Pipelines, courts and politics: opportunities in Kurdistan (part II)

Commenting several IOCs operating in Kurdistan

Warning: the situation in the Middle East is becoming more and more complex after the Hamas’ attack and Israel’s military response. Different government-backed militias and islamic groups are attacking Israel allies in the area, which includes US bases and assets in Iraq and Kurdistan. There have been reports of attacks near Erbil, so anything could happen to the assets and fields in Northern Iraq. Additionally, Turkey is showing a very hostile position with regards to the effects of Israel’s attacks on Gaza that could destabilize the ‘status-quo’ in Syria, where there was an agreement /understanding between Turkey, Russia and Israel. Please, bear in mind that there is a huge risk in investing in companies in this region, so consider this before any investment. The information provided here is not an investment recommendation, it is purely for informative purposes. If you are interested in any of these companies, please, complete your own due diligence.

Companies operating in Iraqi Kurdistan

Some International Oil Companies (IOCs) have been operating in the region despite the series of courts’ decisions and attacks on oil and gas fields and infrastructure in the last 2 decades, which forced most US companies to leave the region. In this write-up, we have made a compilation of the public IOCs that operate in Kurdistan, in case you are interested in learning about those companies that could benefit from the reopening of the Iraq-Turkey Pipeline (ITP).

As it was said in part I of this post, these companies could face changes to their PSCs, which were signed with the KRG and not the federal government. The financial situation of most of these companies is more solid than the average E&P company, still they are owed large amounts by the KRG. In this post, we cover the last production and financial data, main assets, including those outside of Kurdistan, and relevant aspects to be considered for the future. We haven’t followed in any specific order, each company must be analyzed independently from the others. In case you didn’t read the first part, you can access it below:

Pipelines, courts and politics: opportunities in Kurdistan (part I)

Since March 2023, several International Oil Companies (IOCs) have been impacted by the halt of the Iraq-Turkey Pipeline (ITP) that transported their oil from Kurdistan to the port of Ceyhan in Turkey. The pipeline stopped operating after the decision by the International Chamber of Commerce’s International Court of Arbitration (ICA)

In this second part, we compare the companies using the last available data from H1 2023 and the previous year, H1 2022, as the impact of the closure of the ITP can be seen. This can provide an overview of the current situation versus the normal operation of the business without the current blockade, as production and investment since March have been greatly reduced by these companies.

We must insist on the high likeliheed that the PSCs signed by these companies will change for the worse. The federal government was very vocal in their opposition to the agreements signed between these companies and the KRG. Already in 2022, the Oil Minister threatened with consequences to most of these companies:

The minister, Ihsan Abdul-Jabbar Ismail, told The Associated Press the deals, which circumvent the government in Baghdad, are illegal and amount to oil smuggling.

Ismail said the overall goal is to invalidate a total of 17 contracts.

If the companies do not comply, Ismail said the government would resort to “the law and banks” to enforce decisions.

Our opinion is the PSCs will be renegotiated according to the Federal law, which differs from the KRG, as Baghdad tends to use technical service contracts instead of PSCs. If you are curious to see a template of this type of contract, the Iraqi branch of the Extractive Industries Transparency Initiative (EITI) has published one.

All the IOCs mentioned here have greatly reduced their costs in Iraq, with important layoffs in Kurdistan but also across their central services. Most of them have also reduced CAPEX to the minimum under their contractual obligations and to maintain their lower current production.

One challenge of operating in Kurdistan is the high take of the KRG compared to other areas. Production greatly differs between WI and net entitlement volumes that can be sold. In the case of GKP, we have included how the net entitlement is calculated from the gross production. The result varies with the oil price, so it is not a straightforward calculation. A positive aspect of this abusive conditions is that IOCs are not subject to corporate taxes in the KRG. Usually, IOCs report their productions in gross or WI figures, but not all provide the actual net entitlement they achieve, so the actual sales volumes aren’t always evident. In this write-up we have tried to provide net entitlements or actual sales volumes when possible. Nevertheless, 2P reserves shown below aren’t inclusive of this effect and are based on the WI.

HKN Energy

This isn’t a public company, but it has 2 Nordic Bonds with ISIN: NO0010843782 & NO0011002495, which requires it to keep bondholders informed similarly to a public company. HKN has a 62% stake in the Sarsang Block, which includes the Swara Tika field.

These are the main metrics of the company in H1 2023 vs H1 2022:

The production figures reported are on a WI based, and not net entitlement.

The huge change in net debt is due to the dividend of $168 million in August 2022 (what a timing!). HKN has been more transparent about the situation than other IOCs in Kurdistan and its assessments have been more accurate than the others. HKN was the first IOC to report sales to the domestic market after a total halt to production. In August, HKN published an initial update and a second update with relevant pieces of information:

“the recently enacted Iraq budget law will not provide enough funding for the KRG to meet its financial obligations, including those contractual obligations under the Production Sharing Contracts (PSCs)”.

“HKN is not optimistic that negotiations between Iraq and Turkey will lead to re-opening the pipeline in the near-term”.

“HKN does not intend to resume pipeline exports without line of sight to, and a commitment for, payment under our existing contract.”

“it is unclear whether the KRG could provide commercial assurances to oil producers sufficient to achieve a production level of at least 400k bopd”.

“Government of Iraq officials currently believe that the recently passed Iraqi budget law prohibits cost reimbursement to the KRG in excess of the average cost of production per barrel in federal Iraq … Such a level of reimbursement would be materially insufficient to pay the actual costs of IOCs operating in Kurdistan. IOCs are contractually entitled to full cost reimbursement in accordance with the existing PSCs.”

As it can be seen from these updates, HKN is not very positive about both the reopening of the ITP in the short-term and the reimbursement of the oil cost by the KRG. They may be the more realistic of the group or have inside information about the progress of the talk between Erbil, Ankara and Baghdad. Nonetheless, we recommend monitoring any new update released by HKN, as one for Q3 is due in the next 2 to 3 weeks.

ShaMaran - TSX:SMN

The Company has a 27.6% participating interest in the Atrush block and a 18% participating interest in the Sarsang block (the same as HKN). ShaMaran bought TotalEnergies’ stake in the Sarang block on 14th September 2022. The company has been operating in Kurdistan for more than a decade, and it managed to substantially grow reserves since 2014 thanks to the continuous drilling program and the acquisition of Sarang. The company had planned to rapidly increase production in Kurdistan through acquisitions and investments to reach 50+ kbopd by 2025, aiming to reach a FCF above $100M. Therefore, ShaMaran entered into Kurdistan in 2010 via a controversial JV with Aspect Energy for the exploration of the Atrush discovery. In 2013, the JV sold 53.2% interest in Atrush (at that time it still was at exploration stage) to Abu Dhabi’s Taqa for $600M, and the partner left the JV leaving ShaMaran as the only participant.

ShaMaran has been traditionally related to the universe of companies of the Lundin family, which owns 26% as of October 2023. Thus, it has a secondary listing in Sweden. This has attracted many retail investors that follow the Lundins wherever they invest. The market is paying a premium over peers due to Lundin’s involvement in the company. The company has been focused on growing in the KRG, something that has been achieved through M&A. However, as the plans have been halted by the closure of the ITP, Lundins may decide to eventually sell ShaMaran or combine it with another entity. The cooperation with HKN is evident, so a merger between the two could make sense.

The current financial position of H1 2023 vs H1 2022 is shown below (Mcap in H1 2023 is at November 3, 2023):

The production figures correspond to sales volumes, WI production would have been 9,055 bopd in H1 2023. Part of the production was stored and not sold by the end of H1 2023. Production in H1 2022 doesn’t include any sales from Sarsang, as was acquired during H2 2023. During Q2 2023, Atrush hasn’t produced any oil but some oil sales have been completed using the inventory.

The company completed a rights offering in May 2022, which raised $30.15 million. This was required to exchange a 2023 bond for a 2025 bond that is listed in Norway. The current 2025 senior unsecured bond has a nominal of $300M and pays an interest of 12%, hence ShaMaran pays $36M in interest per year. The company assumed a contingent payment of $15 million with TotalEnergies that will not be paid due to the closure of the ITP.

ShaMaran was the first to announce a change introduced by the KRg in September 2022 in the PSCs for the oil price used for the calculation of the payments, from Dated Brent to Kurdistan Blend . This change is relevant as the local blend receives a discount of more than $10/bbl to Brent, and it will reduce the payments for the profit oil. The KRG is trying to reduce tha amounts due to the IOCs.

ShaMaran is in a complicated situation, as it is in a severe need of recover its revenue to pay its debt. The support of the Lundin family is a guarantee and it has granted it valuation multiples above other companies’. It is the most affected company by the suspension of the oil exports and it could require additional funds from investors if the situation prolongs into 2024 and the repayment of the 2025 bond gets closer.

Genel Energy - LON:GENL

Genel owns stakes in 3 blocks in Kurdistan: Taq Taq (30%), Sarta (30%), and Tawke (25%). In early August, Chevron and Genel said they were relinquishing the Sarta license, which has yet to be approved by the KRG. The decision was driven by the challenging geology, high water cuts and rapidly declining pressures. The company also owns other licences in Somalia and offshore Morocco, but they haven’t been appraised. Genel doesn’t seem to be interested in progressing the exploration of the licences outside Kurdistan, even after more than 7 months of halted exports. The company has stated in the last update that they are pursuing the acquisition of new assets that are in production or very close to production. Hence, they could be an active player in Africa, South-east Asia or the North Sea (we think that they could be focusing on Norway, where other companies have expressed heightened competition by companies from outside the country). They also commented that they don’t expect to sign new contracts with Baghdad as they hope that the contracts with the KRG will be valid also under the control of the federal government.

Since the closure, only the DNO-operated Tawke field has been in production, with minor contributions from Taq Taq and Sarta in H1. It has resumed sales directly to the domestic market using trucks.

In a controversial decision, the company decided to maintain the final dividend corresponding to 2022 of $0.12/share (20% increment over 2021 final dividend) to be voted at the Annual General Meeting held in May 2023. Only shareholders representing 223 shares voted against the dividend. Afterwards, the company announced the decision to suspend the payment of any future dividend until the situation is resolved.

In October 2023, the company announced a reverse tender offer for $20 million out of $300M of its senior unsecured callable bonds. The result fell short of its target and Genel acquired $16.2 million nominal value of bonds with the Maximum Accepted Price set to 93.5% of nominal value. The amount is below the initial target, which shows that bondholders aren’t willing to tender their bonds at a discount and are confident about a resolution before the company has any liquidity problems. Currently, the company is at net cash position, so the decision of retiring only 5.4% of the bonds seems suboptimal in our opinion. We understand they want to have enough financial room to close any acquisition that they may find in the short-term, should this opportunity not materialize, we would expect them to be more aggressive with the retirement of the bonds.

Directors of the company have been acquiring shares since the closure of the ITP, which shows that they are confident that there will be a solution to the current situation. The last acquisition by Ümit Tolga Bilgin (Bilgin Grup Doğalgaz A.Ş.) was substantial with £2.47 million worth of shares in Genel.

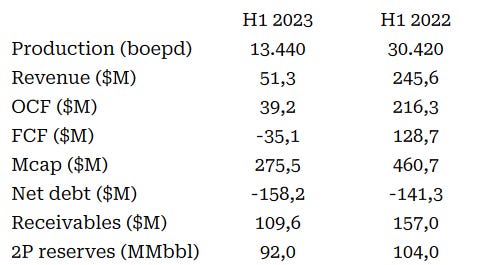

The current financial position of H1 2023 vs H1 2022 is shown below (Mcap in H1 2023 is at November 3, 2023):

The production shown above is based on WI, not net entitlement, as Genel does a great job to hide the actual realised price per barrel, which seems to be quite low. For example, in H1 2022 the realised price seems to be close to $44/bbl (remember, reflecting the lack of corporate taxes). As at 31 December 2022, Genel had estimated net 2P reserves of 92 MMbbls. However, after the decision to relinquish the Sarta licence, the 2P reserves should still be around 89 MMbbls.

The lower YoY debt is due to the receipt of payments from the KRG in H2 2022 and Q1 2023, together with the important reduction of CAPEX and general and administrative expenses. Examining the financial data presented above, it is evident that Genel currently boasts a robust financial position, which could sustain the company for several years even without production. Nevertheless, we anticipate that Genel will announce an acquisition in the coming quarters, regardless of whether the ITP reopens.

We hope the company has learned from this recent experience the importance of diversification, particularly when it enjoys a strong financial position. Genel is paying for the mistake of being overly generous with dividends, ignoring proper risk management strategies. Furthermore, the decision to transition from operations in Kurdistan to Somaliland (it announced its plans to drill some wells in 2023) stands out as a unique and questionable move. Such a decision requires a significant lack of long-term vision to be considered prudent. If the company were to allocate a portion of its earnings in the last years towards acquiring assets in the North Sea, Africa, or the Asia-Pacific region (arguably, only Syria, Libya, or Yemen could have been riskier than Somaliland), it would now possess the necessary local structures to facilitate prompt responses and initiate discussions with potential sellers.

Genel’s shareholders have been oblivious of the risk they were taking by blindly following the company into a high-stakes gamble in the challenging landscape of Kurdistan (you’ll have to excuse me but it is ridiculous that only 223 out of 180,660,883 shares voted against the final dividend after almost 2 month with the ITP halted). The guess is that they were too focused on the cashing dividends and ignored all other red flags around. Perhaps Genel's directors and management are inclined to be risk-takers, although that’s not how they present themselves. Unfortunately, many employees have paid the price with job losses in 2023. Below you can read the company’s description from the website, and I’d let it up to you to consider if their decisions are aligned with the end of the sentence:

We strive to be a socially responsible oil producer and have an asset portfolio that positions us well for a future of fewer and better natural resources projects, the right assets, in the right location, with the right footprint.

In our view, Genel is cheap and its strong financial position may work in its favour, but as with many UK-listed companies, particularly those on the AIM segment, governance is the weakest link.

Gulf Keystone Petroleum Limited - LON: GKP

GKP is the operator of the Shaikan Field (80% WI), one of the largest oil fields in Kurdistan with massive reserves and resources. It has traditionally struggled with the delayed payments from the KRG. In 2022 GKP distributed a gigantic dividend of $215 million (41% of the market capitalization at that time) and again $25m in early 2023. Although, it still enojys a solid financial position.

Contrary to Genel’s decision, GKP announced the cancellation of the final 2022 dividend (c. $25 million) last May, 1 month ahead of the AGM. This was a prudent decision that speaks well of its directors. However, GKP’s directors and management have insisted that the suspension of the ITP is temporary and that exports will resume soon. That has been the message since March 2023 and it has barely changed. They have also repeatedly stated that they expect that KRG will resume the payments. Contrary to their beliefs, we estimate that this may take many years due to the constraints imposed by the federal government over the KRG’s access to the federal budget.

After the ITP closure, the company halted production from all wells. Since July, it has been progressively increasing production for the domestic market after selling all the inventory. In the span of 3 months (July-September), the gross production has grown from 4,900 bopd to 33,000 bopd, which was was 53,700 bopd prior to the closure of the ITP. As other companies have reported, the price it receive for the oil sold to the domestic market is around $30/bbl, which is at least paid in advance. These sales partially limit the financial risk and allow GKP to manage its liquidity. Due to the conditions of its PSC, GKP’s 80% WI translates into a net entitlement is 36% of gross sales. A step-by-step calculation of how the 80% WI is reduced to a sales of 36% of production is shown below:

The current financial position of H1 2023 vs H1 2022 is shown below (H1 2023 Mcap is at November 3, 2023):

The production shown above has been calculated from the revenue and realised prices reported by GKP, which shows the actual net entitlement. These amounts are obviously lower than the gross 23,256 bopd and 44,941 bopd production reported by the company in the reports for H1 2023 and H1 2022, respectively. GKP usually employs gross production - not even WI production - in its reports, which is misleading.

The reserves are massive compared to the other companies and it has one of the best fields in the whole north of Iraq with a very low opex. Nevertheless, GKP is another UK-listed company that is cheap for a reason: a very profitable company that took the gamble to operate in Kurdistan. However, compared to Genel, the directors are showing better risk management abilities and the massive dividends in 2022 makes a huge difference for its long-term shareholders, who have been compensated for the risk assumed. Thanks to the $240M distributed in 2022, its shareholders have heavily de-risked their positions, recent shareholders cannot say the same though. The cancellation of the final 2022 dividend at the same time that Genel approved it was a prudent decision. The reopening of sales to the local refineries is a great news that reduces the risk of liquidity issues. GKP hasn’t publicly confirmed ongoing M&A activities; they have been focused on the resumption of the oil exports through Ceyhan and a settlement of the receivables by the KRG. Although, the company may be working in the background to secure assets elsewhere.

Forza Petroleum - TSE:FORZ

An oil and gas company focused on the Hawler license (65% WI) in Kurdistan. The company had to pay $76.2 million for the acquisition of the Hawler licence by March 31, 2023, which it was unable to satisfy and it reached an agreement with the seller to reschedule the payments. The situation is weird, as the company stated in the recent report that it is pending to receive the “a payment direction and appropriate documentation” from the seller to comply with settlement regulations. The initial amount was $71 million but it generates interest at LIBOR plus 0.25% per annum. In order to pay the amount due, Forza mentioned that it has up to $15 million in funding available from its principal shareholder, aside from its existing cash reserves.

Forza Petroleum is effectively controlled by Zeg Oil and Gas, a privately held company based in the Kurdistan Region of Iraq that provides a broad range of engineering and construction services to the energy sector. Its ultimate controlling party is Baz Karim, a renowned Kurdish businessman that is linked to Masrour Barzani, the PM of Kurdistan. He has been the target of attacks by Iran who has bombed several of his possessions in Iraq and the KRG. Baz Karim owns the KAR group, one of the most prominent Kurdish companies in the oil sector. Among its many assets in Kurdistan, the KAR group owns a stake in the Kurdish pipeline connecting to the ITP as the most relevant one. Zeg owns more than 80% of the outstanding shares, and thus, Baz Karim may make decisions that could not be aligned with the rest of the shareholders. Until now, he hasn’t damaged the minor shareholders, but the company has a generous LTIP that has progressively diluted shareholders in the last few years.

The production numbers above are actual sales volumes.

This company is linked to the officials of the KRG, which has positive and negative consequences. On one hand, it is backed by Kurds, which ensures that the KRG will treat it well and the owners know everyone in the regional oil sector. On the other hand, the federal government may be more reluctant to negotiate with an IOC that is actually kurd-controlled. The Erbil-based KAR group (it differs from Bahrain's KAR Group, the parent company of KAR Petroleum, which indirectly holds ownership of DNO) will remain operating in the region for sure, but in the case of Forza I have my doubts. The issue with the deferred payment seems a bit suspicious, why hasn’t it been paid or an agreement with the seller has been signed more than 3 months after the payment deadline? Forza is a less known company and more related to Kurdistan than any other IOC.

DNO ASA - OSL:DNO

This is the only company of this group that has production apart from Kurdistan. In the last H1 2023 the split was:

Kurdistan: consisting of the Tawke (75% WI) block, including the Tawke and Peshkabir fields, and Baeshiqa (64% WI) block, which began production in H2 2022. DNO is the operator of both blocks. The Baeshiqa block has been disappointing so far. Currently, DNO is only producing from the Tawke field for the domestic market. Net production from Kurdistan in H1 2023 was 11,583 bopd.

North Sea: DNO had diversified production across 10 fields in the North Sea of which eight are in Norway and two in the UK. Most relevant fields for DNO are Alve/Marulk, Ula area, Vilje, Brage (adjacent to the Brasse discovery that will extend its production and life) and Fenja. The exploration efforts have been successful for DNO. A total of 100 MMboe have been discovered net to DNO offshore Norway since 2021, including 78 MMboe just in 2023, driven importantly by Carmen discovery. Net production from the North Sea in H1 2023 was 12,441 bopd.

West Africa: In October 2022, DNO acquired Mondoil Enterprises LLC and its 33.33% indirect interest in privately-held Foxtrot International LDC, whose principal assets are operated stakes in offshore production of gas and associated liquids in Côte d'Ivoire. This transaction was closed with RAK Petroleum, one of the largest shareholders of DNO. The production is reported on an equity basis and not as part of the group production. The assets include Block CI-27 containing the country’s largest reserves of gas that meet more than three-quarters of the country’s gas needs. There are other exploration licences in the country. Net production from West Africa in H1 2023 was 3,604 boepd

Middle East: the Yaalen field at Block 47 in Yemen remains on hold due to force majeure for obvious reasons. The initial production following its discovery was 10,000 bopd. DNO doesn’t recognise reserves for this licence.

As it can be seen above, DNO is the most diversified company of the list and its presence in Africa and the North Sea will keep producing revenue despite the halt of its Iraqi operations, covering the downside in case the current situation is not resolved in the short term. The successful exploration campaigns in Norway have increased both new development opportunities and the life of existing producing fields. More drills are coming in the following years, so this success could be extended. Recently, DNO has been awarded interests in 15 blocks in the last rounds in Norway and the UK, which may continue the consolidation in the North Sea as a key operator. Additionally, there is a doubt over who is the North Sea operator that signed the HoA with Orcadian Energy. Although we didn’t include DNO in the original list of candidates, there is a small chance that DNO is interested in the Pilot field, as it is in search of short-term growth opportunities and its size would allow it not to report it until the final farm-in agreement is signed.

As another example of prudent risk management and shareholders’ value creation, DNO reduced both debt and outstanding shares during 2022 while distributing dividends and exploring new fields outside Kurdistan:

Debt optimization and retirement: in September 2021 it issued a bond (DNO03) to retire an existing bond (DNO02), which reduced the interest from 8.75% to 7.875%. Additionally, during 2022 DNO retired $268.5 million of the DNO03 bond: beginning 2022 it held $23.8 million of this bond, in May 2022 it redeemed $200 million, in July 2022 it acquired $25.2 million of this same bond and, finally, in September 2022 it acquired $19.5 million.

Share buybacks and cancellation: between December 2022 and March 2023, DNO acquired 53,107,326 shares at an average price of 12.0365 NOK, c. $57 million in total. The program was completed a few days before the suspension of the oil exports through the ITP. After its completion, the company held 7.53 percent of its share capital in treasury, all of which were canceled following the approval by the AGM.

Dividends: In the last year it has distributed NOK1/share in dividends with quarterly dividends of NOK0.25/share.

M&A: it entered into Côte d'Ivoire following the deal with RAK Petroleum in October 2022.

Development: it submitted the Berling (where it also increased its stake) and Andvare field development plans to the regulator and progressed the Brasse-Brage development plan.

Exploration: it announced successful drills in Kveikje and Ofelia in 2022, followed by successes at Røver Sør, Heisenberg, Carmen and Norma in 2023.

As it can be seen above, DNO didn’t prioritize the dividends to shareholders, instead it contributed to shareholders’ value creation along all fronts possible: lowering debt and shares outstanding while securing the growth of the company in the next years or decades. This speaks very positively of the directors and management, who can achieve both short-term and long-term rewards. DNO has replaced the Managing Director (equivalent to the CEO), Christopher Spencer replaced Bjørn Dale at the top. Spencer has previously been the Chief Operating Officer of the company, which guarantees a deep understanding of the company and its opportunities for value creation. The Chairman is linked to KAR Petroleum, who has reduced the ownership after distributing its shares, thus, there could be more changes in the Board of Directors.

The current financial position of H1 2023 vs H1 2022 is shown below (Mcap in H1 2023 is at November 3, 2023):

The production figures shown above consist of net entitlement to DNO in Kurdistan, North Sea and West Africa. DNO has been one of the companies that have rejected the application of other prices rather than Brent included in the PSC signed with the KRG to settle the oil payments with the KRG. DNO commented that the invoices prepared for the oil produced after September 2022 still use Brent until there is an agreement with the KRG.

DNO is a superior company compared to the rest. How the company managed its resources to continue delivering value in 2022 shows how well managed the company is. The company has greatly reduced the debt since 2021, maximizing the return from the high oil and gas prices in 2022, instead of just distributing the earnings as dividends. The company has a great exposure to exploration licences in the North Sea and has shown that it is capable of performing M&A. The changes at the top of the company may continue in the next quarters. DNO offers more diversification and lower risk profile than its peers; its counts on operator licences in both UK and Norway, which enables it to acquire large stakes in mature fields, if the opportunity presents. This is an advantage over many non-Norwegian companies willing to enter the o&g sector in Norway. We think DNO is the winning horse in this race, but it is still affected by the outcome of the ITP-Kurdistan situation, which still holds a great value for the company.

Other companies

The MOL Group owns 20% in Shaikan field (operated by GKP), and a 10% in Pearl Petroleum (operator of the Khor Mor field producing ~100,000 boepd). Similarly, OMV owns a 10% of Pearl Petroleum, and has operating Bina Bawi, Shorish and Mala Omar blocks. ExxonMobil still owns stakes in several fields in Iraqi Kurdistan.

Comparison of metrics

The share prices of these companies have reflected how the reaction to the suspension of the export through the ITP wasn’t totally discounted after its announcement. Since March they have entered into a downward trajectory that has brought them to ridiculous prices compared to 1 year ago. Some have recovered since the 52W lows, with DNO standing over the rest due to the excellent performance it has had in Norway. Below we compare the share prices of all of the listed IOCs commented in this post:

As it can see above, DNO has notably outperformed the others, primarily due to its successful discoveries in Norway. It is also the only one with relevant operations outside of Kurdistan. In this instance, diversification has proven to be a prudent strategy, and its shareholders are experiencing less impact from the suspension of the ITP. In our opinion this is the top company of the pack.

ShaMaran’s performance can be easily explained by its large financial leverage and debt, which makes it the most in need of requiring an equity raise at some point if the situation persists for an extended period. The backing of the Lundins could work in its favor in such a scenario.

Both Genel and GKP maintain strong financial positions that can sustain them in the medium-term even without income from Kurdistan. However, there is a contrast in the response from Genel and GKP's directors, with GKP's decisions appearing more prudent. Genel has been more vocal in its pursuit of M&A opportunities outside of Kurdistan, but we have some reservations regarding its directors and their decision-making processes. GKP has demonstrated it takes more measured decisions, but it appears committed to continue operating exclusively in Kurdistan, at least publicly, although the actual situation behind the scenes may differ.

The case of Forza is distinctive, given its control by a Kurdish entity with close ties to the PM of the KRG may protect it from Baghdad’s anger. Nonetheless, the company has a history of making unconventional decisions, and the explanation for the non-payment of the due amount last March is a cause for concern.

Below we provide some metrics to provide an overview of the companies mentioned in this post. We insist that this is an oversimplification and each company has its own peculiarities that aren’t reflected.

The table above shows how cheap these companies are compared to other E&P companies, but the current situation is far from satisfactory and the risk of losing their PSCs is a reality. The amounts due by the KRG to IOCs show that even when the ITP was in operation, Kurdistan is not an ideal place for oil production.

The high EV/bopd metric for ShaMaran is difficult to explain without the involvement of the Lundin family, still it seems the equity of the company doesn’t account for the actual financial situation of the company. Genel looks like the cheapest of the group considering the production, but it doesn’t report the net entitlement and only WI figures, so the metric is not representative. Making a guess, the value considering the net entitlement and not the WI production should be closer to $17,000/bopd, which is still a very good value. It is surprising that both GKP and DNO have similar EV/boepd metrics considering GKP’s dependence on the ITP and worse management compared to DNO. Forza looks like the most balanced of the group with a low EV/bopd metric (in this case we are using actual sales volume) and a reasonable financial position, but the role of Baz Karim casts a doubt over it.

The net debt position shows that only ShaMaran is in serious jeopardy, and it cannot just wait until the situation is resolved. However, the position of all these companies in Kurdistan is at risk, because it is very likely that they will have to re-negotiate with Baghdad with regards to their PSCs. Despite all calls for international entities and governments to solve the Iraq-Turkey dispute ASAP, the end of the situation may still take months. Ideally, the reduced regulatory uncertainty would attract majors back to Kurdistan (not only from US and Europe but also Middle East and Asia), which might be interested in acquiring participations in Kurdistan oil blocks, granting independent IOCs an exit before suffering Baghdad’s wrath.

As we commented in the first part, there are 2 processes to monitor by investors interested in these companies:

Reopening of the ITP with an agreement between Turkey and Iraq for the previous ruling plus the posterior 2018-2023 period.

New PSCs between these IOCs and Baghdad, as the former ones were considered illegal by a federal court.

Risk-takers may be tempted to buy these companies expecting a swift resolution, but everything is yet unclear. Only after the 2 processes mentioned above have finished, the uncertainty will be dismissed forever. Still, these companies may not see their pending payments satisfied in the next few years, so we’d recommend not to consider these amounts as part of the companies’ liquidity.

Nonetheless, an opportunity may arise at any given moment. Therefore, we recommend closely monitoring the situation in Iraq and Kurdistan and keeping an eye on the share prices of these companies. The market can present opportunities as soon as agreements between the various parties are announced.

Disclaimer 1: The situation between the Kurdistan Regional Government, the Iraqi Federal Government and the Turkish Government is complex and may change at any moment. There are some aspects that have not been included as this is not intended to be a thorough review of the historical relationship in this heated region. The information presented here comes from publicly available sources and it is not intended to provide a detailed analysis of the geopolitical situation. This post does not reflect the reality of the conflict in depth and has been prepared only for informative purposes.

Disclaimer 2: The authors do not currently have a long or short position in any of the companies mentioned in the article at the moment of writing the article, but they had in the past and could do so in the future. This article does not constitute an investment recommendation and has been prepared only for informative purposes.

thank you very mich for writing up the 2 parts of the Kurdistan situation. Would really love to read a follow-up.

Thank you for writing about this, I am surprised that it hasn't gotten more coverage given how cheaply the companies are trading. What are your thoughts on more recent developments - the companies, Iraq, and KRG have been negotiating actively and the Iraqi PM in this article states they are amending the constitution to overcome some of the major remaining hurdles - https://www.rudaw.net/english/middleeast/iraq/141220232

And yet, share prices for DNO, Genel, GKP etc have not moved higher. Genel and DNO have even gone further down. I have a small position in those three but am considering buying more. Anything I am missing here?