Sintana Energy: finding diamonds in the Namibian waters

Sintana Energy still is severely undervalued

After the first post on the oil and gas potential offshore Namibia, it is time to talk about how energy investors can benefit. Many of you are reading this post because of the high expectations following the series of discoveries by Shell SHEL 0.00%↑, TotalEnergies TTE 0.00%↑, and Galp (ELI:GALP). One of the companies that has been a standout performer in recent months is Sintana Energy (CVE:SEI), which is also one of the most followed by specialised retail energy investors.

Firstly, we’re going to manage expectations. This article will cover each of the licences and, at the bottom, will provide an estimation of the valuation of Sintana based on these licences. For those who don’t know us, we are not financial advisors, and this is not any kind of recommendation or the work of a professional analyst. Neither of us are geologists nor petroleum engineers. Although we will give you a valuation of Sintana Energy at the end, you must be aware that such figures must be taken for what they are, a valuation made by a couple of tourists. We will discuss the potential hidden in the geology and what’s interesting about each licence, as well as, the timing ahead.

Zero GCoS has grown substantially in the last week. Deep dives like this or the previous one require tens of hours of preparation and writing. The activation of the paid subscription is being considered as the most straightforward reward method. We will make further announcements soon. We will appreciate any feedback and suggestions from our readers and subscribers.

Thank you for supporting us.

A short history lesson

Sintana Energy is a Canadian company whose main asset is a 49% interest in Inter Oil (and its subsidiaries Trago Energy and Custos Energy), which gives it exposure to Namibia. At the beginning of 2024, Sintana, through this stake, held interests in 4 Petroleum Exploration Licences (PELs) in Namibia, 3 offshore licences in the Orange Basin: PEL 83, PEL 87 and PEL 90 and PEL 103 onshore licence. The entry into Inter Oil's capital was made possible by a C$5 million placement agreed with Charlestown Energy Partners, LLC. Shortly after the transaction, Robert Bose, Principal of Charlestown Capital Partners, was appointed President of Sintana. So, technically, the chapter of the current Sintana Energy began in 2021 with the arrival of Robert Bose and the start of his adventure in Namibia.

Before the acquisition of its participation in Inter Oil, Sintana’s sole asset was a 30% interest in the Valle Medio Magdalena 37 (“VMM-37”) block in Colombia. The company had signed a farm-out agreement in 2015 with ExxonMobil for the remaining 70%. Following the election of Petro as President of Colombia with a public speech against the oil and gas sector, ExxonMobil decided to withdraw from this concession in 2023. Sintana then initiated arbitration proceedings, claiming that ExxonMobil had breached the terms of the farm-out agreement. The outcome of this process is unknown and little information is available. Sintana still hasn't published its 2023 annual report, which should provide more information.

After the publication of the outstanding results achieved at Mopane, Sintana has completed another transactions to expand the value of the company, the entry into PEL79 by acquiring a participation in Giraffe Energy Investments. As our previous post described, this is a licence that lies in shallow waters between the Kudu gas field and the coast. There is substantial 2D and 3D seismic data and several prospects have been identified in the block. The block includes a well that didn’t encounter hydrocarbons, but provides some information on the geology that can be used together with the data from Mopane to understand the subsurface from PEL83 to PEL79.

Another key event has been Chevron’s farm-in agreement signed with NAMCOR for PEL82, which is a classic Inter Oil/Sintana move, as the farm-out deal includes a carry of both NAMCOR and Sintana. This is Sintana’s second licence shared with Chevron, which shows the good collaboration and the confidence that the American major has in Namibia and, especially, in Sintana’s acreage. This deal signals that majors are coming back to Walvis and that Sintana could have an interest in the most interesting of all licences. Despite the two wells drilled by HRT in this block failing to discover commercial amounts of hydrocarbons, the presence of a petroleum system in the Walvis Basin was confirmed by the recovery of some oil to the surface. As we pointed out in the previous post, Walvis Basin has been greatly overlooked. Just last June, Maurel et Prom’s PEL44 and PEL45 licences expired after failing to find a partner for a 5-well exploration campaign. In fact, Sintana has highlighted in a recent presentation three drill-ready prospects that mostly lie in PEL44 that is now available: Aurora, Serenade and Harmony. Could Robert be telling us something?

In summary, Sintana Energy’s assets consists of:

PEL79 (Namibia, Orange, Namcor): 16.5% net, looking for a farm-in partner

PEL82 (Namibia, Walvis, Chevron): 4.9% net, carried but details are missing

PEL83 (Namibia, Orange, Galp): 4.9% net, carried to production

PEL87 (Namibia, Orange, Woodside): 7.35% net, carried during the first stage of exploration (seismic data analysis and first well)

PEL90 (Namibia, Orange, Chevron): 4.9%, carried during the first stage of exploration (seismic data analysis and first well)

PEL103 (Namibia, onshore, Apprentice): 15%, not much work is expected

VMM37 (Colombia, onshore, ExxonMobil): 100%, ongoing arbitration.

We will be looking at each of the offshore licences in Namibia, as the onshore licences in Namibia and Colombia appear to be very far from being developed or even explored at the moment. In order to help understand the process of turning a promising licence with several leads into a confirmed development, we have prepared a separate Field Notes post, where the details are published. That article uses the different licences held by Sintana as examples of the progress along this process.

Field Notes: From first studies to FID

This Field Notes was to provide some context on how a licence like those held by Sintana is progressively de-risked and studied, advancing towards Final Investment decision (FID). We are using Sintana’s portfolio to show how the process works with different licences. You can read more about the situation of each licence in the specific post about Sintan…

PEL83 - Galp - 80%, Inter Oil - 10%, NAMCOR - 10%

It is the jewel of the crown. Galp’s success in Mopane has made up for Galp’s previous failed adventure in 2013 in PEL82, as it is briefly described in the previous article. The confirmation of at least 10 billion barrels of oil in place beats the previous discoveries in Venus, Graff or La Rona. The next steps will be the farm-out process that Galp has announced to continue with the exploration and appraisal of the blocks, which will bring Galp’s interest down to 40%. The new licencee will have to carry Sintana into the next steps of the process.

Galp has announced that Mopane isn’t the only potential discovery of the block, and it will look into other prospects in the northern section, such as Cheetah, Eel or Lead B. Galp plans a further 3D towed streamer seismic survey campaign in PEL83, towards the end of 2024 and Q1 2025, which will be around 4,000 square kilometers. This campaign will improve the knowledge of other prospects along the block, but any additional drilling is not going to be imminent. In fact, the exploration efforts will span three years involving the drilling of 10 exploration and appraisal wells, along with flow testing. This additional exploration effort will require a new EAI and permits from the Ministry of Environment, Forestry and Tourism. It is safe to assume that the commitment to continue the exploration campaign with more wells is on hold until Galp finds the farm-out partner.

As the reader may know, hydrocarbons are normally of a lower density than formation water. Thus, if no mechanism is in place to stop their upward migration they will eventually seep to the surface. Hence, an image like the above shows the importance of such oil seeps to confirm the presence of an active petroleum system. We suspect there is more oil in PEL83 than Mopane, we just need to see if in the other prospects there is the appropriate trap and seal that have kept the hydrocarbons in place waiting for a well to help them flow to the surface.

As a result, exploration to appraise the block may continue sometime during 2025 and extend to 2027 or 2028. However, delays in the 3D seismic campaign or the farm-out process could delay this significantly. In order to convert the licence from exploration to production, the partners and the Namibian government will need to resolve a number of regulatory and technical issues. First oil for PEL83 could be as early as 2030 and as late as 2032, if there aren't any major hurdles along the way and all partners and stakeholders are supportive and cooperative. Check the ‘From studies to first oil’ section for an overview of the whole process that could help in understanding the timeline.

Most of today’s Sintana’s valuation comes from this licence, as Mopane has already de-risked it.

PEL90 - Chevron - 80%, Inter Oil - 10%, NAMCOR - 10%

This licence should be the next to be explored as Chevron (through its local subsidiary Harmattan Energy) is in the process of obtaining permits to drill up to 10 wells: up to 5 exploration wells and up to 5 appraisal wells. The permitting process is advanced and the approval of the EIA for the drilling campaign is subject to a final decision by the Ministry of Environment, Forestry and Tourism.

The entire campaign would take up to 36 months, taking into account the schedule provided by Chevron. Sintana is carried through exploration and development until production.

I hope that to anyone's surprise, the major upside would be the identification of the same petroleum system found in Venus or Mopane, which could be possible. The pictures below shows several prospects identified in PEL90. One can speculate that the trend that runs from La Rona to Venus could continue into PEL90.

The drilling campaign would begin as soon as Q4 2024, so announcements have to be made soon, starting with the EIA approval, followed by the selection of the drillship or floater and ending with the mobilization of the vessel to PEL90. The 2 floaters owned by Northern Ocean, Mira and Bollsta, have been operating in Namibia, and both will be available by mid year. Hence, it is highly likely that Chevron could hire one of them for this campaign. The owner of this company is in a challenging financial situation with a large maturity for next year, so a 10-well campaign would be very beneficial. We have already commented on this company in a previous article and is a second order play to benefit from the exploration in deepwater like in Guyana, Suriname, Brazil, Uruguay or Namibia, of course. If you want to be up to date on the selection of this rig, you definitely should follow Tommy Deepwater and Ed on Twitter.

There is little more to say about this licence, which could be the next hit of Sintana’s album, so all eyes should be on Chevron and its future announcements about the licence.

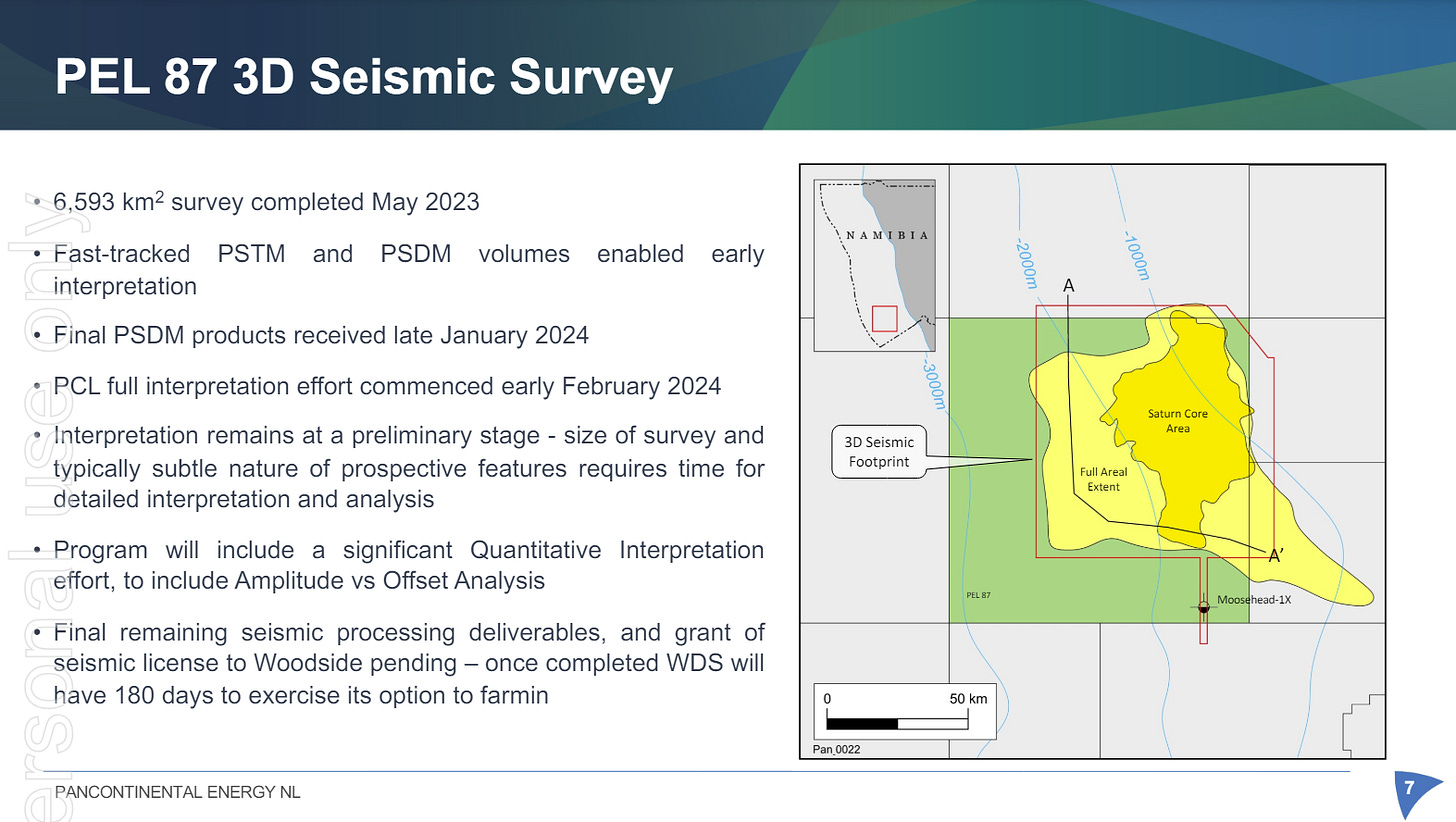

PEL87 - Woodside - 56%*, Pancontinental - 19%*, Inter Oil - 15%, NAMCOR - 10%

*subject to Woodside’s exercise of farm-in option

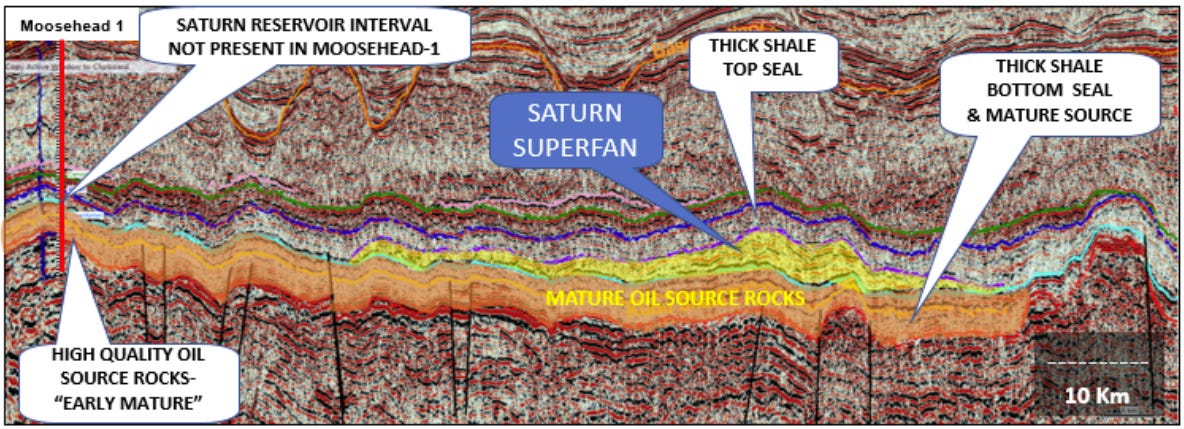

This block includes the very large Saturn superfan, a turbidite complex that could accumulate large amounts of hydrocarbons. It is estimated to cover 2,400 square kilometers with a thickness of about 280 meters.

Woodside conditionally farmed into this licence in March 2023 with the sole commitment to pay for a 3-D seismic survey covering an area of at least 5,000 square kilometers (finally completed over 6,593 km2). Woodside has a period of 180 days to review the final documents provided by Pancontinental and the contractor and decide whether it wants to exercise its option and receive a 56% interest. Then, Woodside will carry the other partners in the completion of the first phase of the work programme of the licence, which includes the drilling of one exploration well.

Pancontinental provides many details about this licence in its releases and presentations. This slide from March clearly shows the timing for Woodside’s decision. The final outcome of the survey was received in January. Pancontinental announced in April that it had received the final processing deliverables by the contractor, and it is awaiting for the authorisation from the Ministry of Mines & Energy to let Woodside access to the documentation. Once Woodside has access to the deliverable, the 180-day period will start counting. Hence, the deadline for a decision is around November 2024. However, Woodside could exercise its option anytime it wants.

In the best scenario, the announcement could be made by July 2024 after the first analysis of the seismic information. Then it will have to complete the EIA to obtain the drill permit and book a drillship or floater, hence, the exploration well in PEL87 could be drilled no earlier than Q2 2025, in our opinion.

This licence could host a huge number of reserves, too bad the HRT and Galp didn’t drill into the superfan back in 2014. Below you can see a seismic line with the location of Moosehead-1 well, which encountered 197 m of the Barremian-Aptian Kudu Shale formation source rock. This is the SAME SOURCE ROCK that was found in the Wingat-1 and Murombe-1 wells in Walvis, which continues to support the idea of a major basin extending from South Africa to the Walvis Ridge in the northern coast of Namibia. As there isn’t much publicly available information about the results of Mopane-1X, it could be speculated that the source rock continues to be the same.

The drilling campaign in PEL87 is of particular interest and the data from the Saturn Superfan will be of great significance. The first well targeting the superfan could be THE WELL, potentially on the same scale as Mopane-1, or even higher. To put the size of the Saturn superfan into context, it covers an area that is 4x times Venus or 15x times Marlim in Brazil, which originally contained 1.7 billion barrels of recoverable oil reserves.

The current interpretation done by Pancontinental supports the idea that the same source rock responsible of the discoveries in the southern licences would also be present in PEL87 (the following statements were done prior to the Mopane discovery):

Based on Pancontinental's interpretation of the preliminary data, there are positive indications for the presence of a mature Kudu Shale oil source formation directly beneath the SaturnTurbidite Complex … Moosehead-1X did intersect the Kudu Shale which presents as a thick, high quality oil source rock believed to be the primary source for the giant oil discoveries made by TotalEnergies and Shell on trend to the south … the Kudu formation appears to be at significantly greater depth than at Moosehead-1X, and is therefore likely to be at a greater level of maturity for oil

Sintana will be carried by Woodside through this first stage of the exploration campaign (seismic campaign and first exploration well). Once this first exploration phase is over, all partners will have to finance the respective net share of drilling costs for the second and following wells. Hence, it is very likely that in the case that Woodside finds hydrocarbons in the superfan, Custos and Sintana will have to decide whether to sell its stake, farm-out another chunk or pay its part of the campaign, which could result in tens of millions of dollars. In the case of Pancontinental, they also have the option to convert its stake to a 1.5% gross overriding revenue royalty.

PEL82 - Chevron - 80%, Custos/Inter Oil - 10%, NAMCOR - 10%

This was the best-known area in Namibia until the discovery of Venus. The farm-in by Chevron confirms the interest of the industry in the results obtained by the Murombe-1 and Wingat-1 wells.

There isn’t a concrete timeline for the exploration of the licence, so, there isn’t much to say about this licence until there are future announcements. We covered in the previous article the geology and the results obtained by HRT and Galp in PEL82, in case you want to read it again.

PEL79 - NAMCOR - 67%, Giraffe - 33%

This is the least mature licence in the portfolio. Shortly after the Mopane results, Sintana announced its entry into PEL79, covering blocks 2815 and 2915, through the acquisition of a stake in Giraffe Energy Investments. NAMCOR and Giraffe will work to further de-risk the block and find a farm-out partner willing to fund at least the completion of the seismic acquisition and processing. It is highly likely that both partners will seek a deal in which they are carried.

These blocks contain several 2D seismic lines shot in the 1990-2000 and post-2000 periods, but there are some discrepancies regarding the number of lines collected in these blocks, as it can be seen in the pictures below.

The left picture above shows a well drilled in 1996 by Chevron, 2815/15-1, which failed to make a discovery but found gas shows at 2,847-2,861 meters. The well found thick Upper & Lower fluvial -deltaic sandstones facies (Stratigraphic trap) and the area with the gas shows has 9 meters of net tight gas sand with a low porosity average of 8.5%.

Thanks to a presentation by NAMCOR at APPEX 2020 we have some good information about this block. In particular, we know that the area of the block when HRT conducted a 3D seismic is full of leads and prospects. The rest of the block could contain more prospects and leads, but the objective seems to be the area where data is already available, as it is also close to the Kudu gas field:

The most relevant prospects are the Meerkat (Albian), Sitatunga (Turonian) and Eland (Cenomanian). The Meerkat prospect has very interesting features that suggest the presence of a potential oil discovery in the block. This prospect was extensively studied by HRT, but the failures of the previous 3 wells drilled in Namibia led PetroRio’s withdrawal from Namibia in 2016. The Meerkat’s prospects main features are:

Water Depth: 183-220m

Resource Potential: >2.6 billion bbls

Prospect Extent: 250 km²

Reservoir Thickness: 600m (gross)

Reservoir EOD: Shallow Marine Sandstone

Reservoir Age: Albian (102–111 Ma)

Trap: Stratigraphic trap with low structural relief

Source Rock:

1) Marine SR (Aptian SR)

2) Lacustrine SR (Syn-Rift Section)

This shows the significance of the licence with many prospects spread across its 10,000 km2. Nevertheless, the hydrocarbon kitchen (the area where the source rock holding organic matter is at the proper temperature and pressure to produce hydrocarbons) for the Aptian-Albian (lower Cretaceous) play is believed to be located in a deeper part of the Basin. Hence, PEL79 could lie outside of the area where most hydrocarbons have been produced from the source rocks, however, the oil and gas could have migrated from deeper layers, as we showed in the previous article.

Nevertheless, the location of PEL79 close to the shoreline also supports the probability that there could be a syn-rift sequence, where mature source rock from fluvial/lacustrine sediments are covered by other layers that could become the seal. These syn-rift sequences could be independent from other discoveries in the Orange Basin and only a local effect due to the faults created during rifting.

Next catalysts for Sintana

As noted above, each licence has its own timetable and work programme commitments. Progress in Namibia tends to be slow due to a lack of local expertise and the absense of local suppliers. Hence, it is hard to establish a schedule and, even harder, to carefully follow it.

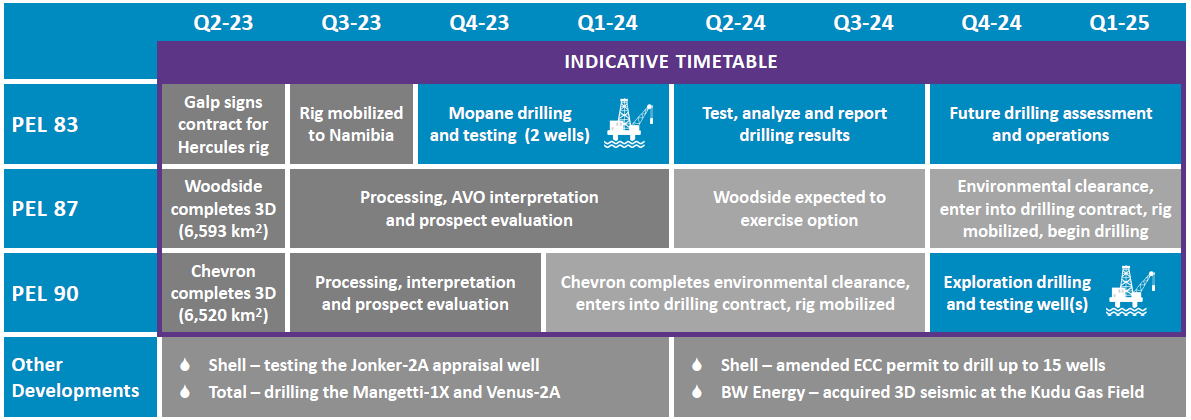

Sintana provided a timeline for FY 2024-Q1 2025 in February, but it could be a bit outdated by now, particularly for PEL 87, which has experienced delays in the completion of the final deliverables:

One of the most important aspects of Sintana is the newsflow for the next few years thanks to the different licences it has accumulated. There are also 2 adjacent licences that could also become catalysts for Sintana as they will provide news on their respective exploration efforts:

PEL3: BW Energy has confirmed its intention of drilling an exploration well in the northern sector of the Kudu field and has already ordered some long lead-time items like wellheads. The result is relevant for PEL83 and PEL79. It is expected that the company will provide this month an update on the status of the campaign and the search for a farm-out partner (for which they opened a data room last year).

PEL85: Azule (JV between Eni and BP) agreed with Rhino Resources the acquisition of a 42.5% in the licence. This company has experience in Angola and could apply this expertise to Namibia. Rhino Resources has already started the EIA process to obtain the drilling permit to drill up to 10 wells within Block 2914A. Prior to the farm-out announcement, Rhine had hired Halliburton for a 2-well campaign expected to begin in November 2024, but no drillship has been confirmed. These plans may be revised after the entry of Azule.

Considering all, we could identify the following newsflow in the next few months:

Chevron secures drilling permit and hires drillship for PEL90 (June-July 2024)

Woodside exercises its option in PEL87 (August-September 2024)

BW Energy confirms an exploration well in PEL3 (August-September 2024)

Rhino Resources receives the drilling permit and hires a drillship for PEL85 (September-October 2024)

Chevron spud first well in PEL90 (October-November 2024)

NAMCOR signs a farm-out agreement for PEL79 (H2 2024-H1 2025)

Galp announces farm-out deal (H2 2024-H1 2025)

Chevron completes first exploration well in PEL90 (January-February 2025)

Rhino Resources obtains results from the first exploration well (February-March 2025)

Woodside obtains drilling permits and hires a drillship for PEL87 (February-March 2025)

Chevron completes second exploration well in PEL90 (April-May 2025)

Chevron completes third exploration well in PEL90 (July-August 2025)

Woodside spuds first well in PEL87 (July-August 2025)

Chevron announces its exploration plans for PEL82 (H1 2025)

De-risking oil prospects

We want to stress one more time that this is exploration, so there are inherent risks in this activity that have to be considered. The main risks to consider before making any assumption on the potential of a prospect are:

Geological chance of success (GCoS): the petroleum system is confirmed with the identification of reservoir, trap and seal bearing a significant column of hydrocarbon-bearing sands.

Commercial chance of success (CCoS): the reservoir is good to excellent with pressure, porosity and permeability allowing commercial exploitation. Also, the oil or gas must not be contaminated with H2S, CO/CO2, H2O, salts or heavy metals, which increases the complexity and cost of the treatment process and could make a discovery sub-commercial.

Of the two risks above, the GCoS is the most significant and which should concern most of you the most. From Sintana’s licences, the one with the lowest GCoS is PEL79, which is only close to the old Kudu gas field. The shallower waters makes this discovery different as the mechanism to mature the source rock and produce hydrocarbons are different. Remember that oil or gas maturation requires specific temperature and pressure conditions. However, PEL79 could host hydrocarbons that migrated from deeper sections of the source rocks. Hence, the exploration wells that both BW Energy (PEL3) and Rhino Resources (PEL85) aim to complete in the short-term could increase the GCoS for this block. PEL85 is surrounded at the east and south by PEL39, where Shell found oil at multiple levels in the Graff-1 deep-water exploration well and the La Rona-1 well, and to the North by PEL83, close to Mopane, and PEL3, where the Kudu gas field is located, so this licence could host significant amounts of oil.

Should the campaign in PEL85 confirm the extension of the same oil-bearing sands found at Graff-1, LaRona-1 and Mopane-1/2, the probability that the PEL79 licence could host at least one oil discovery increases. Nevertheless, the GCoS is still low, as the previous failed attempts by HRT and Galp in the Walvis basin show. They have increased after the last discoveries but the locations were very carefully studied before the drills were spudded. Do not think that offshore Namibia is a new Arabia Saudi, where it doesn’t matter where you drill, you’ll find oil. In fact, there have been some failures such as the Nara-1X and Cullinan-1X wells.

I may insist too much on the geological aspects, but it is critical to understand what it is at play here. The Orange Basin is yet to be fully explored and appraised and the estimations regarding the oil in place and the recoverable amounts are yet to be made public. At this moment, neither Total or Shell have confirmed the oil amounts and the recoverable reserves in their respective discoveries. Remember how Namibia reduced the discovered amount of oil, before this amount was estimated in 11 billion barrels between Venus, Graff and Jonker. The last estimates suggest that Venus, Jonker and Graff could contain at least 2 billion barrels, 300 million barrels and 200 million barrels of recoverable oil, respectively.

Estimating the value for Mopane: A Complex Undertaking

One thing is to confirm the presence of hydrocarbons, but other is the actual exploitation of such reserves. Since the news of Mopane’s 10 billion barrels OOIP were out, there is a term that has been extremely ignored by many and it shouldn’t be disregarded, because it collects the most important aspect for the return of the investment, the recovery factor (RF). At the end, this single value is critical to come close to an approximation of the economic value we can assign to the discovery.

As the readers may know by now, the RF quantifies the proportion of hydrocarbons that can be economically extracted from a reservoir during its whole life. There is no field in the world that can extract every barrel of oil present in a field. Gas fields usually have higher recovery factors than oil fields. In the previous case of Venus, Graff and Jonker, the previously announced 11 billion barrels of oil in place was accurate, that would translate to a RF of just 22.7%, which is way below what current technologies can achieve. A low recovery factor may be caused by different challenges that these fields include (e.g. impurities, lower permeability or fractures) that affect the ability to extract oil at commercial levels. In the end, the recoverable volumes are also dependent on the fiscal framework, and majors could be trying to force the hand of the Namibian government to get attractive fiscal terms for E&P. We need more information to confirm this hypothesis, because there is a lack of detail on the results of the discoveries.

Accurately estimating the RF is critical to assessing the economic viability of hydrocarbon reservoirs, but it presents significant challenges due to the variability and complexity of geological settings and the lack of publicly available information. We have read many bold statements about it - as we have read in recent weeks, even from institutional or "informed" investors - and it is disappointing.

One of the first approaches we can follow to estimate the RF is the drive mechanism of the reservoir, which is inherent to the discovery and has dire consequences on the production. These mechanisms include water drive, gas cap drive, solution gas drive or gravity drainage, and there is an upcoming Field Notes post about them in case you want to know more. In summary, the best mechanism is the water drive, as an underlying water reservoir maintains the pressure, followed by the gas cap drive.

The RF is influenced by a myriad of factors including reservoir properties, fluid characteristics, and the technology applied during extraction. Of course, these are too broad to use when trying to establish a range of RFs for a specific field - and also Total, Shell or Galp haven’t yet released such information. However, we can hypothesize a bit on Mopane.

Upon analyzing the information disclosed about the Mopane-1X and Mopane-2X wells, it appears that the reservoir does not primarily utilize a gas cap drive, as there is no significant evidence of a free gas cap over the oil columns. This inference is drawn from the consistent high pressure observed across these wells coupled with significant light oil columns characterized by very low viscosity and minimal contaminants such as CO2 and H2S. As stated by Galp’s CEO:

Mopane is not a gas discovery but holds light oil with gas condensates … this gas is not expected to be an issue for development for many, many years and will be reinjected initially.

These conditions suggest that the Mopane reservoir might be more effectively driven by solution gas drive mechanisms or supported by an underlying aquifer. The high initial pressures and fluid properties conducive to natural flow hint at a dynamic combination of solution gas drive, supplemented potentially by aquifer support. This would maintain pressure and aid in the efficient displacement of hydrocarbons towards the production wells. As a result, there is no doubt about the characteristics of the oil and reservoir allowing its commercialisation; thus, CCoS = 100% .

Considering these characteristics, along with the lateral continuity and high-quality sand reservoirs, the estimated recovery factor for Mopane could realistically range from 20% to 50%. This range accounts for the efficiency of the hypothesized drive mechanisms and the favorable reservoir properties that typically correspond to higher recovery efficiencies in similar geological settings. Of course, we know such a range is so broad but this is the best we could infer due to the lack of information (and remember, we’re barely tourists). The RF can increase with the use of recent advancements in recovery technology, where tertiary recovery can help to reach recoveries well above 30%, even for complex fields. Hence, we could state that using a RF value of 30% would be good enough in this sense given Mopane's advantageous reservoir properties.

Of course, once we get more info regarding Mopane we should revisit this but as an initial estimation seems adequate. This estimate takes into account not only the inherent characteristics of the reservoir but also the economies of scale that larger fields like Mopane permit. These scales enable more extensive investments in advanced recovery techniques and infrastructure that smaller fields may not economically justify.

In summary the key factors to consider when making an estimation of the value of a discovery include:

OOIP: we know it is at least 10bn barrels.

RF: we have seen that 25-30% is a good approximation.

Price of each recoverable barrel: usually the range could go from $1-3 at an early stage and above $5 when a field is already in production.

We have modeled the valuation of Mopane alone through a Monte Carlo simulation in 3 different scenarios based on OOIP, RF and $/bbl - see the mean values for each scenario in the brackets - obtaining the following mean valuations per Sintana’s share using 396 million as the fully diluted number of shares:

conservative (OOIP: 10.3bn bbl, RF: 24%, $1.95/bbl): C$0.83/sh

base (OOIP: 10.9bn bbl, RF: 30%, $2.52/bbl): C$1.39/sh

bullish (OOIP: 11.3bn bbl, RF: 35%, $3/bbl): C$2.00/sh

Below we show the 3 distributions corresponding to the valuation per Sintana’s shares for the three scenarios (the dashed line is the average and solid line the median):

Of course, these are completely dependent on the assumptions made for the different distribution curves but we think we were pretty conservative in the 3 scenarios. So, we have a range for the valuation of Mopane alone between C$0.83 and C$2.00 per share. But this doesn’t include the potential of the rest of the licences.

Estimating the value for the whole Sintana Energy

Adding the previously mentioned exploration risks, we could make an approximation of the 3 licences, considering a sole discovery per licence. We used the same RF and value per barrel distributions as for Mopane, due to the lack of information available to properly characterize each license. For the exercise, we have kept the OOIP at a conservative level, well below than PEL83. Mean values have been estimated considering the public information we could analyze, with the following results:

PEL79: GCoS - 10%, CCoS - 50%, OOIP - 1 bn bbl

PEL82: GCoS - 20%, CCoS - 30%, OOIP - 1 bn bbl

PEL87: GCoS - 25%, CCoS - 50%, OOIP - 5 bn bbl

PEL90: GCoS - 20%, CCoS - 50%, OOIP - 1 bn bbl

Considering all, we obtain the following mean valuation of those 4 licences per Sintana’s share:

conservative: C$0.07/sh

base: C$0.13/sh

bullish: C$0.21/sh

And with the following distribution:

We must state that this is not the value of such licenses; indeed, it is their risked value. Any derisk would greatly affect the value of them and, as such, highly increase the value of Sintana. For example, the confirmation that there are hydrocarbons in any of these licences would automatically the value, for example 4x times for PEL87 and 10x times for PEL79. We must insist that there could be more than one discovery per licence, but that’s more than a speculation at the moment, that is greatly desireble but just a dream. As we have commented before, Galp will study the northern area of PEL83, but the chances that there is another “Mopane” are not high.

Considering all licences and the net cash (~C$20M), we could currently value Sintana as follows:

conservative: C$0.96/sh

base: C$1.57/sh

bullish: C$2.25/sh

So at the end, Sintana’s share price is almost at the most conservative scenario (where we even model having less than 10B OOIP, poor recovery factors and low $/barrel). Not much is needed to value Sintana much higher but we thought that providing a sensible valuation was more interesting that those baseless projections valuing Sintana at C$5/share. Of course, once Galp completes the farm-out of its stake, we could upgrade our model with the $/barrel paid, knowing Sintana’s should be valued more generously as they are carried. This is an exercise prepared by some tourists, so we can give a number, but there is so much guesswork and conjecture that nobody should take it seriously. It just shows how extremely conservative assumptions lead to a material upside.

Other names to play Namibia

We don’t want to give the impression that Sintana is the only way of profiting from Namibia’s exploration. We have already mentioned drillers, especially Northern Ocean, but there are other E&P companies working in the area.

Outside of majors like Total, Chevron or Shell, these are the best options that, in our opinion considering the different risk/reward ratios, investors interested in the exploration of Namibia should look at (and you should know them by now if you paid attention while reading this write-up):

BW Energy, listed in Norway, owns the Kudu licence and is planning an exploration well that could be confirmed by summer. BW Energy is a consolidated E&P company with producing fields in Gabon and Brazil. Zero GCoS has extensively covered it, so you can check out the last articles about BW Energy. This company has little downside due to its existing production, and any upside in the oil and gas in Namibia isn’t included in the share price.

Pancontinental Energy, listed in Australia, is currently the operator of PEL 87 and will farm-out part of its interest to Woodside. It will be fully funded during the early stages of exploration and could exchange its interest for a 1.5% gross royalty, which seems like a very good deal (think of the cash flow such a royalty would generate if a discovery were made followed by the development of a field at, let's say, 500 kboe/d). This company offers a very high reward in case PEL 87 is successful. The potential 1.5% gross royalty in the Saturn superfan without having to participate in the development costs could represent more than 10,000 bopd.

There are 2 other listed nanocaps companies present in Namibia, in case you are looking for a high exposure to Namibia: Tower Resources PLC (PEL 96) and Global Petroleum Ltd (PEL 94), but they are very small companies listed in the AIM market in London. However, the potential of both companies could deserve the risk, as they capitalise £3.16 and £1.6 million, respectively. We would advise extreme caution when considering an investment in either of these companies, as their need for cash could wipe out your position at any time, if they aggressively raise capital.

There is another company that many of you may know: ECO (Atlantic) Oil & Gas (listed in Canada and London), which also owns 3 licences (PEL 98, PEL 99, PEL 100) in the Walvis Basin, right next to PEL 82, and another one to the north (PEL 97). There is a large uncertainty regarding the progress in these blocks. ECO Atlantic usually follows a similar process like Sintana: farm-in > farm-out > carried interest, but the fact that Chevron decided to enter into Sintana’s PEL 82 instead of one of ECO Atlantic’s licences demonstrates the importance of having the Wingat-1 and Murombe-1 well data. Many have traded Sintana for ECO Atlantic, but the problem is that ECO Atlantic now has 0 confirmed newsflows in the next 12 months, and all catalysts come from potential farm-outs in Guyana or Namibia, which are uncertain.

Lastly, there is another company with an interest in the Venus licence, Africa Oil Corp. This company doesn’t own a stake in other blocks in the Namibian sector of the Orange Basin, so the exploration upside is modest as the PEL56 is already confirmed to host billions of barrels of oil. However, it has a stake in the 3B/4B licence in the South Africa side, same as ECO Atlantic, which will be explored in 18 to 24 months from now.

Conclusions

In summary, the energy exploration landscape in Namibia, particularly what relates to Sintana Energy, appears to be at a pivotal point. The attractiveness of the Mopane discovery, coupled with the breadth of ongoing exploration efforts across Sintana's portfolio, underscores a material upside that arguably remains not fully recognised by the broader market. Recent successes and the well-structured portfolio of exploration initiatives clearly differentiates it from other speculative plays in the region that are predominantly driven by sentiment and market momentum.

Given the current valuation and the substantial reserves potential, Sintana represents one of the most compelling risk/reward propositions in the oil and gas industry today. There is a pronounced potential for multiple returns with what appears to be minimal downside at current share prices. This advantageous position is reinforced by the multitude of catalysts expected over the next 12-24 months, which could further enhance the visibility and intrinsic value of these assets.

In addition, the forthcoming detailing of the ongoing farm-out of Galp's stake in Mopane may establish a more concrete valuation floor for the asset. This milestone is likely to expose the market's underappreciation of Sintana’s assets, including the carry through exploration and production.

Finally, the leadership of Robert Bose, with his private equity background, indicates a strategic intent to maximize the value of the company. Usually, private investment firms don’t hold their breath until production realizes the inherent value. The risk of dilutive capital raisings to finance the development of the licences will be mitigated, preserving the integrity of shareholder value and upside potential. How the company has managed to create the portfolio shows that Mr. Bose and his team think differently to others, and the recent deal for PEL79 speaks for itself. It is reasonable to expect that Sintana's value could be realised sooner rather than later - possibly within the next 36 months.

Thanks to the diversification of the portfolio, another discovery in any of the licences could lead to a significant re-rating of the company's shares. When the broader market begins to recognise the depth of Sintana's undervalued prospects, the reaction will be violent. In essence, the Sintana Energy story is not just about what has been discovered (which is not yet fully appreciated), but also about the value yet to be unlocked in the near future.

Both of us are shareholders of Sintana Energy shortly after the announcement of oil at Mopane, when the share price barely reacted to the news. The share price still is almost at the most conservative scenario of our assumptions, thus, there is some upside left in Sintana Energy. There is still a long way until confirming the actual value of Sintana, but we are here to enjoy the ride.

Disclaimer: both authors own shares of some of the companies mentioned in the text. This post has been prepared only for informative purposes. This is not investment advice.

Great write-up guys, thanks 🙏

Very impressive write-up! Thanks a lot! I bought my first shares at 0.15, but I had no idea what I was doing... Now, I know!