in just 12 months:

So, the IOCs are obtaining cash flows thanks to these low-price, high-volume oil sales but without investing any further in the fields they own. It is what I call a ‘milk the cow’ mode of operation, it is a short-term strategy that will impact the medium-term production of the fields.

In the last weeks, the IOCs have insisted that they want to keep the same terms and they reject the conditions offered by the federal government with a $6/bbl oil cost and a stake in the profit generated by the sales. They have been firm in their position and haven’t been willing to provide their contracts with the KRG and signing new ones with the federal government. The role of the IOCs association, APIKUR, seems obscure and unreliable; its public statements regarding the progress have been consistently debunked by different publications. The last of them has been an offer to sell oil through SOMO, receiving the payments in advance or in escrow accounts. However, they keep insisting on maintaining the same fiscal terms and the payments of both past debts and future sales. Clearly, they aren’t reading the room, because it is absolutely evident the position of the federal authorities.

The IOCs keep repeating the same message, they are open to talk with the federal government, but they want their term unchanged. In my opinion, that’s not going to happen because it would create a very dangerous precedent, but I guess they don’t want to acknowledge the consequences of accepting the terms proposed by the Iraqi Ministry of Oil.

As I already commented in part II of this series, I don’t think most of these companies have operated in an intelligent way. Particularly, Genel and GKP have decided to use its funds for paying dividends or buying back their shares instead of diversifying the business, for me that’s a red flag. ShaMaran has doubled the bet in Kurdistan by reorganizing the participation in the Kurdish fields, and it still is the most leveraged company of the pack. DNO is the only one promptly working to reduce the dependence from Kurdistan, so good for them. Lastly, Forza has been taken private, so there isn’t much to say about it. I’d only save DNO from the rest if I had to choose one, because I think their future isn’t bright, as I’ll explain later.

The federal government

Aside from this ‘legal’ dispute, the federal government has demonstrated that it is ready to bypass Kurdistan by fixing the original ITP pipeline, which was damaged during the clashes with ISIS. This segment runs from Kirkuk through the provinces of Salahuddin and Mosul to the border area with Turkey. This would change the dynamics in the region, as it would allow Iraq to resume production without allowing the IOCs export their oil through Ceyhan.

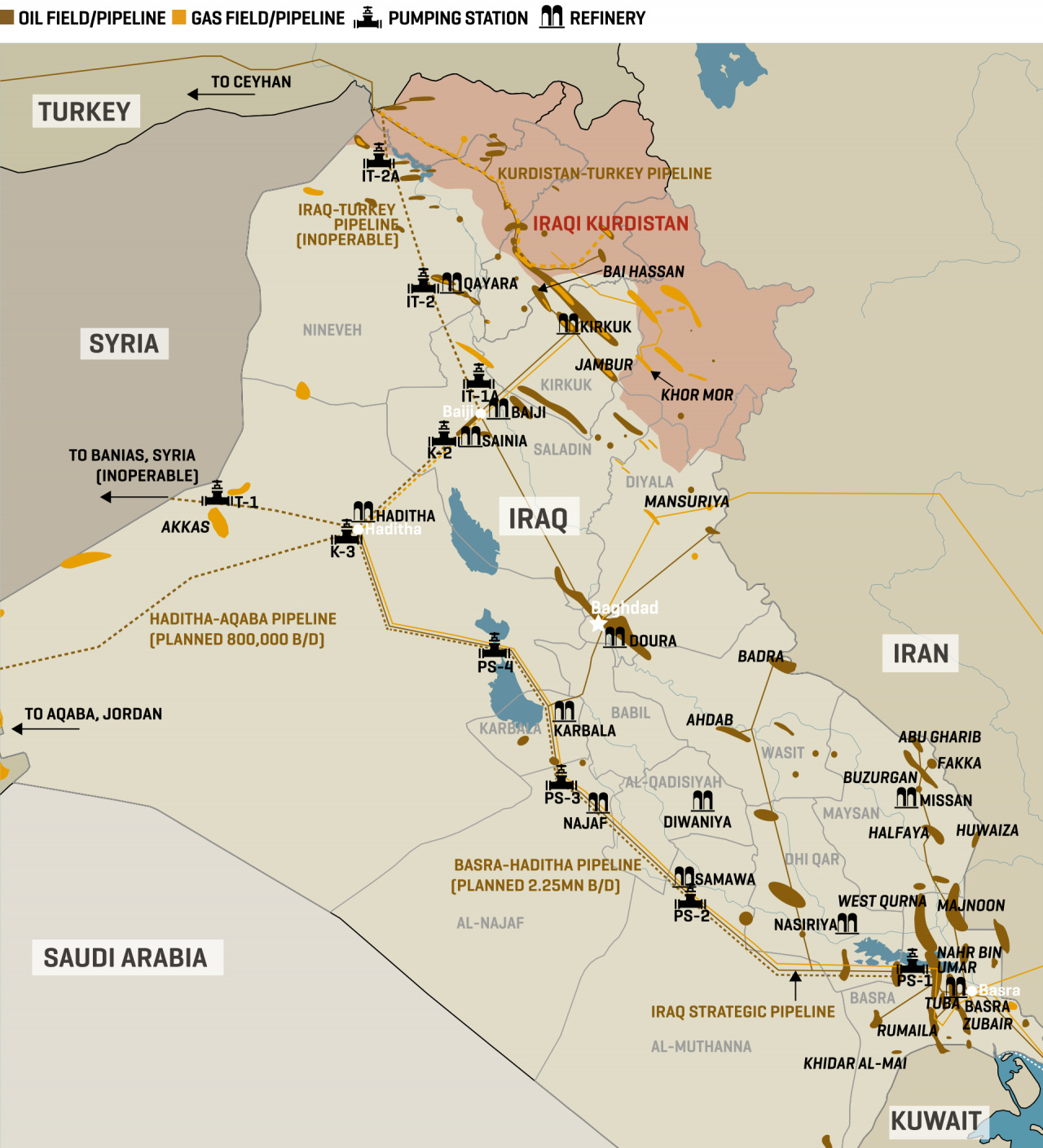

The federal government isn't just looking at reconnecting the ITP, it is making a complete revision of its national infrastructure. An article from MEES describes in detail how Iraq has decided to expand its oil transport network by building a new pipeline improving the North-South connection. The article provides a great overview of the status of the Iraqi oil infrastructure and production and export points. The picture below is from that same article and shows the national network, including the inoperable section of the ITP that is being repaired.

By improving the North-South connection and revamping the original ITP, Iraq will be at a position where its oil exports do not depend exclusively on its southern connection to the Global markets. At this moment, Iraq is a peninsula in terms of exports; it can only export oil via Basra’s offshore terminals. With the connection of the fields located in Central and North Irad to the ITP and from there to Ceyhan, it will keep an alternative export route. At a time where the Houthi have been able to take out most traffic through the Red Sea, having a secondary route for your oil seems like a wise move. Traditionally, Iraqi oil is more demanded by the Asian countries, but Europe consumes approximately 900,000 bopd of Iraqi oil, as the data from Vortexa shows below. The sanctions on Russian oil have had little impact on the European demand of Iraqi oil, but the Houthi actions have considerably affected the exports, making more necessary than ever a second export route.

However, the progress on the Iraqi section of the ITP is unclear, and there aren’t large consumers of oil in the region around Haditha. Thus, this new pipeline could be used as a preparation for the reopening of not only the ITP but also one of the other connections to Jordan or Syria. The situation in Syria is still dire, so the only true alternative would be Jordan, where the Iraqi oil could be loaded into tankers sailing through the Suez Canal, bypassing the waters around Yemen.

What if the Iraqi sector of the ITP was beyond repair? Because the news on its repairs were published last April and nothing else has been written about it. Then, Iraq could use its existing connection from Haditha to Kurkik to create a North-South infrastructure for all its oil connecting Basra with Ceyhan. Does this mean that the federal government could use the Kurdish ITP sector? Yes, technically, it could. Before the halt, this pipeline was exporting circa 100,000 bopd from the Kirkuk area. Would this allow Kurdish oil to flow towards Ceyhan again? Not necessarily, because the federal government may use all its capacity thanks to the additional oil coming through Haditha, reducing the dependency from Basra. Iraq currently exports 3.4 million bopd through its offshore terminal, and the Kurdish ITP can transport circa 450,000 bopd, so there is enough Iraqi oil from Central and North Iraq to block the IOCs in Kurdistan from using it.

Another important aspect mentioned by the MEES article is that the Kurdish section of the ITP doesn’t belong to the KRG or the IOCs. The Iraqi federal government has created a company focused on the oil and gas pipelines, the Iraq Oil Pipelines Company, under the control of the Ministry of Oil. The company controlling the asset is the Kurdistan Pipeline Co, which is owned 60:40 by the Russian state firm Rosneft and the Kurdistan-based KAR Group. That means that this infrastructure is also different from any other in the country, where the federal government owns and controls all the other pipelines and pumping stations. If the federal government were to use it, Iraqi oil would have to pay these companies transportation fees for reaching Turkey. The Federal government has already included in the budget an amount that could be used for this purpose.

What about the gas? Why is it always about oil in Iraq? Despite Iraq’s production of millions of barrels of oil per day, it just flares the large majority of its own gas, which is necessary to run power plants and some of the pumping stations required for its oil infrastructure. The country has been unable to increase its own production, widening the deficit between production and consumption since 2016, when the demand for gas started its upward trend. More on the gas production and infrastructure in the conclusion ...

Iraq is importing gas from Iran to satisfy its demand. The picture displaying the Iraq infrastructure shows a gas pipeline connecting Iraq and Iran, which is required for the supply of gas. Last year, Iraq announced an agreement with Turkmenistan to import natural gas, but there has been little reported progress, and that supply would have to cross other neighboring countries, creating additional doubts.

It is not totally lost with regards to the production of natural gas in Iraq. In the recent Round 5(+) and Round 6 Licensing Rounds, several gas blocks were awarded, which shows that Iraq is taking seriously its needs for more national gas production. One of the awards, the Al-Khlisiya gas exploration block, was for the Kurdish company KAR Group, the same that owns 40% of the Kurdish ITP. In fact, only the KAR Group and Chinese companies received awards in these rounds, showing that the Ministry of Oil is open to collaborate with Kurdish companies under federal terms. Something that the IOCs have constantly rejected.

The gas imports aren’t the only Energy imported by Iraq, it also needs more electricity, especially during summer, when the demand rises. Iraq again depends on Iranian electricity to satisfy the demand. However, Iran has been unable to keep this supply during high-demand periods to avoid power shortages in some of its own territories. With this in mind, Iraq has approached the Gulf Cooperation Council (GCC) – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates – to connect its electrical grid with those of the GCC states. This development would stabilize its own precarious electricity supply and strengthen relations with the GCC states.

In summary, the federal government is preparing its national infrastructure to allow the resumption of exports through Ceyhan, but it is unclear that this would include Kurdish oil. In parallel, Iraq depends on its imports of both Iranian gas and electricity, but it seems to be progressing towards diversification of the supply, even developing its own production. In summary, Iraq is a powerhouse in terms of oil that turns into a laggard in terms of gas and electricity production due to its terrible planning, but this situation could change in the following years.

The KRG

The situation of the KRG isn’t easy, it is constantly involved in a power struggle between the 2 main parties, KDP and PUK, which haven’t been able to agree on holding long-delayed elections. After the halt of Kurdish oil exports, the regional government agreed with Baghdad the access to the federal budget in return for granting the control over the oil and non-oil revenue. The deal agreed between Baghdad and the KRG states that the regional government would receive 17% of all oil revenue through the federal budget. This amount is the same that was offered by the federal government to the KRG in 2007 until the situation blew up in 2014.

However, the KRG has repeatedly complained about Baghdad’s non-compliance with these agreements and the federal law itself. Due to the regional government’s lack of revenue, the federal government, parliament and courts have progressively increased the financial support to the KRG in different forms, such as the payment of the salaries of its workforce, even Kurdistan’s security forces, which was a very controversial decision, as it gives Baghdad detailed information on the members of these forces.

The KRG-Baghdad agreement requires that SOMO administers the sales of all oil produced in Kurdistan. However, SOMO hasn’t been able to seize control over this production so far. The KRG sent 11 million barrels to Baghdad as payment, but it didn’t receive any revenue back. This led the KRG to pause any additional shipment of oil to SOMO.

However, the IOCs have increased the production as we saw in the first section, but not in the way that SOMO would have wanted. In the span of just 1 year, the local sales have demonstrated a surprising ability to absorb more than 120,000 barrels of oil per day from the IOCs (DNO 57,200 boepd, GKP 38,700 bopd, Genel 19,080 bopd, ShaMaran 6,877 bopd). APIKUR puts the gross amount in between 200,000 and 220,000 barrels per day. I think I missed the reports on the construction of several new refineries that are required to serve this brand new local industry, one that didn’t need any local oil until Q2-Q3 2023 … I suppose you have understood by now that there isn’t a local market that has risen from out of nowhere, do you? Some legal/illegal refining capacity could have been developed, but at a small scale and not enough to consume IOCs’ current production. The trucking of oil through the frontier with Iran and Turkey has been occurring since the 2010s, receiving the name of “Pipeline on wheels”, but it seems that the traffic has increased above previous levels. This has even triggered protests by the citizens. Kurdistan Watch is reporting on this on twitter and substack. In a recent article, Commodity Insights Oil reports that the oil smuggling is done even using horses (I don’t have access to the article, only headlines and minimal commentary). Kurdistan Watch estimates in “160,000 barrels of crude daily across borders into these neighboring countries” the amount of oil being illegally exported.

The KRG mentioned that it hasn’t received any oil revenue since the closure of the ITP. How come? Aren’t the local sales taxed? Are the IOCs breaching their PSCs? It is an uncommon situation, but it could be the KRG relaxing the grip over the IOCs while some ‘local businessmen’ turn into oil traders. It seems suspicious to me that both the KRG and SOMO aren’t applying any measure to prevent it despite being public.

The ‘local businessmen’ are doing a hell of a trade; they are buying millions of barrels on the cheap, less than $30/bbl each, while the oil from Kurdistan has historically received a discount between $21 and $23 per barrel against Brent. That means that instead of a more logical price of $60-65 per barrel, the IOCs have decided that less than $30 is a good price. At least, they are being paid on time this time. This “unofficial” oil flow could be allow in exchange for the long-standing debt to the IOCs, who knows?

It looks like the KRG has officially renounced control of oil production. It has signed the accession agreements to the federal budget and it isn’t playing sides; it participated in the meetings between the federal government and the IOCs, but its role is passive. Some people in Kurdistan may be benefiting from this lack of oversight, acquiring cheap oil that can be easily smuggled into Turkey and Iran. I won’t say that the KRG is being an accomplice of these practices, but I doubt that these new oil tycoons would be operating in the Kurdistan border without the explicit consent of the KDP or PUK. Hence, a solution to this stalemate won’t come from the KRG, which seems more preoccupied in securing the federal funds after the oil revenue isn’t flowing anymore, at least officially…

Turkey

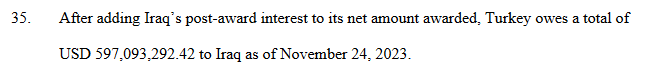

In the meanwhile, Turkey doesn’t seem to be a relevant player, despite the ICSID ruling and the award to the Iraqi government. This amount was challenged by Turkey at the US district court of Columbia, but the petition has been rejected and the payment has now been calculated at almost $600 million. However, Turkey is still pending a second decision for the oil exports between 2019 and March 2023, which may result in another award in favor of Iraq above $500 million. The Iraqi federal government still has to enforce the ruling to collect the amount due, but it could be using it to have a stronger hand in its future negotiations with Ankara.

During the recent trip to Iraq, a point of attention was the support to the Turkish actions against the PUK in both Syria and Kurdistan, instead of the ITP reopening. However, Erdogan’s main focus seemed to be the expansion of bilateral relations. This included the commitment of both countries towards the Development Road Project, sometimes also called Iraq Development Road. This project consists of the construction of road and railway infrastructure across Iraq that would join forces with Turkey, Qatar and the United Arab Emirates in connecting the Persian Gulf with Türkiye and, from there, Europe. Do you know what this project is also called? The Basra-Turkey-Europe corridor. That is exactly the same route that the new pipeline approved and financed by the Iraqi federal government, what a coincidence! Isn’t it?

This Development Road initiative would move Iraq away from Iran’s sphere of influence, creating an alignment with Turkey’s position in the Middle East and the Arab states in the Persian Gulf (the UAE aren’t particularly fond of Iran). This realignment is a bit shocking coming from a PM that was appointed by a coalition of pro-Iran parties, but it seems that Turkey has also other things to offer. As part of this process to strengthen the bilateral relations, Turkey has historically tried to attract the support of the Sunni Parties, but with little success so far due to their fragmentation and lack of unity.

Despite many comments that the reopening of the ITP would be timed with Erdogan’s visit, it didn’t seem to have moved the positions an inch. Turkey seems more interested in other aspects of the Turkish-Iraqi relationship and is paying more relevance to the ‘large picture’. More cohesion between Turkey and Iraq would affect the weight of Iran in the Iraqi politics and economy, making the ITP look like a minor issue. In any case, the resumption of Kurdish oil exports through the ITP and Ceyhan will not depend on Turkey. At some point, Iraq will receive the amount due in one way or another, but the reopening isn’t on Turkey, because there isn’t any technical aspect that impedes the Turkish section to operate.

Iran

Iran has amassed a surprising control over Iraqi politics. The two countries haven’t usually seen eye to eye due to the different forms of Islam and territorial conflicts. While Iraq’s muslim population is mostly Shia (50-60%), the Sunni had controlled the country for decades. This caused some of the conflicts between Iraq and Iran, such as the 8-year war in the 1980s when Saddam and his Baʽathist Party, mostly supported by Sunni, were afraid of the growing Sunni influence over the Iraqi population. For most of the XX century, Iran and Iraq have been constantly clashing on every possible front, with the international community swinging positions.

The 2003 U.S.-led invasion of Iraq was an inflection point, and Iran began supporting Iraq in its war against the US and its allies. Sadam’s regime downfall created a void in Iraq’s government, which was used by Shia politicians to take the power from Sunni hands. During the invasion, groups armed and trained by Iran led the skirmishes that resulted in more than 1,000 annual deaths of soldiers and contractors. The fall in disgrace of the Baʽathist Party and other Sunni politicians more preocuppied with their own internal battles, it wasn’t difficult by the Shia and pro-Iran parties to take the control of Iraq, not only politically, but also militarily. Which started as an operation to prevent further terrorist attacks, destroyed a country that was stable compared to other countries in the region and threw it into the hands of Iran and its hate on the US and its allies.

After “accomplishing its mission”, the US retired most but not all of its ground forces; but this presence increased again during the 2014-2016 campaign against ISIS, which was necessary after it occupied the Northern and Western regions of Iraq. That intervention against ISIS was successful, but it didn’t end the military presence of the US, with about 2,500 US troops in Iraq to monitor ISIS presence in Iraq and also Syria. This presence has allowed Tehran and Iran-backed armed groups to use Iraq to launch attacks on US troops in the country and other countries while spreading anti-US sentiment.

In the 2021 election, the pro-Iran Parties such as the Coordination Framework and the Sadrist Movement (created by Muqtada al-Sadr who isn’t an Iranian satellite but is aligned in some aspects) extended their power and became the controlling force of the parliament. Despite the tensions during the election of a president of the parliament and the Prime Minister, the Coordination Framework appointed Al Sudani as PM. Nevertheless, the Sadrist Movement showed its strength by assaulting the safest compound in Baghdad - the Green Zone - and the Iraqi parliament. Despite this display of strength, the pro-Iranian coalition appointed Al Sudani. This shows that the political landscape in Iraq depends on Tehran.

Apart from the control over Iraqi politics, Iran has another critical aspect of the Iraqi economy under its iron grip, the gas and electricity supplies. These imports are essential for the wellbeing of the citizens and the few industries established in Iraq. An Iranian news agency has estimated that the natural gas trade has resulted in 52 billion cubic meters (c.1.8 billion MMBtu) worth $15 billion since 2017. However, Iraq hasn’t always paid its bills for the energy received from Iran. During 2023, Iran reduced the flows of gas and electricity due to late payments that had created a substantial debt, until Iraq agreed to pay $2.76 billion in gas and electricity debt. This year, the debt had grown to $11 billion in pending payments, which is not petty cash.

Despite these challenges, the trade is continuing, and Iraq has recently signed a 5-year agreement with Iran for the supply of 50 million cubic meters (c.1.7 million MMBtu) per day. The Iraq-Iran relationship is far from perfect, but the two countries seem to be closer than ever in recent history. One could think that this understanding will continue in the future, but more voices in Iraq are claiming against the control that Iran is implementing over the country. Even Muqtada al-Sadr would like to see a reduction of the influence of Iran. The relationship between the two countries is also a matter of discussion by other countries in the area, as the activity of the Iran-backed militias are not bound to keep the stability of the region.

The relations between Iran and the KRG are complex. The recent attack on Khor Mor gas field is the last one of a series of 8 attacks in less than two years. This attack resulted in the death of 4 workers, becoming the most deadly so far. Other attacks were claimed by Iran-backed militias, but no one has come forward for this one. The objective is particularly relevant, because this field is critical for the power generation of the region. If one was to choose a target with the maximum impact at the minimal cost, Khor Mor is the perfect fit. This exemplifies the difficulties of the KRG-Iran relations and how a prosperous Kurdistan may not be of the interest of Iran, or it may be a feud about the gas business … Either way, the future of Kurdistan as part of an Iraq that is controlled by Iran isn’t promising, but it is something that the KRG has to solve. In order to do so, President Nechirvan Barzani visited Tehran last May and met with Supreme Leader Ali Khamenei, Iranian Revolutionary Guard Corps (IRGC) commander Hussein Salami, and a host of other high-level officials. This trip is significant as Barzani’s KDP is less pro-Iran than the PUK. An Iranian representative paid the visit back, which shows that both sides are open to an understanding. However, these public displays of cooperation come after the Iranian attack in Erbil with ballistic missiles that killed a Kurdish businessman in January, which marked a low point in the bilateral relations.

I do believe that Iran is important in the future of the o&g sector in Kurdistan, but not in the sense of being an offtaker or supplier. I’ll explain in more detail in the conclusion why I see its role as critical, but Iran is part of Iraq’s large picture and this cannot be ignored.

The US

It is impossible to talk about Iraq without mentioning the US. After the 2003 invasion and the campaign against ISIS, the US has had a love-hate relationship with Iraq. The country hasn’t been supportive of the presence of US oil companies in the country, as I mentioned in part I of this series. However, the relations have been more or less stable during the last decade. The current Iraqi PM, Al Sudani, has recurrently met with US envoys and recently visited the US for the first time since his appointment in October 2022.

The US is afraid of the growing influence of Iran over Iraq, including the presence of the Popular Mobilisation Forces and its different milities, and it has helped Al Sudani with some of its security struggles. During its last visit to the US, Al Sudani publicly called on a stronger relationship with the US, which might be a PR stunt, but it wasn’t well received by some of the Iran-backed parties. It is important to stress that Al Sudani was appointed PM by a coalition of Iran-backed parties, so this public support to the relationship with the US shouldn’t be overlooked.

The actions of some of the Iran-supported armed groups have caused much distress for the country’s stability, using Iraq to train and launch attacks on Syria and Israel. The militias are well-equipped by the Iranian Revolutionary Guard Corps and constantly threaten the US presence with periodic attacks on some of the bases holding US soldiers and contractors. These groups are part of the Iranian proxies that launched 165 attacks on US forces between October 17, 2023, and February 4, 2024. As a result, the US has set as a priority the easing of Iranian control over Iran. Without the presence of the US troops in the country, the PMF or Muqtada al-Sadr’s militias would take over the state in full, appointing a figure that could be controlled or, at least, totally aligned with Iran. The country would be plunged into a spiral of chaos and disorder that would wipe out all the progress made since the 2003 invasion. Al Sudani knows this and he’s aware that the support of the US is essential to balance the power of Iran in the country. The video below shows the use of the C-RAM defenses to protect the US Embassy from attacks launched by pro-Iran militias (I love the sound of a C-RAM).

Since the start of the invasion in 2003, the US has maintained different financial assistance mechanisms aimed at improving the stability of the country. Therefore, most of the financial aid has been military, with peaks during the 2003 invasion and the fight against ISIS. The data for 2023 is still provisional, being 2022 the last year with complete data. That year alone, the US provided $150 million in development assistance and $285 million in humanitarian assistance for Iraq, becoming the largest funding donor by far.

But the US-Iraq relationship isn’t just about financial assistance and military support, it is also a trade partner. According to the US Trade Representative, the US had a trade deficit of $6.2 billion in 2023, resulting from $2.3 billion in exports and $8.5 billion in imports. Despite being the largest producer in the world, the US imports some Iraqi oil for its refineries, due to the specifications of some of its refineries. That trade represents 7% of all the Iraqi oil seaborne exports:

The Iraq-US relations are far from perfect. Due to the pressure from the Shia parties, the Iraqi government is calling for a reduction of the presence of US forces in the country, even top representatives have called for a clear timing for the complete withdrawal from the country. As Iraq’s commander-in-chief, Al Sudani possesses the authority to directly request the Us troops to leave. Instead, he has opted to establish a committee on the matter to discuss it. This approach indicates his intention to de-escalate the situation and adopt a collective strategy for defining the next phase of the security relationship.

Moreover, the US government has avoided sanctioning government agencies and state-run companies that deal with Iran. These sanctions would hit the Iraqi economy very hard, as its oil trade is mostly done in USD. Al Sudani knows this, as well as that Iran’s support would not be enough to survive through a package of sanctions, with total chaos being the most likely scenario.

Since the closure of the ITP, the US has requested the Iraqi and Kurdish authorities to resolve their differences and reopen the pipeline. This has included the visit by the US Energy envoy to Baghdad and Erbil in May and trips by Kurdish and federal authorities to Washington, but separately. The US and Baghdad have been aligned in their public calls to both KDP and PUK to finally organize the KRG elections since the last round in 2018. However, it doesn’t seem that the US has been very worried about this event rather than the stability of the country as a whole.

The OPEC

In parallel to these disputes, someone filtered to the Media that OPEC had requested Baghdad the resumption of the oil production from Kurdistan. That was a bad attempt to establish a totally baseless narrative, or pure market manipulation, who knows …

Baghdad and OPEC have been going back and forth about the oil quota that has been consistently breached by Iraq in Q1 2024. Since then, Baghdad has committed to compensate for this overproduction by lowering the oil output for the rest of the year. The production in May came higher or lower than in the past months, it depends on the article you read. So far, Iraq hasn’t made an Angola-like decision to leave the organization in disagreement with a lower export quota.

Nevertheless, Baghdad officials sent confusing messages ahead of the last OPEC meeting. First, the oil minister commented on the country’s position against extending the ‘voluntary’ production cuts, but he quickly took those words back showing a total support to OPEC’s decision. This shows that OPEC isn’t interested in any resumption of exports from Kurdistan because that would result in an instant increase of Iraqi production.

Under the KRG-Federal agreement, all oil production from Kurdistan must be handled by the Ministry of Oil. Thereby, Iraq must be ready to absorb this additional production without breaching its quota. Is Iraq in position to increase its production with another 300-400 thousand barrels per day? I don’t think so.

OPEC doesn’t meddle in the decisions of its members, it just wants its policies being applied by its members. In case of doubt, an independent audit will decide the capacity used to calculate the export levels, as it has happened this year with the UAE. Hence, the origin of the oil being exported by Iraq is not incumbent for OPEC, which doesn’t have any authority over the planning and organization of the oil sectors of its members. Thus, the Kurdish oil doesn’t seem to fit within Iraq’s quota, unless OPEC lifts it above the current levels. An important aspect is that OPEC doesn’t account for oil smuggling, which leaves all the oil transport from Kurdistan into Turkey and Iran outside of the official quota. Nevertheless, those barrels do affect the oil market, as several hundreds of thousands of barrels isn’t an insignificant amount. Iraq may decide to extend its unified Iraqi customs system to Kurdistan checkpoints to control this flow, but it seems not willing to implement it, maybe because it is well established at both sides of the border and it would affect the communities living at both sides of the border.

What could the result be?

The situation is extremely difficult as there are many interests that are impossible to coordinate. However, I think there could be a scenario that could still provide an exit to most of the participants.

In brief, the IOCs don’t have any capacity to enforce the resumption of oil, and they are benefiting from the total lack of oversight over their activities. The KRG doesn’t care anymore because it has transferred to the federal government the responsibility over the oil revenues and it is fighting for its stake in the federal budget. The position of the federal government hasn’t moved an inch since March 2023, it wants to sign new contracts under its conditions, but more importantly, it has shown an absolute apathy regarding the progress of the talks. The Ministry of oil knows that it would be in breach of its commitments towards OPEC the moment the Kurdish oil exports flow towards Ceyhan. Hence, it seems unlikely that this could occur in the next 12 months. Meanwhile, the federal government is struggling to keep the lights on, it needs more gas and power.

The US would like to withdraw from Iraq but the situation is still extremely unstable and would like to lessen the Iranian influence before actually leaving the country. Regarding the oil price, the US is officially urging Baghdad to resume exports though the ITP. However, the oil price has been somewhat stable since the ITP halted operations and the pump prices are now the lowest since March 2023. With the next election looming, it doesn’t need to lower the pump prices even more. However, the US government is really pushing Baghdad to reduce the dependency on Iranian gas, and this hasn’t changed.

Iran and Turkey don’t care about the ITP, but they would like Iraq to become closer to them as they benefit from an ally/minion for their own plans.

In my opinion, the IOCs are the weakest link by far. However, there is natural gas in Kurdistan, which could be exported to the Central regions of Iraq. Kurdistan and North Iraq are already connected with a gas pipeline that runs to Kirkuk. Besides, the KRG started work to expand its gas pipeline network connecting Erbil and Dohuk, next to the Turkish border. Once completed, Dohuk will be connected to the Khor Mor field by a gas pipeline that also connects Chemchemal, Bazian and Erbil. This same year, the Iraq Oil Pipeline Company successfully extended a dry gas 16-inch pipeline connecting the Kirkuk Gas Power Station and the Khor Mor field. This new pipeline goes through Jambur, a field operated by the North Oil Company (under the control of the federal government), outside of the area controlled by the KRG. The KRG issued a warning to the pipeline operator, Dana Gas, against any agreement with the Iraqi government to move Kurdish natural gas without its permission. This occurred in November 2023, after the KRG had agreed with the federal government that it renounced the oil revenue in exchange for the federal budget. But, did this agreement include the gas from Kurdish fields? It is strange to me that the KRG was triggered so easily, but it could be just the opposing interests of the KDP and PUK.

I find it amusing that nobody is paying attention to the needs of Iraq. Its economy runs on oil exports, but the country needs more gas for its power consumption. Due to the US sanctions and the own problems of Iran, Iraq has repeatedly confirmed that Iran isn’t a reliable source of natural gas. In order to develop its own gas production, the federal government could turn its eyes towards the Kurdish enormous gas reserves, 200 trillion cubic feet (5.67 trillion cubic meters) of recoverable natural gas. Maybe that’s the reason why the Khor Mor gas fields has been attacked 8 times in the last years, as a signal by Iran that it isn’t comfortable with the development of Iraqi gas production, even in Kurdistan.

Here comes my craziest idea … Why wouldn’t the Iraqi federal government seek to develop the local gas production starting with Kurdistan? Right now, it doesn’t need to increase oil production under its agreement with OPEC, and Russian and Chinese companies are already investing to increase Iraqi oil production capacity in case it could increase oil exports. One thing is crystal clear, Iraq needs more gas to satisfy the demand and reduce or eliminate the dependency from the troublesome, unreliable gas and power supply from Iran. From what I have seen, now it is a good moment, because Iraq has already developed an initial backbone infrastructure across Kurdistan that is connected to the rest of Iraq through Kirkuk.

Another interesting point is that Dana Gas is the operator of the infamous Khor Mor field and the new pipeline to Kirkuk. This company isn’t a small independent E&P company listed in London or Canada. Dana Gas is the largest non-government owned natural gas company in the Middle East based in the UAE. Another UAE-based company, Crescent Petroleum, is also a stakeholder in Khor Mor. The relevance of these 2 companies shows an alignment between the UAE and Kurdistan and … Iraq? Do you remember the Development Road Project where the UAE was participating? Hence, Iraq could be supported by Turkey, UAE and Qatar in the development of these gas reserves, which would allow it to balance the potential political, economic or military countermeasures of Iran after losing part of the influence in the region.

Iran would be disgruntled by this measure, it already showed it’s against it, but I haven’t talked about oil yet. Even Khor Mor produces liquids, so, what could happen with all the oil and liquids produced by the Kurdistan gas field? Could they still flow through the border with Turkey and Iran maintaining the status quo? Iran could keep benefiting from the cheap barrels crossing the border with Kurdistan, and Iraq wouldn’t receive high-priority emails from its OPEC partners after missing its quota one more time.

Under this scenario, the US would be gloated as it would see how Iraq is less dependent on Iran. This wouldn’t relax the political influence that the pro-Iran parties have obtained since the 2003 invasion, but it would weaken the grip over the Iraqi economy. Additionally, the cheap barrels flowing into Iran will continue to be shipped into the Global markets, maintaining a downward pressure on the oil price for the next election. This de facto green light to oil smuggling into Iran would be off the spotlight, so the US wouldn’t be seen colluding with Iran, but supporting Iraq in satisfying its own energy needs.

What would be the role of the IOCs in APIKUR? I think Charles Darwin said it better:

The IOCs have 2 options, they can remain entrenched in their positions without yielding in any way, or they could understand that the federal government isn’t going to pay any past debt or offer them contracts that differ from those already signed. If they wanted to survive in Kurdistan, they would either sign a profit sharing or service agreement, or participate in this transition from oil to gas production. Either way, I think that their days of glory are behind.

This is my vision on a potential outcome that would benefit most players, Iran wouldn’t be especially happy, but it would still get a piece of the cake. I don’t expect you to agree with this view, but I think it is interesting to read about different perspectives. The events required to make this happen won’t unfold in a matter of weeks or months, but it would be progressive steps towards the final solution. It could easily take 2 or 3 years. The ITP would remain shut until OPEC raises Iraq’s quota or Iraq decides to export its oil from the Central and South fields, providing Iraq with an alternative route for its oil exports.

I hope you enjoyed this overview of the situation of Iraq and Kurdistan and how it is difficult to see the ITP reopening in the short term. I currently don’t hold any position in the companies operating in Kurdistan or Iraq, but I could do so in the future. The situation is complex and may change at any moment. The information presented here comes from publicly available sources and it is not intended to provide a detailed analysis of the geopolitical situation. This post does not reflect the reality of the conflict in depth and has been prepared only for informative purposes.

Very impressed with the breadth and depth of details you have synthesized and coherently laid out.

Thanks, that is an awesome work and interesting perspective. One question: Do you have an estimate, how much the IOCs would earn per bbl with the federal contract? Is it significantly less than the current $28?