It's been a while since I felt the need to write for ZeroGCoS. While there's no shortage of interesting companies out there, many have been thoroughly covered across FinTwit, making yet another analysis of the same numbers and stories redundant (and incredibly boring). I've been following several situations but couldn't justify writing about them when others were already doing a great job covering the same ground.

This highlights one of the main problems I have always had with Substack - the implicit pressure to maintain constant publication if one aims to grow, even when the content might not warrant it. Quality analysis doesn't always align with regular publishing schedules. However, there are always interesting setups in the markets, and a hated sector like Energy is no different. Several E&P companies I've discussed before (both publicly and privately) deserve to be commented on briefly for those who like to keep up with the sector but don't want to spend time unravelling the stories.

In that sense, I will comment on several companies and situations I find interesting - Sintana Energy, Valeura Energy, Seplat Energy in this chapter - whether because they are truly actionable and deserve to be in many of your portfolios, or because I see catalysts on the horizon that could make them so. If this analysis proves valuable, I'll consider making these musings more frequent, as most of it comes from private conversations with other investors.

What’s going on in the oil and gas?

The current market narrative around Energy is, to put it mildly, confusing. We're seeing oil prices hover around $75 while money keeps flowing out of the Energy sector. The bearish signals keep piling up: the Israeli strike on military targets has reduced some risk premium, OPEC+ has to decide yet again about postponing their cuts tapering, and Valero's comments about "flat to slightly down year-over-year" light products aren't helping sentiment.

As the elephant in the room, China's story adds another layer of complexity. Gasoil, representing about 22% of China's oil demand at 3.8 million b/d, might be approaching its peak earlier than expected. PetroChina's Planning & Engineering Institute suggests demand peaked in 2023 and projects a 5% year-over-year decline in 2024, primarily due to LNG-fueled heavy-duty trucks displacing around 612,000 b/d of gasoil. Similarly, gasoline demand growth faces headwinds from NEV adoption (reaching an all-time high of 43.8% of total vehicle sales in July).

Add to this the normalization of Libyan oil exports and a peculiar US recession narrative that seems to only matter when discussing oil consumption, and you have a perfect storm for bearish sentiment. Of course, I am not so naive to base my investments on the Middle East blowing up - as we already know there is simply too much oil in the market (and there is plenty of spare capacity, not only in OPEC realms). I keep a conservative approach to the sector. Playing beta or torque on shitcos (cough bison cough) leads to underperformance in a year where nearly everything has gone up. Yet, as is often the case in markets, periods of uncertainty and pessimism can create interesting opportunities.

While I won't dive deep into macro predictions (there are plenty of those around), I will focus on specific situations where I see clear catalysts or asymmetric setups, regardless of where oil decides to trade in the coming months. Let's start with some familiar names that have evolved in interesting ways since I last covered them.

Sintana Energy - still not credited enough

Let's start with Sintana Energy, the diamond of the Orange Basin. After a quiet summer period (caused by the harsh winter conditions with stronger currents), they just announced the spud of the Mopane 1-A Well, located 7.5 km from Mopane-1X and 3.5 km from Mopane-2X. The fun part of the year begins now, and while Galp's farmout process is taking longer than expected (despite rumours of an imminent announcement and whispers that Namibian authorities already know the winning bidder, Galp has confirmed it will happen after this campaign, at the end of 2025), there are multiple catalysts ahead for the next couple of months.

Near-term developments to watch:

Santorini PEL83 drilling results should come relatively soon, in mid December and Galp confirmed they will inform the market. The 3rd well is targeting AVO1 and a mini DST will be done. The 4rd well will happen in June, as they are still processing the seismic for the exact location. It will be targeting a different region. The purpose with a farm down would be to accelerate the development phase of Mopane, AVO1 would be the first put on production. In Q1-25 an extensive seismic will be conducted over the whole Mopane area, which will be vital to define the location of wells 5 and 6 and future production wells.

PEL90 drilling should commence in weeks using Deepsea Bollsta (though target and location remain undisclosed, the speculation is that this first drill will be located in the southern sector to confirm whether Venus/Mangetti or Mopane extend into this block), with potential news by January

Deepsea Mira is days away from spudding Tambotti-1X, a prospect in Total's PEL53 believed to be an extension of Mopane or a similar structure. Results here will be crucial for Sintana, as confirmation could suggest similar structures in Chevron's block

While Shell has paused activity in PEL39 (home to Jonker and Graff discoveries) for this year's campaign, Noble Venturer will be drilling for Azule in PEL85 in November/December, adding to regional momentum

The Galp farmout resolution remains a key catalyst and after Galp’s Q3 results call the following Bose quote is interesting:

"And for your audience members who've been following more generally, what's been going on with PEL83, there's been a lot of discussion in the press about Galp thinking about potential partners for this world class, world scale development. And so, you know, they'll be kind of thinking about options for that as they continue through this program. So that's another exciting catalyst that we're really looking forward to in the beginning of next year"

This timing suggests Bose had advance knowledge of Galp’s plans, drill one well and return to the negotiation table with more data. This approach is shrewd - by incorporating both the new well data and results from neighboring licenses, Galp can not only optimize their future drilling locations but also strengthen their negotiating position. Given that Namibian capital expenditure represents a significant financial commitment for a company of Galp's size (they expect to invest $250MM in Namibia anually), maximizing the value of their investment is crucial.

The farmout structure itself presents interesting dynamics. While many investors focus on using the potential farmout value as a key metric for valuing Sintana, this approach may be oversimplified. Given Galp's desire to be fully carried on development costs, I expect a relatively modest upfront payment. But as Sintana’s stake is carried until production, it becomes much more valuable for a third player. However, there's a possibility that the Interoil stake (10%) could be sold simultaneously with the farmout announcement, allowing new partners to focus on next year's campaign as early as possible. While purely speculative, my bet would be for APA to be the buyer for this stake.

Lastly, we await Woodside's execution of their option to farm in Pancontinental's PEL87. Though still pending Namibian authorities' approval, this delay might actually benefit Woodside, giving Pancontinental more time to re-evaluate seismic data and observe this year's Namibian campaign results. While it's disappointing that the huge Saturn Superfan prospect likely won't be drilled in this campaign, we'll look forward to its potential inclusion in the 2025 program.

It goes without saying I am incredibly bullish on Sintana, as the current valuation appears pretty conservative and just reflects Mopane, not any of the other licenses. While Pancontinental's share price has come off a lot and Eco Atlantic's capitalization seems small, I would not hold them except for as a trading opportunity in anticipation of confirmed drilling in either of them, as one is a bet on the Saturn Superfan and in the other you must trust a management that has proven to be untrustful before.

Valeura Energy - the everlasting promise

Moving from the Atlantic basin to APAC, we find Valeura Energy. In ZeroGCoS we have not written an article on it though we have been holding it since the 6th of December of 2022, the day it was announced the acquisition of some of the Mubadala assets in Thailand. Many could think the best is a thing of the past, but I personally still have it as my major holding. I think the market still has not grasped the story here, it is assigning a multiple for what Valeura was and not what it already is or is going to be.

And yes, many people from time to time post about how cheap it is or how it is possible that the market is giving you something that will probably have in net cash its market capitalization by next year's end. Many investors seem incapable of updating their thought process and repeat what was last year's concern, "this is an incredibly high cost producer due to capex, so if oil goes south $70 it's a sell".

Nothing could be further from reality. Not only is the highly cited $70 price absolutely made up (as from now on we should expect an OpEx of around $27/bbl and CapEx of $18/bbl excluding Wassana’s redevelopment), but Valeura has proven it can increase both production and reserves while also increasing the cash pile in the bank. The thesis boils down to a simple question: Can Valeura not only replace what they produce each year in reserves, but significantly increase them?

This question is especially pressing given Valeura's current 2P Reserve Life Index (RLI), which stands at approximately 5.2 years if production is maintained at 20,000 boed, and drops to 4.3 years at 24,000 boed. With current 2P reserves of 37.9 MMbbls, the RLI highlights the company’s limited production horizon, emphasizing the need to extend reserves. Until now they have proven they can do it, and after this year's successful exploration campaign and the redevelopment plan for Wassana, I believe they will do it again, so 2P reserves reaching 50 MMbbls is reasonable and that would at least add a couple of years of production.

Why are reserve increase the key to this story?

They push further in time the ARO (Abandonment and Restoration Obligations), which aren't now a problem due to the cash pile and increase in Reserve Life Index (RLI), but must be considered. Further reductions on them in the balance are expected.

As they increase reserves and the production percentage on them each year is reduced, depletion costs will massively go down. This drives earnings and equity growth, clearing the picture for those that only look briefly at the financial statements and potentially changing the perception of institutional investors

If current production levels (20-25 Mbbl/d) can be expected to last until the mid-2030s, suddenly the current multiple makes no sense and the much anticipated rerate shall occur.

Beyond the reserves story, there are two additional catalysts that I consider free optionality:

Corporate Restructuring: The highly delayed corporate restructuring would allow them to use their huge tax losses on the whole portfolio, besides Wassana, significantly improving earnings.

M&A Opportunities: They're sitting on a huge pile of cash and Sean has repeatedly commented that they are actively seeking acquisitions. While such M&A needs to prove more accretive than buybacks (the multiple paid must be close to Valeura’s current valuation, which seems difficult in the present environment), I believe it will be the right choice for two reasons. First, acquiring reserves inorganically directly addresses their primary challenge: the relatively low RLI of approximately 5 years. Extending reserves through acquisitions would push this timeline further, significantly improving their production sustainability and mitigating depletion pressures. Second, taking money outside Thailand for buybacks incurs a 10% tax, making M&A a more tax-efficient strategy

As for potential M&A targets, Sean's preference for gas assets (due to predictable cash flows through long-term contracts) points to several compelling options:

Mubadala's remaining 40% stake in Erawan field, which accounts now for 320 MMscf/d and 0.6Tcf in 2P reserves.

Chevron's substantial Gulf of Thailand assets: currently producing about 499 MMscf/d of gas, 14,810 barrels of condensate, and 16,171 barrels of oil daily across 25 operating areas, including notable fields like Benchamas, Tantawan, and Pailin.

Outside Thailand: attractive assets like the North Ganal gas block in Indonesia.

I believe Erawan is the most probable target, while Chevron's assets, though more frequently rumored, are likely out of reach given management's conservative approach to debt - even a typical 40/60 or 30/70 partnership structure would require earnouts that would be difficult to justify. However, no matter what the target is at the end, I am pretty confident it will add incredible value and make the story even more compelling.

Seplat Energy - the patient will be rewarded

Moving on to yet another lovely place, Nigeria, Seplat Energy's acquisition of Mobil Producing Nigeria Unlimited (MPNU) appears to be in its final stages. Following the Settlement Agreement between NNPCL and ExxonMobil announced last June, which terminated the related court proceedings, we received confirmation last week that President Tinubu, as Minister of Petroleum Resources, has granted consent for the transaction. With these major hurdles cleared, the closing of the acquisition seems imminent.

The assets are world-class, including a 40% operated interest in four offshore oil mining leases (OMLs 67, 68, 70, and 104) with over 90 shallow water and offshore platforms, 300 producing wells, and strategic infrastructure including the Qua Iboe Terminal and a 51% interest in Bonny River Terminal and Natural Gas Liquids Recovery Plants. The production correspoding to MPNU has declined from 175k boepd in 2014 to around 63k boepd currently, presenting clear upside potential from reversing years of underinvestment as Exxon prepared its exit.

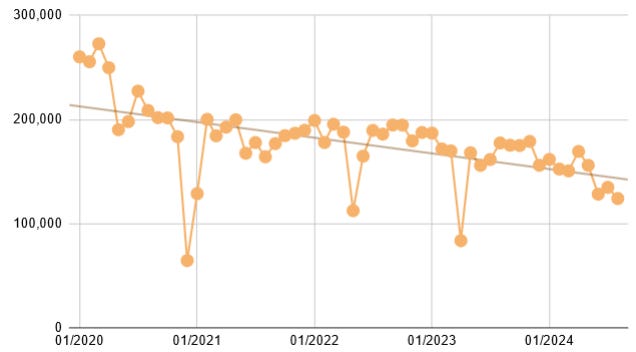

The graph below shows the gross production of oil (excluding condensates) from these assets, with a 52% decline since January 2020 in oil output (260,303 bopd vs. 124,152 bopd). Exxon must have begun the sales process by then, causing the halt in investment with the subsequent production loss. There are many undeveloped fields and there are many infill opportunities that have been shelved since then, Seplat could run a moderatly risky drilling campaign to recover a large chunk of this decline. Still, a net 40% or 30% net production represents today 49,661 bopd or 37,246 bopd, respectively, a noticeable production for Seplat that has just averaged 47,525 boepd in the frist 9 months of 2024.

There were some rumors suggesting that Seplat might only acquire 30% instead of the full 40% stake on the licenses to get regulatory approval. So far, Seplat's management has consistently maintained the terms disclosed originally remain unchanged. I thus keep the 40% as my base case.

For those unfamiliar with the deal structure, two weeks before Russia invaded Ukraine and oil prices mooned, Seplat signed an agreement to acquire these assets. The structure was elegant: Seplat would pay what seemed a big acquisition for their size but with an effective date of January 1st, 2021, implementing a Lockbox solution where accumulated profits would reduce the final consideration. After a year of regulatory delays, a profit sharing scheme was signed so ExxonMobil would receive a portion of the value in the Lockbox that would otherwise fully accrue to Seplat Energy once the transaction completed.

To understand the value creation, let's analyze the cash generation potential of these assets under Nigeria's new tax regime. The 2021 Petroleum Industry Act (PIA) replaced the old Petroleum Profits Tax framework with a more favorable system (we assumed Exxon opted for the conversion to this new regime). Using public production data and actual oil prices, we can model the economics, but the actual terms have not been disclosed (at least for free).

Under the PIA, these shallow water assets face a layered tax regime: 30% Hydrocarbon Tax for Petroleum Mining Licenses, 30% Corporate Income Tax, and 3% Tertiary Education Tax. However, several deductions significantly reduce the effective tax burden. First, royalties combine a production-based component (starting at 5% for the first 5k bpd, 7.5% for 5-10k bpd, and 12.5% above) with a price-linked element (scaling from 0% below $50/bbl to 10% at $150/bbl). Operating costs, conservatively modeled from $18/boe in 2021 to $23/boe in 2024, remain well below the Cost Price Ratio limit of 65% of gross revenues. Capital expenditure, which we estimate declining from $200MM to $100MM annually reflecting Exxon's minimal investment approach, benefits from favorable treatment with 20% initial allowance and the remainder spread over four years. Additionally, a mandatory 3% of OpEx goes to host communities, but is tax deductible.

Running these numbers for 2021-2024, we estimate cumulative cash generation of $1.93bn, despite declining production and conservative assumptions. Under the Lockbox mechanism, these cash flows reduce the acquisition cost. With a base price of $1.28bn, contingent payments of $300MM, and $128MM already paid, the remaining consideration of $1.46bn would be more than covered by the accumulated cash. Even assuming the profit sharing scheme takes up to $500MM, the final cash outlay will be close to zero - effectively getting 60k boepd of current production, 400 MMboe of 2P reserves (92% liquids), and strategic infrastructure for free.

The MPNU acquisition will more than double Seplat's output, with significant upside from reversing years of underinvestment. The control over the Qua Iboe export terminal and 51% participation in the Bonny River natural gas liquids recovery plant further enhance Seplat's role as a key operator in Nigeria, which could open additional opportunities as other majors exit. For example, the approval of the Exxon-Seplat transaction contrasts with the rejection of the Shell-Reinassance deal.

Beyond this transformational acquisition, Seplat has another major catalyst nearing fruition. Five years ago, they embarked on a joint venture with the National Oil producer NNPC to establish one of West Africa's largest Gas Plants: ANOH. Through this project, Seplat would earn revenue through both Upstream and Midstream channels. After years of delays, ANOH was commissioned by President Tinubu in May 2024. ANOH alone could be worth half of the current market cap due to having 10-15 year inflation-adjusted Take-or-Pay contracts.

These two transformational milestones are coming together after years in the works, positioning Seplat for significant growth in Nigeria, now the government wants to compensate for the ongoing decline in production. Both are extremely cash flow generative, enabling Seplat to deploy CapEx to capture the upside from both MPNU's recent underinvestment and their other promising assets like Akiala, Sibiri, and Sapele.

Though the market has been gradually recognizing the value throughout the year as the MPNU deal progressed toward completion, I still believe the current price makes no sense, regardless of the final terms. Once disclosed, we could be looking at an E&P company with an Enterprise Value of around $1.5B that could potentially produce more than 120k boepd in 2025, backed by 1,000 MMboepd of 2P reserves. With notably low OpEx across their assets, Seplat is positioned to print cash.

The valuation disconnect becomes particularly evident when comparing it to peers like Kosmos Energy, another West African-focused producer (with minor Gulf of Mexico operations), which trades at triple the EV despite similar expected production of 100k boepd next year. While the Nigeria discount will always apply, and Kosmos is diversified and has LNG upside, this simple napkin math exercise helps illustrate where the opportunity lies.

So what?

These three cases exemplify how selective opportunities can emerge even in periods of sector-wide pessimism. While the broader energy market grapples with bearish signals - companies with clear catalysts and strong fundamentals continue to offer compelling value propositions.

Sintana Energy stands to benefit from the ongoing Orange Basin exploration campaign, Valeura Energy is doing everything right while trading at a fraction of its intrinsic value, and Seplat Energy is on the verge of completing two transformational projects that could reshape its future. Each represents a different facet of value creation in the energy sector: exploration upside, operational excellence, and strategic M&A.

These situations demonstrate that rather than playing broad sector beta, Mr. Buffett followers on Occidental Petroleum will learn a valuable lesson, focusing on specific catalysts and asymmetric setups can yield better results. As we'll explore in the second part of this musings, similar opportunities exist across other regions and operating models, from the North Sea to Californian waters, each offering their own unique value proposition and demonstrating why careful stock selection matters more than ever in today's energy landscape.

Disclaimer: the author own shares of the companies mentioned in the text. This post has been prepared only for informative purposes. This is not investment advice.

Thanks!

In the case of Sintana the exploration potential of PEL83 is quite interesting as well and seems to be overlooked, particularly as they are carried and apparently there are some additional large leads there.

Sintana is 3-5x from here with very little downside.