BW Energy (OSL: BWE) has released the Q3 results today, and the market reacted with a -11% fall of the share price, bringing the share price to NOK 25.4 as the low intraday point, so far. The company has scheduled a call at 14.00 CET, which hasn’t happened while I write this post. I plan to publish an update to this post after it.

You can find my notes from the conference call in a separate post: notes to the BWE Q3 CC.

Low story short: I think the market has overreacted. Are the results good? NO. Are they worth a 11% drop? NO. BWE still has a path to grow production and repay all debt in the next 3 years.

I’m going to go through the main aspects from today’s update and provide a short-term outlook, based on my opinion. If you want a more detailed overview of the company and its assets, I recommend you to go through the previous write ups: Diversification done right and Challenging path to dividends. I recently published a post about why the market keeps ignoring BW Energy, but it mostly consists of my thoughts and opinions about the company and provides less information about the assets.

Gabon

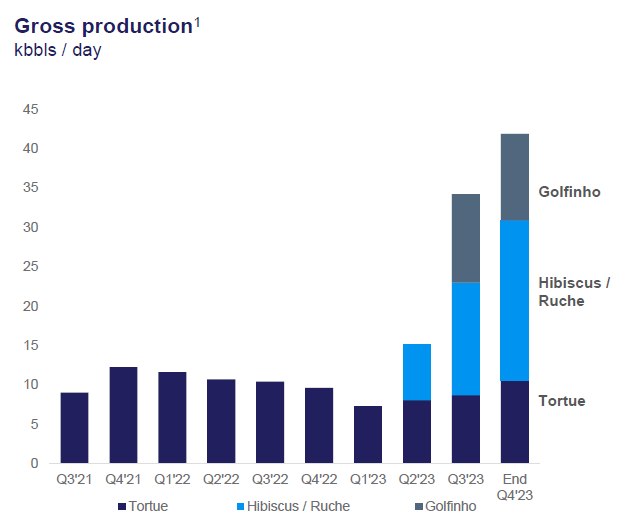

Gross production in the quarter has been ~23,200 bopd, or a net production of 17,052 bopd for BWE. In Q2, gross production was ~15,200 bbls/day, which represents a 52% increase.

BWE has continued the drilling campaign in Hibiscus/Ruche with positive results. However, it has also been the pain in the ass in the last 2 quarters due to the damn Electric Submersible Pumps (ESPs) on the DHIBM-3H and -4H wells and the need of a different completion tubing for the DRM-3H well.

The company said on the 26th of October that the ESPs were re-started and the production was being stabilised. That temporarily increased gross production to 35,000 bopd, which was also confirmed by Panoro Energy’s update today. However, the problems have persisted in this quarter and the company is working with the supplier to fix them. We have no visibility of what the definitive solution could be, would it require the replacement or repair of the ESPs? BWE hasn’t confirmed any potential outcome yet.

The DRM-3H well has been drilled but it is still incomplete until the specific final casing arrives. That doesn’t look like a big concern by looking at how productive other wells have been. I expect to hear in today’s call about why this well is different than the others and what this specific casing means for the prospect of reaching an initial production of ~6,000 bopd like the previous wells.

Despite these teething problems, the good performance of the first wells has beaten the initial estimation. Hibiscus resource has been revised upwards and Ruche resource has been slightly reduced. The overall impact estimated by management (not a CPR) is the net addition of ~10 MMbbls oil in place over the previous estimation.

The drilling campaign is progressing well, the next targets are a fifth Hibiscus well, completion of the Ruche well, a production well in Hibiscus South and a Bourdon prospect test well. The Bourdon Prospect is located in a water depth of 115 metres approximately 7 km to the southeast of the BW Mabomo production facility and 14 km west of the BW Adolo FPSO. Bourdon’s mid-case estimates 83 MMbbls oil in place and 29 MMbbls recoverable in the Gamba and Dentale formations.

The successul exploration DHBSM-1 well in the Hibiscus South prospect resulted on a confirmed discovery. This well will be sidetracked to convert it into a production well. The initial estimation is that this low-risk, low-cost development targets recoverable volumes of 6-7 MMbbls. Maybe these discoveries can increase the current production outlook, something that hasn’t been confirmed yet:

Dussafu is on its way to achieve the 40,000 bopd target of this drilling campaign, with the additional upside of the better than expected performance, the confirmation of the Hibiscus South discovery and the potential addition of the Bourdon prospect. On track for many years of very profitable production that will finance the remaining planned developments.

Brazil

But, let’s look beyond Dussafu. We have Brazil, where the company has been producing from Golfinho since August. So far, the block has had a record production of 11,500 bopd over the initial estimation of 9,000 bopd. The company mentioned in previous updates that the guided production accounted for initial operational issues and downtimes. It doesn’t seem the case and the block keeps working fine, despite the FPSO looking like an old, rusty vessel.

The company has used the $80 million Golfinho prepayment facility in full. Next milestone is to receive the authorisation by ANP to replace Saipem as operator of the FPSO, which should lower OPEX, by how much you ask? I don’t know.

Maromba is still pending the financing package and FID (both are related, the former shall trigger the latter). BWE has paid the first payment of $30 million for the FPSO BW Polvo, with $20 remaining in Q2 2024. The plans for Maromba should be advancing as I write this, but there is a lack of visibility of the actual situation regarding the FDP and the financial terms. Once the drilling campaign in Dussafu is over, the focus should be on Maromba.

Remember that there is much more than just oil in Golfinho, the field has a long life when the gas reserves at Camarupim and Brigadeiro are factored in. It is a bummer that the infill drilling campaign is planned in 2026, but it makes sense when one considers that BWE is not a major like Equinor, and it cannot deal with the simultaneous development of both Maromba and Golfinho/Camarupim. The company has projected Golfinho’s peak production above 20,000 boepd by 2027:

Brazil seems like the next goal in the next few years, and first oil of Maromba in late 2026 or early 2027 could be an inflection point with regards to shareholders’ remuneration.

Namibia

What about Namibia? The company said very little, right? I don’t agree, I think it said very little and A LOT at the same time:

In Namibia, BW Energy is progressing the revised development plan for the gas- to-power project and analysing data from the 3D survey completed in May. Interpretation of the initial fast-track data has enhanced the depositional model and de-risked potential targets?with additional prospects identified, and the Company has decided to start ordering long-lead items for a future exploration program.

This paragraph is exciting, at least. An E&P company doesn’t begin ordering “long-lead items for a future exploration program“ if there isn’t a very good reason. They must have seen something interesting in the initial results of the data processing. We can only especulate at this stage, but BWE is telling the market that there is something that justifies an exploration drilling campaign. I hope we hear more details in the call today.

Other companies are currently drilling exploration wells in the area around BWE’s licence, some even in the same oil- and gas-charged sands that are present in Kudu. The results can provide a better understanding to the petroleum system(s) present offshore Namibia. The Namibian government is “forcing” TotalEnergies and Shell to cooperate with BWE in the development of the gas infrastructure that will be needed for producing gas. This collaboration will be positive for the country but also for the companies involved, which will share costs and reduce the development time of the different licences.

Financials

Regarding the financial, see main metrics I care about:

CFO was $10.4 million, ($2.8) million including lease payments, significantly impacted by change of ($27) million in working capital. This working capital increase is justified by the pre-payment to Saipem for the FPSO plus accruals for Golfinho operations.

FCF was ($94.1) million, ($107.3) million including lease payments, due to a CAPEX of $104.5 million in the quarter.

Opex of $28/bbl in Dussafu and $48/bbl in Golfinho. FY2023 guidance of $30/bbl. Take over FPSO operation should reduce Golfinho’s opex.

Net debt on 30 September 2023: $182.4 million. Cash balance of $197.6 million & total drawn debt balance of $380 million. Debt should have increased after paying the first installment for the FPSO BW Polvo, but the larger production in Q4 should balance it. I expect Q4 debt to be at a similar level.

Net interest expense have increase to $8.3 million (+$4.6 million) due to the larger amouns drawn.

ARO liabilities have increased to $179.4 million (+$154.3 million) due to the acquisition of Golfinho, Camarupim and Brigadeiro and a policy change. I expect to hear more about this in today’s call.

During Q4, the increase in working capital should be compensated, positively impacting the Q4 cash flow. Regarding the ARO liabilities, it is expected that it will increase in the following years, but at a much lower rate than this quarter.

After completing 1 lifting at both Dussafu and Golfinho, there are 2 more liftings in this quarter, one from each block, which bring the total amount of lifting in Q4 to 4. This is down from 5, as BWE planned 3 liftings at Dussafu in the guidance provided with the previous results. This is understandable and not a suprise given the lower production caused by the ESPs and the delayed completion of the DRM-3H well.

The company ended Q3 with an under-lift position of 116,000 barrels at the end of the period, but these barrels would have been sold already. The inventory should be also be high by the end of Q4 as there are now 2 liftings instead of 3 at Dussafu, but the barrels produced in Q3 and sold in Q4 should compensate this.

Q4 outlook and beyond

The outlook for this quarter is mixed, the production will increase, but not at the desired rate. Panoro has estimated that gross production at Dussafu for Q4 is expected to be 25,000 - 30,000 bopd. However, the exit rate should grow above the 35,000 bopd depending on the number of wells brought on stream during the quarter and if the ESPs are fixed.

As a result of the oprational challenges, the guidance for sales volume in the whole year has been revised to 6.7 MMbbls (which includes the contribution of Golfinho since 28 August 2023).

For the year 2024, the company expects to produce in the range of 10 to 12 MMbls in Dussafu, as it still expects production being affected by the ESPs. This will result in a net production of 27,400 - 32,900 bopd in Dussafu in 2024. This would be a dissapointing production compared to previous estimations, and I hope it is a case of underpromise/overdeliver after the last issues found. Should the company find a fix early in the year, the guidance should be increased. Considering that the company is guiding ca. 9,000 bopd from Golfinho in 2024, which would mean a production of 3.28 MMbbls. Hence, the total production for BWE in 2024 should be in the range of 13 to 16 MMbbls.

On a side note, BWE keeps reporting gross production, which is not great now that both Golfinho and Dussafu are in production with different WIs. I expect the to change this in the following quarters, because it sometimed induces errors among shareholders.

Conclusions

This is my opinion, and I’d love to read yours in the comments.

The operational problem suck big time. I cannot say I’m satisfied with how the company has managed the problems with those 2 ESPs. I wish it had dealt with them in a more expedite way. I hope that a solution would come at some point in Q1 2024. But it is just me guessing, I don’t have a clue. The market is pricing this in as a permanent problem, which doesn’t seem the right approach to me.

However, that is a solvable issue. The company has drilled 4 out 8 wells, and 1 hasn’t been completed yet due to the need for receiving a different casing for its completion. I still expect a large production increase in Gabon in the next 2 quarters, and I think the market is ignoring it. The overreaction has allowed me to buy some more shares, but it is still a pain. I like my stocks to go up, I don’t like “opportunities to buy cheap”.

Once the drilling campaign is over with all 8 wells completed, the production in Dussafu would increase to 40,000 bopd, 1 prospect will be brought to production and onether one would be drilled (results unknown yet). I think that’s a pretty good prospect.

Brazil is progressing slow, but the higher production than expected at Golfinho has made for some of the lower production at Gabon. There isn’t a confirmation of where opex would be at once BWE takes over the FPSO Cidade de Vitória, but it should lower. It is a bit frustrating the Maromba still seems far ahead, same with the infill drilling campaign in Golfinho/Camarupim, but the oil and gas isn’t going anywhere. I understand that the company is prudently managing liquidity, but if oil prices stay above $80/bbl in the next few quarters, these plans can be revised and the timelines shortened.

In my opinion, BWE thesis hasn’t changed, they are growing production and will continue doing so in the next 3 years. There are many opportunities in Gabon (remember the G12-13 and H12-13 blocks with Vaalco and Panoro), Brazil and Namibia. The current assets can make this company produce more than 70,000 boepd in 4 years. Optimistically, better than expected performance of the assets in Gabon and Brazil might increase production closer to 80,000 boepd. Namibia is an unknown, but Kudu will be developed at some point, which could add another 20,000 - 30,000 boepd.

I’m not worried about this short-term noise, I will remain being a BWE shareholder in the years to come as I think the best is still ahead of us. We could even see Calvin’s dividends as soon as 2025, who knows?

Maybe it is me consuming large amounts of copium as the price dropped significantly today. Nevertheless, I’m still convinced that BW Energy is a good investment for the medium and long term, representing a positive high risk - high reward opportunity. This is my first position at the moment.

Disclaimer: this document only represents the opinion of its author; its content cannot be considered investment advice and it has been prepared only for informative purposes. Please, make your own due diligence and analysis.

• Work to fix the reemerged EPS issues at Dussafu constitutes of taking the units to surface to establish the exact cause of failures. The

pumps will then be repaired (works scope likely days to weeks in magnitude, per well) or replaced by new units. The partners have rig

capacity to conduct the work

• Given well downtime, Dussafu production in Q4 is expected at 25-30,000 bpd in Q4 vs previously reported levels of 35-40 bpd

• The 2024 guidance of 27-33,000 bpd is also well below our 38,000 bpd expectation. While anyway a major disappointment, we believe

BWE may have decided to set the guidance at a level that is very likely to be achieved or beaten. Given the recent history of production

guidance downgrades at the asset this would also be the prudent decision, in our view

• Given the issues are equipment related (i.e. not reservoir), lost volumes should be recovered at a later stage

• Following the exploration success in Hibiscus South (link), the partners have decided to drill the 29 mill boe Bourdon prospect

---More comments from PAS

There is a warranted discount factor due to BWE management originating from the BW group and the BW group not being big on E&P expertise - management is happy to admit this also face to face. So I actually don't think it's unfair to think there will be always be some hickup every other quarter. That said, I like the assets and their approach to building this. If they only achieve 80% of the LT run-rate production they gun for this should be a winner.